Do You Charge Sales Tax On Discounts What should you know to best understand when a sale is taxable or exempt And what should you know to ensure that a customer or you can claim an exemption Ask these 4 questions to help find the answers you re searching for

Learn the complexities of applying sales tax to discounted products From cash discounts to coupons navigate the rules with this comprehensive guide Sales discounts only appear as expenses on the income statement and not on the balance sheet Another term for sales discounts is cash discounts or early payment discounts Accounting Treatment for Sales Discounts Sales discounts are not technically expenses because they actually reduce the price of a product

Do You Charge Sales Tax On Discounts

Do You Charge Sales Tax On Discounts

https://loanscanada.ca/wp-content/uploads/2021/12/Car-Sales-Tax.png

How To Charge Sales Tax In The US A Simple Guide For 2023 Business

https://i.pinimg.com/originals/34/5c/61/345c61204e4acc33022a9be1d9d8dce6.jpg

Marketplace Tax Laws Still Challenging 4 Years After Wayfair

https://multichannelmerchant.com/wp-content/uploads/2020/12/online-sales-tax-keyboard-feature-cropped.jpg

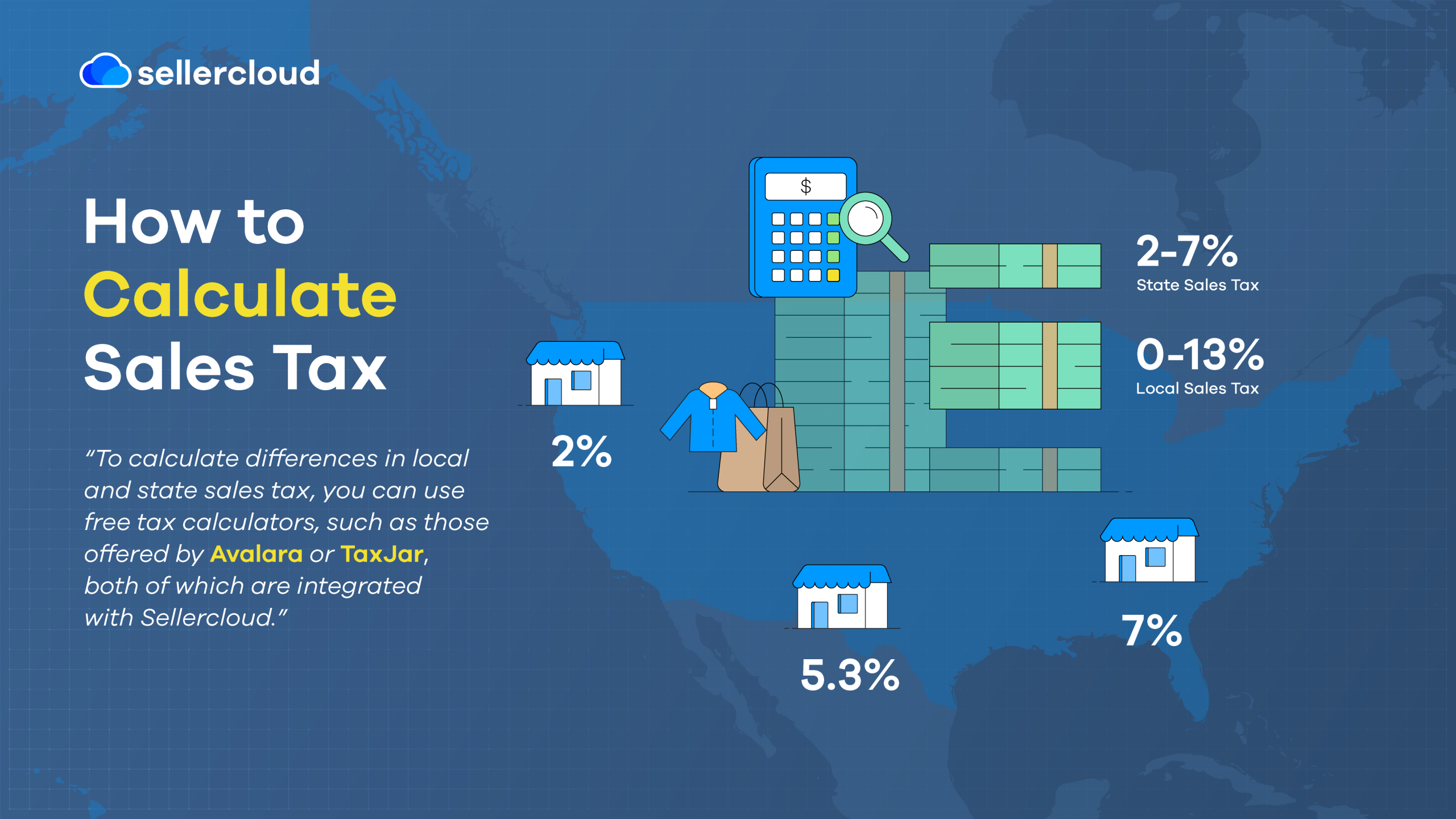

Whether or not you need to charge sales tax depends on various factors like your business location and the type of goods or services you sell Most of the time sales tax will depend on what your business offers because tax obligations differ between physical goods services and digital products Whether you re a retailer or a consumer grasping how sales tax is calculated amidst discounts is crucial for financial transparency In this guide we ll jump into the intricacies of sales tax computation with discounts shedding light on essential concepts and practices

In origin based states if you make a sale to someone in your state then you simply charge the sales tax rate at your location But in destination based states the point of sale is considered to be the buyer s location Be careful of what your sales tax calculations might be charging your customers when it comes to discounted sales You might be in for trouble like Target Target is accused of overcharging customers when coupons were used in a new class action lawsuit filed this March

Download Do You Charge Sales Tax On Discounts

More picture related to Do You Charge Sales Tax On Discounts

Car Rental Tax And Fees In The US Hertz Resources

https://www.hertz.com/content/dam/hertz/global/blog-articles/resources/tax-when-renting-a-car.jpg

Does Florida Charge Sales Tax On Online Purchases EPGD Business Law

https://www.epgdlaw.com/wp-content/uploads/2021/05/55822098_s.jpg

