Do You Get A Tax Break For Buying A Hybrid Car 2022 Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the

Do You Get A Tax Break For Buying A Hybrid Car 2022

Do You Get A Tax Break For Buying A Hybrid Car 2022

https://static.toiimg.com/photo/93703656.cms

Things You Need To Know Before Buying A Hybrid Car Best Trend Car

https://www.besttrendcar.com/wp-content/uploads/2021/11/Things-You-Need-to-Know-Before-Buying-a-Hybrid-Car1-1024x621.jpg

46 Terms To Know Before Buying A Hybrid Or Electric Vehicle Trust Auto

https://img.321ignition.io/321ignition-v4-prod-images/public/613bb2ed5ce9c8010acca31f/cms/tesla-model-x-2048x1024.jpg

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and Before we delve into the world of hybrid EV and PHEV tax credit it is worth noting that tax credits for hybridized vehicles will not continue indefinitely Once a manufacturer has sold

Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of either Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased after December 31 2022 may be eligible for a federal tax credit of up to 4 000

Download Do You Get A Tax Break For Buying A Hybrid Car 2022

More picture related to Do You Get A Tax Break For Buying A Hybrid Car 2022

Electric And Hybrid Cars Why Buying Used May Offer More Value For

http://media1.s-nbcnews.com/i/newscms/2016_28/1143131/electric-cars-001-tease-today-160714_9ae85c028b75b31c85af6dbf7369fb39.jpg

5 Things You Should Know Before Buying A Hybrid Car PakWheels Blog

https://static.pakwheels.com/2015/12/honda-insight-battery.jpg

What Is A Hybrid Car Benefits Working Types Explained All About

https://www.cars24.com/blog/wp-content/uploads/2022/05/hybridcars-scaled.jpg

If you purchased a plug in hybrid motor vehicle you may qualify for a credit on your tax return This tax credit is nonrefundable meaning it can only reduce your tax liability The Inflation Reduction Act of 2022 expanded the scope of clean vehicle tax credits to include certain plug in hybrid electric vehicles PHEVs fuel cell vehicles and all

You can claim the IRC 30D credit or the IRC 30D g credit for the tax year in which you purchased and began driving the vehicle For example you would need to have If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to

Pros And Cons Of Buying A Hybrid Car

https://imgcdnblog.carmudi.com.ph/carmudi-ph/wp-content/uploads/2015/05/01122749/2013-honda-civic-hybrid-rear-three-quarters.jpg

Questions To Ask When Buying A Hybrid Car Todays Past

https://todayspast.net/wp-content/uploads/2019/12/Questions-to-Ask-When-Buying-a-Hybrid-Car.png

https://www.irs.gov › credits-deductions › used-clean-vehicle-credit

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle

https://www.irs.gov › newsroom › heres-what-taxpayers...

