Do Pensioners Pay Income Tax In India Verkko Income Tax for Pensioners 2023 When you get a certain amount of money as pension from your employer that amount of money becomes your salary after retirement and therefore it becomes taxable according to the provisions of the Income Tax Act 1961

Verkko 16 marrask 2023 nbsp 0183 32 Income Tax Calculation for Pensioners Pension benefits are taxed along with salary income In this case the pension amount is taxed on your income tax return under the heading quot Salary quot The possibility of receiving a commuted pension a lump sum payment rather than a monthly income exists Verkko 23 marrask 2023 nbsp 0183 32 Pension is taxable under the head salaries in your ITR According to the rules of taxation an uncommuted pension is viewed as a salary under the Income Tax Act of 1961 and therefore pension earners are required to

Do Pensioners Pay Income Tax In India

Do Pensioners Pay Income Tax In India

https://okcredit-blog-images-prod.storage.googleapis.com/2020/12/incometax4.jpg

Different Ways To Save Income Tax In India Under Section 80C

https://i.pinimg.com/originals/2b/99/cb/2b99cb347a93577e2e11ab53512dc436.png

Do Pensioners Pay Council Tax Pension Need to knows

https://www.localfinancialadvice.co.uk/media/osjk5kyc/pension-increase-2022.jpg?rmode=max&width=1000

Verkko Updated on May 3rd 2023 8 min read CONTENTS Show According to the IT Act pensions come under the head Income from Salaries Thus if a person s pension income falls above the exemption level filing the ITR for pensioners is necessary In this regard individuals can submit the ITR 1 Sahaj form Verkko Do pensioners pay tax on their pension The money you receive from pensions is classed as income and most income is taxed How is income tax calculated for a pensioner The 10 of the total pension of 10 years will be given in advance as lump sum amount Therefore 10 of Rs 20 000 x 12 x 10 Rs 2 40 000 will be the

Verkko 26 maalisk 2023 nbsp 0183 32 Pension income is considered Salary Income and is taxed at the taxpayer s appropriate slab rates Pension income is taxable for senior citizens and super senior citizens depending on Verkko 9 kes 228 k 2019 nbsp 0183 32 Please note pension is always taxable for all government employees and non government employees While calculating tax on commuted pension you will be eligible for exemption under section 10 10A Pensioners are also eligible for section 16 deductions from their gross salary Therefore for assessment year 2019 20 previous

Download Do Pensioners Pay Income Tax In India

More picture related to Do Pensioners Pay Income Tax In India

Personal Income Tax Guide In Malaysia 2016 Tech ARP

https://www.techarp.com/wp-content/uploads/2016/03/lhdn.png

Revocation Of Election To Pay Income Tax PDF Internal Revenue

https://imgv2-2-f.scribdassets.com/img/document/604062224/original/fd949e9143/1667214133?v=1

Why Do So Few People Pay Income Tax In India Parallels NPR

https://media.npr.org/assets/img/2017/03/07/gettyimages-625464968_wide-adf2731fc831e2dedd8f1d8dd793ba5bd032d26c.jpg?s=1400

Verkko Commuted pension which is being received by a family member as a lump sum payment may also get a tax exemption under the head Income Tax from other Sources Uncommuted pension received by one s family member subject to a minimum of Rs15 000 or 1 3rd of the total pension amount is exempted from tax Verkko 12 tuntia sitten nbsp 0183 32 Income tax returns 2024 Filing annual income tax returns are must for all Indian citizens Employees while retiring have to pay taxes on pension gratuity and employee provident fund

Verkko 7 jouluk 2023 nbsp 0183 32 Income tax on pension As per the income tax laws any money or benefit received in connection with your employment present and past is taxed under the head salaries How various pension schemes Verkko When the pension earned is below Rs 3 lakh no tax is levied Pension earned is from Rs 3 lakh to Rs 5 lakh 5 tax is levied Pension earned is from Rs 5 lakh to Rs 10 lakh then 20 tax is levied

WHAT IS INCOME TAX SHOULD YOU PAY

https://static.wixstatic.com/media/31c268_e005c6de2e0648f097387aa64ef37bcc~mv2.jpg/v1/fill/w_980,h_611,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/31c268_e005c6de2e0648f097387aa64ef37bcc~mv2.jpg

