Do Rebates Need To Be Reported On Tax Returns Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example

Do Rebates Need To Be Reported On Tax Returns

Do Rebates Need To Be Reported On Tax Returns

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

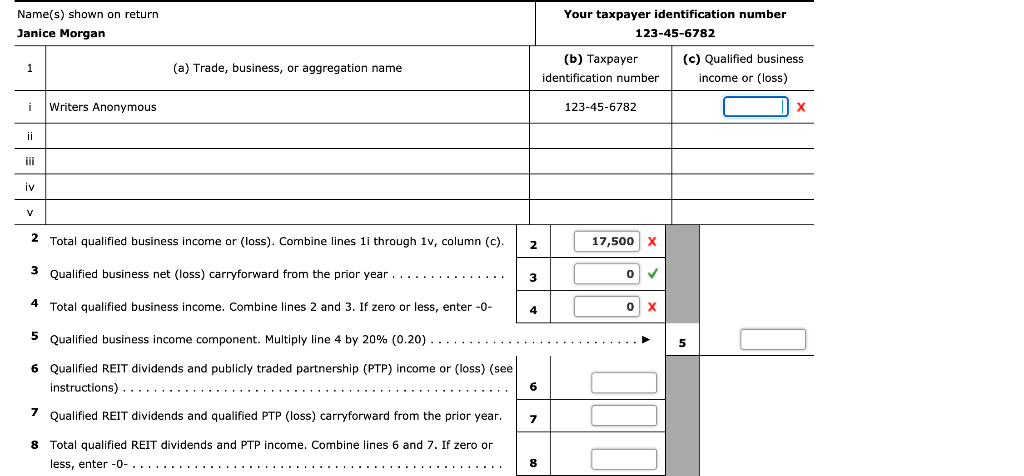

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

How To Report A 1099 R Rollover To Your Self Directed 401k YouTube

https://i.ytimg.com/vi/ZBjS1C6iOp8/maxresdefault.jpg

Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be Web 13 janv 2022 nbsp 0183 32 DO NOT report any information regarding your first or second Economic Impact Payment or 2020 Recovery Rebate Credit on your 2021 tax return Q H1 I m

Web 20 d 233 c 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax Web 9 f 233 vr 2023 nbsp 0183 32 The payments do not need to be claimed as income on California state income tax returns according to a spokesman for California s Franchise Tax Board

Download Do Rebates Need To Be Reported On Tax Returns

More picture related to Do Rebates Need To Be Reported On Tax Returns

Rick Telberg On Twitter IRS Says Special State Payments And Tax

https://pbs.twimg.com/media/FopIpFaaMAAH7rB.jpg

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Form 1040 New Mexico Income Tax Energy Rebate Can Now Be Reported On

https://data.formsbank.com/pdf_docs_html/224/2246/224684/page_1_thumb_big.png

Web If you didn t receive the distribution by April 15 2022 you must also add it to your wages on your 2022 tax return If the distribution was for the income earned on an excess deferral your Form 1099 R should have code 8 in box 7 Add the income amount to your wages on your 2022 income tax return regardless of when the excess deferral was made Web 11 sept 2017 nbsp 0183 32 Cash rebates from a dealer or manufacturer for an item you for items you buy are tax free They are viewed in the tax law as merely reducing the purchase price

Web 11 mars 2023 nbsp 0183 32 State payments related to disaster or pandemic relief are not taxable and don t need to be reported Getty Images While the days of federal stimulus checks are Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware

PragmaticObotsUnite On Twitter RT PIX11News The IRS Says People Who

https://pbs.twimg.com/media/Fo9ZlewWIBAF99V.jpg

WarDamnEagle On Twitter RT Tropicow Tens Of Thousands Of

https://pbs.twimg.com/media/Fq4UfFQX0Bo3GTJ.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Form 1040X Lets You Fix A Wrong Tax Return Don t Mess With Taxes

PragmaticObotsUnite On Twitter RT PIX11News The IRS Says People Who

How To Report Your 2020 RMD Rollover On Your Tax Return Merriman

Kathleen Malone Works On Tax Returns At The Cincinnati Internal News

:max_bytes(150000):strip_icc()/Life-insurance-cash-in_final-f8e68bd9f44049eab8722b08240470a4.png)

Cashing In Your Life Insurance Policy

How Do I Get My Rebate From Verizon A Step by Step Guide Verizon Rebates

How Do I Get My Rebate From Verizon A Step by Step Guide Verizon Rebates

Recovery Rebate Credit What You Need To Know Before Filing Your 2020

Prior Year Tax Returns Irss Americanpikol

How To File A Zero Business Tax Return

Do Rebates Need To Be Reported On Tax Returns - Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be