Do I Qualify For A Solar Rebate Web Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet the following criteria Your solar PV system was installed between January 1 2017 and December 31 2034 The solar

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

Do I Qualify For A Solar Rebate

Do I Qualify For A Solar Rebate

http://www.solarquotes.com.au/blog/wp-content/uploads/2016/05/solar-rebate-phase-out.jpg

Your Home May Qualify For Government Rebates To Go Solar TonicGrid

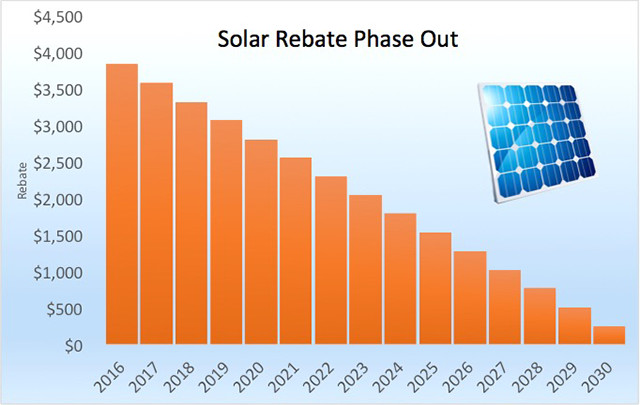

https://tonicgrid.com/wp-content/uploads/2018/04/img894.png

Do I Qualify For The Solar Rebate

https://www.experteasy.com.au/blog/content/images/size/w1600/2021/06/solar-panel-installation.jpg

