Do Tax Deductions Increase Your Refund The beginning of the reduction of the credit is increased from 15 000 to 125 000 of adjusted gross income AGI a local expert matched to your unique situation will do your taxes for you start to finish Or get unlimited help and advice from tax experts while you do your taxes with

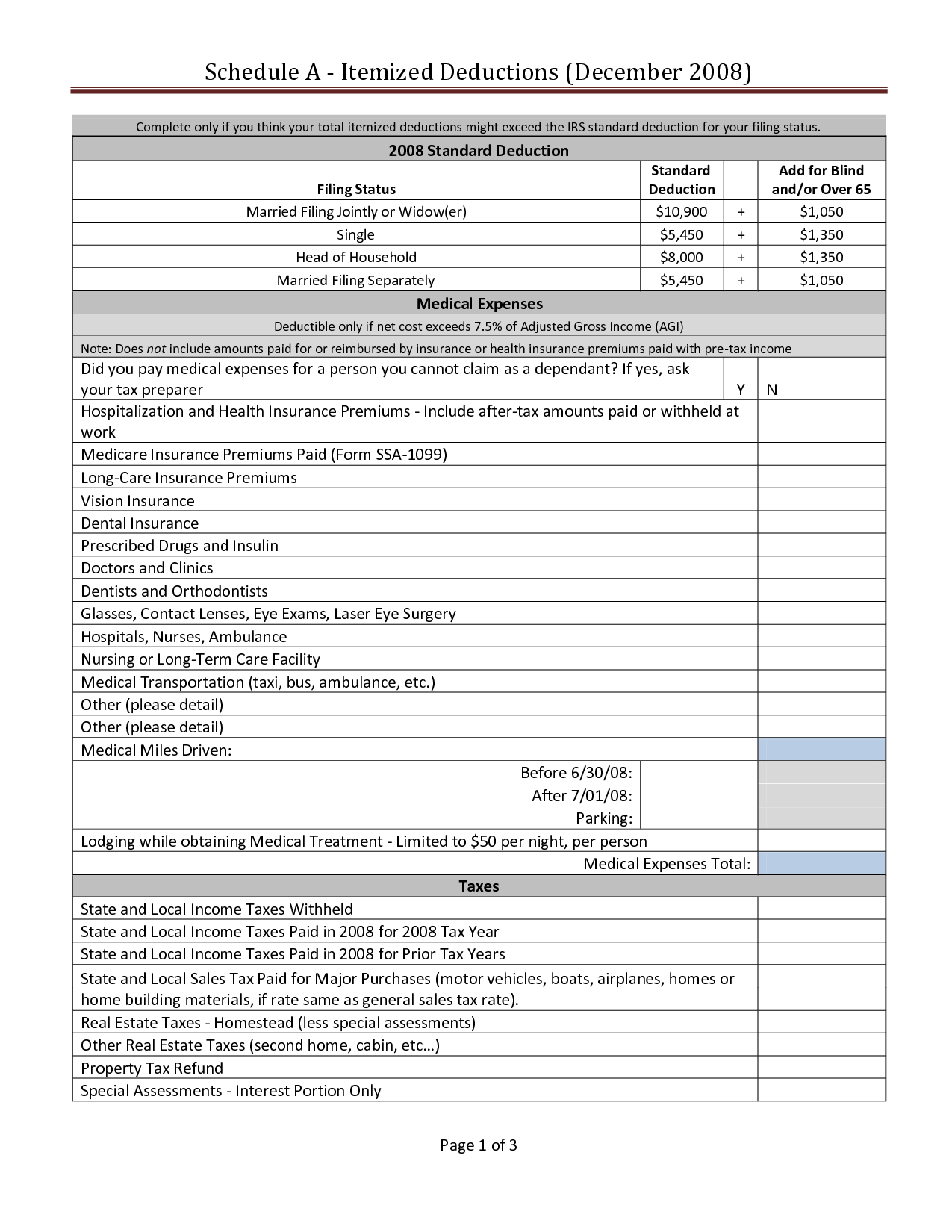

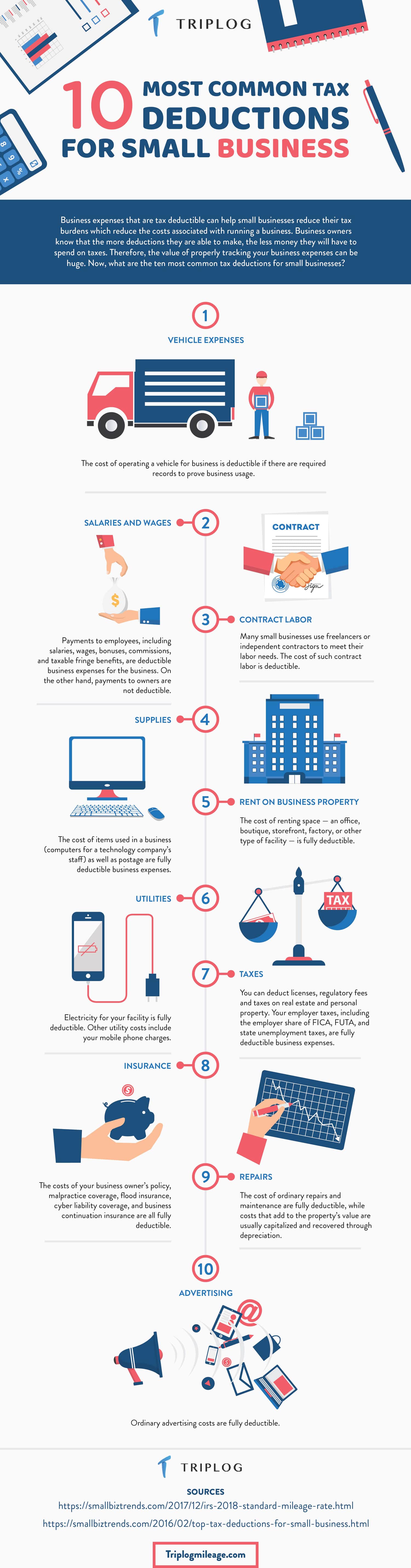

If your refund doesn t budge after you ve entered your medical expenses charitable contributions mortgage interest sales taxes or your state local or property taxes it s probably because your Standard Deduction is currently higher than your itemized deductions We automatically select the deduction that works best in your favor Your filing status determines your standard deduction amount as well the income thresholds used for some credits and deductions The status you use could significantly alter your refund

Do Tax Deductions Increase Your Refund

Do Tax Deductions Increase Your Refund

https://jessicaautumn.com/wp-content/uploads/2017/01/5-Deductions-That-Will-Greatly-Increase-Your-Tax-Refund.jpg

Where s My Refund Bill Brooks CPA

https://www.billbrookscpa.com/wp-content/uploads/2019/03/tax-return.jpg

What Credits And Deductions Increase Tax Refund Awutar

https://www.accesousa.com/latest-news/91p6ee/picture271540742/alternates/LANDSCAPE_1140/GettyImages-1403453245.jpg

Tax deductions reduce your taxable income and therefore can reduce the amount of tax you owe Reducing the taxable portion of your income can help to swing your tax return toward the refund side Key Takeaways Tax credits tax deductions and itemized income tax returns are ways you may be able to reduce your taxable income or increase your income tax refund Tax credits offset your tax