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to

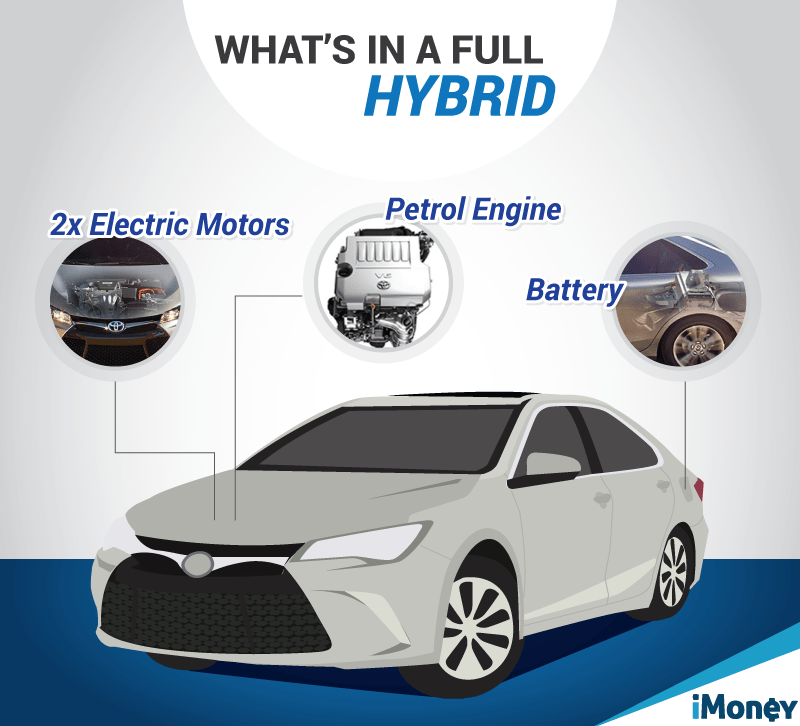

Why Buying A Hybrid Car Makes Total Financial Sense IMoney

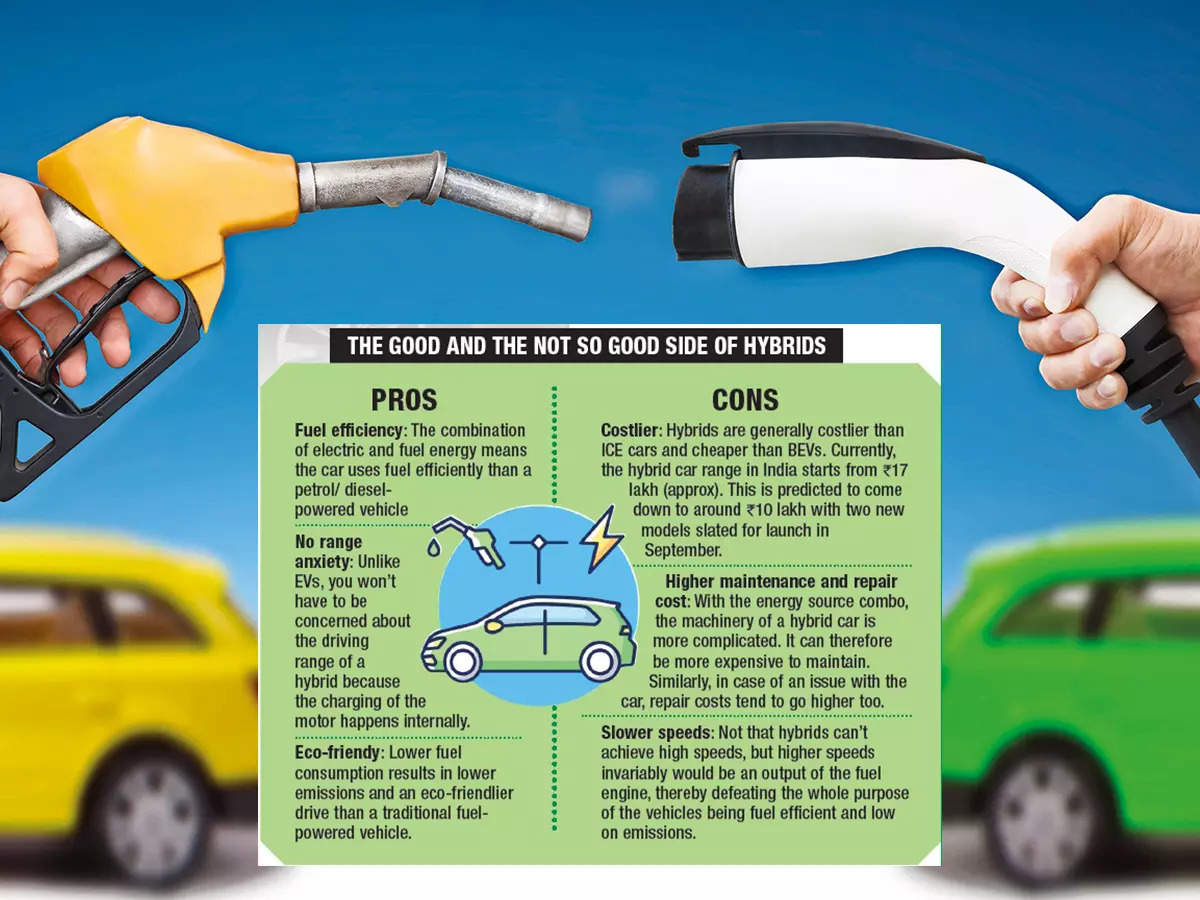

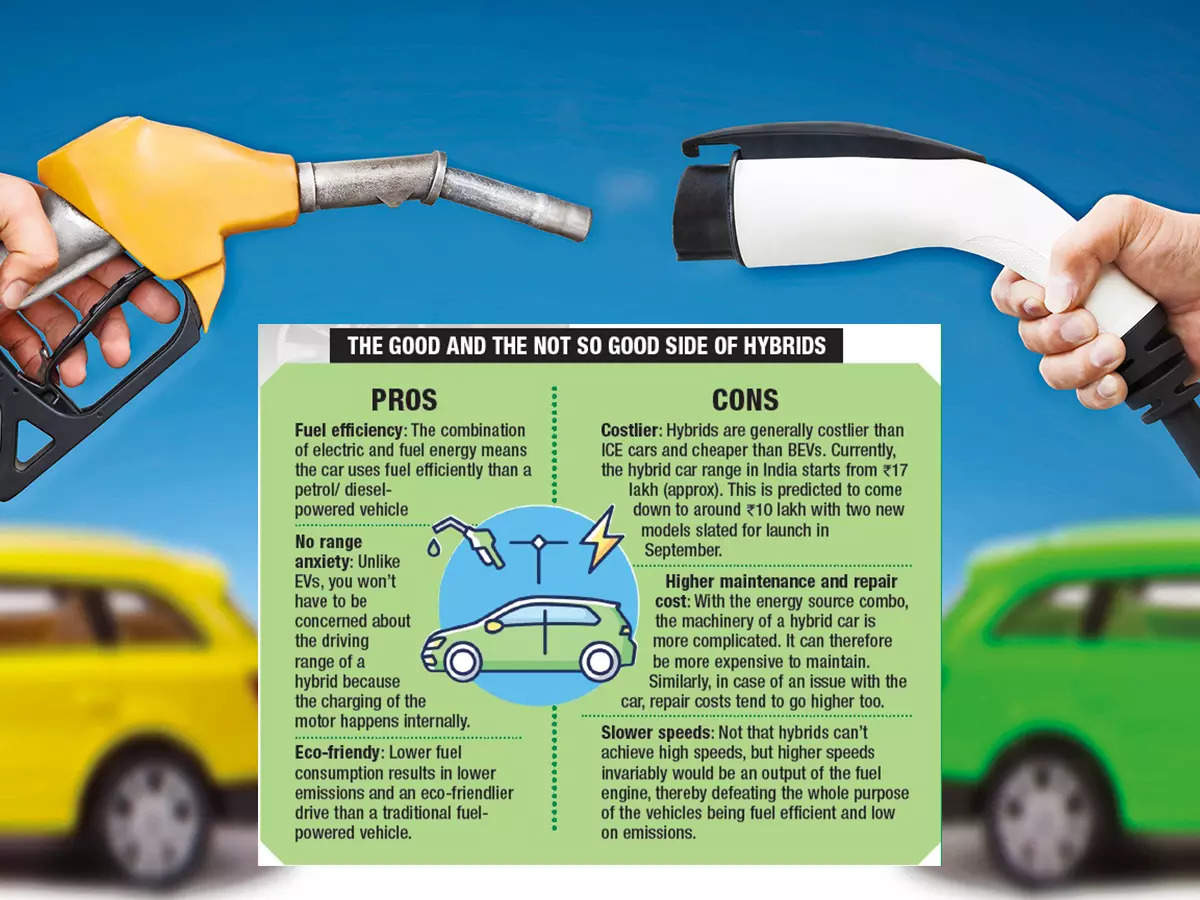

Pros And Cons Of Buying A Hybrid Car

Top 5 Pros Of Buying A Hybrid Car

5 Things To Look For When Buying A Used Hybrid Car Buying A Car

Considering Buying An Electric Or Hybrid Car Here s What You Should

Is It Worth It To Buy A Hybrid Car

Is It Worth It To Buy A Hybrid Car

Pin On My Next Car

6 Reasons To Buy A Hybrid Car Parents

Reasons For Buying A Hybrid The Good The Bad And The Moronic

Do You Get A Tax Break For Buying A Hybrid Car 2022 - According to the U S Department of Energy you can receive a tax credit of up to 7 500 for each electric vehicle you purchase on or after January 1 2010 The IRS will give a federal tax