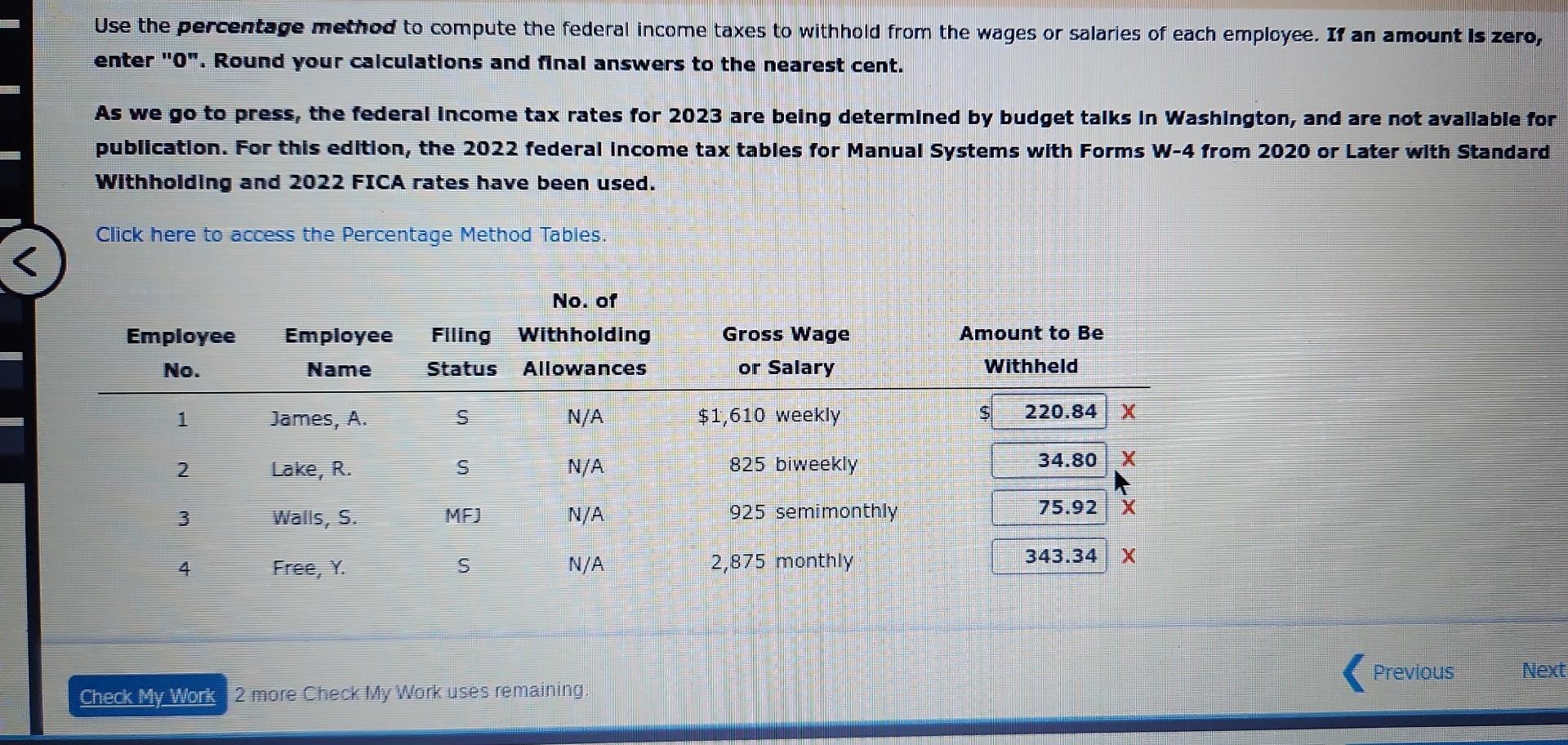

Do Seasonal Workers Pay Taxes Part time and seasonal employees are subject to the same tax withholding rules that apply to other employees For additional information on your tax responsibility as an employer refer to

One of the first things to consider is classifying seasonal workers which determines how to handle payroll taxes and benefits If seasonal workers are hired as employees income taxes The IRS defines a seasonal worker or employee as someone who performs labor or services on a seasonal basis say three to eight months However nothing else separates a seasonal worker from a part time or full time employee

