Do I Have To Pay Back The Premium Tax Credit In 2023 For the 2024 tax year you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for There are also dollar caps on the amount of

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums you may have to pay back the excess amount of APTC Q1 What is the premium tax credit updated February 24 2022 A1 The premium tax credit is a refundable tax credit designed to help eligible individuals and families with

Do I Have To Pay Back The Premium Tax Credit In 2023

Do I Have To Pay Back The Premium Tax Credit In 2023

https://www.accountingfreedom.com/wp-content/uploads/2021/04/premium-tax-credit-2021.jpg

Do I Have To Pay Back Any Advance Child Tax Credit Received YouTube

https://i.ytimg.com/vi/J7aKvKnik2k/maxresdefault.jpg

Premium Tax Credit PTC 965 Income Tax 2020 YouTube

https://i.ytimg.com/vi/vZ-LzT0wVuI/maxresdefault.jpg

If you haven t filed your 2023 tax return or filed a return but didn t reconcile the premium tax credit for all household members you must do so immediately If you confirm that you filed your 2022 tax return you The premium tax credit PTC is a refundable tax credit designed to help you pay for health plans purchased through the federal or state exchanges Eligibility for the PTC for an exchange plan is

Once you have it follow the steps below You must file a federal tax return for 2023 even if you usually don t file or your income is below the level requiring you to 1 Find your After the end of the year when you prepare your taxes we calculate the premium tax credit based on your actual household income When there s a difference in these

Download Do I Have To Pay Back The Premium Tax Credit In 2023

More picture related to Do I Have To Pay Back The Premium Tax Credit In 2023

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

Foreign Gift Tax Do I Have To Pay Cerebral Tax Advisors

https://www.cerebraltaxadvisors.com/wp-content/uploads/2021/10/shutterstock_291024491-Convertido-01-scaled-e1635459590629-1536x774.jpg

