Do Seniors Get A Tax Break On Property Taxes In Georgia A senior property tax exemption reduces the amount seniors 65 years of age or older have to pay in taxes on properties they own Property taxes are quite possibly

Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10 000 or less you qualify for a 4 000 Taxes can get confusing but it s worth studying If you re a Georgia senior there are a number of tax exemptions and benefits you may qualify for benefits that

Do Seniors Get A Tax Break On Property Taxes In Georgia

Do Seniors Get A Tax Break On Property Taxes In Georgia

https://seniorlivingheadquarters.com/wp-content/uploads/2021/11/Do-Seniors-Get-a-Tax-Break-in-Florida-2-1024x576.jpg

How Much Does The Average American Pay In Taxes It Depends

https://www.gannett-cdn.com/-mm-/3eb9009c1a9366e33a28c376eca11ea26824544a/c=0-44-580-370/local/-/media/2018/04/22/USATODAY/usatsports/MotleyFool-TMOT-33d5f547-taxes_large.jpg?width=3200&height=1680&fit=crop

Should You Protest Your Property Taxes In Austin

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

The L5A Senior School Tax Exemption is a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up to one acre of Property Tax DeKalb County offers our Senior Citizens special property tax exemptions The qualifying applicant receives a substantial reduction in property taxes Currently

It s one of the more tax friendly states for older workers and retirees with tax breaks for seniors on their retirement income and property and no state tax on Social This break can drop annual property taxes to well below 2 000 yr for most seniors Call or email us for a chart showing savings for most Metro Counties Further Georgia has an exclusion from state income tax that

Download Do Seniors Get A Tax Break On Property Taxes In Georgia

More picture related to Do Seniors Get A Tax Break On Property Taxes In Georgia

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Hecht Group Who Pays Property Taxes When A House Is Sold Mid Year

https://img.hechtgroup.com/1662954474877.jpg

Circuit Breaker Tax Exemption Archives California Property Tax

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/11/The-History-of-Property-Taxes-in-California-scaled.jpg?resize=1200%2C1006&ssl=1

Yes but there is a significant tax exclusion available to seniors on all For anyone ages 62 to 64 the exclusion is 35 000 per person For age 65 or older the exclusion is 65 000 per person That applies to all income An official website of the State of Georgia The gov means it s official Local state and federal government websites often end in gov State of Georgia government websites

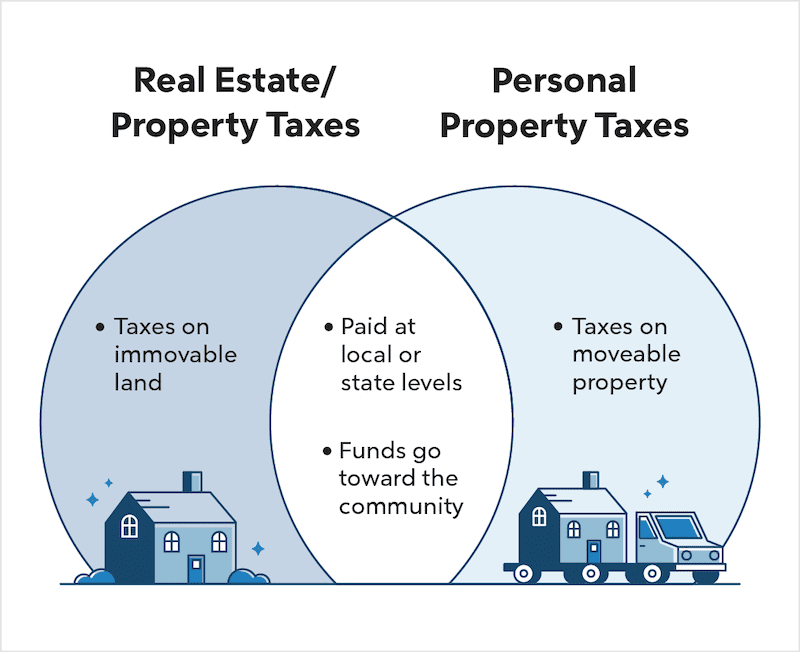

The property tax break is already part of Georgia law but inactive A handout from the governor s office noted it was established in 1999 under O C G A 36 A tax rate of one mill represents a tax liability of one dollar per 1 000 of assessed value The average county and municipal millage rate is 30 mills The State mill rate on all real

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Should You Get A Property Tax Break If Your House Burns Down Inside

https://www.nj.com/resizer/wDYOLJb60k7J6LNeXOX0BAg3QHM=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/7I7CXH2WRBENJNDF6763UXR6F4.jpg

https://themortgagereports.com/63473

A senior property tax exemption reduces the amount seniors 65 years of age or older have to pay in taxes on properties they own Property taxes are quite possibly

https://www.nolo.com/legal-encyclopedia/are-you...

Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10 000 or less you qualify for a 4 000

How Much Does Your State Collect In Property Taxes Per Capita

How High Are Property Taxes In Your State American Property Owners

Do Seniors Get A Discount With Dish Network Choice Senior Life

Do Seniors Get A Discount At Denny s Choice Senior Life

Property Taxes By State County Median Property Tax Bills

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

Michigan Property Tax Rates By Township Massive E Journal Photography

Property Taxes In Georgia How They Measure Up Syndication Cloud

Do Seniors Get A Tax Break On Property Taxes In Georgia - It s one of the more tax friendly states for older workers and retirees with tax breaks for seniors on their retirement income and property and no state tax on Social