Do Placement Students Pay Tax If you are on a paid placement you will have to pay Income Tax and National Insurance on earnings that are over your personal allowance This includes international students

Do students pay tax Although you don t have to pay council tax students studying full time technically do still have to pay income School work experience placements Work experience students of compulsory school age are not entitled to the National Minimum Wage Voluntary workers Workers are not

Do Placement Students Pay Tax

Do Placement Students Pay Tax

https://www.expatustax.com/wp-content/uploads/2023/03/How-much-tax-do-you-pay-UK.jpg

Tips To Help International Students Pay Tax In Australia Total

https://www.totalassignment.com/blog/wp-content/uploads/2020/07/international-students-pay-tax-Australia-01-1.jpg

Do Students Pay Tax Think Student

https://thinkstudent.co.uk/wp-content/uploads/2022/11/pexels-nataliya-vaitkevich-6863248-1-1200x800.jpg

If your earnings exceed this personal allowance and you will be required to pay income tax It is worth noting however that an academic year spans two tax years Placement students do pay National Insurance Contributions The amount you pay will depend on how much money you will earn each week You only have to pay National

Foreign students usually do not pay UK tax on foreign income or gains as long as they re used for course fees or living costs like food rent bills study materials Check that the Wages paid to students are subject to tax and National Insurance Wage to students already on the payroll as part time workers No change to existing terms and conditions

Download Do Placement Students Pay Tax

More picture related to Do Placement Students Pay Tax

Do University Students Pay Tax Think Student

https://thinkstudent.co.uk/wp-content/uploads/2022/10/pexels-nataliya-vaitkevich-6863259-1.jpg

UK TAX SYSTEM EXPLAINED DO STUDENTS PAY TAX INCOME DEDUCTIONS IN

https://i.ytimg.com/vi/rNbM6dG3nj8/maxresdefault.jpg

Does Pay For Placement PR Work Crenshaw Communications

https://crenshawcomm.com/wp-content/uploads/2018/08/payforplayPR.jpg

What s the Deal with Paying Tax Even though you re still classed as a student if you earn over 10 600 on your placement year you ll have to pay income tax If you re a student and you have a job you ll have to pay Income Tax and National Insurance if you earn over a certain amount This still applies if you work

You won t have to pay council tax during your placement year This is because you are officially registered as a full time student with UWE Bristol You must provide the local Student taxes explained Here are seven things to know about tax in the UK When do you start paying tax Everyone in the UK is liable to pay tax but only on what

Do Students Pay Tax In Japan Japan Nihon

https://www.japannihon.com/wp-content/uploads/2023/03/im_5_pes-1-1200x600-1-1024x512.jpg

Do Students Pay Tax Tax Rebates Savings Tax More Uni Compare

https://cdn.universitycompare.com/img/studenttax.jpg

https://www.bath.ac.uk/guides/planning-your...

If you are on a paid placement you will have to pay Income Tax and National Insurance on earnings that are over your personal allowance This includes international students

https://www.savethestudent.org/make-money…

Do students pay tax Although you don t have to pay council tax students studying full time technically do still have to pay income

Do Students Pay Tax Tax Rebates Savings Tax More Uni Compare

Do Students Pay Tax In Japan Japan Nihon

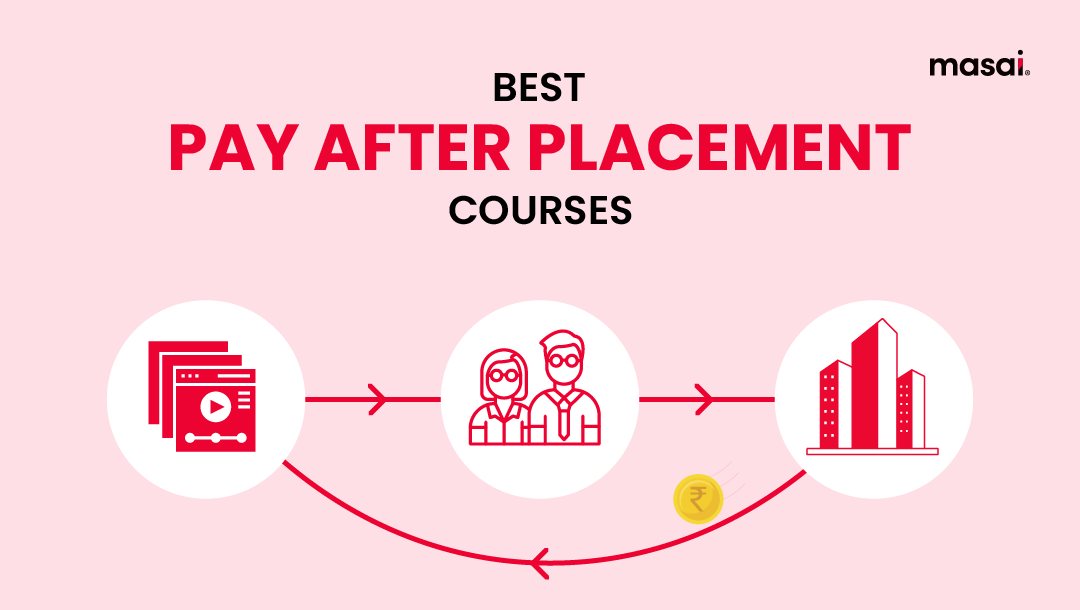

Best Pay After Placement Courses In India Masai School

Discover 92 About Highest Paying Job Australia Hot NEC

Do Students Pay Tax Unifresher

Do Students Pay Tax And Do They Pax Tax On Student Loans

Do Students Pay Tax And Do They Pax Tax On Student Loans

Scrapping Quater Two month Extension To Pay Tax Bills Online

The 6 Biggest Tax Myths That International Students Believe Tax

International Student Tax Return Explained Claim Your Refund Study

Do Placement Students Pay Tax - Wages paid to students are subject to tax and National Insurance Wage to students already on the payroll as part time workers No change to existing terms and conditions