Do Refunds Count As Income Fastest refund possible Fastest tax refund with e file and direct deposit tax refund time frames will vary The IRS issues more than 9 out of 10 refunds in less than 21 days

A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting

Do Refunds Count As Income

Do Refunds Count As Income

https://www.credible.com/blog/wp-content/uploads/2022/03/Do-Student-Loans-Count-as-Income-on-My-Taxes_.png

Does A Tax Refund Count As Income Yes In Some Cases

https://media.marketrealist.com/brand-img/s_iPuAFJp/2160x1130/does-tax-refund-count-as-income-1646229479451.jpg?position=top

Does A Tax Refund Count As Income Yes In Some Cases

https://media.marketrealist.com/brand-img/D5syRmQmC/1024x536/state-income-tax-refund-1646229909932.jpg

First federal income tax refunds are not taxable as income Second interest from both the federal and state governments is considered taxable income and should IRS refunds are rarely taxable First things first If your refund comes from the federal government it s not taxable income You re just getting back your own

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the Yes report last year s state or local tax refund and we ll figure out if it s taxable or not If all three of the following are true your refund counts as taxable income

Download Do Refunds Count As Income

More picture related to Do Refunds Count As Income

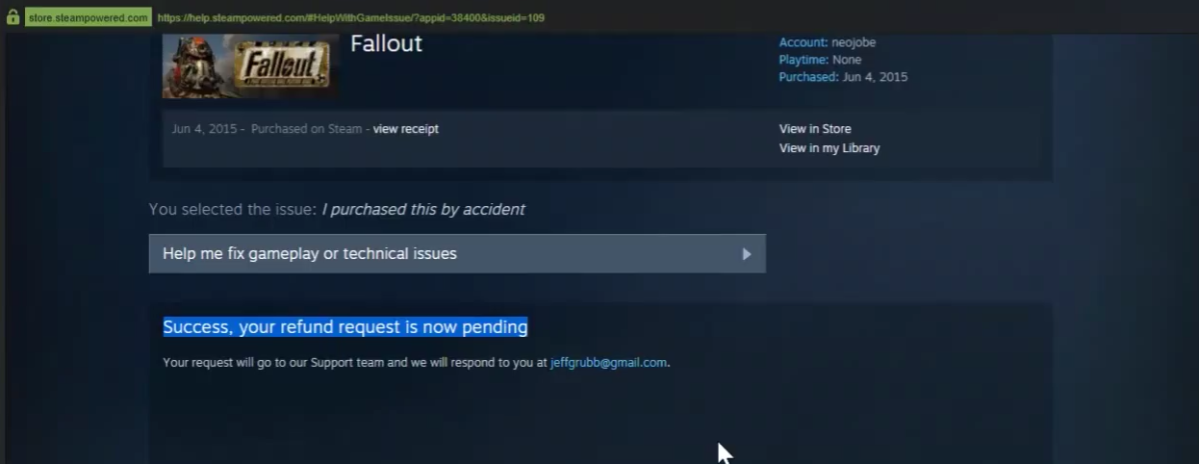

How Long Do Steam Refunds Take Xiledsyndicate

https://xiledsyndicate.com/wp-content/uploads/2022/09/how-long-do-steam-refunds-take.png

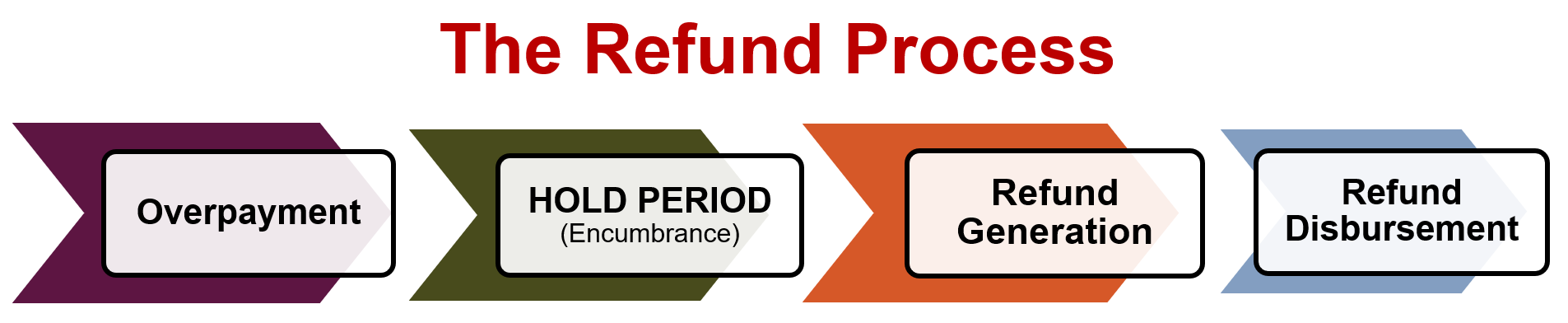

Refunds Office Of Business And Finance

https://busfin.osu.edu/sites/default/files/the_refund_process.png

Do Student Loans Count As Income Check Out Here

http://awajis.com/wp-content/uploads/2020/04/Do-Student-Loans-Count-As-Income_.png

