Do You Get A 30 Rebate On Solar Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

Web 16 ao 251 t 2022 nbsp 0183 32 Here s a quick example of the difference in credits in 2021 and 2022 for a 9 kW solar array at an average cost of 27 000 Installed and claimed in 2021 taxes at the Web Systems installed on or before December 31 2019 were also eligible for a 30 tax credit It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in

Do You Get A 30 Rebate On Solar

Do You Get A 30 Rebate On Solar

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/TX-rebates-ring.png

Through Government Rebates And Tax Incentives This Solar Program Is

https://i.pinimg.com/originals/bf/55/f9/bf55f9b304663ca72ea800518d118729.jpg

Solar Panel Rebate Victoria How It Works How To Claim

https://cyanergy.com.au/wp-content/uploads/2020/06/Solar-Panel-Rebate-by-Cyanergy.jpeg

Web 26 avr 2023 nbsp 0183 32 Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032 That s Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal solar tax credit The

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of Web 6 juin 2023 nbsp 0183 32 If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal

Download Do You Get A 30 Rebate On Solar

More picture related to Do You Get A 30 Rebate On Solar

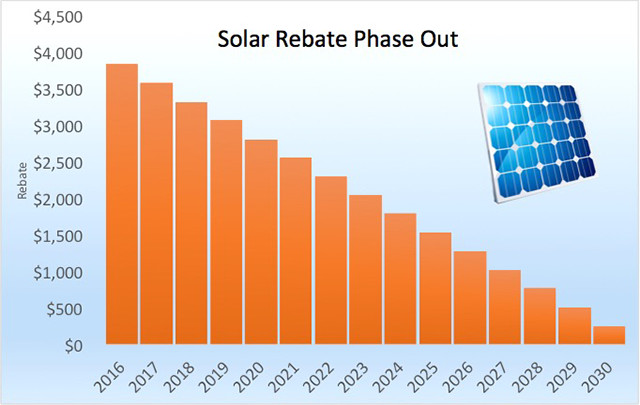

2017 Australian Solar Rebate Changes Click To See If You Qualify

https://blog.australiansolarquotes.com.au/wp-content/uploads/2017/01/FB-Card-2017-SOLAR-REBATE-CHANGES.jpg

Solar Rebate 2023 Your Ultimate Guide To Australia Read Now

https://rescomsolar.com.au/wp-content/uploads/2022/12/solar-panels-save-money-scaled-1.jpeg

The Solar Rebates Ending Make The Most Of It While You Can

https://www.solargain.com.au/sites/all/themes/solargain/assets/images/solar-rebate-ending-web.png

Web 3 janv 2023 nbsp 0183 32 The investment tax credit ITC also known as the federal solar tax credit allows you to apply 30 percent of your solar energy system s cost as a credit to your Web To put it simply if you qualify for the federal solar tax credit you can claim up to 30 of your solar system s cost as a credit This could mean lowering the amount of federal taxes

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit also known as the Investment Tax Credit ITC is a tax incentive worth 30 gross solar system cost The only requirements are that You own the system by Web The solar investment tax credit ITC is a tax credit available to all homeowners worth 30 of expenditures on solar and or battery storage with no maximum limit on the value of

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

SunPower Solar Rebate Scudder Solar Energy Systems Blog

https://www.scuddersolar.com/blog/wp-content/uploads/2020/03/35thAnniversaryPromo2-812x1024.jpg

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

https://www.solar.com/learn/federal-solar-tax-credit

Web 16 ao 251 t 2022 nbsp 0183 32 Here s a quick example of the difference in credits in 2021 and 2022 for a 9 kW solar array at an average cost of 27 000 Installed and claimed in 2021 taxes at the

The Truth About The Solar Rebate SAE Group

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Solar Panel Rebate To Be Phased Out From 1st Of January 2017 Solar

Solar Panel Rebate How It Works And How To Get It

Pin On Information

Australia s Solar Rebate In 2020 What You Need To Know

Australia s Solar Rebate In 2020 What You Need To Know

Everything You Must Know About The Solar Panel Rebate 2022

Affordable Solar Program Launched In New Mexico For Middle Class

Solar Hot Water Rebates NSW Save Thousands Check Your Eligibility

Do You Get A 30 Rebate On Solar - Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal solar tax credit The