4 ways to increase your tax refund come tax time Everyone wants to know how to get more back on taxes but the hard part is knowing where to start From filing status considerations to income tax deductions and credits several factors can impact how much tax you pay each year 1 Consider your filing status Many people use the terms interchangeably Here s what you need to know Deductions decrease your taxable income Your taxable income is the portion of your annual income that s subject to federal and state taxes Deductions help decrease that amount making less of your income taxable This reduces the amount of taxes you owe

Download Do Tax Deductions Increase Your Refund

More picture related to Do Tax Deductions Increase Your Refund

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Don t fret You can still claim certain deductions even when you take the standard deduction Remember You file 2023 taxes in 2024 and 2024 taxes in 2025 What Are Above the Line This can lower your tax payment or increase your refund Some credits are refundable You need documents to show expenses or losses you want to deduct Your tax software will calculate deductions for you and enter them in the right forms If you file a paper return your deductions go on Form 1040 and may require extra forms

In terms of your tax refund credits typically yield a bigger tax return than deductions But that doesn t mean you should overlook key write offs for which you qualify Instead of reducing the amount of tax you owe deductions reduce the amount of income that is subject to tax A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/itemized-deductions-worksheet_449334.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

https://turbotax.intuit.com/tax-tips/tax-refund/...

The beginning of the reduction of the credit is increased from 15 000 to 125 000 of adjusted gross income AGI a local expert matched to your unique situation will do your taxes for you start to finish Or get unlimited help and advice from tax experts while you do your taxes with

https://ttlc.intuit.com/turbotax-support/en-us/...