Wondering if you ll get a tax refund how long you ll have to wait and how to maximize it Find all the answers right here Debunking myths about federal tax refunds IRS Tax Tip 2022 49 March 30 2022 Once taxpayers file their federal tax returns they re eager for details about

It is possible that your state refund is taxable income You may need to claim all or part of it if You received a state or local income tax refund credit or offset You itemized In the United States you can deduct state income taxes paid in the year that you paid them but if you do so then you need to treat any state tax refund for that

1 If A s Income Is 20 Of B s Income Then Express B s Income As A

https://hi-static.z-dn.net/files/d93/e83974b5b1c7b3f2448e6e2e60755c19.jpg

What Time Do Refunds Go Into Bank

https://dontdisappoint.me.uk/wp-content/uploads/2022/08/Featured-image-460-1-1.png

https://turbotax.intuit.com/tax-tips/irs-tax...

Fastest refund possible Fastest tax refund with e file and direct deposit tax refund time frames will vary The IRS issues more than 9 out of 10 refunds in less than 21 days

https://ttlc.intuit.com/community/taxes/discussion/...

A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized

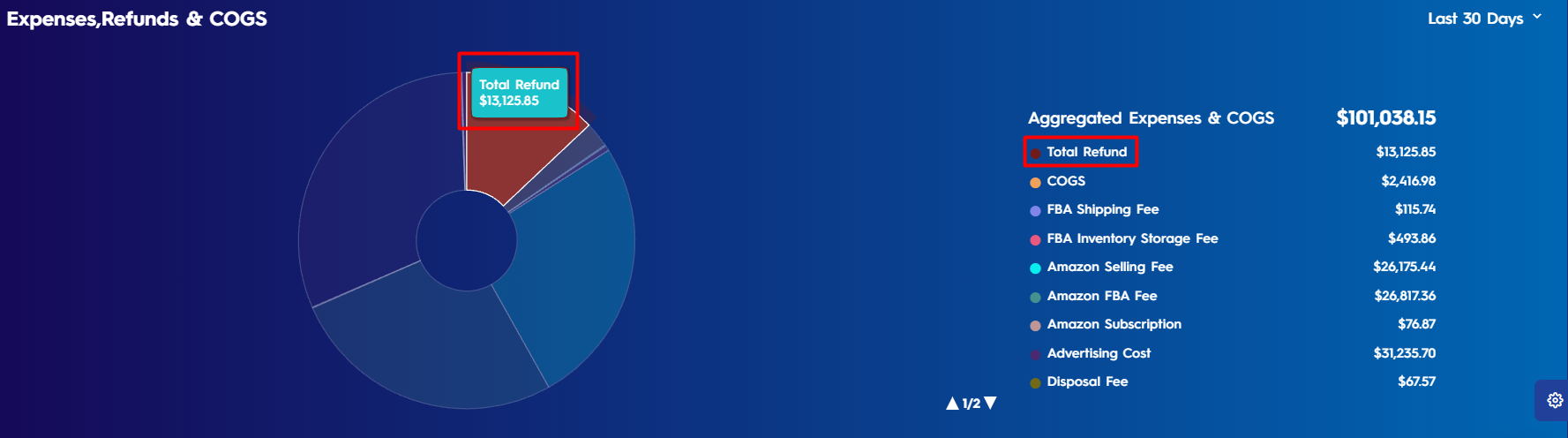

Aggregated Expenses Refunds COGS Chart Help Center Eva

1 If A s Income Is 20 Of B s Income Then Express B s Income As A

Income Codelive

Refunds Update Kiwiburn

Do Refunds Count Against Spending Toward A Sign up Bonus Newark

New Things That Make Life Easy Good Product Online The Daily Low Price

New Things That Make Life Easy Good Product Online The Daily Low Price

Do I Have To Pay Taxes On My Refund How To Know If Refunds Count As

How Can I Add Income

Aggregated Expenses Refunds COGS Chart Help Center Eva

Do Refunds Count As Income - IRS refunds are rarely taxable First things first If your refund comes from the federal government it s not taxable income You re just getting back your own