Do Refrigerators Qualify For Energy Tax Credit The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 While you can t claim your standard energy efficient appliances like a dishwasher or a dryer you can most likely get a federal tax credit for any renewable energy systems that run those appliances

Do Refrigerators Qualify For Energy Tax Credit

Do Refrigerators Qualify For Energy Tax Credit

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

https://rwcnj.com/wp-content/uploads/2018/01/Depositphotos_14725837_m-2015.jpg

What Appliances Qualify For Energy Tax Credit ByRetreat

https://byretreat.com/wp-content/uploads/2023/12/energy_tax_credit_eligible_appliances-1000x575.jpg

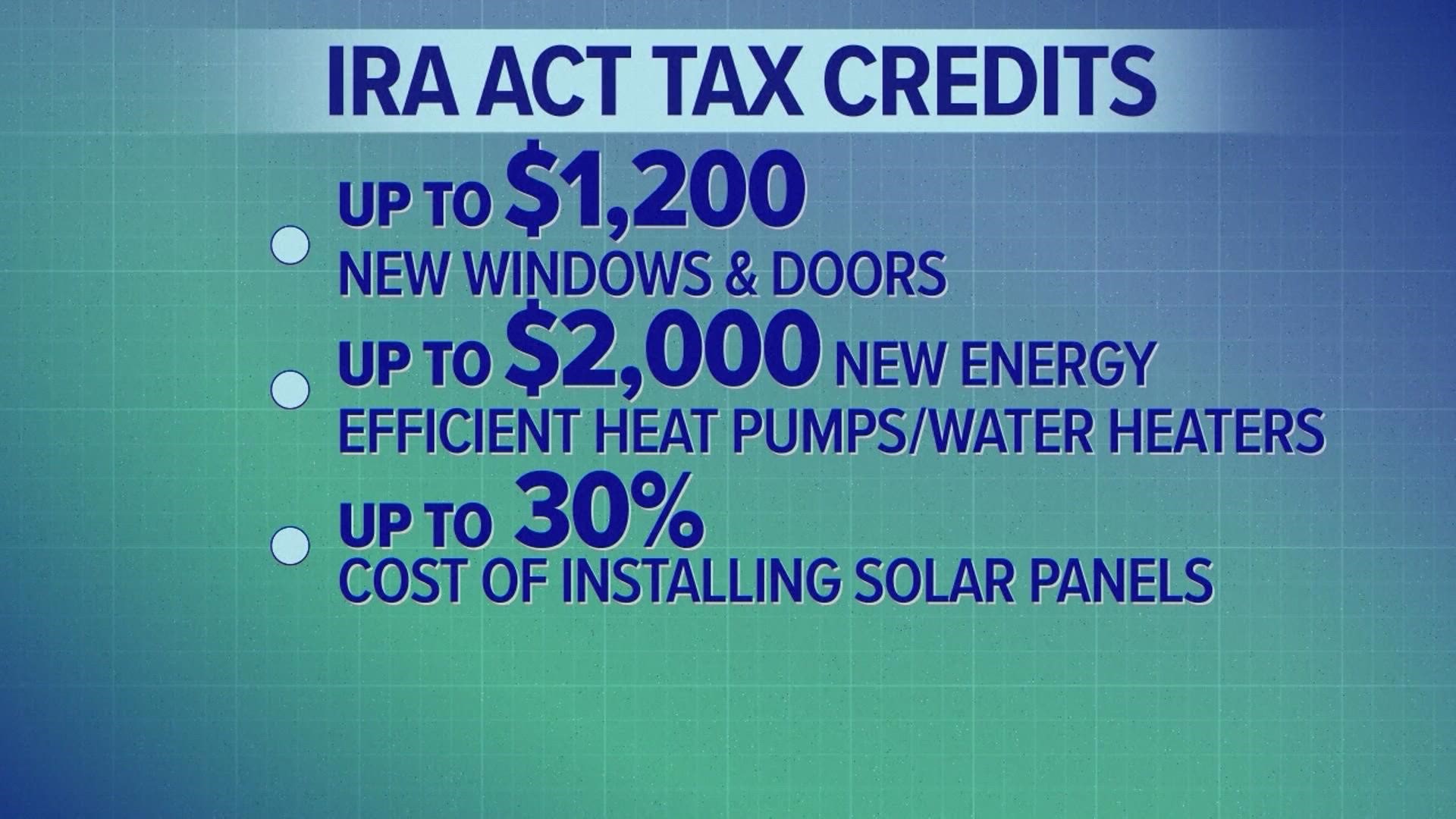

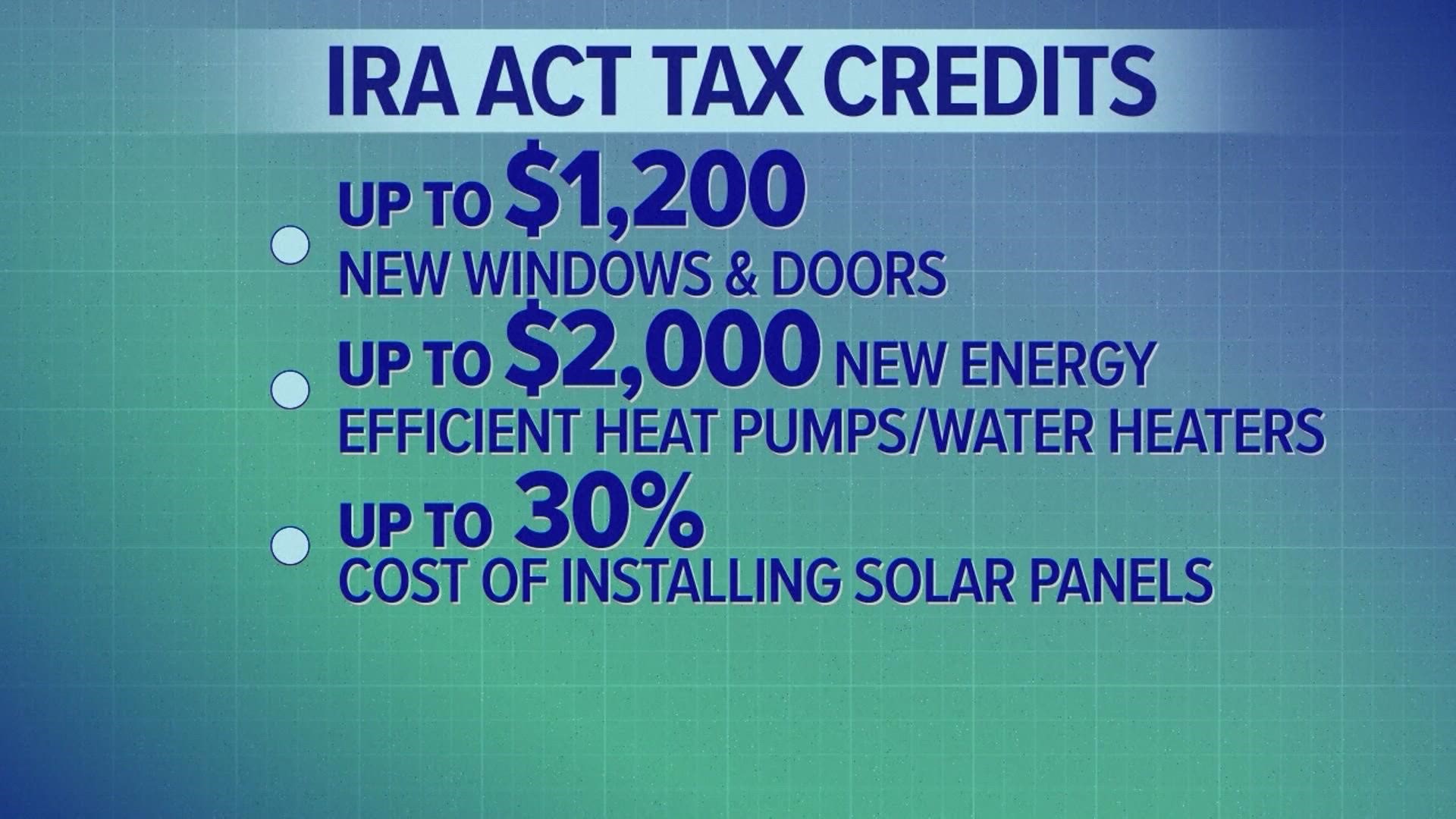

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources What did the Inflation Reduction Act of 2022 do for energy tax credits What energy tax credits are available to claim Click to expand Key Takeaways Energy tax credits are government incentives to provide tax savings to individuals and businesses when investing in certain energy technologies

Download Do Refrigerators Qualify For Energy Tax Credit

More picture related to Do Refrigerators Qualify For Energy Tax Credit

What Home Improvements Qualify For Tax Credit Energy Texas

https://www.energytexas.com/blog/wp-content/uploads/2022/11/AdobeStock_82265451.jpeg

The 8 Best Counter Depth Refrigerators For 2019 Reviews Ratings

https://blog.yaleappliance.com/hubfs/images/yale-appliance-counter-depth-refrigerator-display.jpg

Do You Qualify For A Home Energy Tax Credit Benefyd

https://www.benefyd.com/wp-content/uploads/2016/02/home-energy-tax-credits0.png

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product and services Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year

If you need to upgrade your home s electrical panel in order to accommodate an electric range or any other electric appliance upgrade covered by the Inflation Reduction Act such as certain Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to ENERGY STAR certified models Accountants should assist clients in understanding the eligibility criteria and documenting the installation of energy efficient water heating systems

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

Opiniones Y Precios De Las Bombas De Calor Rheem 2021 Trend Repository

https://www.pickhvac.com/wp-content/uploads/2017/12/rheem-heat-pump.jpg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

What Insulation Qualifies For Energy Tax Credit Storables

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

Does A New Roof Qualify For Energy Tax Credit In Florida

Built in Refrigerators Panel Ready Side By Side French Signature

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

What Appliances Qualify For Energy Tax Credit ByRetreat

What Appliances Qualify For Energy Tax Credit ByRetreat

Industrial Vs Standard Refrigerators For Home Key Differences

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And

2023 Residential Clean Energy Credit Guide ReVision Energy

Do Refrigerators Qualify For Energy Tax Credit - The Inflation Reduction Act includes significant funding for states and tribes to offer rebates to households that install new electric appliances including super efficient heat pumps water heaters clothes dryers stoves and ovens and for households that make repairs and improvements that increase energy efficiency