Do I Have To Pay Taxes On My Hsa Distributions An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for anything other

If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make contributions to your Key Points HSA distributions are tax free when used for IRS approved medical expenses Distributions for non medical purposes are typically subject to taxes and a 20 penalty

Do I Have To Pay Taxes On My Hsa Distributions

Do I Have To Pay Taxes On My Hsa Distributions

https://res.cloudinary.com/highereducation/images/f_auto,q_auto/v1664301925/AffordableCollegesOnline.org/GettyImages-1214278899-1_2339950e44/GettyImages-1214278899-1_2339950e44.jpg

Do You Have To Pay Tax On Your Social Security Benefits YouTube

https://i.ytimg.com/vi/yVRdBCJXqAU/maxresdefault.jpg

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

You will still have to pay taxes on withdrawals made for something other than a qualified medical expense When you make a withdrawal from an HSA the funds will count towards your income for HSA distributions The IRS requires you to prepare Form 8889 and attach it to your tax return when you take a distribution from an HSA However if your 1099 SA indicates

When Distributions Are Tax Free The following distributions aren t taxable An HSA or Archer MSA distribution if you used it to pay qualified medical expenses of the account holder or Contributions are tax free and you re not taxed on money used for qualifying medical expenses either An HSA is also a great tool for retirement savings even if those

Download Do I Have To Pay Taxes On My Hsa Distributions

More picture related to Do I Have To Pay Taxes On My Hsa Distributions

Do I Have To Pay Taxes On Reselling Items 2022 YouTube

https://i.ytimg.com/vi/X3fByY4HXik/maxresdefault.jpg

Are EBay Sales Subject To Taxation

https://stepofweb.com/upload/1/cover/do-i-have-to-pay-taxes-on-ebay-sales.jpeg

Cryptocurrency Taxes In Germany Ahsan Finance

https://ahsanfinance.com/wp-content/uploads/2021/05/cryptocurrency-taxes.jpg

HSA FSA Taxes and Contribution Limits in 2024 Here s how to get a tax break on medical bills through an FSA or HSA plus new 2025 HSA contribution limits Updated May 15 2024 Written Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

If you use your HSA money for eligible medical expenses outlined above you won t pay taxes on withdrawals Which distributions are taxable HSA distributions used for File Form 1099 SA Distributions From an HSA Archer MSA or Medicare Advantage MSA to report distributions made from a health savings account HSA Archer medical

Do You Have To Pay Taxes On A Money Market Account YouTube

https://i.ytimg.com/vi/vNxnFewcjDE/maxresdefault.jpg

Do You Have To Pay Taxes On Etsy Income Etsy Seller Tips YouTube

https://i.ytimg.com/vi/ZMJOg_oRaJg/maxresdefault.jpg

https://ttlc.intuit.com/turbotax-support/en-us/...

An HSA distribution money spent from your HSA account is nontaxable as long as it s used to pay for qualified medical expenses HSA distributions used for anything other

https://www.fidelity.com/.../hsa-tax-form

If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make contributions to your

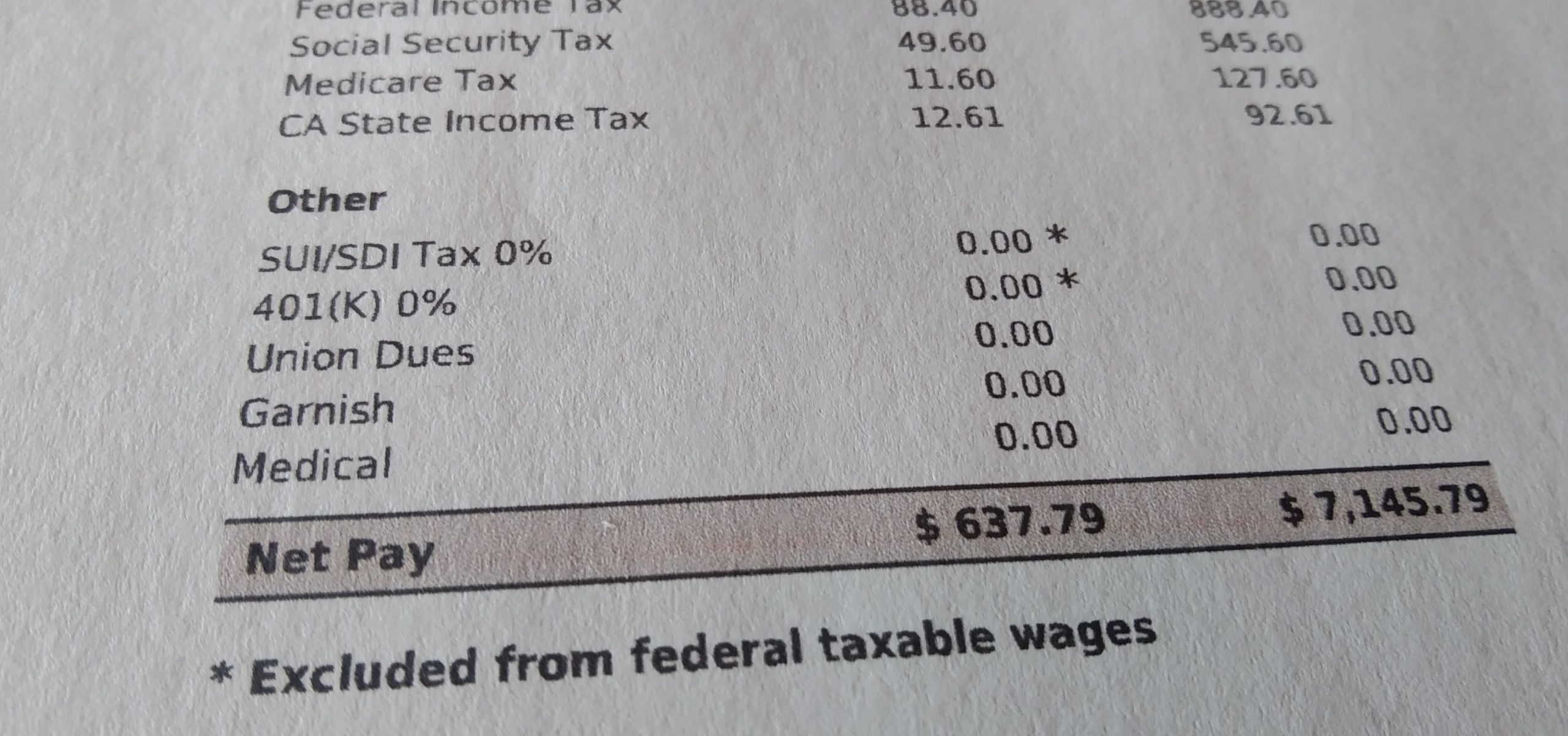

Understanding Different Pay Stub Abbreviations

Do You Have To Pay Taxes On A Money Market Account YouTube

Do I Have To Pay Taxes On Crypto A Comprehensive Guide The

Do You Have To Pay Taxes On Your Comp Settlement YouTube

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

Hoeveel Betaalt Een Werkgever Aan Loonbelasting Loonbelasting UAC Blog

Sibley Law Associates PLLC I Inherited Some Property Do I Have To

Do I Have To Pay Taxes On My Hsa Distributions - When Distributions Are Tax Free The following distributions aren t taxable An HSA or Archer MSA distribution if you used it to pay qualified medical expenses of the account holder or