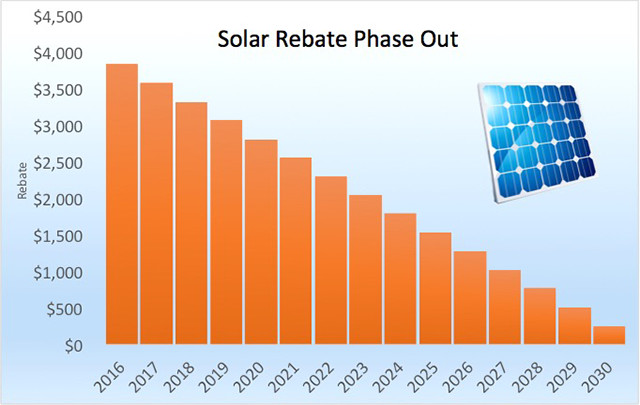

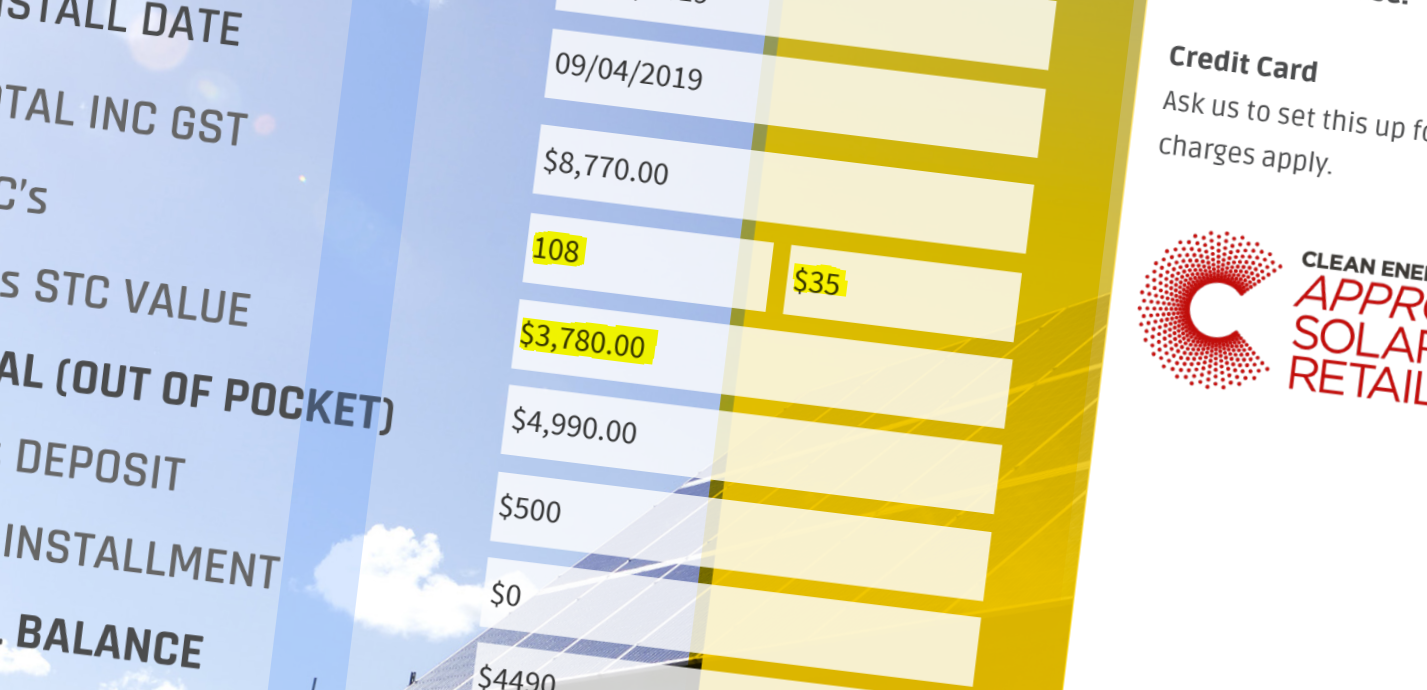

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web 21 avr 2023 nbsp 0183 32 Solar systems installed before 2033 are eligible for a tax credit equal to 30 of the costs of installing solar panels A 20 000 solar system would receive a tax credit of 6 000 to what you owe in federal

Web 30 d 233 c 2022 nbsp 0183 32 View available federal tax credits for social energy systems such as solar panels and solar water heaters Review requirements credit amounts and more Web 16 ao 251 t 2022 nbsp 0183 32 Here s the new and improved federal solar tax credit step down schedule As you can see the new schedule has the credit at 30 until it steps down to 26 in 2033 and 22 in 2034 And the 30 credit

Download Do I Qualify For A Solar Rebate

More picture related to Do I Qualify For A Solar Rebate

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

Solar Rebates Saving The Planet And Your Pockets Alliance For

https://www.all4energy.org/uploads/1/0/5/6/105637723/editor/solar-rebates-final-final.png?1564772220

2020 Guide To Solar Panels In Maryland Solar Tax Credits SRECs More

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-MD-solar-rebates--ranked.png

Web The credit is worth 26 of your project costs in 2022 It drops to 22 in 2023 then expires for residential projects at the start of 2024 The Solar ITC is a major incentive for going solar that most Americans are eligible Web 12 sept 2022 nbsp 0183 32 Yes off grid residential solar systems can qualify for the solar tax credit if they meet the other criteria In fact solar systems on RVs and boats can also qualify if they are established through the IRS as a

Web 1 janv 2023 nbsp 0183 32 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per Web 16 ao 251 t 2023 nbsp 0183 32 To qualify for the new rebate program s incentives for cutting energy use such as San Francisco s GoSolarSF program and Sacramento s SMUD solar rebate

The Victorian Solar Homes Rebate Explained Half Price Solar Starting Now

https://www.solarquotes.com.au/blog/wp-content/uploads/2018/08/victoria-solar-rebate.jpg

WA Rebate Finder Solar

https://wa-rebatefinder.com.au/wp-content/uploads/2019/10/Qualify-Solar-Badge-1080x1080.png

https://www.energy.gov/eere/solar/homeown…

Web Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet the following criteria Your solar PV system was installed between January 1 2017 and December 31 2034 The solar

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Your MAXIMUM Solar Rebate Perth WA Subsidy Ultimate Guide

The Victorian Solar Homes Rebate Explained Half Price Solar Starting Now

Solar Panel Rebates And Incentives A Comprehensive Guide

News Solar Power Direct

Latest Solar Rebates And Payments

A Solar Attic Fan May Qualify You For Tax Rebates ISolar Solutions

A Solar Attic Fan May Qualify You For Tax Rebates ISolar Solutions

The Truth About The Solar Rebate SAE Group

How To Apply For A Rebate On Your Solar Panels REenergizeCO

Solar Rebate Program Ending Alba Solar Energy

Do I Qualify For A Solar Rebate - Web 30 d 233 c 2022 nbsp 0183 32 View available federal tax credits for social energy systems such as solar panels and solar water heaters Review requirements credit amounts and more