Sales Tax Basics For Interior Designers Capella Kincheloe

https://images.squarespace-cdn.com/content/v1/58406b84b3db2b7f14465fb8/1494268422868-5B16T0ZTDMV7TRE9N0ZN/sales-tax-basics-for-interior-designers-capella-kincheloe.png

Here s how the sales tax deduction works how to calculate what to write off and how to evaluate your options so you can maximize savings and cut your tax bill The Federal Reserve was about to cut interest rates turning the corner after a long fight with inflation But now its soft landing is in question

If you file your sales tax return and pay your sales tax on a timely basis you are allowed to keep a portion of the sales tax as a discount The allowable discount for timely filing and paying is 1 2 of the first 6 000 collected and 0 9 percent for any excess amount above 6 000 Sales tax is charged on each taxable item however amounts representing on the spot cash discounts employee discounts volume discounts store discounts such as buy one get one free wholesaler s or trade discounts rebates and store or manufacturer s coupons shall establish a new purchase price if both the item and the coupon are

How To Charge Sales Tax In The US 2022

https://cdn.shopify.com/s/files/1/0070/7032/files/How_to_charge_sales_tax.jpg?v=1656354490

US Supreme Court Rules On Internet Sales Tax BJM Atlanta CPA

https://www.bjmco.com/wp-content/uploads/sites/7/2020/02/feat_announcements.jpg

https://www.salestaxinstitute.com › resources

What should you know to best understand when a sale is taxable or exempt And what should you know to ensure that a customer or you can claim an exemption Ask these 4 questions to help find the answers you re searching for

https://quaderno.io › blog › sales-tax-discounted-goods

Learn the complexities of applying sales tax to discounted products From cash discounts to coupons navigate the rules with this comprehensive guide

Do I Have To Pay Sales Tax On A Car That Was Gifted Nj

How To Charge Sales Tax In The US 2022

3 Numbers To Know Costs Markup And Profit PKF Mueller

What Do You Charge Quraishi Law Firm Wealth Management

Sales Tax Vs VAT Explained Yonda Tax

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

What Is Sales Tax And How Do I Calculate It Sellercloud

How To Bid On Plumbing Jobs The Complete Guide 2022

Texas House Passes Bill That Would Remove Sales Tax On Menstrual

Do You Charge Sales Tax On Discounts - In origin based states if you make a sale to someone in your state then you simply charge the sales tax rate at your location But in destination based states the point of sale is considered to be the buyer s location