Do International Students Need To File Taxes Do International Students Have to File a Tax Return Yes According to the Internal Revenue Service IRS all international students and scholars on F or J visas must file Form 8843 even if they do not earn an income while studying in the United States

Income partially or totally exempt from tax under the terms of a tax treaty and or Any other income that is taxable under the Internal Revenue Code Filing IS NOT required by nonresident alien students and scholars who have income ONLY from Foreign sources Interest Income from a U S bank U S savings loan institution U S credit Do international students have to file a tax return Yes compliant tax filing is one of the conditions of the F 1 visa Therefore you must file your tax documents before the deadline in 2023 the tax deadline is April 18 for the 2022 tax year

Do International Students Need To File Taxes

Do International Students Need To File Taxes

https://images.ctfassets.net/2htm8llflwdx/vN2XBaud15BTKHM0ip10I/c90a8fa4366f91a3fcbbd1f58251be66/GettyImages-1294420811.jpg

Tax Info For F 1 International Students

https://mccollege.edu/wp-content/uploads/2021/04/F1-students-filing-taxes.png

Top 9 Do I Need To File A Tax Return If My Income Is Low 2023

https://digitalasset.intuit.com/IMAGE/A7WNPg8Cw/1does-everyone-need-to-file-an-income-tax-return_L7pluHkoW.jpg

Student Tax Return All international students inside the United States must file their tax return each year In 2023 this needs to be done on or before Monday April 18th Our tax section has all the information and advice you need to file your tax return and get professional help if needed If you are an international student or scholar follow these steps to file a tax return Step 1 Determine your residence status Step 2 Determine whether you had any income from US sources in the previous year Step 3 Determine which forms you need to fill out Form

Taxes for International students studying in Canada If you are an international student studying in Canada you may have to file a Canadian income tax return You must determine your residency status to know how you will be taxed in Canada Every international student is required to file a tax return as a condition of your visa but not everyone will pay taxes to the American government International students are entitled to a number of benefits and exemptions so many will not owe anything In fact if you paid too much tax throughout the year you may be entitled to a refund

Download Do International Students Need To File Taxes

More picture related to Do International Students Need To File Taxes

Why International Students Need To Know The Cost Of Hiring In The U S

https://romeromentoring.com/wp-content/uploads/2021/06/why-international-students-need-to-know-the-cost-of-hiring-in-the-u-s.png

Do I Need To Pay Taxes The Minimum Income To File Taxes

https://www.taxslayer.com/blog/wp-content/uploads/2018/09/do-i-make-enough-to-pay-taxes-e1605639489394-2048x1154.jpg

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_1080xN.3639280950_fitj.jpg

Just like Americans international students in the USA are required to file a tax return It s important to understand that filing tax returns is mandatory for international students and not doing so by the deadline could result in problems with or a revocation of your visa as well as possible ineligibility for a green card You must file your taxes by April 15 F 1 and J 1 students are NOT exempt from paying taxes You must file a tax return if you earn any taxable income by working in the U S If you are an F 1 or J 1 student and didn t earn any taxable income in the U S you will still have to fill out Form 8843 and submit it to the IRS

As an F or M international student you must file taxes if you have Income from wages unless the income you earned does not exceed the personal exemption amount A taxable scholarship or fellowship Income from stock options Lottery or gambling winnings Other types of non wage income F 1 and J 1 international students and scholars who were present in the U S during any portion of the past calendar year may be What is a Tax Return or Tax Filing Why Do I Need to File Any of your earnings in the U S are subject to applicable federal state and local taxes Filing tax paperwork such as a tax return is a

What Tax Forms Do I Need To File Taxes Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/10/what-tax-forms-do-i-need.jpg

When To File Taxes H R Block Newsroom

https://www.hrblock.com/tax-center/wp-content/uploads/2019/01/when_to_file_hero.jpg

https://shorelight.com/student-stories/filing...

Do International Students Have to File a Tax Return Yes According to the Internal Revenue Service IRS all international students and scholars on F or J visas must file Form 8843 even if they do not earn an income while studying in the United States

https://www.irs.gov/individuals/international...