Premium Tax Credit WhatTaxpayers Need To Know Tax Relief Center

https://i.pinimg.com/originals/d8/bf/5c/d8bf5c8f2a6724d32c86a120a90b5947.png

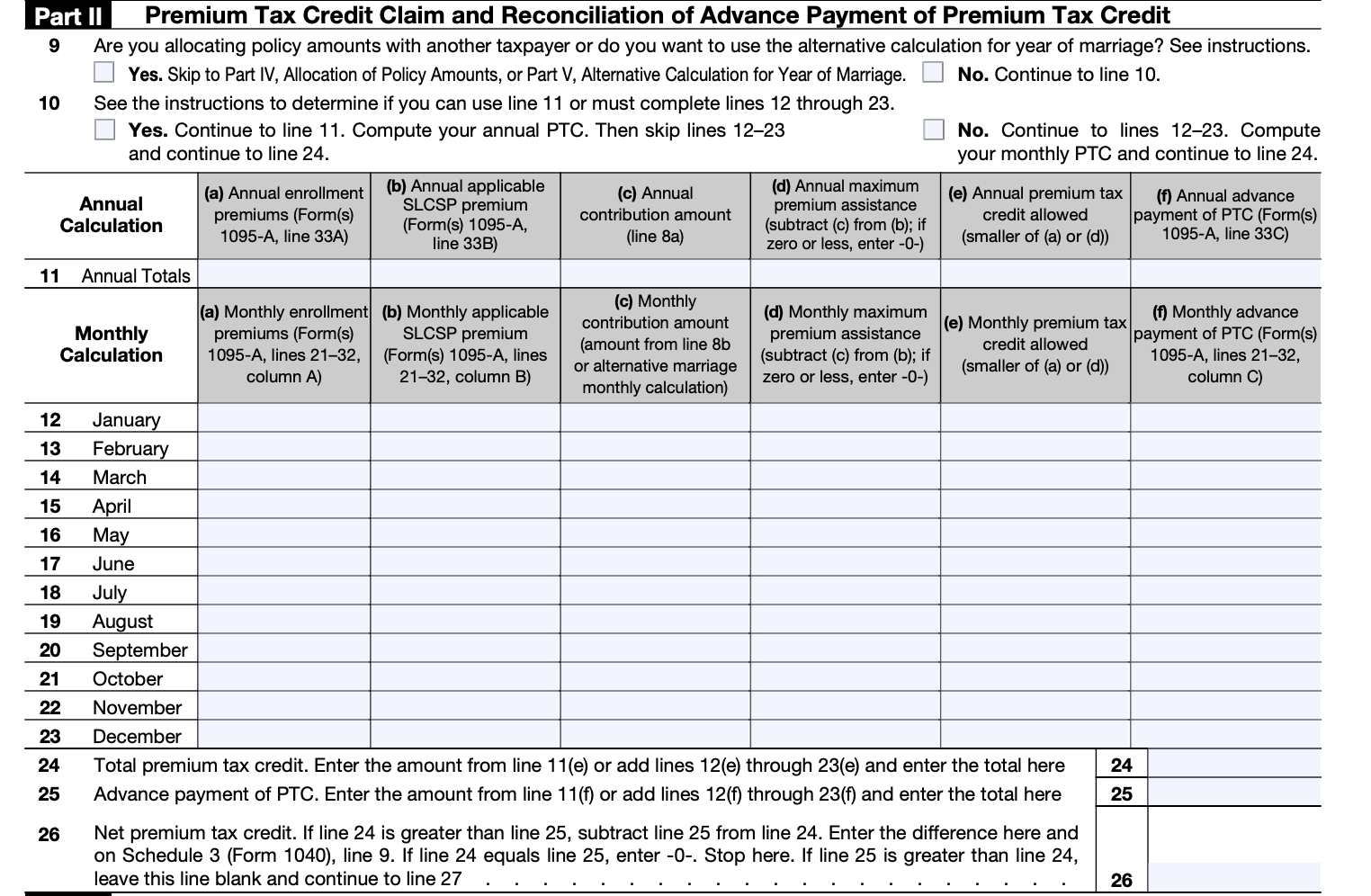

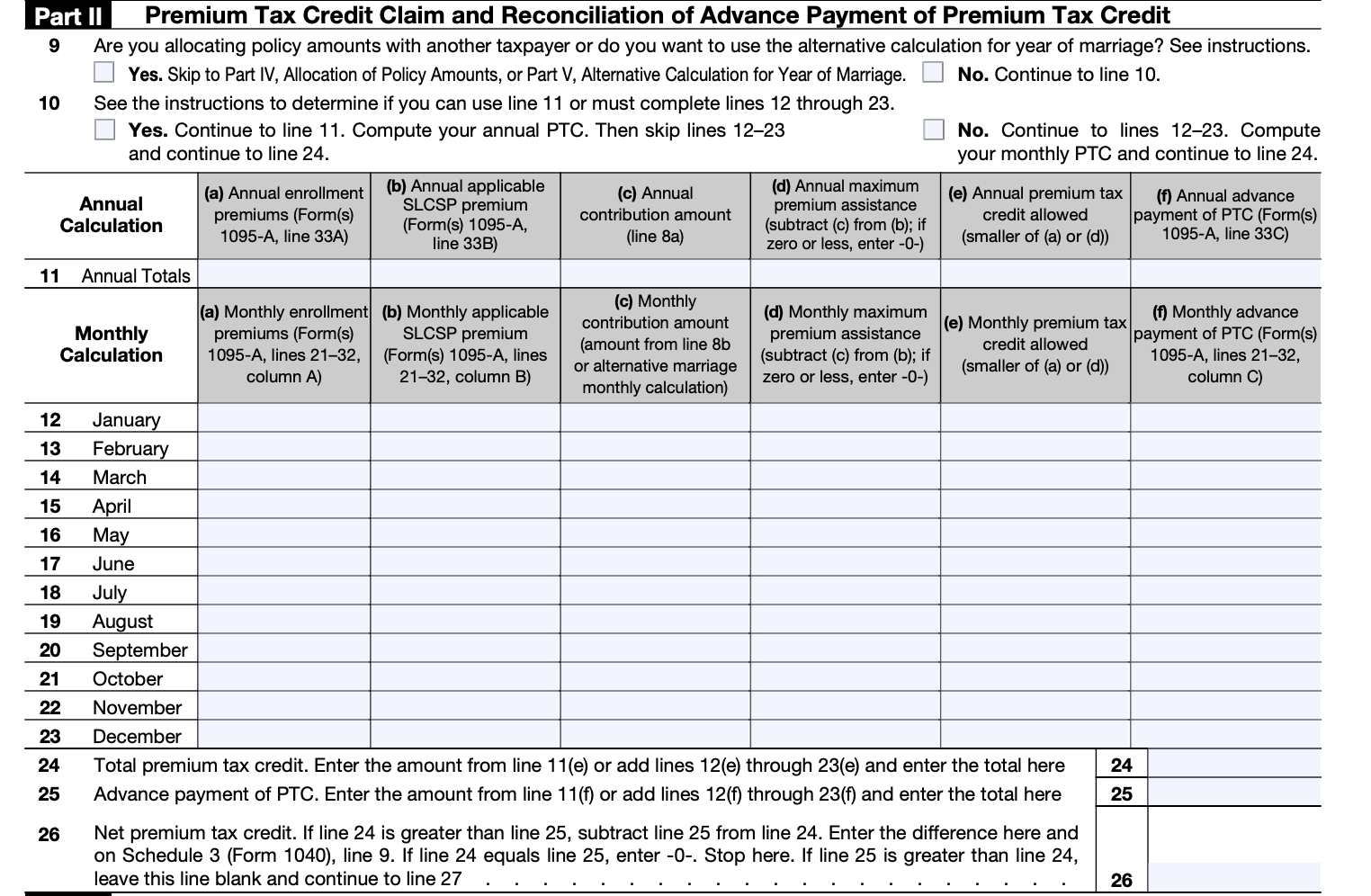

If you believe you re eligible for the premium tax credit you ll use IRS Form 8962 to claim it There are two parts to the form and you can t skip either one The first section determines eligibility for the Let s say the benchmark health plan on Tom s health insurance exchange costs 3 900 per year or 325 per month Use this equation to figure out the subsidy amount Cost of the benchmark plan

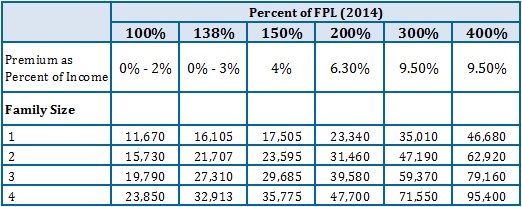

For example you won t know your exact premium tax credit for 2022 until you file your 2022 tax return in April 2023 Each year you receive an advance If your estimated income falls between 100 and 400 of the federal poverty level for a household of your size and you purchase health insurance through

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

What s The Right Way To Look At Financing Your Startup By Brett Fox

https://miro.medium.com/max/881/1*Xs1xXMXMKA7kcX86PjmFtA.jpeg

https://www.kff.org/faqs/faqs-health-insurance...

