Do We Get Tax Benefit On Fixed Deposit Should we pay tax on fixed deposits each year or only on maturity What does the law say What are the options for the investor Can we pay on maturity even if there is a tax deduction at source Let us find out

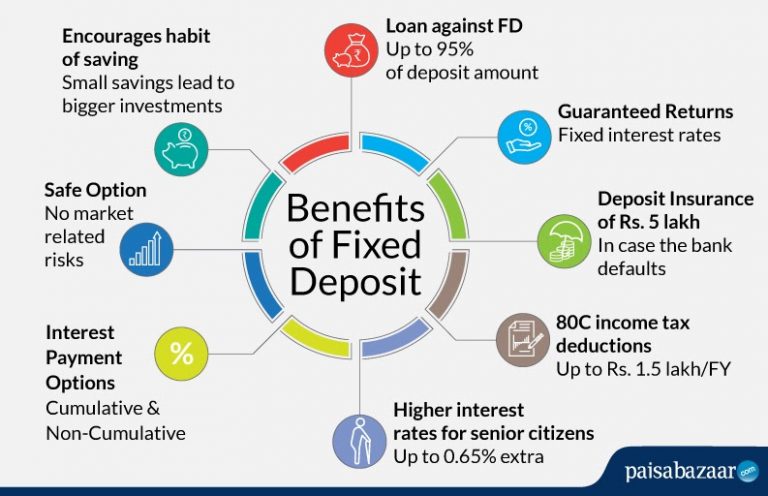

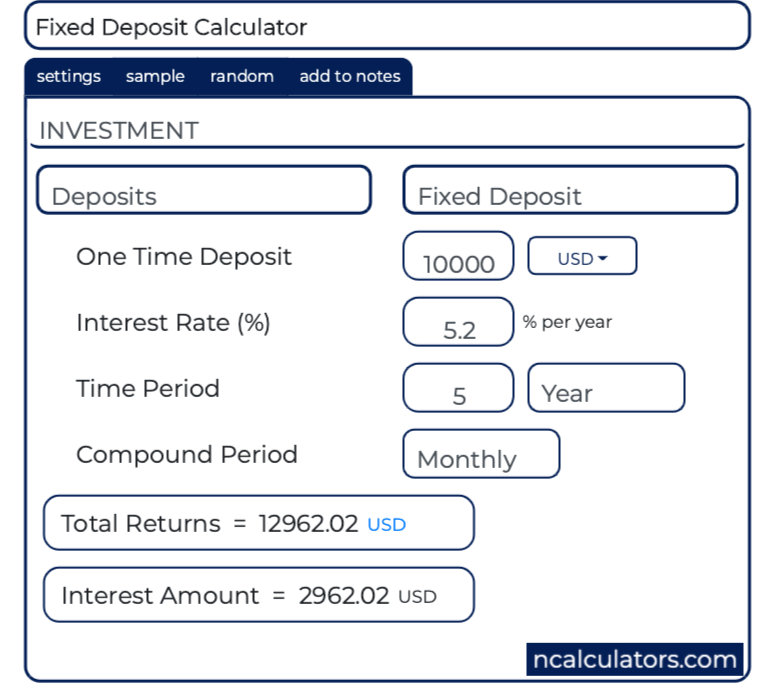

Fixed deposit accounts offer a variety of options including tax saving FDs with specific benefits like income tax deduction under Section 80C Tax saving FDs have an interest rate ranging from 5 5 to 7 75 and a lock in period of 5 years Tax Benefits Investments in tax saving fixed deposits are eligible for a deduction of up to 1 5 Lakhs under Section 80C of the Income Tax Act This deduction helps reduce the taxable income of the investor

Do We Get Tax Benefit On Fixed Deposit

Do We Get Tax Benefit On Fixed Deposit

https://www.paisabazaar.com/wp-content/uploads/2020/02/fixed-deposit-benefits-768x496.jpg

