Do I Pay Fica On Pension Income Depending on where you live your state may tax pension income Pensions are not taxable by the state in which the money was earned Rather they are

Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation and Edited by Mike Obel Fact Checked by Jeff White CEPF If you generate retirement income from an investment portfolio you will not pay FICA taxes such as

Do I Pay Fica On Pension Income

Do I Pay Fica On Pension Income

https://i.ytimg.com/vi/3eXbeUp3-f0/maxresdefault.jpg

What Is The FICA Tax And How Does It Connect To Social Security GOB

https://cdn.gobankingrates.com/wp-content/uploads/2021/10/iStock-1095175206-3.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

The money you contribute to FICA won t directly impact how much you receive in Social Security benefits nor how much you ll pay for Medicare coverage FICA Retirement doesn t cut your responsibility to pay income tax or Social Security and Medicare known as FICA taxes If your sources of income change in retirement

Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security State and local government employees in some states who are entitled to a pension may only be required to pay the Medicare portion of FICA taxes If you are

Download Do I Pay Fica On Pension Income

More picture related to Do I Pay Fica On Pension Income

What Is FICA Tax The TurboTax Blog

https://lh6.googleusercontent.com/xTwJdMALHxH_uMnxI5fVesuT_Df6YvQupgpFx4pnNsRH9cdwtrpyrictq6X9N24hmU0Od89iw1srY2doCtk1ZQKQhBqM-C-ldygkIJLVxxaWrYCSXkKyE0iyGtMnws32bph5Q3y8uDcv7QN0cZGotcfpZXiQujr8HX6eMEfBTcjAuoQkZj3XgVh8

What Is FICA Tax The TurboTax Blog

https://lh4.googleusercontent.com/L65ItuDWwYXa3PATXhw3vL_rHdwa0Ot3FfsalcyqzBmXaToSyt22icmEHUqksjp7ZVNANXIoZ9w-Dz7e67Rao5M69lmORiGeZ5uIu6llEBhgzGFafGiP-KpheSrrUAb-dZg6Nx1V88_9LHkL1s19c_dKEoloYKJ4a-5fNfTcIXVjDs1iTExumuNP

Who Pays Payroll Taxes Cheatsheet

https://www.patriotsoftware.com/wp-content/uploads/2022/12/FICA-Tax-1.png

As employees work and pay FICA taxes they earn credits for Social Security benefits Today s FICA taxes help pay for current retirees and other beneficiaries benefits If If money was withheld from your wages for Social Security or FICA your wages are covered by Social Security This means you are paying into the Social Security system

No but they are closely connected FICA the Federal Insurance Contributions Act refers to the taxes that largely fund Social Security retirement You may not pay FICA taxes if your retirement income isn t from wages or businesses If you receive Social Security benefits you may owe income taxes