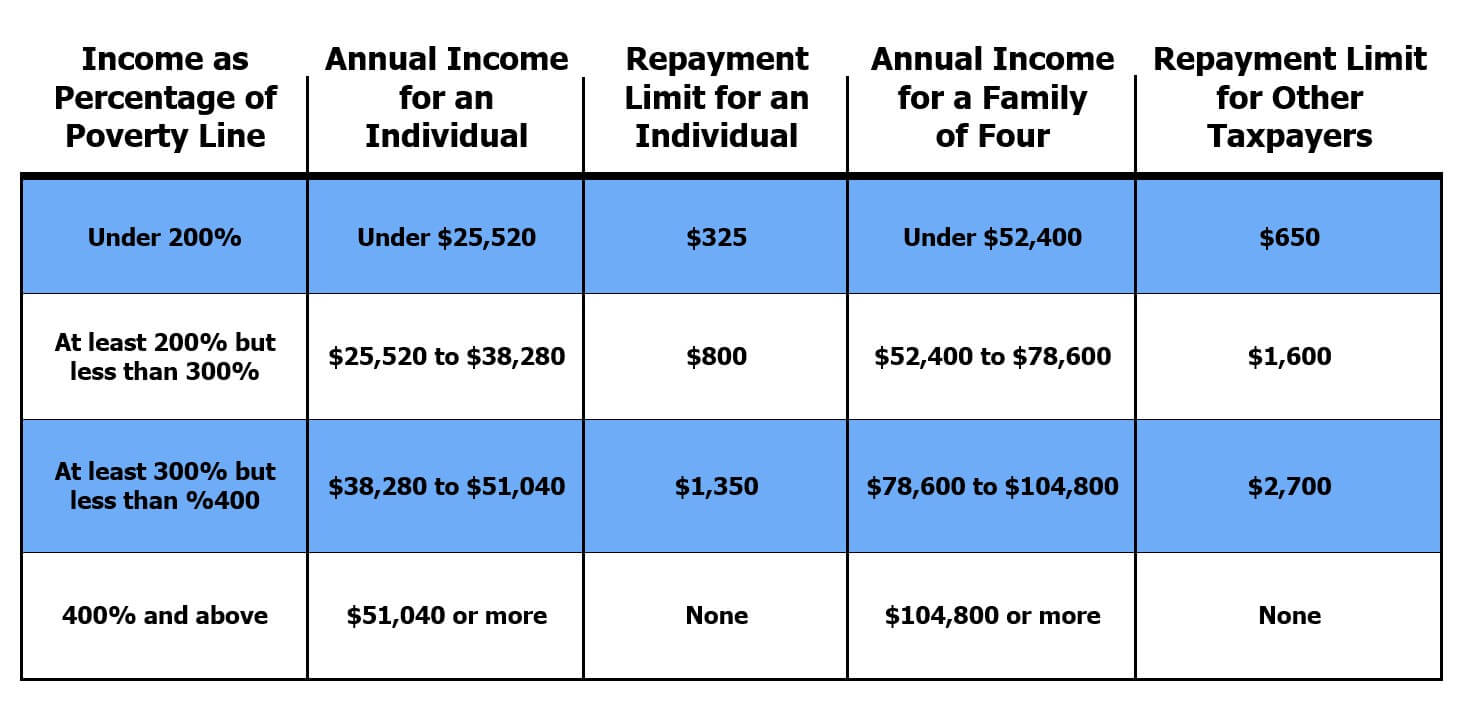

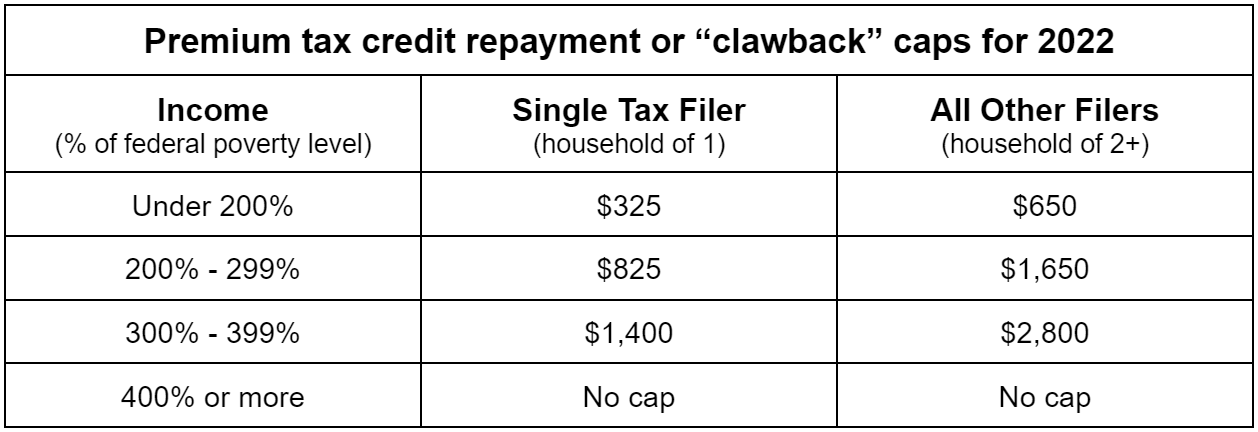

For the 2024 tax year you must repay the difference between the amount of premium tax credit you received and the amount you were eligible for There are also dollar caps on the amount of

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums you may have to pay back the excess amount of APTC

When Do I Have To Pay Back The Money I Spend On A Credit Card

Earned Income Tax Credit For Households With One Child 2023 Center

Repayment Limits For Advanced Premium Tax Credit

Who Gets The 1400 Tax Credit Leia Aqui Who Is Eligible For The 1400

Tax Credits Save You More Than Deductions Here Are The Best Ones

All About IRS Form 8962 And Calculating Your Premium Tax Credit Nasdaq

All About IRS Form 8962 And Calculating Your Premium Tax Credit Nasdaq

Irs Publication 974 Form Fill Out And Sign Printable PDF Template

FAQ Am I Eligible For Premium Tax Credits

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

How To Calculate Form 8962 Printable Form Templates And Letter

Do I Have To Pay Back The Premium Tax Credit In 2023 - If you haven t filed your 2023 tax return or filed a return but didn t reconcile the premium tax credit for all household members you must do so immediately If you confirm that you filed your 2022 tax return you