Do Pensioners Pay Council Tax Pension Need to knows

https://14528013.fs1.hubspotusercontent-na1.net/hub/14528013/hubfs/iStock-1359105322-1.jpg?width=1499&quality=low

https://www.bankbazaar.com/tax/income-tax-for-pensioners.html

Verkko Income Tax for Pensioners 2023 When you get a certain amount of money as pension from your employer that amount of money becomes your salary after retirement and therefore it becomes taxable according to the provisions of the Income Tax Act 1961

https://lifeinsurance.adityabirlacapital.com/.../income-tax-for-pensioners

Verkko 16 marrask 2023 nbsp 0183 32 Income Tax Calculation for Pensioners Pension benefits are taxed along with salary income In this case the pension amount is taxed on your income tax return under the heading quot Salary quot The possibility of receiving a commuted pension a lump sum payment rather than a monthly income exists

The India Fix Why Does Such A Small Number Of Indians Pay Income Tax

WHAT IS INCOME TAX SHOULD YOU PAY

Infographics INDIA S TOP CORPORATE TAX PAYERS Gallery Social News XYZ

01 Helpful Notes About Income Tax 2020 INCOME TAX AND SPECIAL

Do Pensioners Pay Council Tax If State Pension Is Taxable And Life

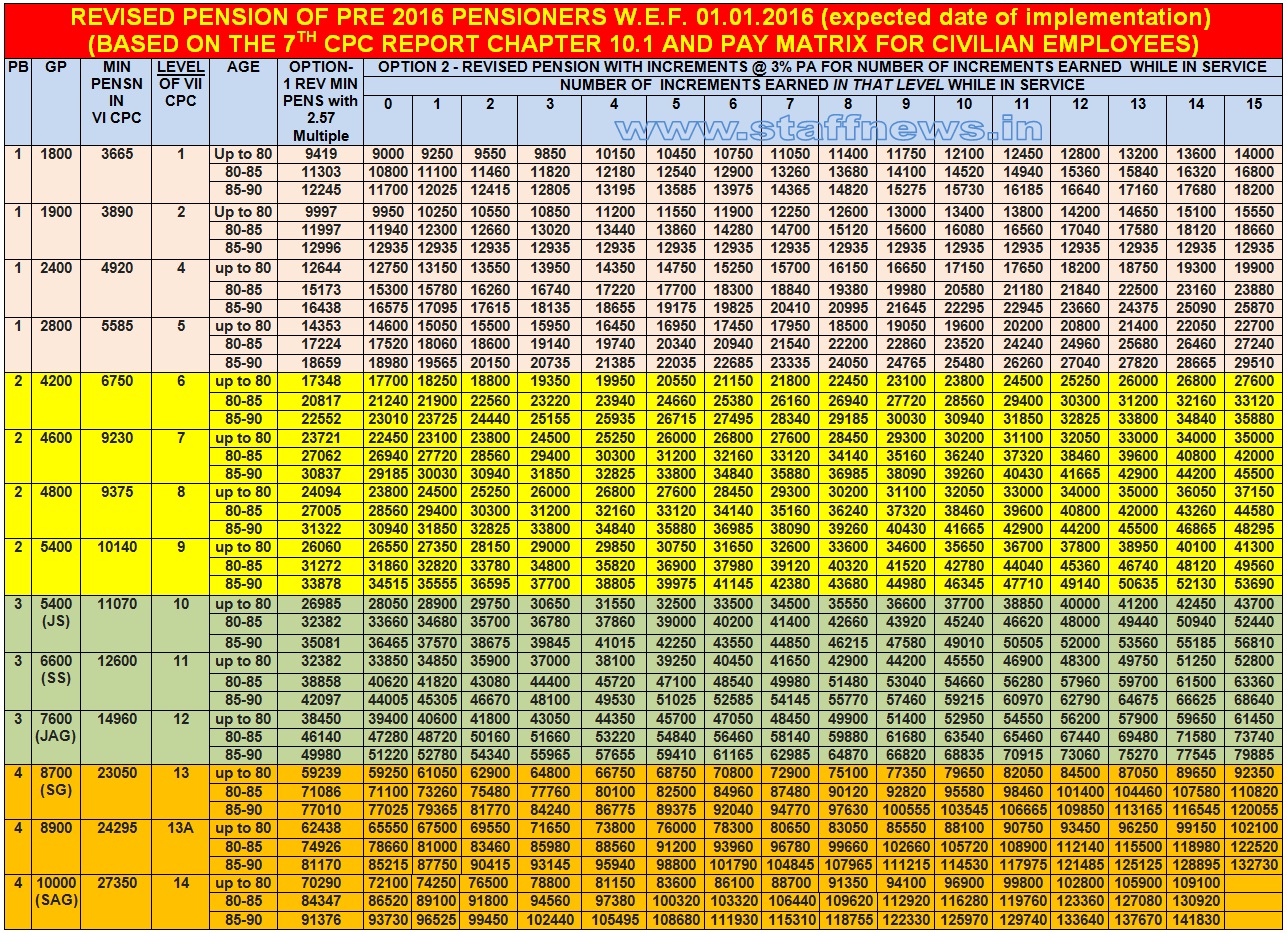

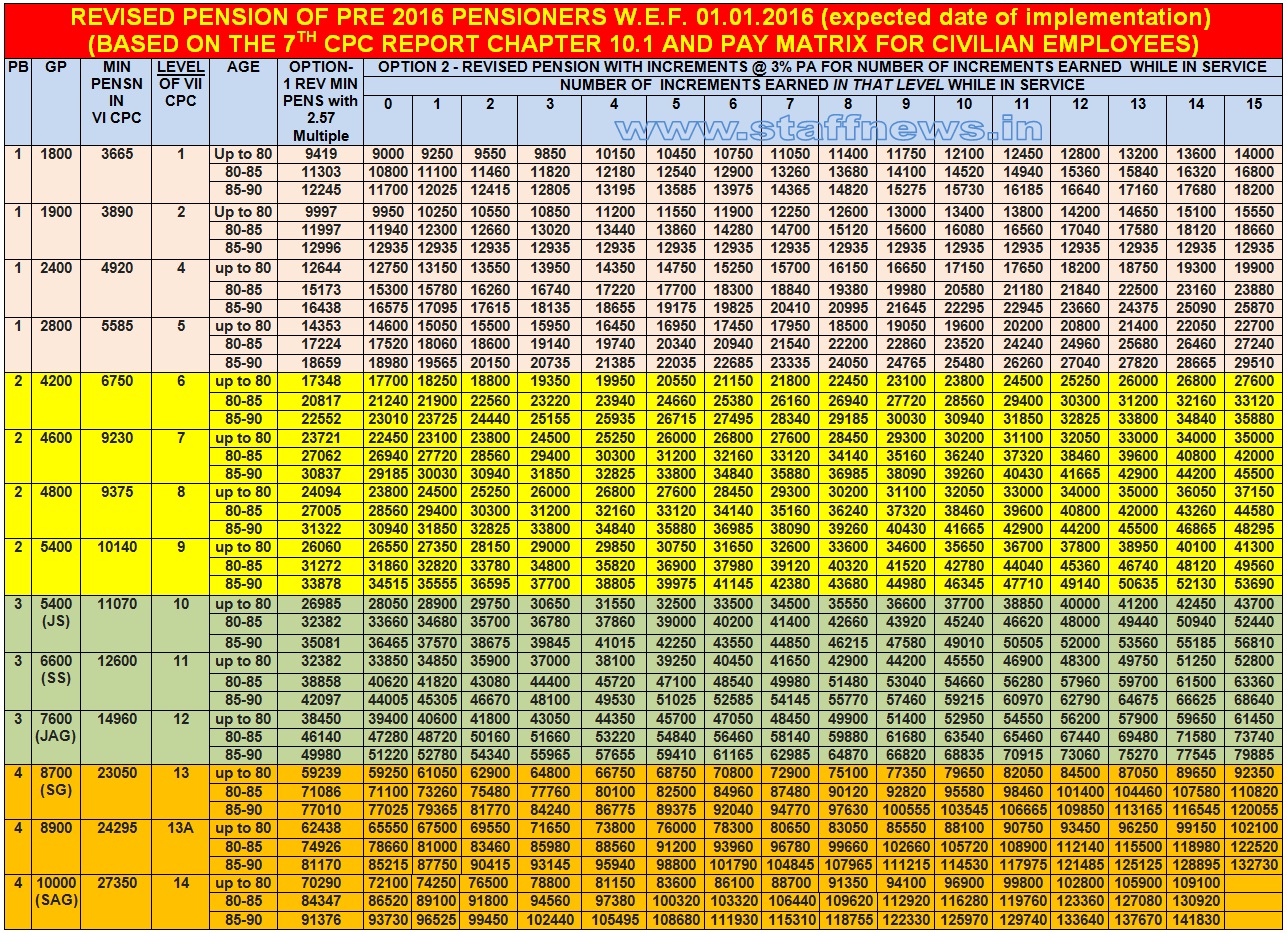

Revised Pension Table Of Pre 2016 Pensioners Based On 7th CPC Report

Revised Pension Table Of Pre 2016 Pensioners Based On 7th CPC Report

What Is The Personal Income Tax Who Must Pay

How To Save Income Tax In 2022 Top 9 Tax Saving Investments

Company Income Tax Malaysia Jacob Berry

Do Pensioners Pay Income Tax In India - Verkko 13 kes 228 k 2020 nbsp 0183 32 Pension is treated as salary and is generally taxed on one s income earned through salary This income is taxed under the head of salary in the taxpayer s ITR form Whether the pension is paid in lump sum amount or periodically both are taxable with different regulations In this article you will get to know complete