Do I Have To Report Foreign Interest Income Report the Interest Income All worldwide income including interest earned from a foreign savings account must be reported on your U S tax return You

If you earn foreign interest income in a country in which you pay U S Tax you are entitled to a Foreign Tax Credit Otherwise the income is combined with your other worldwide Individuals don t need to report foreign financial accounts held in individual retirement accounts described in Internal Revenue Code Sections 408 and 408A and

Do I Have To Report Foreign Interest Income

Do I Have To Report Foreign Interest Income

https://www.sjcindiana.com/ImageRepository/Document?documentId=28482

How To Report Foreign Income

https://optimataxrelief.com/wp-content/uploads/2023/04/2023-how-to-report-foreign-income.jpg

Do I Have To Go Into Debt To Get Good Credit Good Credit Debt Credits

https://i.pinimg.com/736x/c0/f0/ec/c0f0ece178cf7b43d4d99bac82a8f0b0--credit-score-to-get.jpg

Generally U S citizens and resident aliens must report all worldwide income including income from foreign trusts and foreign bank and securities The aggregate value of the specified foreign financial assets exceeds a certain threshold For married taxpayers filing joint tax returns and living in the United States this threshold is 1 100 000 on the last

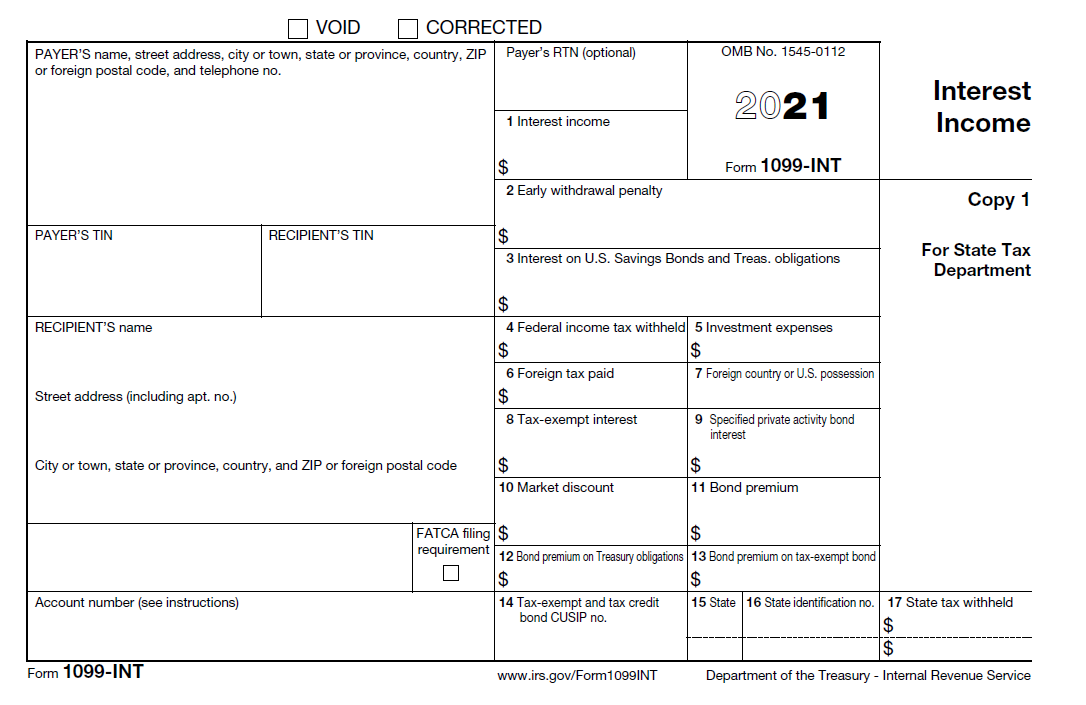

Do Taxpayers Have to Report Interest Income From a Personal Loan Personal loans generally don t count as income which means they don t have to report any interest earned to the IRS The Form 8938 requires disclosure of different tax items for example interest dividends royalties etc from your foreign accounts and where you are reporting them on your tax return

Download Do I Have To Report Foreign Interest Income

More picture related to Do I Have To Report Foreign Interest Income

Do I Have To Report My Financial Aid For Taxes A Guide To

https://www.lihpao.com/wp-content/uploads/2023/01/do-i-have-to-report-my-financial-aid-for-taxes.jpg

How Much Do I Have To Pay According To Income And Marital Status

https://wearebreakingnews.com/wp-content/uploads/2022/03/how-much-do-i-have-to-pay-according-to-income-and-marital-status.png

Why You Shouldn t Worry About Reporting Your Child s PFD Income On Your

https://cdn.staylittleharbor.com/do_i_have_to_report_my_childs_pfd.jpg

The good news is that yes you can still file your U S taxes without a W 2 The bad news is that depending on the country you live in and whether you re claiming any exclusions of credits it may take some According to the IRS If you are a US person living abroad you must file Form 8938 if you must file an income tax return and Single or Married Filing Separately The total of your

Reporting foreign interest income I ve received 1556 of foreign interest income but do not have a 1099 INT form from the foreign bank Q1 How do I report International Tax Overview of U S taxes on foreign income for individuals Thomson Reuters Tax Accounting October 12 2023 17 minute read Jump to What is

IRS Form 2555 H R Block

https://www.hrblock.com/expat-tax-preparation/resource-center/wp-content/uploads/2022/10/form-2555-tablet.jpeg

Interest Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/06/21155832/Interest-Income-Example-Calculation.jpg

https://www.visaverge.com/knowledge/reporting...

Report the Interest Income All worldwide income including interest earned from a foreign savings account must be reported on your U S tax return You

https://www.goldinglawyers.com/foreign-interest...

If you earn foreign interest income in a country in which you pay U S Tax you are entitled to a Foreign Tax Credit Otherwise the income is combined with your other worldwide

Do You Have To Report VA Disability As Income For 2023 Taxes Hill

IRS Form 2555 H R Block

How To Report Foreign Pension Income Counting My Pennies

Do I Have To Pay Taxes On Virtual Currency If My Profit Is Less Than

Do I Have To Use Estate Agent s Mortgage Advisor YesCanDo

Foreign Bank Account Report FBAR Direct Tax Relief

Foreign Bank Account Report FBAR Direct Tax Relief

Form 1040 Line 2 Interest A Practical Guide Article 5 The Law

US Expat Tax Return Evaluation Your Opinion Matters Most US Expat

Interest Expense In A Monthly Financial Model Cash Interest Vs

Do I Have To Report Foreign Interest Income - The aggregate value of the specified foreign financial assets exceeds a certain threshold For married taxpayers filing joint tax returns and living in the United States this threshold is 1 100 000 on the last