Do Rebates Include Gst How GST applies to rebates Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and suppliers on making an adjustment Accounting for a rebate as a separate sale Information for suppliers and purchasers for a rebate as a separate sale QC 16694 Print or Download

Learn how to charge and account for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates Some government grants attract GST and some do not How to determine this depends partly on whether an obligation a good or service or an expectation to do something is supplied in return for the grant or sponsorship money

Do Rebates Include Gst

Do Rebates Include Gst

https://theminoritymindset.com/wp-content/uploads/2021/07/pexels-pixabay-164527-scaled.jpg

Is GST Mandatory For Udyam Registration Compulsory Or Not

https://udyamregistrationform.com/wp-content/uploads/2021/09/is-gst-mandatory-for-udyam-registration.jpg

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63bbe19de7d3d4408c132ae8_why-rebates-are-important-manufacturers-distributors-2400x1348px4 (1).png

If the customer making the purchase and receiving the rebate is a GST HST registrant and entitled to claim an input tax credit ITC for the GST or HST special rules apply to manufacturers rebates Gross income doesn t include goods and services tax GST If you carry on a business and earn income from salary and wages as someone else s employee this is not included as business income in your tax return

The assignment of solar tax credits does adjust the calculations for GST depending on the situation The ATO has an example that best describes and informs you on how to do the calculations This is under the GST and the Small scale Any price reduction you make does not include a refund adjustment or credit of the GST HST and neither you nor the customer has to issue a credit or debit note for GST HST purposes or make any adjustment on your GST HST return

Download Do Rebates Include Gst

More picture related to Do Rebates Include Gst

Rebates Are Inherently Collaborative YouTube

https://i.ytimg.com/vi/_iXRRf5CqGU/maxresdefault.jpg

Contract Compliance Audits Supplier Rebates How Confident Are You

https://financialprogression.com/wp-content/uploads/shutterstock_94008607.jpg

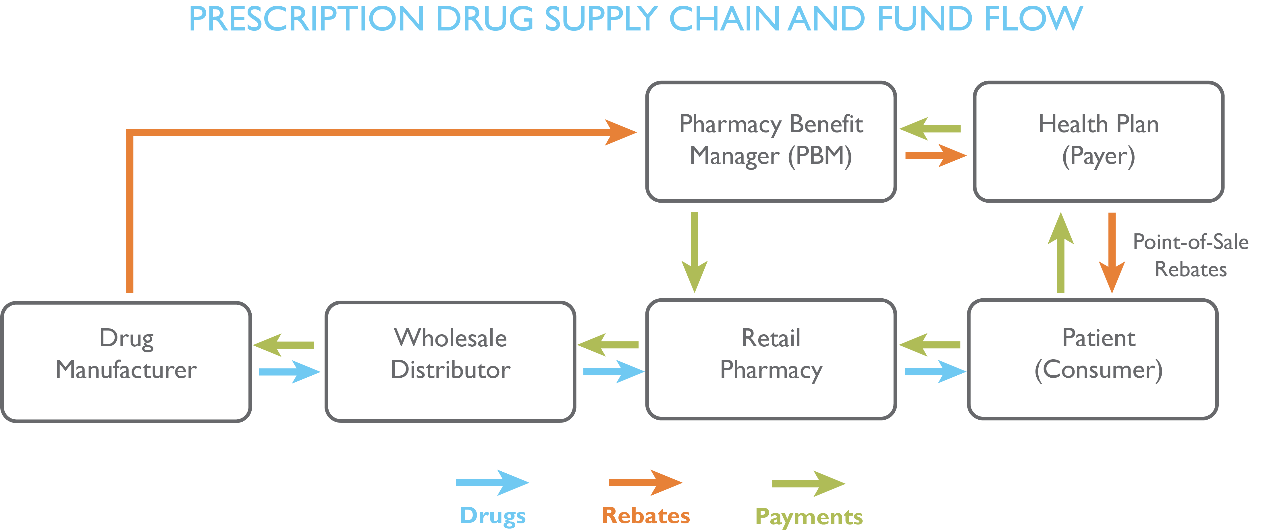

Plaintalk Blog What Is A Drug Rebate CIVHC

https://civhc.org/wp-content/uploads/2022/05/Drug-Rebate-Flow-Chart-Graphic.png

The calculation is correct GST is based on the price of the installation before the discount rebate is applied You can read up more on the GST and Small scale Renewable Energy Scheme information page If your solar rebate is offered by your Aim 1 1 This e Tax Guide provides details on the GST treatment applicable to common scenarios encountered by retailers businesses that sell goods to end consumers 1 2 You should read this guide if you are a GST registered person in the retail business 2 At a Glance

