Do Senior Citizens Pay Property Taxes In Colorado On January 1 st 2023 the State of Colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the Understanding Property Taxes in Colorado Property tax revenue supports public schools county governments special districts municipal governments and junior colleges All of

Do Senior Citizens Pay Property Taxes In Colorado

Do Senior Citizens Pay Property Taxes In Colorado

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

Should You Pay Your Commercial Property Taxes Early Hegwood Group

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

Do Senior Citizens Pay Property Taxes Find Out Here Greatsenioryears

https://greatsenioryears.com/wp-content/uploads/2023/10/do-senior-citizens-pay-property-taxes-1024x585.jpg

A property tax exemption is available to senior citizens and the surviving spouses of seniors who previously qualified When the State of Colorado s budget allows 50 On January 1st 2023 the State of Colorado expanded the deferral program to include the property tax growth The property tax growth allows those who do not qualify for the

The senior property tax exemption is a form of property tax relief available to seniors who own and occupy their home in Colorado The exemption is equal to 50 of the first Property Tax Relief Programs for Senior Citizens Subjects Fiscal Policy Taxes Housing Agency Legislative Council Staff Published 09 21 2018 This memorandum

Download Do Senior Citizens Pay Property Taxes In Colorado

More picture related to Do Senior Citizens Pay Property Taxes In Colorado

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

Do Senior Citizens Pay Taxes On Lottery Winnings Greatsenioryears

https://greatsenioryears.com/wp-content/uploads/2023/04/62f2d2e173c01a0768b3f3f8_lotterytaxes-scaled.jpg

Understanding If Senior Citizens Pay Property Taxes

https://greatsenioryears.com/wp-content/uploads/2023/10/do-senior-citizens-pay-property-taxes-1-1024x585.jpg

Most states including Colorado allow property tax exemptions only for a senior s primary residence Seven states18 impose additional residency requirements whereby seniors This year 51 homeowners applied under Active Military 170 under Tax Growth and 957 under Seniors for a total of 3 685 648 in deferred tax payments for

As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending on the state you live in and often Taxpayers who are at least 65 years old as of January 1 and who have occupied their property as their primary residence for at least 10 consecutive years may be eligible for

