Do I Have To Pay Social Security Tax On Retirement Income If you have income from multiple sources in retirement such as pensions withdrawals from retirement accounts or side jobs you may have to pay taxes on part of your Social

Retirement income from tax deferred 401 k s or Traditional IRAs is taxable as is pension annuity Social Security income Roth IRA income usually isn t taxable If your Social Security income is taxable depends on your income from other sources Here are the 2024 IRS limits

Do I Have To Pay Social Security Tax On Retirement Income

Do I Have To Pay Social Security Tax On Retirement Income

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

End Of Tax On Retirement Income Begins Monday

https://s.hdnux.com/photos/01/02/53/10/17478169/38/rawImage.jpg

Do You Have To Pay Income Tax On Retirement Pension YouTube

https://i.ytimg.com/vi/GxsA3gpKoag/maxresdefault.jpg

If you do have to pay taxes on your Social Security benefits you can choose to have federal taxes withheld from your benefits to avoid or reduce owing tax in the future For Everyone working in covered employment or self employment regardless of age or eligibility for benefits must pay Social Security taxes However there are narrow exceptions to

You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and If you do have to pay taxes on your Social Security benefits you can choose to have federal taxes withheld from your benefits to avoid or reduce owing tax in the future For

Download Do I Have To Pay Social Security Tax On Retirement Income

More picture related to Do I Have To Pay Social Security Tax On Retirement Income

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

Why Are Social Security Benefits Taxable The Motley Fool Social

https://i.pinimg.com/originals/4e/e3/8d/4ee38dea532885d8b55926dea346a286.jpg

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Everyone working in covered employment or self employment regardless of age or eligibility for benefits must pay Social Security taxes However there are narrow exceptions to Social Security benefits are payments for retired American workers who have paid Social Security taxes on their income If you have paid enough by earning 40 work credits which is

Social Security Benefits Depending on provisional income up to 85 of Social Security benefits can be taxed by the IRS at ordinary income tax rates Pensions Social security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income SSI payments which aren t taxable

Do Probationary Workers Have To Pay Social Insurance Thuvienpc

https://cdnmedia.baotintuc.vn/Upload/ekaE01yuAw3S4G2j0Rtmuw/files/2023/08/VIECLAM/371454226_685805509637626_6094574271466133657_n.jpg

States With No Tax On Retirement Income Benzinga

https://cdnwp-s3.benzinga.com/wp-content/uploads/2023/01/09160353/Untitled-design-28-768x384.jpg?width=1200&height=800&fit=crop

https://money.usnews.com/money/retir…

If you have income from multiple sources in retirement such as pensions withdrawals from retirement accounts or side jobs you may have to pay taxes on part of your Social

https://www.nerdwallet.com/article/inve…

Retirement income from tax deferred 401 k s or Traditional IRAs is taxable as is pension annuity Social Security income Roth IRA income usually isn t taxable

Retiring These States Won t Tax Your Distributions

Do Probationary Workers Have To Pay Social Insurance Thuvienpc

7 Steps To Tax Efficient Retirement Income Tax Planning To Grow Your

Do I Have To Pay Any Brokerage When Applying For An IPO

Social Security Retirement Benefit Basics Articles Consumers Credit

8 Smart Ways To Lower Your Taxes In Retirement The Fiscal Times

8 Smart Ways To Lower Your Taxes In Retirement The Fiscal Times

Thousands Of Seniors May No Longer Have To Pay Social Security Tax

The Most Common Sources Of Retirement Income SmartZone Finance

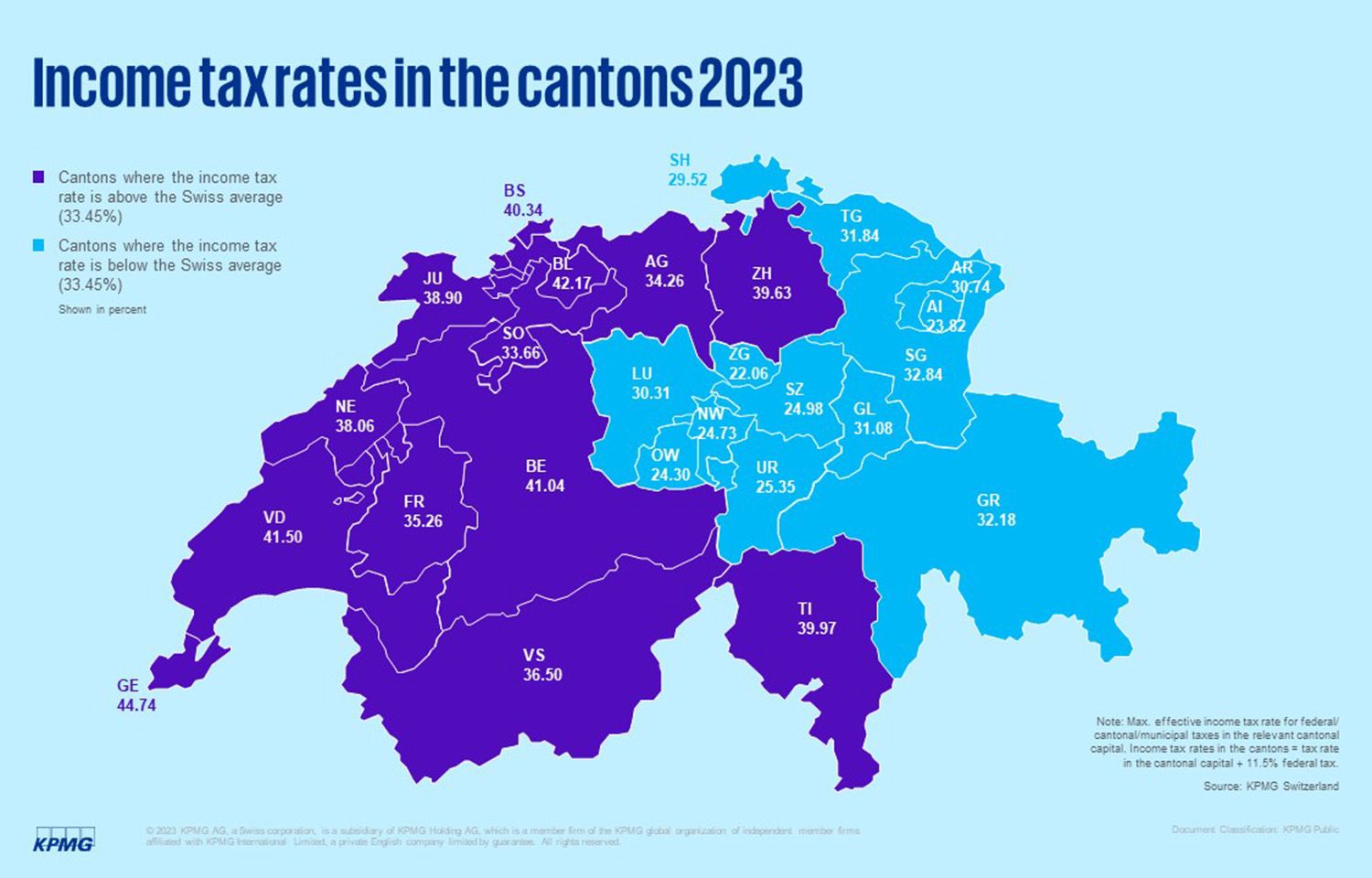

Media Press Release Clarity On Swiss Taxes 2023 KPMG Switzerland

Do I Have To Pay Social Security Tax On Retirement Income - Social Security taxes don t depend on age they depend on income How much Social Security retirement benefits are subject to federal taxation is unrelated to