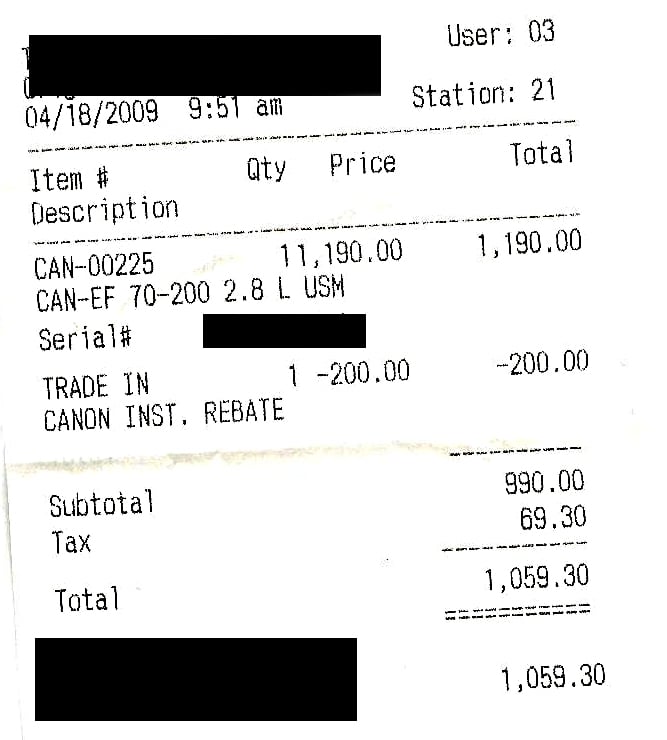

Although the purchaser is charged tax on the full amount the rebate includes an amount in respect of the GST such that the net effect is that the purchaser pays an amount which is equivalent to tax being charged on the price less the rebate exclusive of tax 6 000 I understand the GST on sales is calculated on the gross income before STC applies However I feel confused about when I actually get the money rebate for the STCs that the business owner sold to me

Tax Rebates Services

https://huzzaz.com/procoverphotos/tax-rebates-services.jpg?1656079144

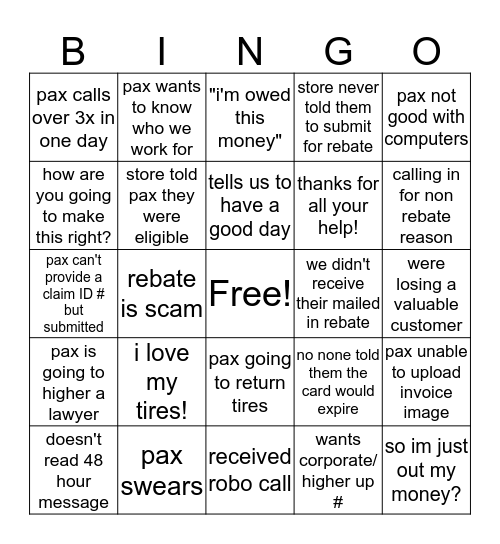

REBATES Bingo Card

https://bingobaker.com/image/2552513/544/1/rebates.png

https://www.ato.gov.au/.../gst-and-rebates

How GST applies to rebates Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and suppliers on making an adjustment Accounting for a rebate as a separate sale Information for suppliers and purchasers for a rebate as a separate sale QC 16694 Print or Download

https://www.iras.gov.sg/.../gst-on-discounts-and-rebates

Learn how to charge and account for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates

Website Aims To Make Rebates Easier To Get

Tax Rebates Services

Milwaukee Tool Rebates Printable Rebate Form

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Size Of This Preview 800 480 Pixels Other Resolution 320 192

USA Rebates

USA Rebates

Experience The Benefits Rebates Offers YouTube

Quick Availability Huge Equipment Rebates Industry Leading Financing

4 0 Rebates Apple

Do Rebates Include Gst - Gross income doesn t include goods and services tax GST If you carry on a business and earn income from salary and wages as someone else s employee this is not included as business income in your tax return