Do I Include Redundancy On My Tax Return You pay tax on a non genuine redundancy as part of your ETP This means you generally pay tax at a lower rate than your normal income if the payment doesn t exceed certain caps Amounts you include from a genuine redundancy Depending on your employment conditions a genuine redundancy payment may include payment in lieu of notice

This article will complete an example scenario to best explain the process and entries required for the method of declaring redundancy and severance payments In this scenario the overall payment received as per the P60 P45 is 100 000 of which 75 000 is relating to redundancy You are entitled to statutory redundancy pay of 10 000 PENP does not apply to statutory redundancy pay so you will not pay tax or National Insurance on this

Do I Include Redundancy On My Tax Return

Do I Include Redundancy On My Tax Return

https://blog.beforepay.com.au/hs-fs/hubfs/shutterstock_681704671.jpg?width=4342&name=shutterstock_681704671.jpg

Can An Accountant Help With My Tax Return Stonehouse

https://www.stonehouseaccountants.com/wp-content/uploads/2021/09/Can-An-Accountant-Help-With-My-Tax-Return.jpg

HOW A REDUNDANCY WORKS Explained For Employees YouTube

https://i.ytimg.com/vi/aJ2jcc5clI8/maxresdefault.jpg

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be taxed in the same way as regular income If all you have is a redundancy payment up to 30 000 against which your employer has allowed an exemption and the amount of post employment notice pay is Nil just fill in box 9 with the amount

In general you will need to complete a Self Assessment tax return if you have redundancy pay if either of the following applies Your redundancy pay is more than the 30 000 tax free allowance You don t need to declare in your tax return amounts on your payment summary at Lump sum D tax free component of a genuine redundancy or early retirement scheme payment This tax free component is not part of your ETP and is not assessable income

Download Do I Include Redundancy On My Tax Return

More picture related to Do I Include Redundancy On My Tax Return

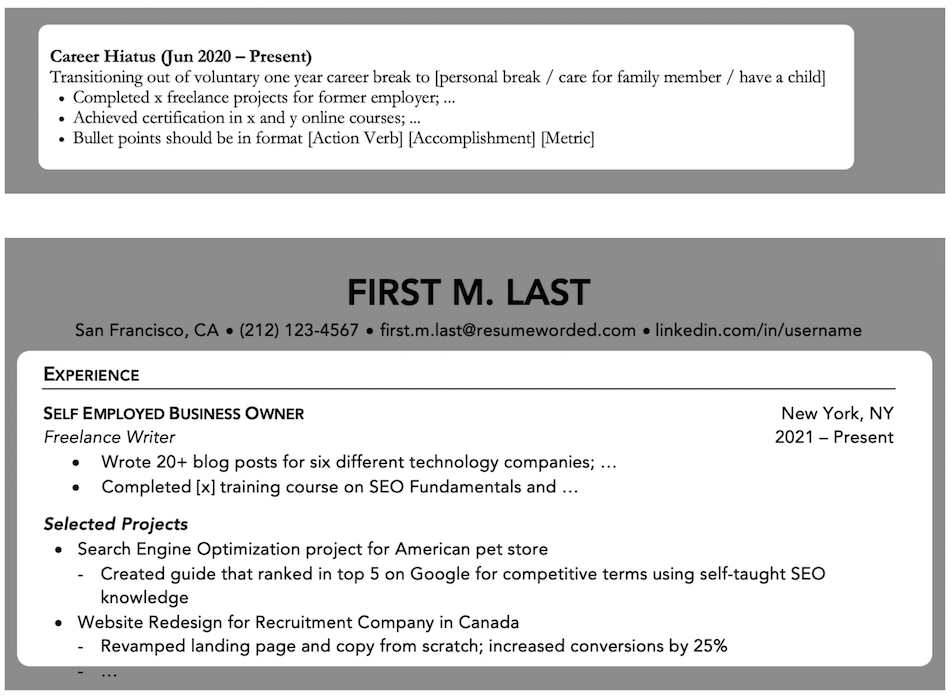

How To List Gaps On A Resume Without Making It A Big Deal

https://resumeworded.com/blog/content/images/2021/04/gaps-on-resume-1.png

5 Redundancy Letter Template Uk Sampletemplatess Within Failed

https://i.pinimg.com/originals/36/66/86/36668665fd706d3ecea8de0b2be6ec6b.png

Which IRS Form Is Right For My Tax Return

https://www.noobpreneur.com/wp-content/uploads/2018/12/file-tax-return.jpg

Redundancies qualify for special treatment under tax law you can receive up to 30 000 in redundancy pay without having to pay any tax on it There s a legal minimum your employer must offer you as compensation for losing your job but some companies offer more generous terms Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

I received a redundancy payment from my old job last year employment ended in 2021 but I did not receive the payment until 2022 When I opened my self assessment it told me that HMRC hold the If you receive a genuine redundancy your payment may be tax free up to a limit Your employer will report the tax free amount of your genuine redundancy at Lump sum D When lodging your return through myTax you include the amount reported at Lump sum D under Salary wages allowances tips bonuses etc this amount may already be pre

Same I Get Literally 0 In My Tax Return

https://cdn-webimages.wimages.net/052c744694986a2e89a59731eeb5403546fc82-v5.jpg?v=3

BG CONSULTANCY UK

https://www.consultantservice.co.uk/wp-content/uploads/2019/12/Is-It-Better-To-Submit-My-Tax-Return-Early_-1200x550-1.png

https://www.ato.gov.au/.../redundancy-payments

You pay tax on a non genuine redundancy as part of your ETP This means you generally pay tax at a lower rate than your normal income if the payment doesn t exceed certain caps Amounts you include from a genuine redundancy Depending on your employment conditions a genuine redundancy payment may include payment in lieu of notice

https://kb.taxcalc.com/2273

This article will complete an example scenario to best explain the process and entries required for the method of declaring redundancy and severance payments In this scenario the overall payment received as per the P60 P45 is 100 000 of which 75 000 is relating to redundancy

How Can I Calculate My Tax Return The Tech Edvocate

Same I Get Literally 0 In My Tax Return

Your 5 Most Important Numbers To Track

What Various Status Of Tax Returns Mean Easy Guide 2023 Easy Guide

Here s Why Your Tax Return May Be Smaller This Year Wnep

Can I Submit My Tax Return Early TI Accountancy Ltd

Can I Submit My Tax Return Early TI Accountancy Ltd

Tax Return Pricing Allied Tax Consulting

Online Tax Return Form BKG Book Keeping Accounting Services

How To Reduce Landlord Taxes Tax Insider

Do I Include Redundancy On My Tax Return - If all you have is a redundancy payment up to 30 000 against which your employer has allowed an exemption and the amount of post employment notice pay is Nil just fill in box 9 with the amount