Income partially or totally exempt from tax under the terms of a tax treaty and or Any other income that is taxable under the Internal Revenue Code Filing IS NOT required by nonresident alien students and scholars who have income ONLY from Foreign sources Interest Income from a U S bank U S savings loan institution U S credit

International Students In UK Higher Education FAQs House Of Commons

What Tax Forms Do I Need To File Taxes Credit Karma

6 Benefits Of Filing Your Taxes Early You Need To Know Sheffield

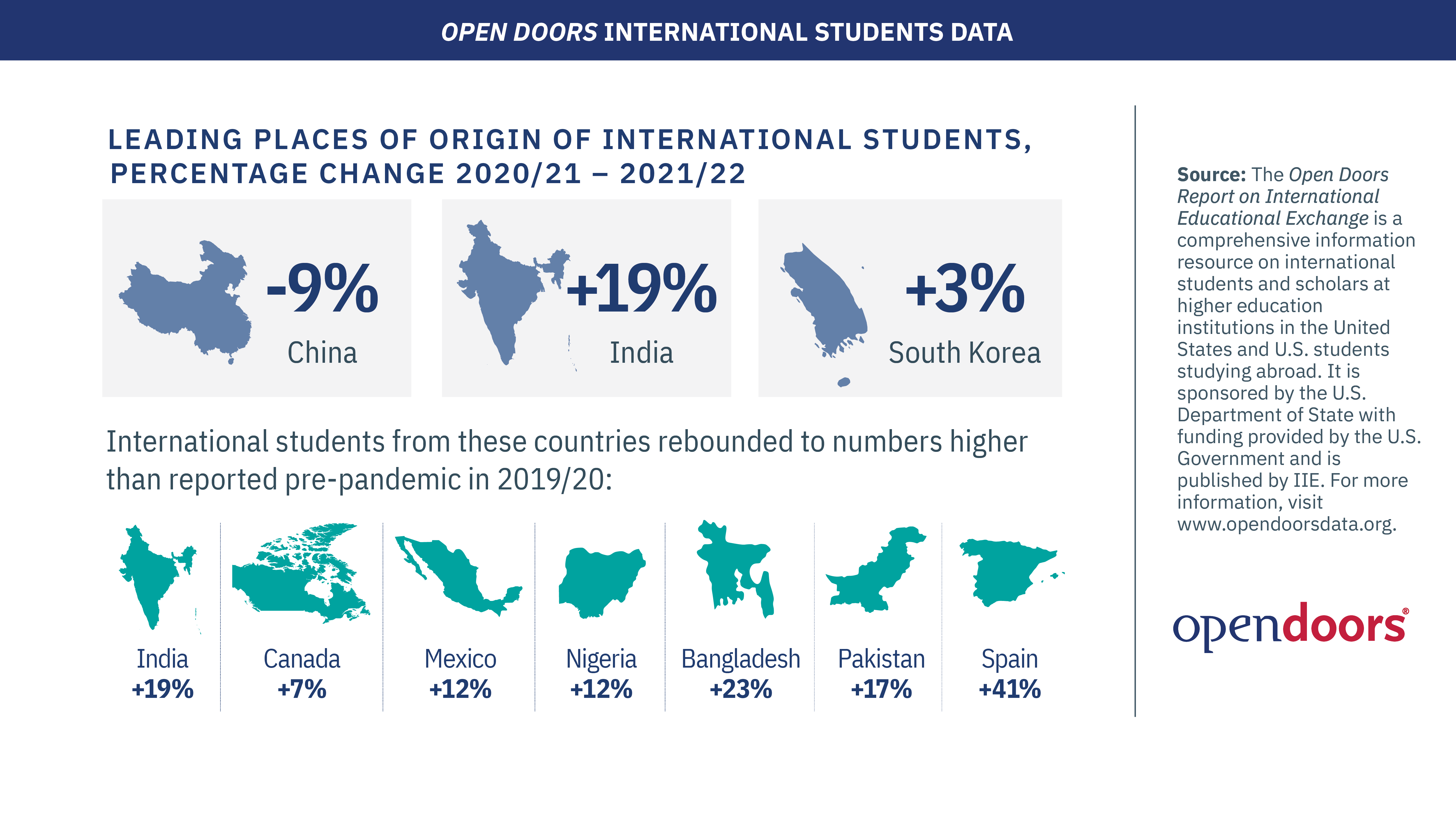

International Students Are Coming Back To U S Campuses

8 Things International Students Need To Know About Manitoba The Arc

Do You Need To File Taxes As A Small Business Owner Camino Financial

Do You Need To File Taxes As A Small Business Owner Camino Financial

International Students In US By Country Of Origin 1949 2022

2023 Income Tax Filing Threshold Printable Forms Free Online

When Can You File Taxes In 2023 Kiplinger

Do International Students Need To File Taxes - Every international student is required to file a tax return as a condition of your visa but not everyone will pay taxes to the American government International students are entitled to a number of benefits and exemptions so many will not owe anything In fact if you paid too much tax throughout the year you may be entitled to a refund