Do International Students Get Tax Refund However being a student or trainee you may be entitled to student tax relief based on a tax treaty in the same manner as residents The relief amounts to 510 per month or 17 a day unless otherwise provided in the tax treaty between your country and Finland

I m an international student can I claim a tax refund when I leave the UK If you are a non EU resident who has been studying in the UK and you leave the UK and EU for 12 months or more then you can sometimes get VAT refunds on purchases you have made in the UK within the last 3 months Are international students due a tax refund If the amount of tax deducted from your payments during the tax year is more than the tax shown on your 1040NR then you will be due a refund otherwise you will be required to pay your US tax liabilities

Do International Students Get Tax Refund

Do International Students Get Tax Refund

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

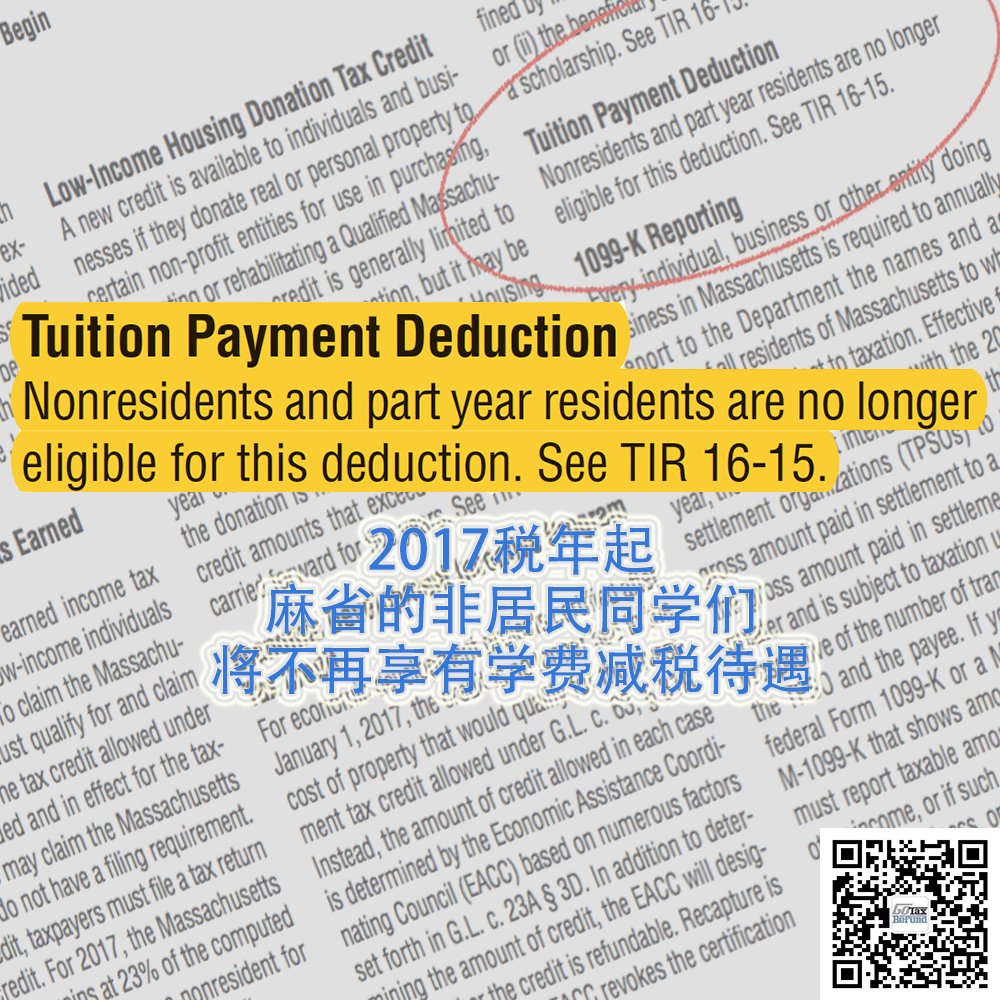

Do International Students Get Tax Refund On Tuition Tax Walls

https://pbs.twimg.com/media/DUU1N-2X0A00kHw.jpg

How To Get A Full Tax Refund As An International Student In US

https://blog.sprintax.com/wp-content/uploads/2017/02/full-tax-refund-international-students-1500x844.jpg

You might get a refund Some international students will qualify for a refund due to tax treaties and a lack of serious income if they ve earned income in the US Protect taxation of your worldwide income Every international student is required to file a tax return as a condition of your visa but not everyone will pay taxes to the American government International students are entitled to a number of benefits and exemptions so many will not owe anything

Do International Students Have to File a Tax Return Yes According to the Internal Revenue Service IRS all international students and scholars on F or J visas must file Form 8843 even if they do not earn an income while studying in the United States Aliens temporarily present in the United States as students trainees scholars teachers researchers exchange visitors and cultural exchange visitors are subject to special rules with respect to the taxation of their income