When How To Pay Income Tax On Fixed Deposit

https://askopinion.com/images/Files/UserFiles/posting/lrg/2017/8/taxes-euw.jpg

Safe Mode Of Investment

https://lh3.googleusercontent.com/rPDJKUJg_XudsAvXmkQDw1k7MEA9I6mrsJhSgheSZLwMTOwDJ-EM_R9ZrEe2BtmdMi2XqwuKsAHr8Dvy2b41qDvBI2kJrKPFzba564oVsawXJ2bmtPoQRCsvIjIA7g

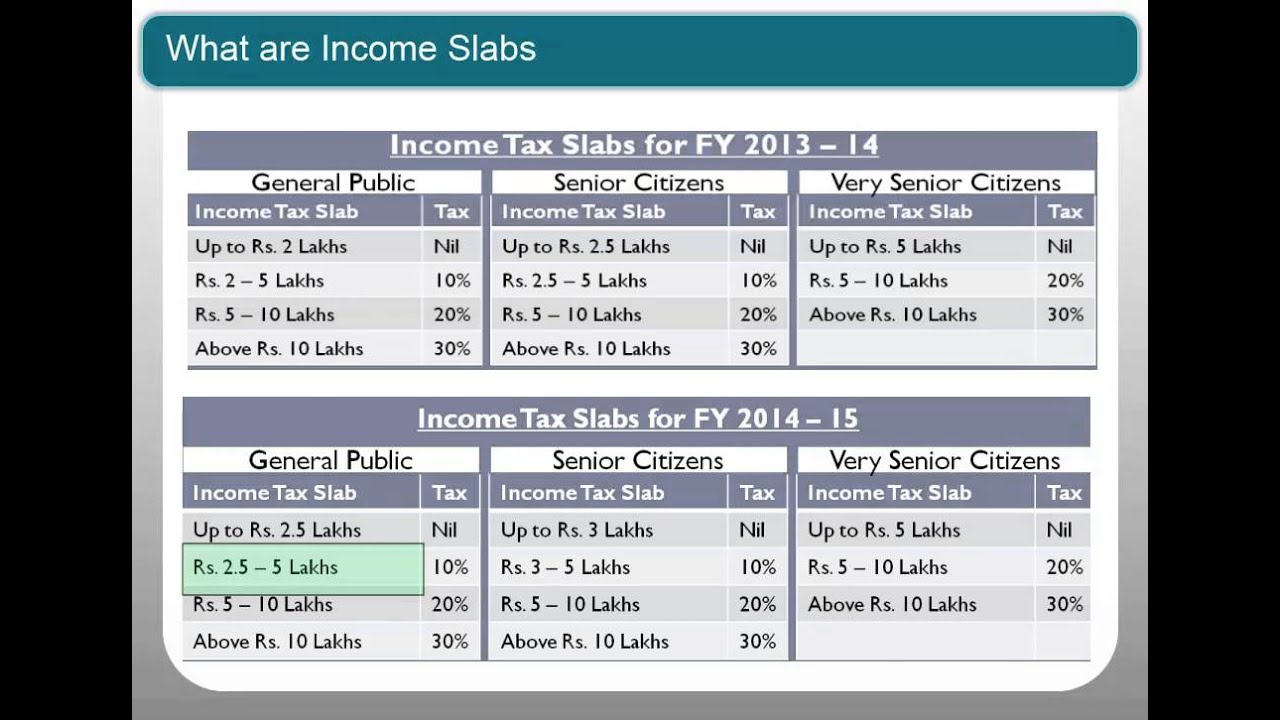

Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks Key benefits of a tax saving fixed deposit You are liable for a fixed deposit tax if your earnings from the interest exceed 40 000 and 50 000 for senior citizens The tenure for a tax saving deposit is fixed at 5 years with a maximum tax deductible investment of 1 5 lakhs in a year