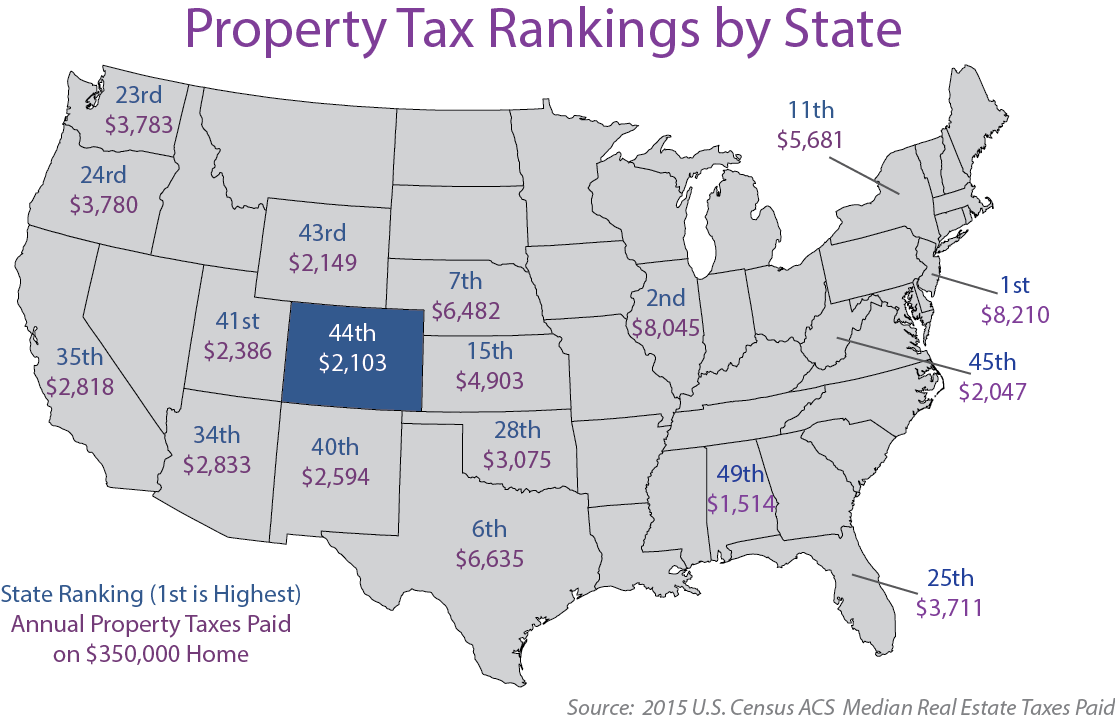

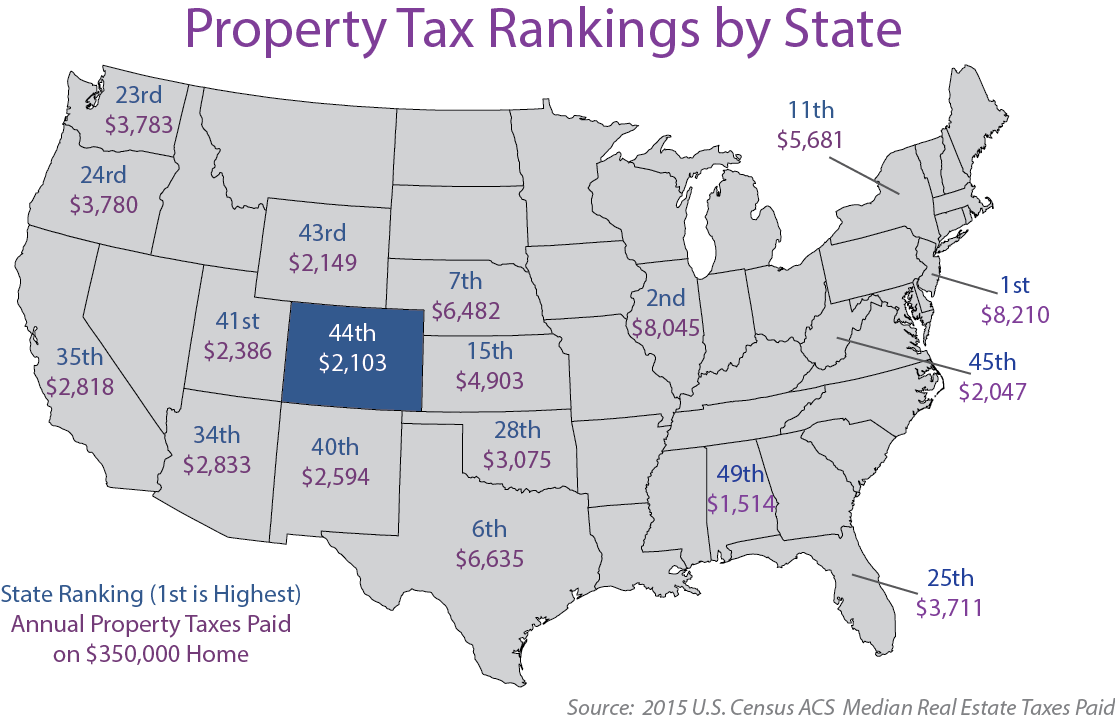

Colorado s Low Property Taxes Colorado Fiscal Institute

https://www.coloradofiscal.org/wp-content/uploads/2017/03/property-tax-rankings-by-state-1.png

Hecht Group Schenectady Property Taxes How To Pay In Person

https://img.hechtgroup.com/1665371371575.Document

https://treasury.colorado.gov/property-tax-deferral-programs

On January 1 st 2023 the State of Colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion

https://agingstrategy.colorado.gov/sites...

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the

Property Taxes In Colorado Simplified Part 2 Ranch Resort Realty

Colorado s Low Property Taxes Colorado Fiscal Institute

Hecht Group Arizona Seniors May Be Eligible For A Discount On Their

Hecht Group Outstanding Property Taxes

Do Senior Citizens Pay Property Taxes In Texas Find Out Now

Do Senior Citizens Pay Property Taxes In South Carolina

Do Senior Citizens Pay Property Taxes In South Carolina

The Highest And Lowest Property Taxes In Colorado

Do Senior Citizens Pay Taxes On Lottery Winnings Greatsenioryears

I Paid 76 954 41 In Property Taxes

Do Senior Citizens Pay Property Taxes In Colorado - A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income that is less than or equal to 65 000