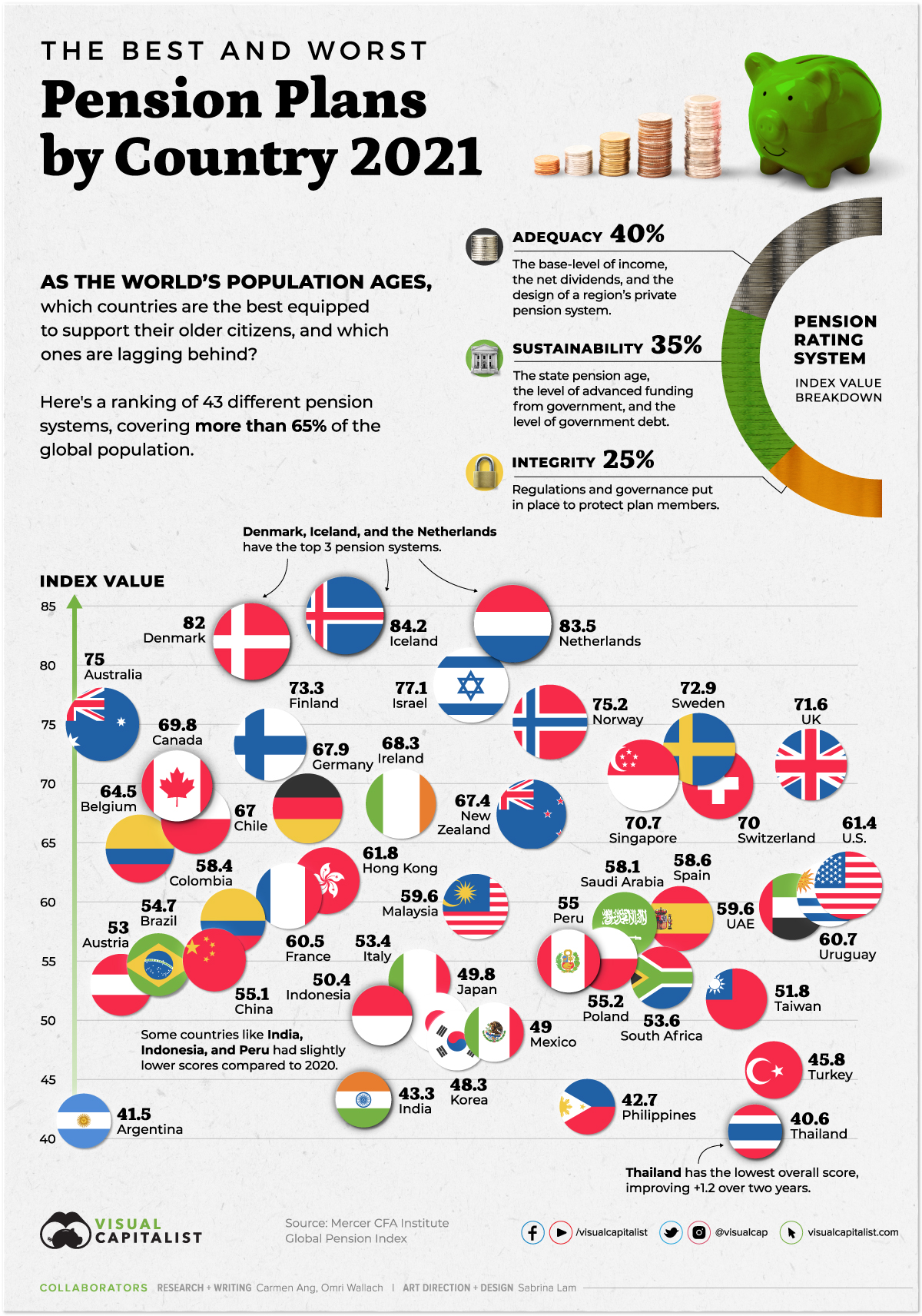

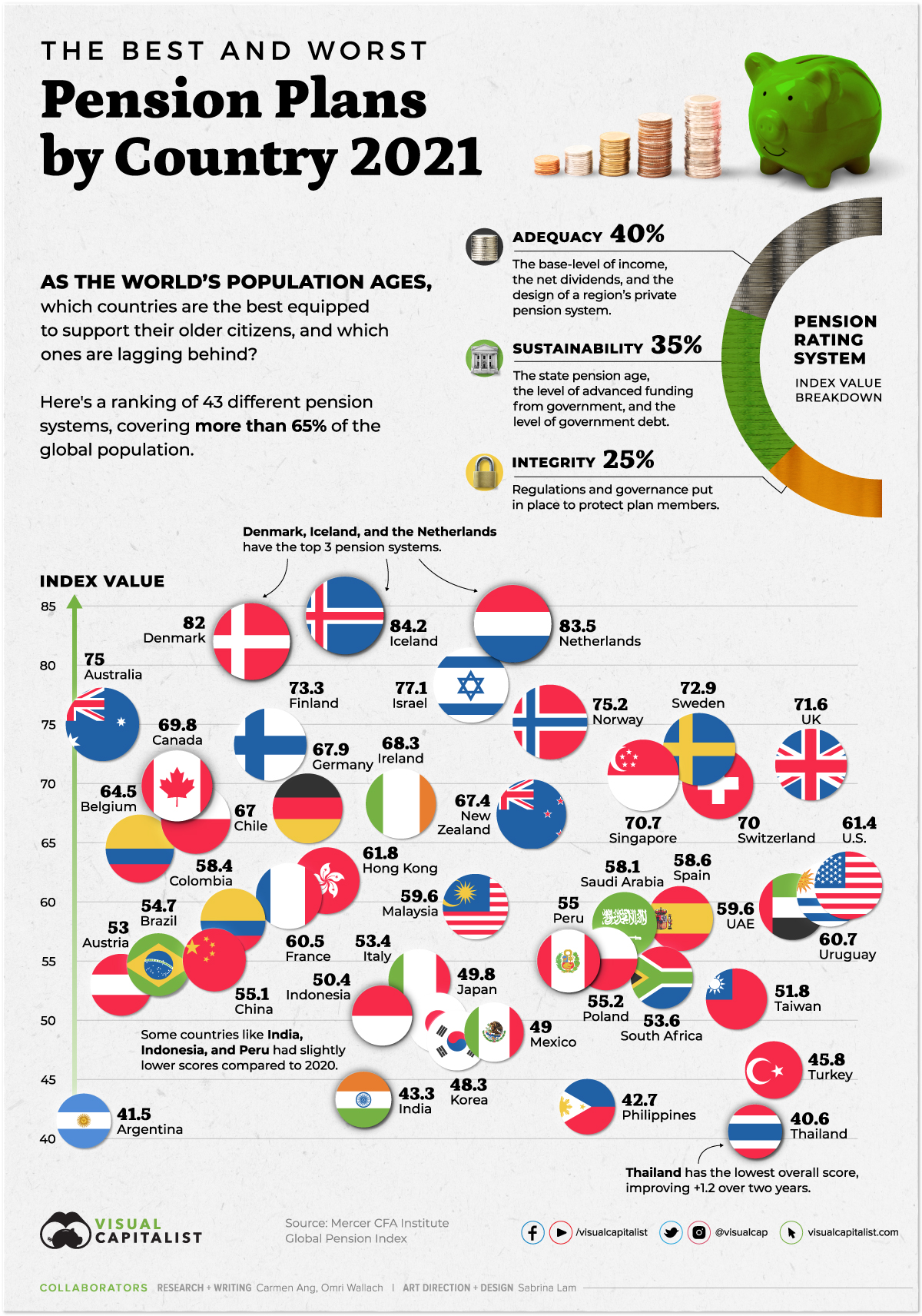

Ranked The Best And Worst Pension Plans By Country

https://www.visualcapitalist.com/wp-content/uploads/2021/11/The-Best-and-Worst-Pensions-Plans-Around-the-World-2021_Nov23_main.jpg