If your refund doesn t budge after you ve entered your medical expenses charitable contributions mortgage interest sales taxes or your state local or property taxes it s probably because your Standard Deduction is currently higher than your itemized deductions We automatically select the deduction that works best in your favor

7 Common Tax Deductions That Helped Me Land A 1 345 Tax Refund

5 Itemized Tax Deduction Worksheet Worksheeto

Tax Deductions You Can Deduct What Napkin Finance

Tax Credits Vs Tax Deductions Making The Most Of Your Tax Benefits

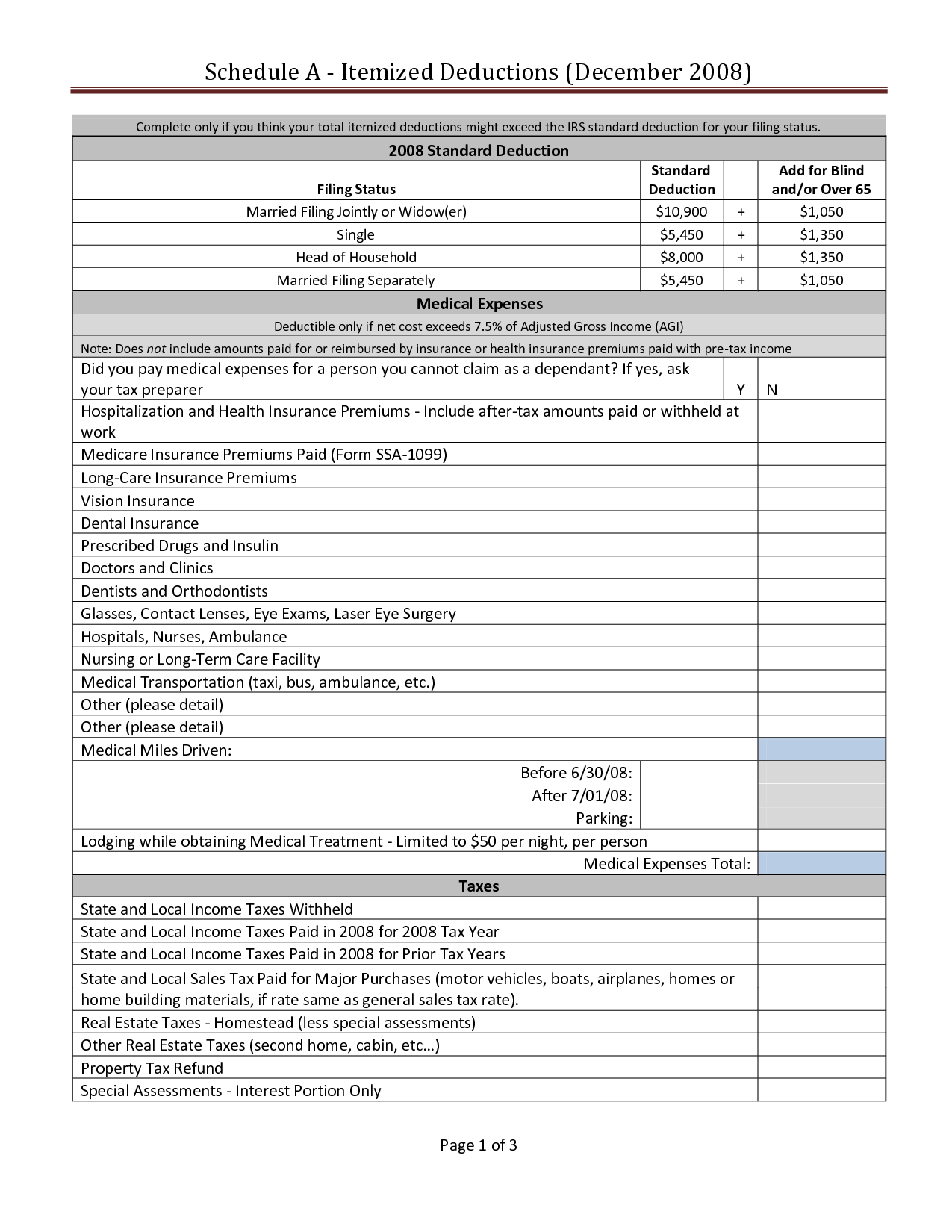

10 Most Common Small Business Tax Deductions Infographic

Small Business Tax Deductions Deductible Expenses

Small Business Tax Deductions Deductible Expenses

What Are Tax Deductions And Credits 20 Ways To Save Yoursharelink

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Do Tax Deductions Increase Your Refund - Many people use the terms interchangeably Here s what you need to know Deductions decrease your taxable income Your taxable income is the portion of your annual income that s subject to federal and state taxes Deductions help decrease that amount making less of your income taxable This reduces the amount of taxes you owe