Do We Get Tax Benefit On Home Loan All joint owners can individually avail of tax benefits on a joint home loan provided certain conditions are met Let s examine them It s pertinent to note that ownership of the property is a prerequisite to availing any tax benefits against the property

While personal loans do not offer specific tax benefits if used for certain purposes like home renovation education or business tax deductions can be claimed under specific sections of the Income Tax Act in India Optimal financial planning can ensure tax efficiency when utilizing loan funds Since the Tax Cuts and Jobs Act doubled the standard deduction far fewer taxpayers benefit from itemizing deductions like mortgage interest and property taxes and those who do tend to need

Do We Get Tax Benefit On Home Loan

Do We Get Tax Benefit On Home Loan

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

8 Tax Breaks For Homeowners The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the

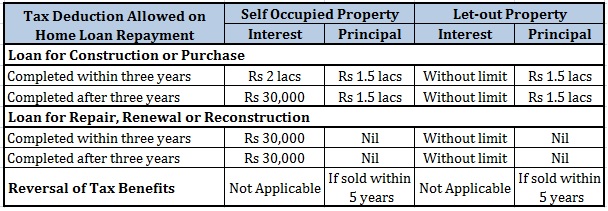

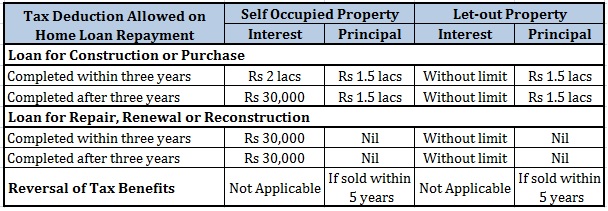

You can usually deduct mortgage interest on your tax return The loan must be secured by your home The loan s proceeds must be used to buy build or improve your main residence It can also be used for one Yes the home loan comes with many tax saving deductions such as a deduction under section 24 for interest payments a deduction under 80C for repayment of the principal amount loan and an additional benefit to first time buyers of INR 50000

Download Do We Get Tax Benefit On Home Loan

More picture related to Do We Get Tax Benefit On Home Loan

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

https://img.etimg.com/thumb/height-450,width-800,msid-67320956,imgsize-277725/tax4-getty.jpg

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

Yes the interest on home equity loans and lines of credit is tax deductible provided the loan proceeds are used to buy build or substantially improve the taxpayer s home that secures the loan The mortgage interest deduction one of the main tax benefits for homeowners allows you to deduct the interest you pay on a mortgage used to buy build or improve your main home or second home You can deduct the interest paid up to 750 000 of mortgage debt if you re an individual taxpayer or a married couple filing a

It can also come with tax benefits one being the mortgage interest deduction However not all homeowners can claim this tax deduction and the rules can be complex The mortgage interest deduction is a tax incentive for homeownership It lets some taxpayers write off some of the interest charged by their home loan The deduction once was a staple of

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

Tax Benefits How To Use Home Loan Interest To Benefit Of Tax

https://blog.regrob.com/wp-content/uploads/2016/10/tax-benefit-on-home-loan-interest.png

https://cleartax.in/s/tax-benefits-on-home-loan-for-joint-owners

All joint owners can individually avail of tax benefits on a joint home loan provided certain conditions are met Let s examine them It s pertinent to note that ownership of the property is a prerequisite to availing any tax benefits against the property

https://cleartax.in/s/tax-benefits-on-personal-loan

While personal loans do not offer specific tax benefits if used for certain purposes like home renovation education or business tax deductions can be claimed under specific sections of the Income Tax Act in India Optimal financial planning can ensure tax efficiency when utilizing loan funds

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How Housing Loan Tax Benefit

Income Tax Benefits On Housing Loan In India

20151209 Tax Benefits On A Home Loan Personal Finance Plan

20151209 Tax Benefits On A Home Loan Personal Finance Plan

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

TAX BENEFITS WHILE AVAILING HOME LOANS PO Tools

Do We Get Tax Benefit On Home Loan - Tax Benefits of Home Ownership in 2024 When a consumer considers purchasing or selling a home they should consider the fact that there are many tax benefits that could potentially make owning a home quite profitable By far the buying of a home can be one of a consumers biggest investments