Do I Need To Claim Tax Relief On My Pension Contributions When you can t claim relief You can t get tax relief if you use your

To claim additional tax relief you ll need to enter your total gross pension contributions for the tax year including the 20 basic rate tax bonus Once you ve calculated your annual pension contributions Steve Webb replies One of the attractive features of saving into a pension is that you get tax relief on your pension contributions The amount of tax relief you receive depends on

Do I Need To Claim Tax Relief On My Pension Contributions

Do I Need To Claim Tax Relief On My Pension Contributions

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

You get relief at source in all personal and stakeholder pensions For tax relief at source into an employee pension you don t need to do anything to

You ll have to personally claim tax relief on pension contributions if you re a higher How to tell if you re due a pension tax refund You may have been affected by this and could be due a refund from HMRC if you are over 55 the age you re allowed to access your pension pot from and have

Download Do I Need To Claim Tax Relief On My Pension Contributions

More picture related to Do I Need To Claim Tax Relief On My Pension Contributions

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

What Is Pension Tax Relief Moneybox Save And Invest

https://www.moneyboxapp.com/wp-content/uploads/2020/01/Copy-of-How-do-_pensions-work_-02-1024x516.png

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

You can get tax relief on personal pension contributions up to 100 of You can get UK tax relief on contributions you make into certain types of

Tax relief if you don t pay tax If you earn less than the Personal Allowance 12 570 in Tax relief is payable only on eligible contributions made into your Nest retirement pot The contributions that are eligible for tax relief are One off and regular contributions paid by you Contributions deducted from

How To Claim Pension Higher Rate Tax Relief

https://static1.s123-cdn-static-a.com/uploads/2997680/2000_60357c3160036.jpg

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

https://rebategateway.org/wp-content/uploads/2020/06/Eligible-2-2048x2048.png

https://www.gov.uk/guidance/self-assessment-claim...

When you can t claim relief You can t get tax relief if you use your

https://getpenfold.com/news/self-assessment …

To claim additional tax relief you ll need to enter your total gross pension contributions for the tax year including the 20 basic rate tax bonus Once you ve calculated your annual pension contributions

List Of Personal Tax Relief And Incentives In Malaysia 2023

How To Claim Pension Higher Rate Tax Relief

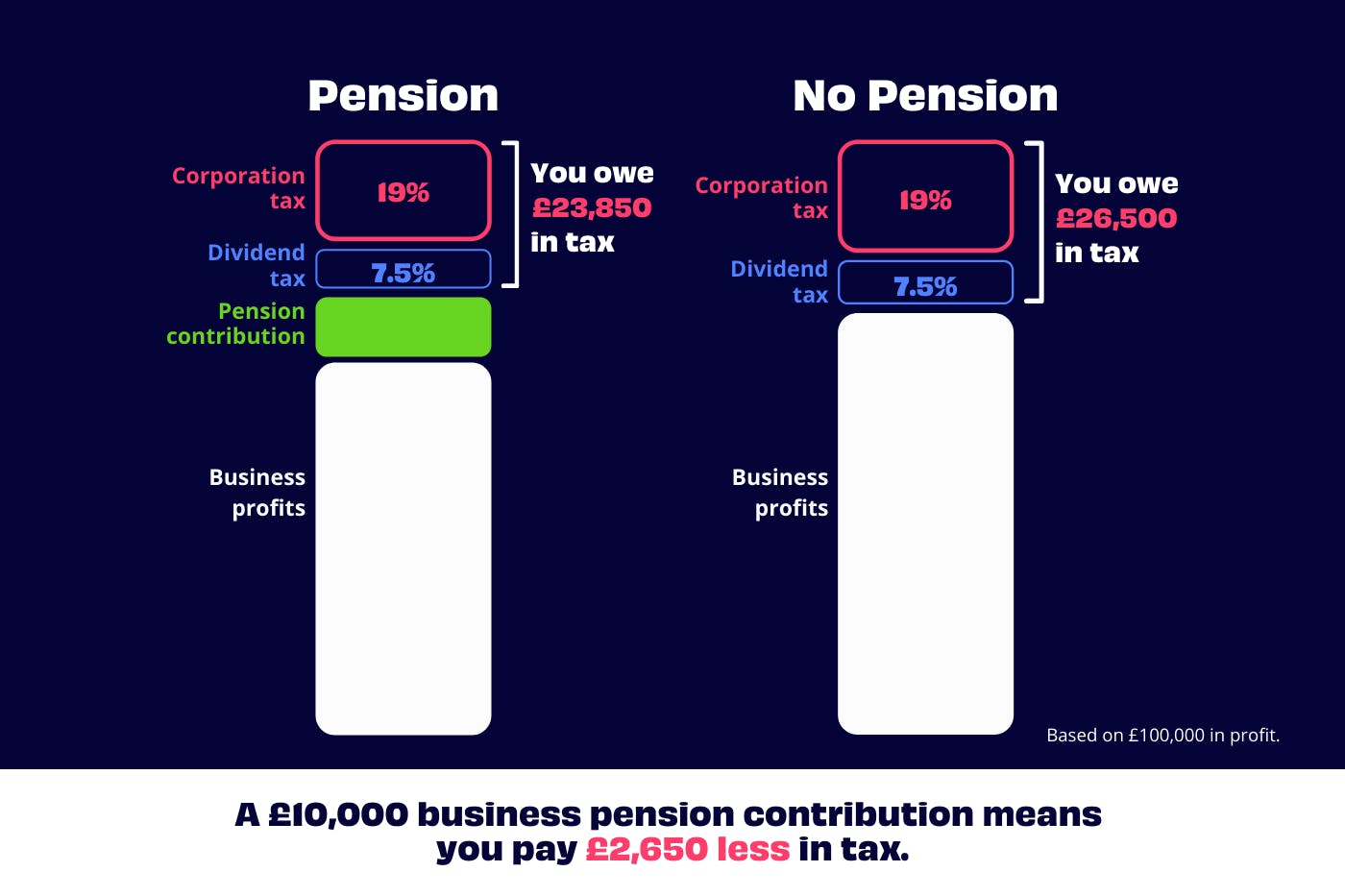

Tax Relief On Pension Contributions FKGB Accounting

Pension Tax Relief In The United Kingdom UK Pension Help

Self Employed Pension Tax Relief Explained Penfold Pension

How To Claim Pension Tax Relief 2023 Updated

How To Claim Pension Tax Relief 2023 Updated

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Claim Tax Relief As An Employee For Your Expenses Prestige Business

.jpg)

Huisdieren Pension Vogels

Do I Need To Claim Tax Relief On My Pension Contributions - For tax relief at source into an employee pension you don t need to do anything to