Download Do International Students Get Tax Refund

More picture related to Do International Students Get Tax Refund

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-e1566379729336.jpg

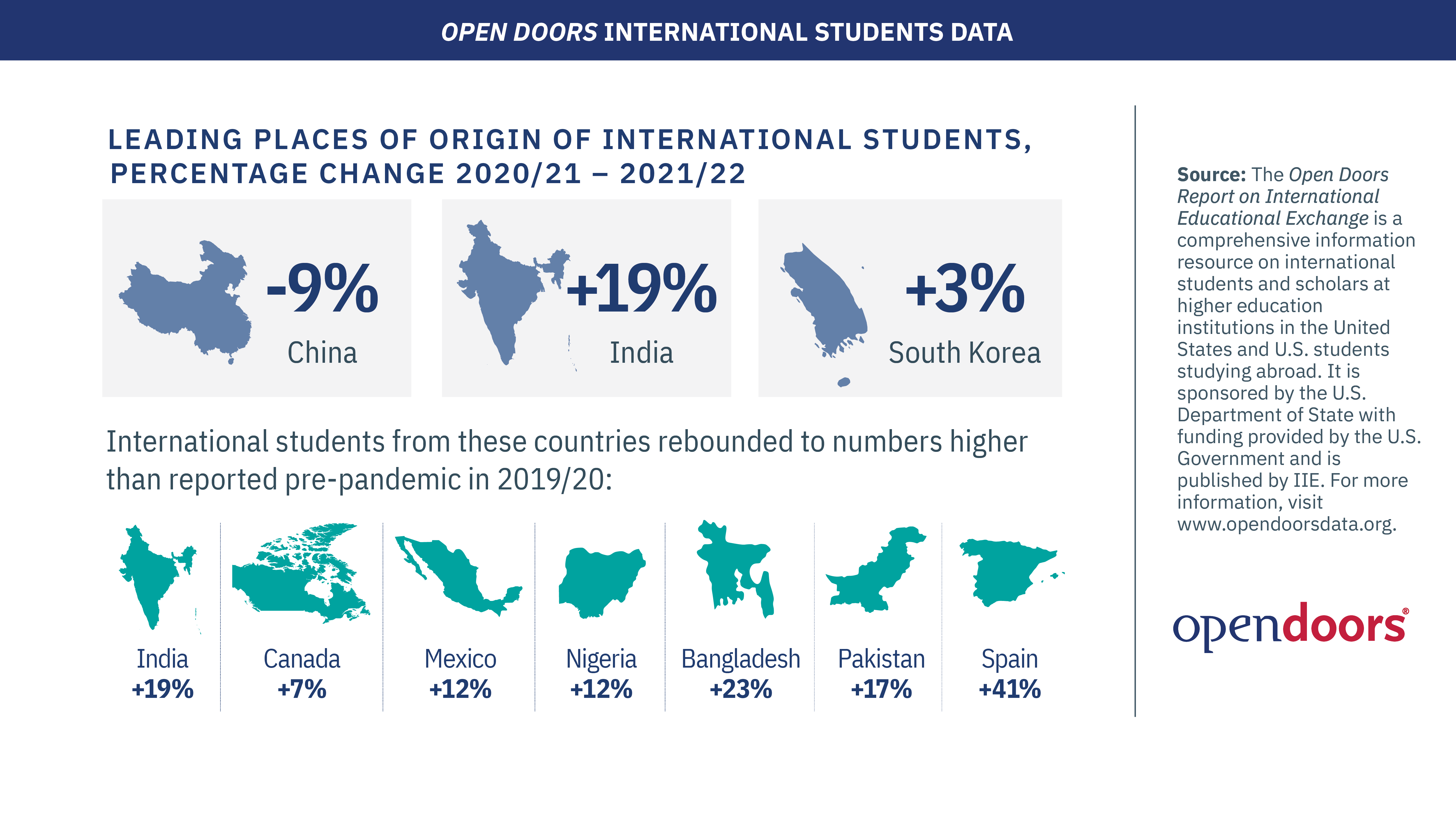

International Students Are Coming Back To U S Campuses

https://www.insidehighered.com/sites/default/server_files/media/OD22_Infographics_International Students_Rebound.png

International Students In US By Country Of Origin 1949 2022

https://statisticsanddata.org/wp-content/uploads/2022/12/International-students-in-US-by-country-of-origin.png

If you are an international student studying in Canada you may have to file a Canadian income tax return You must determine your residency status to know how you will be taxed in Canada Students who are eligible to take out a UK student loan have to make repayments through the UK tax system in the same way as any other UK student borrower if they come within the UK tax system after they finish their course for example if they find a job in the UK after completing their studies

If you re an overseas student and enrolled to study in Australia in a course that lasts for 6 months or more you may be regarded as an Australian resident for tax purposes Generally if you are an Australian resident you need to declare all income you ve earned both in Australia and overseas on your Australian tax return The tuition tax credit is a non refundable tax credit What it does is take your tax payable to 0 So if you had no income and paid no tax there is nothing for the tax credit to be applied to and it will carry over for next year well 2023

Canadian Work Placement Tax Refund For International Students In Canada

https://www.studyandgoabroad.com/wp-content/uploads/2015/07/tax_refund.jpg

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

https://www.vero.fi/en/detailed-guidance/guidance/...

However being a student or trainee you may be entitled to student tax relief based on a tax treaty in the same manner as residents The relief amounts to 510 per month or 17 a day unless otherwise provided in the tax treaty between your country and Finland

https://self-service.kcl.ac.uk/article/KA-01322/en-us

I m an international student can I claim a tax refund when I leave the UK If you are a non EU resident who has been studying in the UK and you leave the UK and EU for 12 months or more then you can sometimes get VAT refunds on purchases you have made in the UK within the last 3 months

Filing Taxes In Canada As An International Student OurTRU

Canadian Work Placement Tax Refund For International Students In Canada

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

How To Apply For A Tax Refund Theatrecouple12

Do International Students Have To Pay Income Tax 2020

Your Tax Refund Is The Key To Homeownership

Your Tax Refund Is The Key To Homeownership

How To Get Tax Refund In USA As Tourist Resident For Shopping FAQs

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

Do International Students Get Tax Refund - You will have to pay tax on the income you earn while in Australia but the good news is that the majority of international students in Australia are entitled to claim a tax refund at the end of the year Students that work part time in Australia pay on average 15 5 income tax on their earnings