Do Mini Splits Qualify For Tax Credit Did you know you can claim tax credit from your mini split system Discover what rules are in place and how you can claim credit next tax season

Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Do Mini Splits Qualify For Tax Credit

Do Mini Splits Qualify For Tax Credit

https://www.richaircomfort.com/mt-content/uploads/2023/09/savings.png

Unlocking Savings Do Mini Splits Qualify For Tax Credit In 2024

https://www.richaircomfort.com/mt-content/uploads/2024/01/do-ductless-mini-splits-qualify-for-tax-credit-in-2024-2.png

Which Electric Vehicles Qualify For Federal Tax Credits The New York

https://static01.nyt.com/images/2022/12/29/multimedia/29EV-LIST-1-7403/29EV-LIST-1-7403-videoSixteenByNine3000.jpg

If your ductless mini split system was installed and running after December 31 st 2022 but before January 1 st 2024 you could get 22 percent off as a tax credit If your system was installed and running after December 31 st 2019 but before January 1 st 2023 the tax credit is 26 percent If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 We ll help you compare the credits and decide whether they apply to expenses you ve already paid or will apply to

The answer is indeed yes but there are specific conditions that must be met to be eligible for these tax credits To qualify for federal tax credits now and future tax years it s crucial that the mini split system you choose meets specific energy efficiency criteria set by the government The good news is ductless mini splits still qualify for home energy tax credits in 2024 However as before there are specific efficiency criteria your mini split must meet to be eligible federal tax credits

Download Do Mini Splits Qualify For Tax Credit

More picture related to Do Mini Splits Qualify For Tax Credit

Unlocking Savings Do Mini Splits Qualify For Tax Credit In 2023

https://www.richaircomfort.com/mt-content/uploads/2023/10/mini-split-tax-credit-1-1.png

Do Mini Splits Work In Cold Weather Climate Effectively Aircondlounge

https://aircondlounge.com/wp-content/uploads/2021/07/Do-Mini-Splits-Work-in-Cold-Weather-1200x800.jpg

