Do Seniors Get Property Tax Break In Nj We have seniors in the state of New Jersey today who under the provisions of this bill can make 450 000 a year and still get 6 500 back in property tax relief said Assemblyman Brian Bergen R Morris

If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction You also may qualify if you are a surviving spouse or civil union partner The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home To qualify you must meet all the eligibility requirements for each year from the base year through the application year

Do Seniors Get Property Tax Break In Nj

Do Seniors Get Property Tax Break In Nj

https://seniorlivingheadquarters.com/wp-content/uploads/2021/11/Arizona-Property-Taxesa-2-pdf-1024x576.jpg

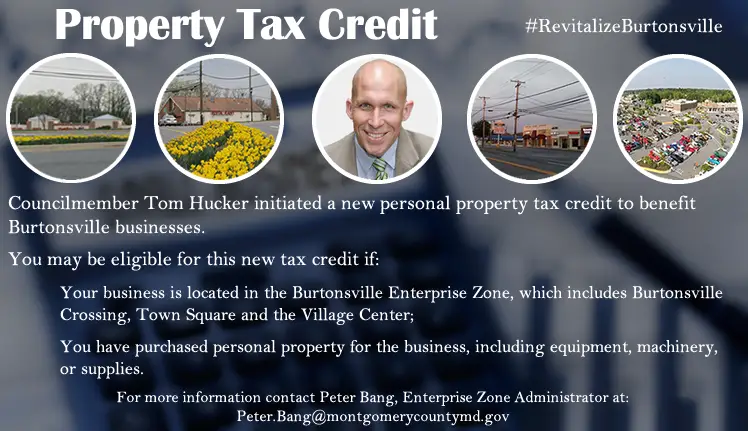

Small Businesses In NJ Might Get Temporary Tax Break

https://townsquare.media/site/385/files/2021/11/attachment-127977214_3588241974555206_6576242065813984905_n.jpg?w=980&q=75

Do Seniors Get A Property Tax Break In California VVP Law Firm

https://www.vvplawfirm.com/wp-content/uploads/2022/02/ww-1.png

Murphy Assembly Speaker Craig Coughlin and Senate President Nicholas Scutari said homeowners 65 and older who make 500 000 or less will qualify for up to 6 500 in property tax relief under their plan Renters would also get up to 700 in rebates Homeowners 65 and older who make 500 000 or less will qualify for up to 6 500 in property tax relief under this plan By Mike Catalini Published June 22 2023 Updated on June 23 2023 at

The ANCHOR payments which are for the 2021 tax year will pay up to 1 500 to homeowners and 450 for renters with senior homeowners and renters getting an extra 250 If you need help with your Eligibility requirements including income limits and benefits available for all property tax relief programs are subject to change by the State Budget Request for a Letter of Property Tax Relief Ineligibility Out of State Residents Change Your Address ANCHOR Program Senior Freeze Program

Download Do Seniors Get Property Tax Break In Nj

More picture related to Do Seniors Get Property Tax Break In Nj

Nj Property Tax Relief For Seniors

https://www.state.nj.us/treasury/taxation/div-assets/images/ptr/ptr-index.jpg

How Do Seniors Get Free Cell Phones Wireless Devices Reviews

https://www.wirelessdevicesreviews.com/wp-content/uploads/2020/03/How-do-seniors-get-free-cel-750x563.jpg

NJ Property Tax Break For Seniors In Budget After Agreement

https://www.northjersey.com/gcdn/presto/2019/12/26/PNJM/4631d3ec-e98f-4078-97d9-a42438a784e3-YearinPhotos2019-Gallery_44.JPG?crop=4522,2544,x0,y0&width=3200&height=1801&format=pjpg&auto=webp

An estimated 1 5 million taxpayers will be notified of their automatic eligibility for a new round of state funded Anchor property tax relief benefits starting next week state Treasury officials said Tuesday The benefits intended to help offset the state s high local property taxes will once again total as much as 1 750 per household A program designed to give sweeping new property tax relief to New Jersey seniors became law Friday night as Gov Phil Murphy signed the plan hours after the state Legislature

Democrats who lead the state are on the verge of enacting a sweeping and heavily debated plan they say would put the vast majority of seniors in New Jersey in line to receive new property ANCHOR provides property tax relief to residents who own or rent property in New Jersey as their principal residence and meet certain income limits Under the latest state budget the next round of Anchor benefits will continue to range from 450 to 1 750 depending on age annual income and whether an eligible resident is a renter or

How To Get Property Tax Relief In Salt Lake County Elderly Or Low

https://utahrealtyplace.com/wp-content/uploads/2023/07/retiree-Senior-Blog.jpg

Do Seniors Get A Property Tax Break In Maryland Greatsenioryears

https://greatsenioryears.com/wp-content/uploads/2023/04/1664415648298.png

https://newjerseymonitor.com/briefs/senior-citizen...

We have seniors in the state of New Jersey today who under the provisions of this bill can make 450 000 a year and still get 6 500 back in property tax relief said Assemblyman Brian Bergen R Morris

https://www.nj.gov/treasury/taxation/lpt/lpt-seniordeduction.shtml

If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction You also may qualify if you are a surviving spouse or civil union partner

Do Seniors Get A Discount At Denny s Choice Senior Life

How To Get Property Tax Relief In Salt Lake County Elderly Or Low

New Texas Law Gives Elderly And Disabled Property Tax Break KEYE

The Real Estate Tax Discount For Seniors S Ehrlich

Hecht Group When Do Seniors Stop Paying Property Taxes

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Will This Major Property Tax Break Survive A Trump Presidency

NY Passes Bill To Curb Misuse Of Tax Break Syracuse Has some Of The

Election 2018 Proposition 5 Property Tax Break KQED

Do Seniors Get Property Tax Break In Nj - A trio of bills aimed at cutting property taxes for New Jersey seniors that has drawn criticism from the governor cleared committee with bipartisan support Thursday