Do We Claim Vat On Donation Earlier in 2019 HMRC clarified its view of a business s right to reclaim VAT on mixed sponsorship and donation payments How does this

Donation and grant income is not consideration for a supply and is a non business activity that falls outside the scope of VAT This is because this income is freely given with no strings VAT treatment of donations grants and sponsorship In respect of donations these are normally a financial gift to a cause worthy of support by the donor As such provided nothing is given in return for the money it is a non

Do We Claim Vat On Donation

Do We Claim Vat On Donation

https://gg.myggsa.co.za/can-you-claim-vat-on-fuel-south-africa-.jpg

How To Claim Back VAT VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to VAT_claimingx2.1646877578209.png

VAT Or Non VAT What Should You Choose JCSN Accounting Services

https://jcsnaccounting.com/wp-content/uploads/2021/11/jcsn-vat-or-non-vat-scaled.jpeg

VAT is not payable on genuine donations that a charity receives from its supporters or other third parties they are outside the scope of VAT because there is no supply Output VAT charged by a charity can be reclaimed as input tax if the receiver is registered for VAT and incurs it for business purposes If supplies are made to non VAT

Overview As a charity you do not pay VAT when you buy some goods and services Community amateur sports clubs CASCs do not qualify for the same VAT reliefs as charities How to get Find out about the conditions you must meet so that your charity pays no VAT the zero rate when you buy advertising and items for collecting donations aids for disabled people

Download Do We Claim Vat On Donation

More picture related to Do We Claim Vat On Donation

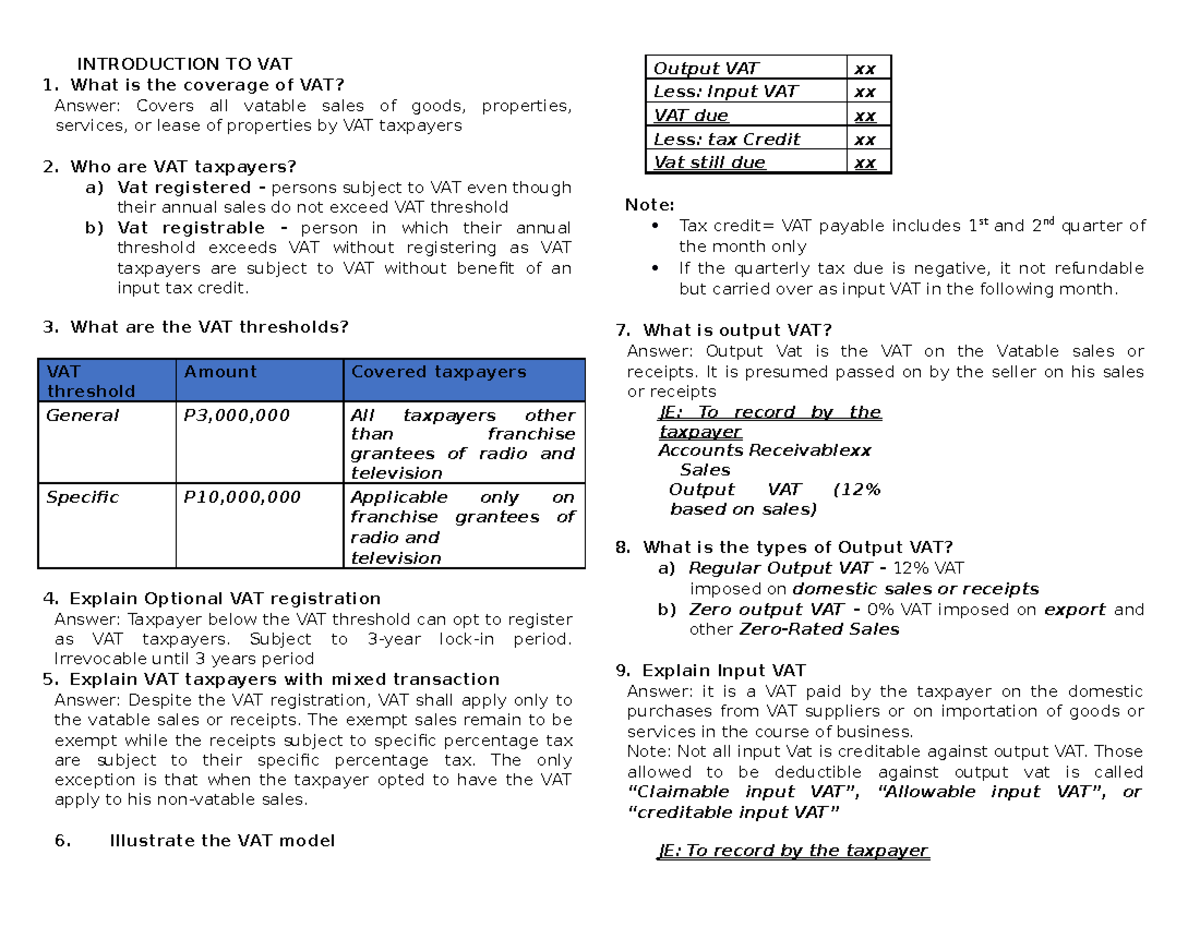

Introduction TO VAT Business Taxation Summary INTRODUCTION TO VAT 1

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/55347d0f0a26346fad35d035fe05f31e/thumb_1200_927.png