Do Seasonal Workers Pay Taxes

Do Seasonal Workers Pay Taxes

https://dyernews.com/wp-content/uploads/taxmap-1.png

How To Pay Estimated Quarterly Taxes To The IRS YouTube

https://i.ytimg.com/vi/qtI7M3TeC0w/maxresdefault.jpg

Payroll Tax Estimator GeorgeAnmoal

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

Tax Withholding for Seasonal Workers When you start a seasonal job you ll need to fill out a W 4 form This form tells your employer how much tax to withhold from your In some cases seasonal employees may not have to pay income tax This exemption applies to those who earn less than the total of their personal exemption and the standard deduction for

Part time and seasonal employees are subject to the same tax withholding rules that apply to other employees and all taxpayers should fill out a W 4 when starting a new job Employers use this form to determine the In many states the wages you pay seasonal workers are subject to state unemployment taxes SUTA However some states have exemptions or reduced rates for businesses that hire

Download Do Seasonal Workers Pay Taxes

More picture related to Do Seasonal Workers Pay Taxes

Seasonal Workers Get Severance Pay When They Are Terminated CA

https://www.achkarlaw.com/wp-content/uploads/2022/04/Do-Seasonal-Workers-Get-Severance-Pay-When-They-Are-Terminated.png

Do Undocumented Workers Pay Taxes The Process Explained

https://images.squarespace-cdn.com/content/v1/603a992bcf34a07d765e1085/28e461e1-9cf4-454e-9c5a-883c13360da9/5596768_56206.jpg

Canadians Now Paying Lower Income Taxes Than Americans OECD Data Shows

https://img.huffingtonpost.com/asset/5cd54b0c2000005c0096fe4b.jpeg?ops=1778_1000

In many states the wages you pay seasonal workers are subject to state unemployment taxes SUTA However some states have exemptions or reduced rates for If you are a seasonal worker whether it is just for a short time or ongoing you must report seasonal income earned when you file your taxes The same IRS tax withholding

As a seasonal or part time worker you may not be required to file a federal or state return if the wages you earn at a part time or seasonal job are less than the standard However seasonal employees often face unique tax considerations that differ from those of full time year round workers To make the most of your seasonal job while staying on

CI Post 2 Do Immigrants Pay Taxes

https://sites.psu.edu/jasminracquel/wp-content/uploads/sites/4979/2014/01/Undoc_Taxes_Infographic.jpg

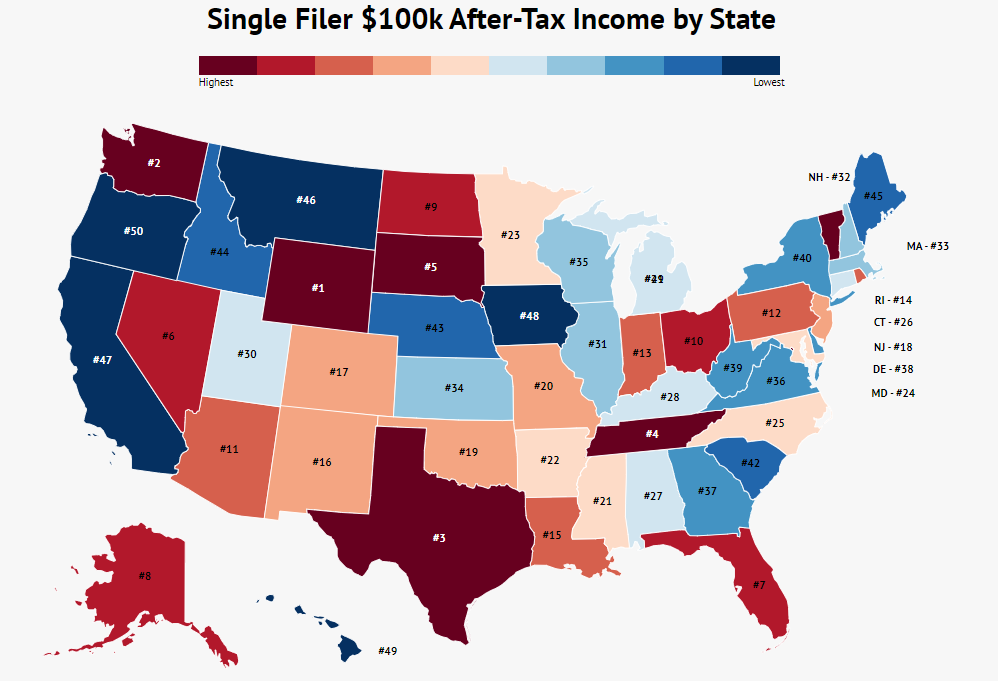

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

https://www.irs.gov › ... › part-time-or-seasonal-help

Part time and seasonal employees are subject to the same tax withholding rules that apply to other employees For additional information on your tax responsibility as an employer refer to

https://www.cbiz.com › insights › articles › article...