Tax Saving Fixed Deposit There are specific tax saving FDs that are eligible for tax deductions A tax saving FD has a maturity period of 5 years and the principal amount up to 1 50 000 per annum is tax deductible under section 80C of A tax saving fixed deposit FD is a term deposit scheme that offers the benefit of income tax deductions under section 80C of the Income Tax Act You can open a tax saving FD also known as a tax saver FD with most leading banks and non banking financial companies NBFCs in

Download Do We Get Tax Benefit On Fixed Deposit

More picture related to Do We Get Tax Benefit On Fixed Deposit

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

Tax Benefits Of NRE Accounts Saving Current Recurring Or Fixed

https://4.bp.blogspot.com/-nR3ri3XCT_U/VvYsA2vOfkI/AAAAAAAAFZM/Pbve44ORGNAQIWGzQaQgsknZ5LMc9cygw/s1600/Tax%2BBenefit%2Bof%2BNRI%2Baccounts.jpg

Tax On Cash Deposit And Withdrawal What You Need To Know In 2023

https://www.bharatbank.com/images/taxdeposit.jpg

Tax saving deposits are a type of deposit scheme that allows you to enjoy a deduction of up to 1 5 lakh under Section 80C of the Income Tax Act They come with a lock in period of 5 years Just like other fixed deposits returns on a You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital protection

The Bank of England will announce at midday its latest decision on its interest rate Economists widely expect the Bank to cut the rate from 5 to 4 75 So do investors with the market putting However tax saving fixed deposit schemes allow tax benefits interest earned on such FD is taxed at source TDS This means that while the initial deposit amount will be allowed as deduction u s 80C interest earned on this investment shall not be tax free

What Is A Fixed Deposit FD Account Meaning Functioning Features

https://blog.rblbank.com/wp-content/uploads/2022/11/meaning-features-of-fd-m.jpg

Income Tax On Fixed Deposit FD Interest Income FD Tax Benefits

https://i.ytimg.com/vi/GIXUmeF4ABs/maxresdefault.jpg

https://freefincal.com/tax-on-fixed-deposits

Should we pay tax on fixed deposits each year or only on maturity What does the law say What are the options for the investor Can we pay on maturity even if there is a tax deduction at source Let us find out

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Fixed deposit accounts offer a variety of options including tax saving FDs with specific benefits like income tax deduction under Section 80C Tax saving FDs have an interest rate ranging from 5 5 to 7 75 and a lock in period of 5 years