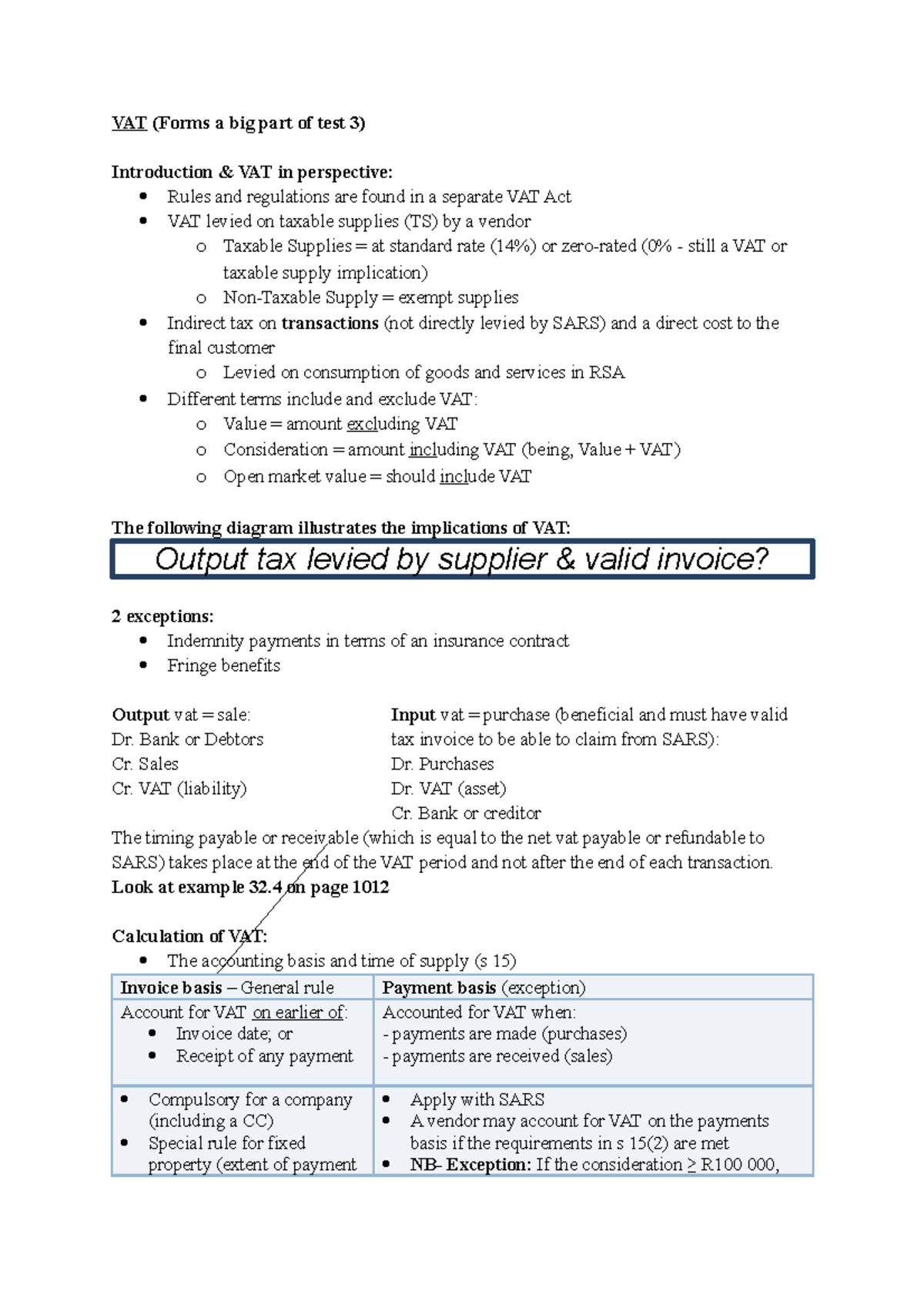

Chapter 32 VAT VAT Forms A Big Part Of Test 3 Introduction VAT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/56d1c7e8adaa2c40ba44b2f7c004c705/thumb_1200_1698.png

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

They can only claim the VAT back on their purchases if they themselves are registered for VAT There are however some goods and services that qualify for VAT relief In this scenario charities are entitled to pay As a charity you will be exempt from paying VAT when buying certain types of goods and services Information in this section explains what VAT relief is available to charities Extra

Subject to certain conditions sales of donated goods can be zero rated The benefit of the zero rating is that the charity or its trading subsidiary does not need to account for VAT on the sale Claiming VAT relief for charities To be able to purchase the goods and services described above at a reduced or zero rate of VAT charities should provide their suppliers with evidence of their

Are Donations For Medical Expenses Taxable

https://www.mycause.com.au/blog_images/donate.jpg

Can You Claim VAT On Commission Paid

https://southafricanvatcalculator.co.za/wp-content/uploads/2023/06/Can-You-Claim-VAT-on-Commission-Paid.jpg

https://www.madaboutbookkeeping.co.uk/recl…

Earlier in 2019 HMRC clarified its view of a business s right to reclaim VAT on mixed sponsorship and donation payments How does this

https://www.charitytaxgroup.org.uk/tax/vat/...

Donation and grant income is not consideration for a supply and is a non business activity that falls outside the scope of VAT This is because this income is freely given with no strings

How To Claim VAT Back On Expenses

Are Donations For Medical Expenses Taxable

Can You Claim VAT On Entertaining Clients Employees YouTube

What Can I Claim Vat Back On Self employed 2023 Updated

VAT Calculation On Sales Invoices Manager Forum

How Does VAT Work In South Africa

How Does VAT Work In South Africa

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

Donation Acknowledgement Letter Template Word

Free Vat Invoice Template Invoice Template Ideas Riset

Do We Claim Vat On Donation - Overview As a charity you do not pay VAT when you buy some goods and services Community amateur sports clubs CASCs do not qualify for the same VAT reliefs as charities How to get