Do Landlords Get Tax Relief On Mortgage Payments How did the mortgage interest tax relief change Before 2017 The interest for your mortgage was 100 deductible Since most individual landlords have interest only mortgages you could basically claim all mortgage

Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every Explore tax relief options for residential landlords including deductions and allowances Optimise your tax strategy with expert advice

Do Landlords Get Tax Relief On Mortgage Payments

Do Landlords Get Tax Relief On Mortgage Payments

https://comfortkeepers.ie/app/uploads/2022/08/BC_220302_1438_Final-resize.jpg

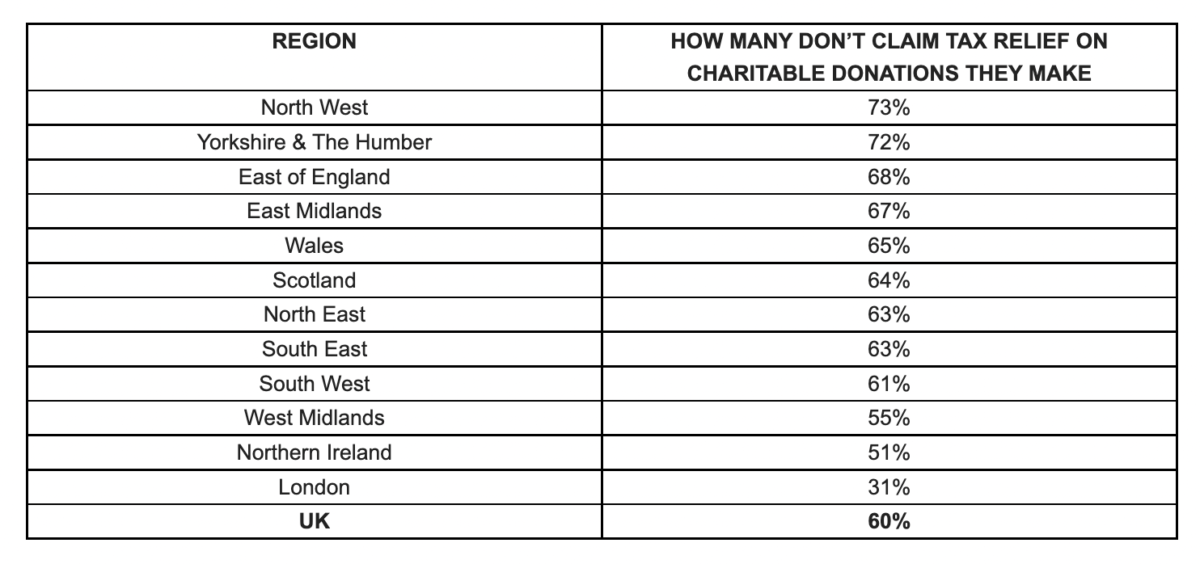

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Direct Tax Relief On LinkedIn Direct Tax Relief Confidential

https://media.licdn.com/dms/image/D5618AQGLEC5iEoohYg/companyUpdate-article-image-shrink_1280/0/1657839917937/IRSProblemsjpg?e=2147483647&v=beta&t=0y3ohXTeQR5SlirhQ6oD3DVi6QNW7yu_4i6zH1r_Ngw

The new mortgage interest tax relief rules mean landlords have to pay more tax on buy to let income Here are 3 calculations so you know what to expect The tax relief that residential landlords could previously claim on their mortgage interest payments was gradually phased out over a period of four tax years Prior to 2017 The total interest paid

Historically the interest you paid towards a mortgage payment could be deducted from your rental income before you paid tax on it However as of April 2020 Landlord mortgage interest tax relief in 2024 25 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill Instead you now receive a tax credit

Download Do Landlords Get Tax Relief On Mortgage Payments

More picture related to Do Landlords Get Tax Relief On Mortgage Payments

Tax Relief Matters Abacus Advice

https://www.aaltd.co.uk/blog/wp-content/uploads/2023/07/taxre.jpg

Landlords Tax Relief On Mortgage Interest Dixon Lewis

https://dixonlewis.co.uk/wp-content/uploads/2022/04/CTAsPM_BLUE_RGBjpg.jpg

5 Reasons To Put Your Tax Refund Into A Savings Account

https://cottslaw.com/wp-content/uploads/2023/05/avoid-4-tax-resolution-comapny-rip-offs-1000x675.jpg

Landlord mortgage interest tax relief in 2024 25 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental income to reduce your Landlords could previously deduct mortgage expenses from their rental income before tax reducing their overall bill This meant a landlord with mortgage interest

Landlords can no longer deduct their mortgage interest payments as an expense when calculating their taxable rental income Instead a tax credit known as the property Sarah Bradford explains the rules governing tax relief for interest and finance costs Landlords whose current fixed rate mortgage deals have come to an end are likely to be facing a hike in

Window To Enjoy Tax Reliefs Closing CN Advisory

https://cnadvisory.my/wp-content/uploads/2023/12/2418512.jpg

Tax Relief Changes For Residential Landlords As Of April 2017 First

https://www.firstcallfinancials.co.uk/wp-content/uploads/2016/08/Tax-Relief-Blog.jpeg

https://taxscouts.com › landlord-tax-return…

How did the mortgage interest tax relief change Before 2017 The interest for your mortgage was 100 deductible Since most individual landlords have interest only mortgages you could basically claim all mortgage

https://www.mo…

Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every

Computer Tax Relief Fresh Mango Technologies UK

Window To Enjoy Tax Reliefs Closing CN Advisory

Made In The Midlands Patent Box Tax Relief Changes

Crypto Losses How To Claim Tax Relief UK HMRC Guide 2023

:max_bytes(150000):strip_icc()/4-things-landlords-are-not-allowed-do_final-b75d9df2c42841239d7f7222cceba6c1.png)

4 Things Landlords Are Not Allowed To Do NRS CHAPTER 118A LANDLORD

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Is A pensions Tax Raid Coming Weston Murray Moore

Conditions Related Tax Relief On HRA The Economic Times

Do Landlords Or Tenants Pay Property Taxes Complications Of Property

Do Landlords Get Tax Relief On Mortgage Payments - It s crucial to understand that the Buy to Let mortgage interest tax relief applies exclusively to individual landlords and those in partnerships Companies and Furnished