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

https://www.carscoops.com/wp-content/uploads/2022/08/EVs-tax-credits.jpg

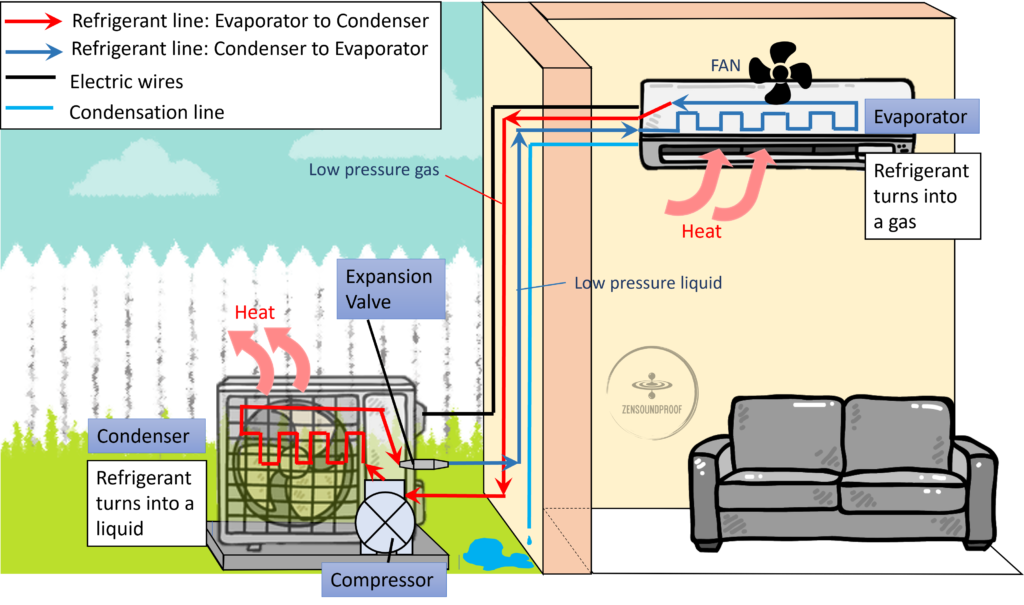

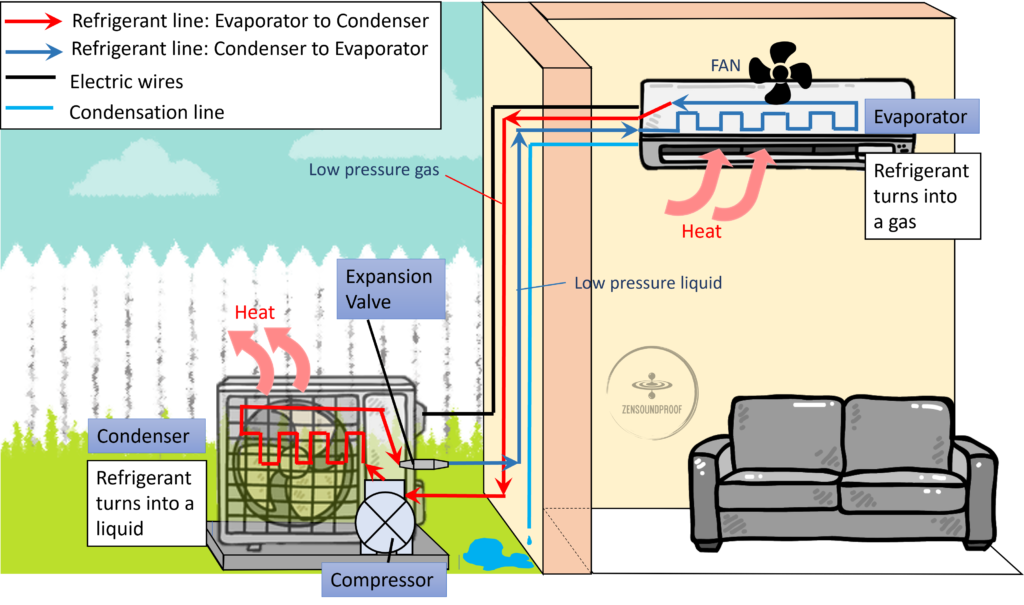

Begins with tax year 2023 January 1 2023 claim credit in 2024 on your 2023 taxes Up to 600 per item up to 1 200 credit breaker panel insulation fossil fuel systems meeting elevated efficiency limits 30 of total cost up to 2 000 is applicable for the category of heat pumps and heat pump water heater installations These devices are available as ducted and ductless versions the latter are also called mini splits and both types of heat pumps are eligible for EEHIC For installing a qualifying energy efficient heat pump you can claim 30 of the purchase and installation costs as tax credits up to a maximum of 2 000 annually

ENERGY STAR certified ductless heat pumps are an energy efficient environmentally friendly way to keep your home comfortable without the trouble or expense of adding ductwork What is a Mini split Heat Pump How to identify ductless heat pumps that qualify for the federal tax credits Set your browser to the CEE Directory Web site and select Find Variable Speed Mini Split and Multi Split Heat Pumps Qualifying split system heat pumps must meet CEE Tier 2 standards their highest tier for these systems Our ductless heat pumps are incredibly

Top 9 Quietest Mini Split Air Conditioners Which Ductless AC To Pick

https://zensoundproof.com/wp-content/uploads/2022/02/Mini-Split-summary-picture-1024x605.png

Only Six EVs Will Qualify For The 7 500 Federal Tax Credit Starting

https://bgr.com/wp-content/uploads/2021/12/Tesla-Cars.jpg?quality=82&strip=all

https://www.pioneerminisplit.com/blogs/news/do...

Did you know you can claim tax credit from your mini split system Discover what rules are in place and how you can claim credit next tax season

https://www.energystar.gov/about/federal-tax...

Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

Ioniq 5 And Many Other EVs May Lose Federal Tax Credit Eligibility

Top 9 Quietest Mini Split Air Conditioners Which Ductless AC To Pick

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

The Best 12000 BTU Mini Split Options HVAC Solvers

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

The Best Self Employed Tax Deductions And Credits In 2022

Do Mini Splits Run On 110 Or 220

Do Mini Splits Qualify For Tax Credit - After January 1 2023 homeowners may receive a nonrefundable tax credit for 30 of installation costs of eligible HVAC system installations in existing homes up to Up to 600 for qualifying air conditioners Up to 600 for qualifying gas furnaces Up to 2 000 for qualifying heat pump systems