One of the first things to consider is classifying seasonal workers which determines how to handle payroll taxes and benefits If seasonal workers are hired as employees income taxes

Guide To Gig Worker Taxes H R Block

CI Post 2 Do Immigrants Pay Taxes

How Much Money Does The Government Collect Per Person

How Much Does Lululemon Pay Their Workers Rights

Do You Have To Pay Taxes On A Settlement Check Rose Sanders Law

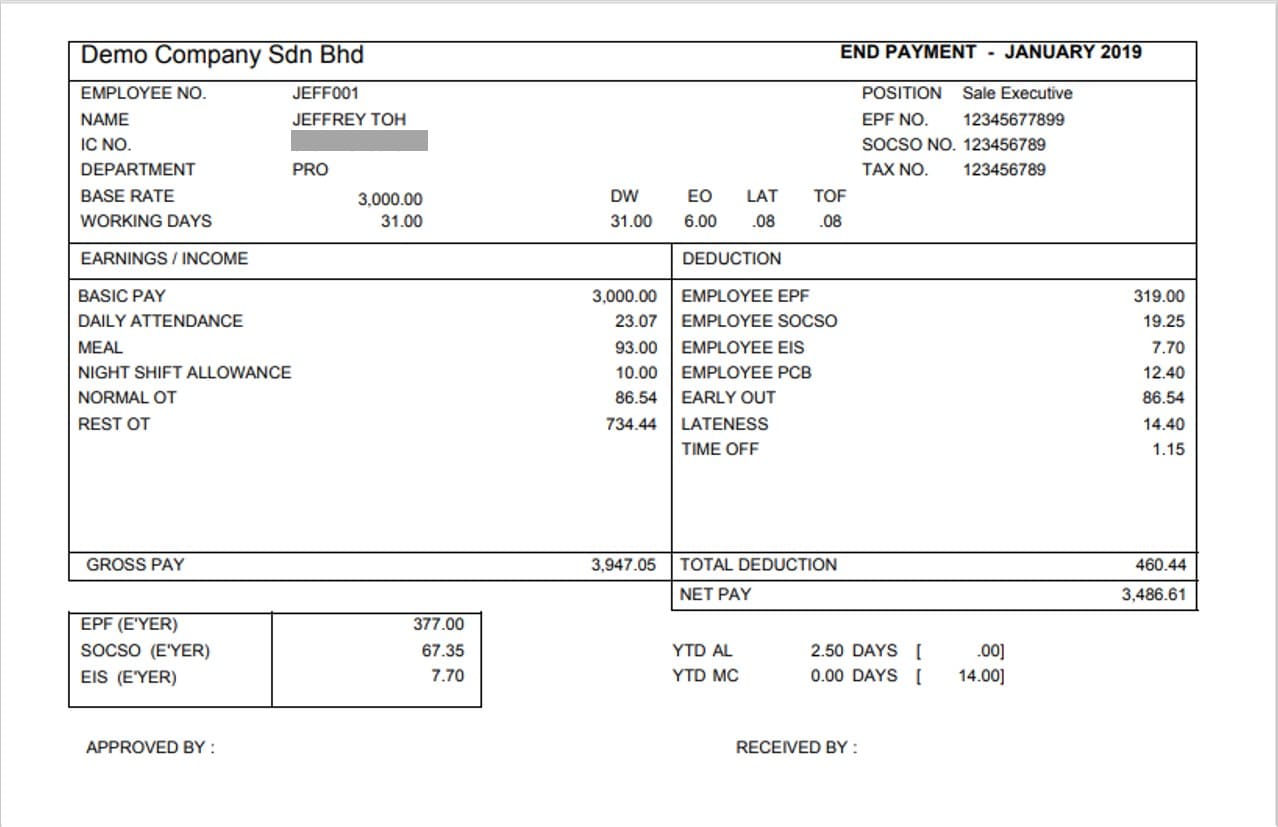

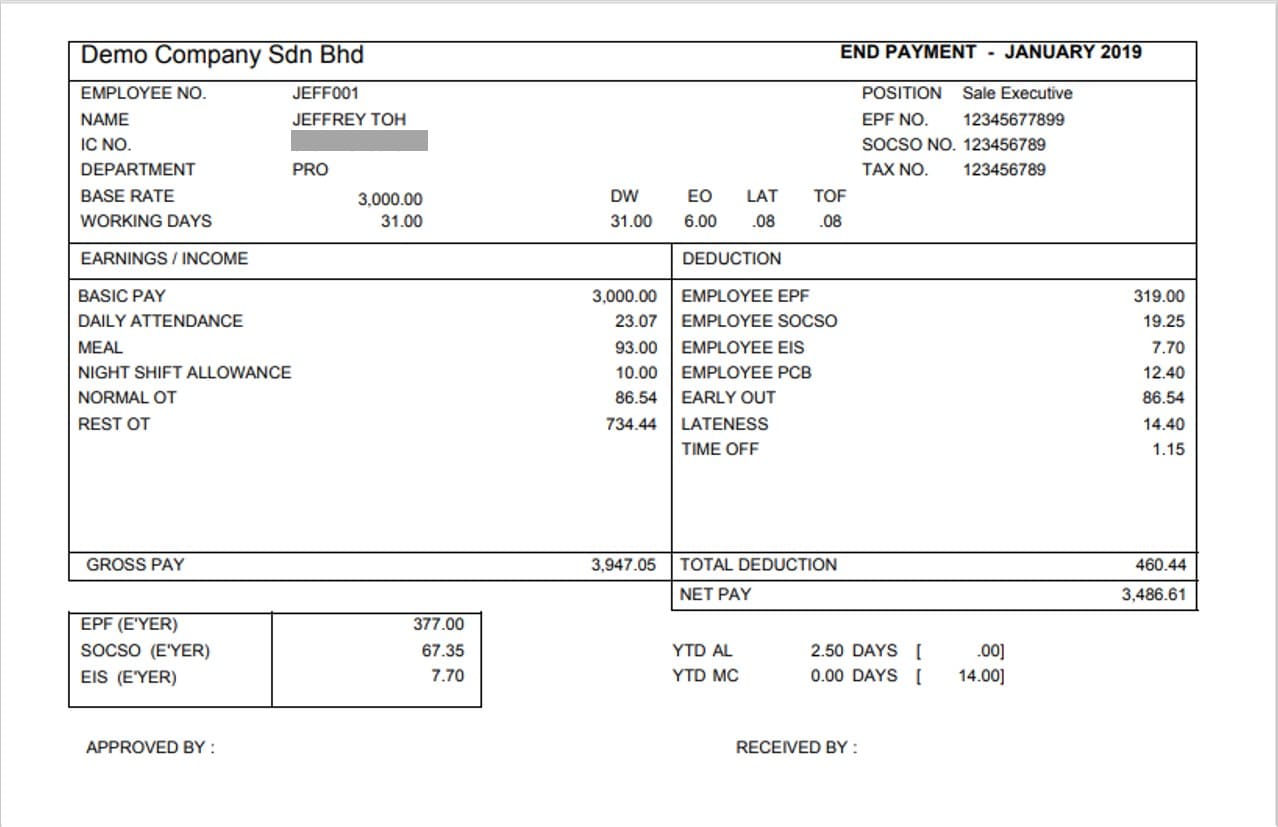

Salary Slip Template Malaysia Salary Slip Template Statementrm Excel

Salary Slip Template Malaysia Salary Slip Template Statementrm Excel

Do Domestic Workers Pay Taxes JobPHGov

Use The Percentage Method To Compute The Federal Chegg

What Happens If You Don T Pay Back Tax Credits Leia Aqui Do I Have To

Do Seasonal Workers Pay Taxes - Each quarter if you pay wages subject to income tax withholding including for sick pay and supplemental unemployment benefits or Social Security OASDI and Medicare taxes you