Fixed Deposit TDS On FD And How To Show Interest Income From FD In ITR

What Is A Fixed Deposit FD Account Meaning Functioning Features

Fixed Deposit Monthly Interest Calculator BrendynLeith

5 year Tax Saver Fixed Deposit Latest Interest Rates Yadnya

All You Want To Know About Mounted Deposits And FD Calculators

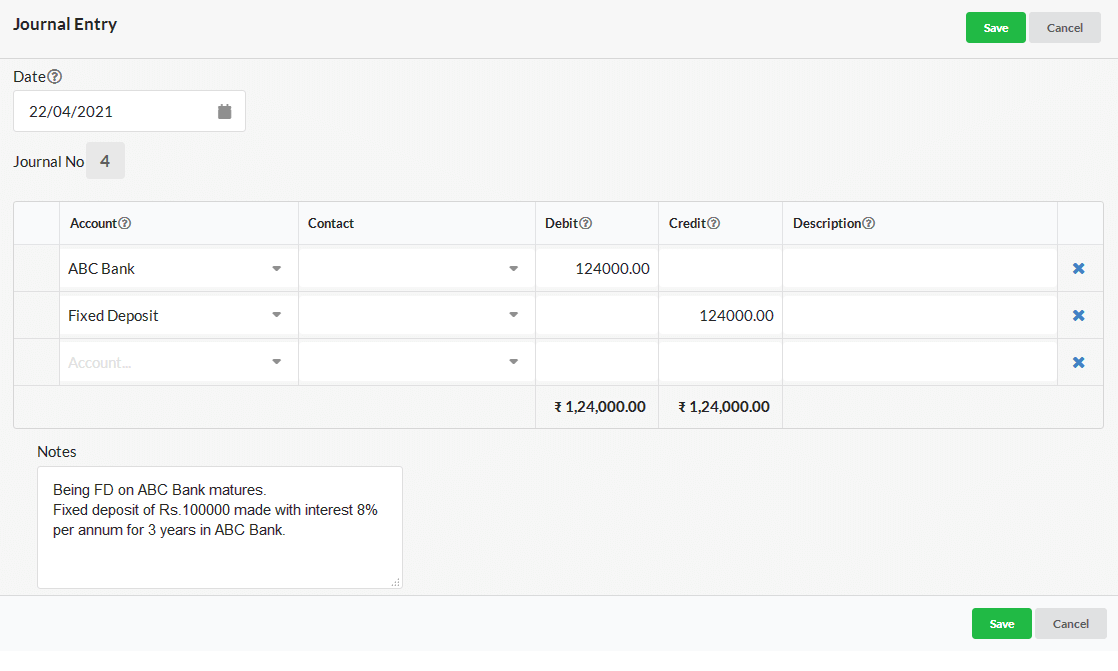

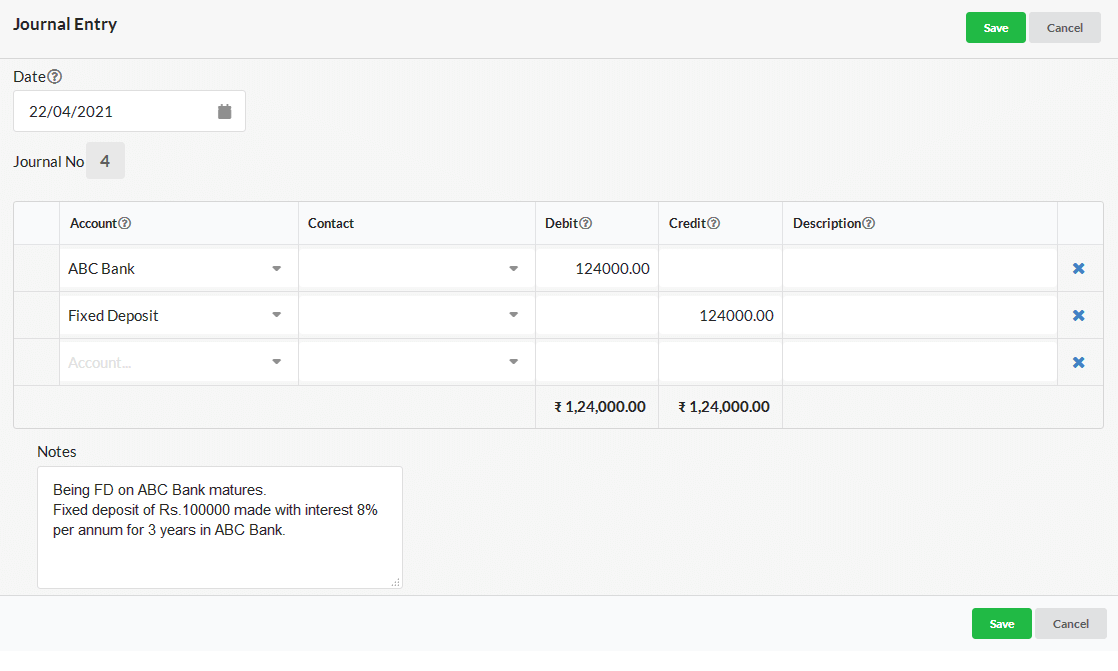

Journal Entry Of Fixed Deposits Output Books GST Billing Software

Journal Entry Of Fixed Deposits Output Books GST Billing Software

3 Ways To Avoid TDS On Bank Fixed Deposit SavingsFunda

Best Fixed Deposit Rates

The Importance Of Benefits Management Ntegra

Do We Get Tax Benefit On Fixed Deposit - Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction by investing in a tax saving fixed deposit scheme offered by different banks