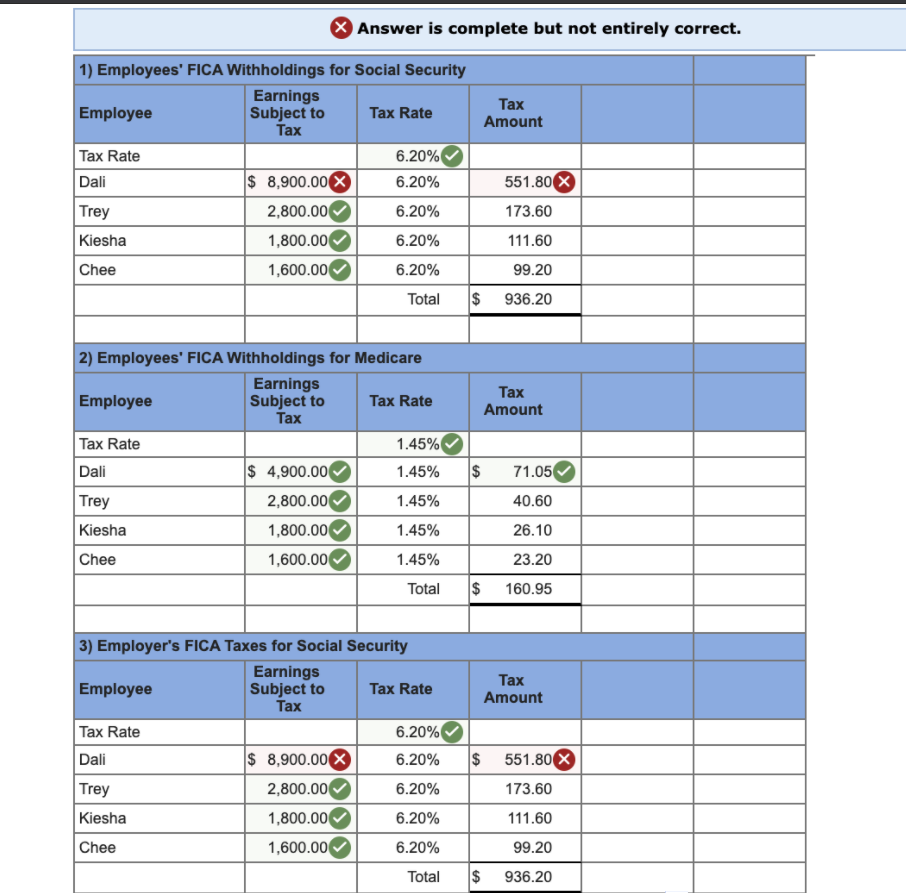

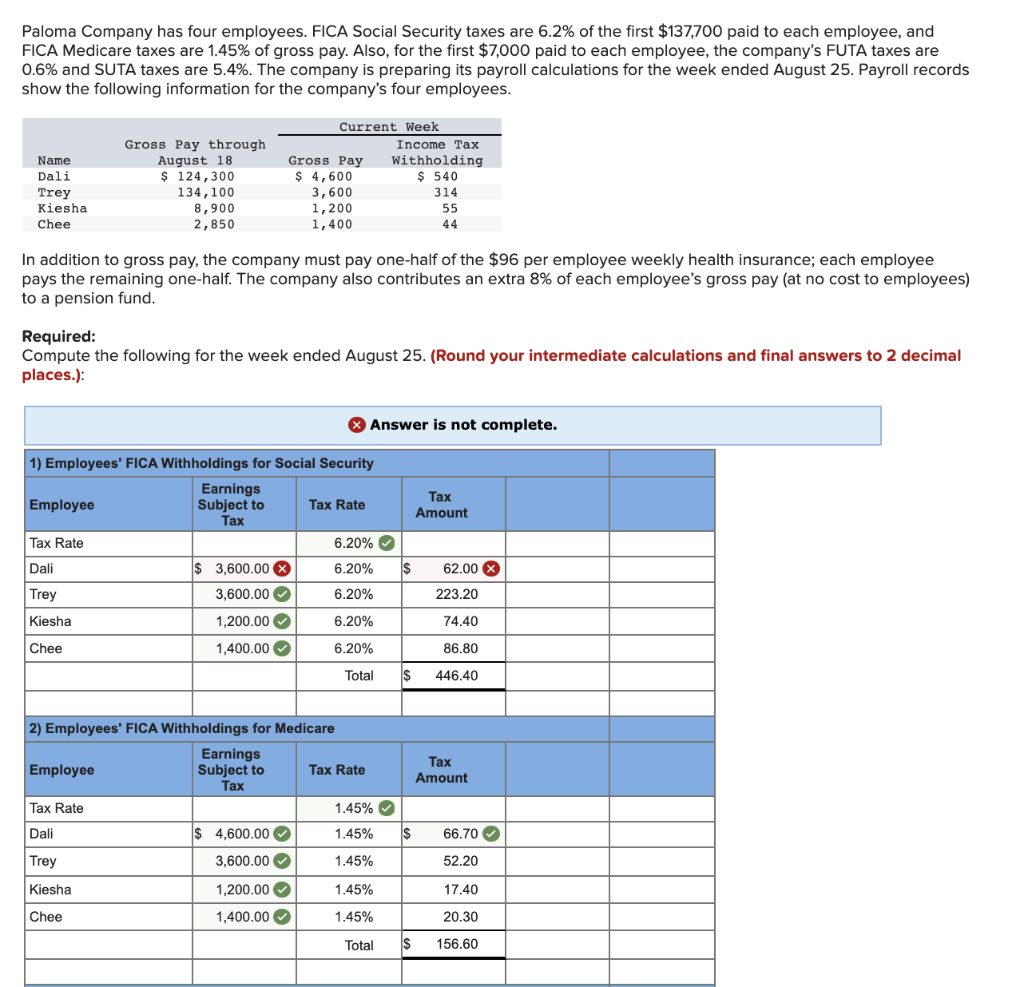

Solved Paloma Co Has Four Employees FICA Social Security Chegg

https://media.cheggcdn.com/media/a23/a23a4cec-d78f-4bb7-91f0-72d04c315939/phpmfYpza.png

https://money.usnews.com/money/retirement/aging/...

Depending on where you live your state may tax pension income Pensions are not taxable by the state in which the money was earned Rather they are

https://www.vero.fi/en/individuals/tax-cards-and...

Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation and

Do I Pay Social Security Taxes On All Of My Income The Motley Fool

Ranked The Best And Worst Pension Plans By Country

Changes In NHS Pension Contributions Are You A Winner Or Loser

Solved Paloma Company Has Four Employees FICA Social Chegg

Maximize Your Paycheck Understanding FICA Tax In 2023

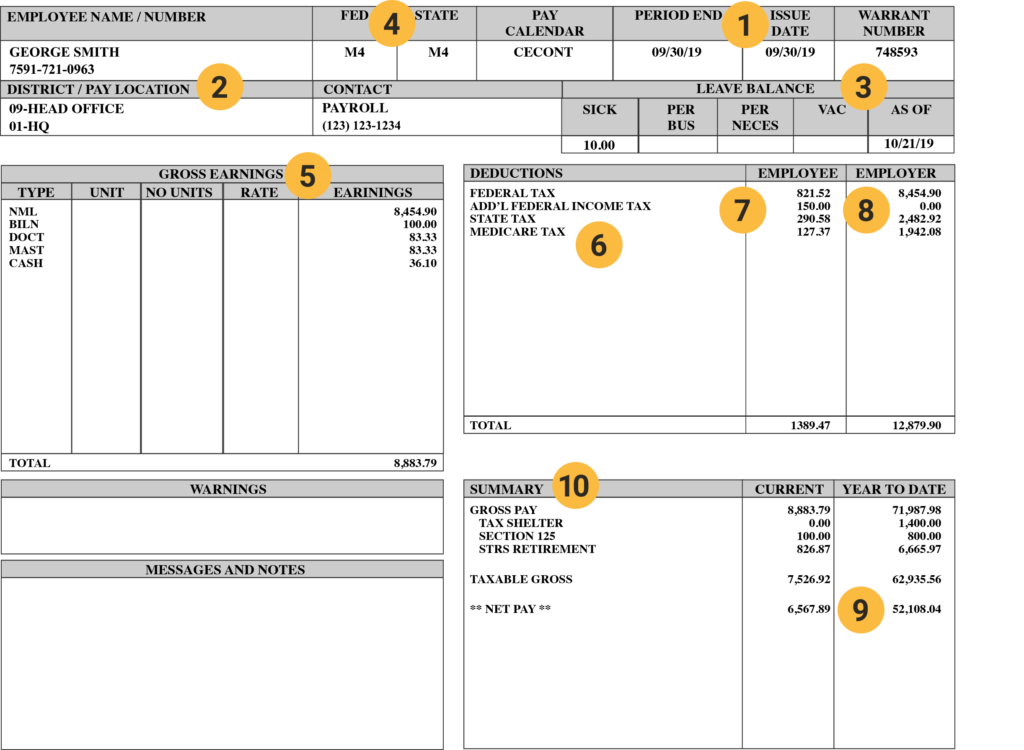

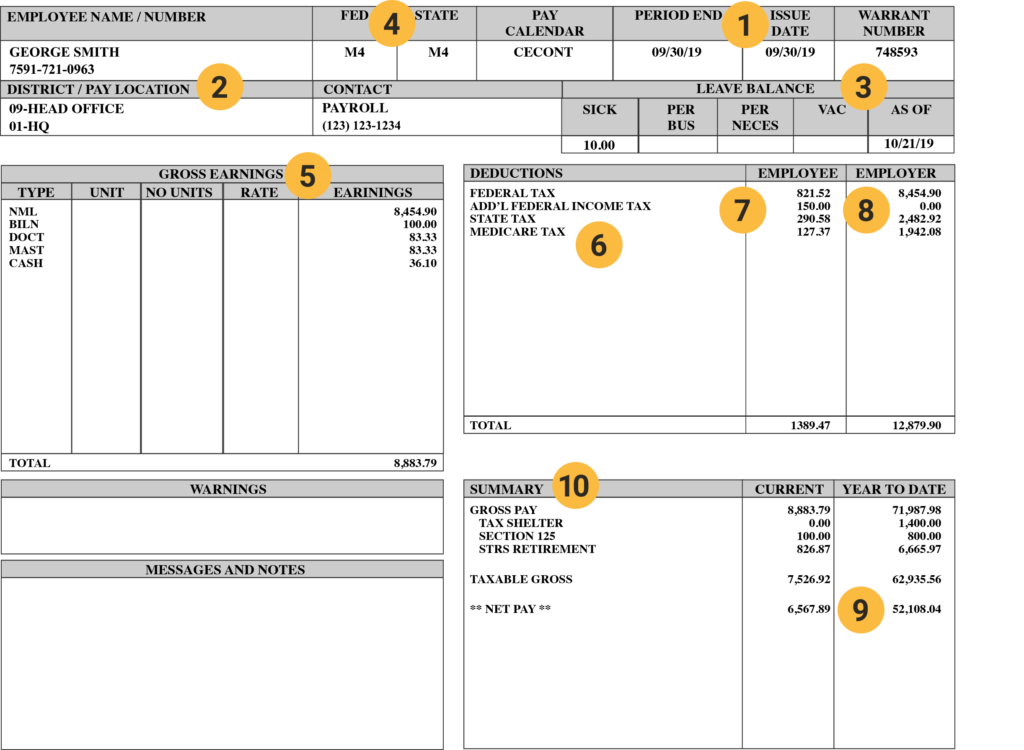

9 Proof Of Wage Loss Paystub SwalesSrikar

9 Proof Of Wage Loss Paystub SwalesSrikar

INCOME TAX ON PENSION HOW TO CALCULATE TAX ON PENSION IS PENSION

How To Calculate Exemption On Pension Income

How To Calculate FICA For 2020 Workest

Do I Pay Fica On Pension Income - Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security