Do You Get A Tax Break For Buying A New Car There s not much to claim for purchasing a personal vehicle You can only deduct the sales tax you paid when you purchased the vehicle by adding it to the Sales Tax Table amount for your state and the vehicle registration fees that you paid if your state bases the fee on the value of your truck

Get a tax break for buying a car 3 Mins Sep 09 2020 Tweet If you are self employed and plan on buying a car September is the perfect month to do so Is it an auspicious period Are the stars aligned in your favour which makes it a lucky time for you No the reasons are more practical and have to do with tax benefits Let us see how Section 179 and bonus depreciation are two methods that allow you a bigger upfront tax break for buying a car Tax law has included section 179 and bonus depreciation for a while but both were both modified considerably by the Tax Cuts and Jobs Act TCJA which Congress signed into law in December 2017

Do You Get A Tax Break For Buying A New Car

Do You Get A Tax Break For Buying A New Car

https://seniorlivingheadquarters.com/wp-content/uploads/2021/11/Do-Seniors-Get-a-Tax-Break-in-Florida-2-1024x576.jpg

How Many Kids Can I Claim On Child Tax Credit The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/07/kc-child-tax-credit-plat.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

No you do not get a tax break for buying a car Understanding The Tax Breaks Tax breaks for buying a car can be complex but understanding them is crucial Discover the ins and outs of whether you qualify for a tax break when purchasing a new vehicle What Is A Tax Break IR 2023 160 Sept 1 2023 WASHINGTON The Internal Revenue Service reminded consumers considering an automobile purchase to be sure to understand several recent changes to the new Clean Vehicle Credit for qualified plug in electric drive vehicles including qualified manufacturers and tax rules

If you re looking for your first home you should know that you can get a tax break for buying a house The IRS encourages homeownership with several tax deductions and credits that you can claim in most cases year after year as long as you own your home and use it as your primary residence A new law now offers a tax rebate on some used EVs and PHEVs purchased from dealers The final sale price must be 25 000 or less for vehicles at least 2 model years old and the buyer s

Download Do You Get A Tax Break For Buying A New Car

More picture related to Do You Get A Tax Break For Buying A New Car

Buy A Truck Or SUV Get A Tax Break Section 179

https://media.licdn.com/dms/image/C5612AQExzJDhegK3GA/article-cover_image-shrink_720_1280/0/1618244914187?e=2147483647&v=beta&t=_nveYK1DRUIEioF-_M9GgEQJrexNc8MswS3wn47Rltg

Time To File Your Taxes What To Know The New York Times

https://static01.nyt.com/images/2022/04/14/business/14Tax-burst-illo/14Tax-burst-illo-videoSixteenByNine3000.jpg

Everything You Need To Know About Buying A New Car Autoversed

https://cdn.autoversed.com/autoversed/wp-content/uploads/2019/04/GettyImages-988321834.jpg

If you re shopping for or researching an electric vehicle in 2024 you ve probably heard that significant changes in the federal tax credit of up to 7 500 for EVs and plug in hybrids took Sellers must also register online and report the same information to the IRS If they don t your vehicle won t be eligible for the credit Find information on credits for used clean vehicles qualified commercial clean vehicles and new plug in EVs purchased before 2023 Who qualifies

As part of the phasing in of the new tax and climate law Section 25E of the tax code was amended to include an allowance of a credit for a qualified buyer purchasing a used EV from a dealer to be eligible for a credit equal to 24 Reasons Why Buying a New Car Is a Financial Trap Provided by From Frugal to Free Buying a new car is an exhilarating experience It s easy to get caught up in the excitement of buying a

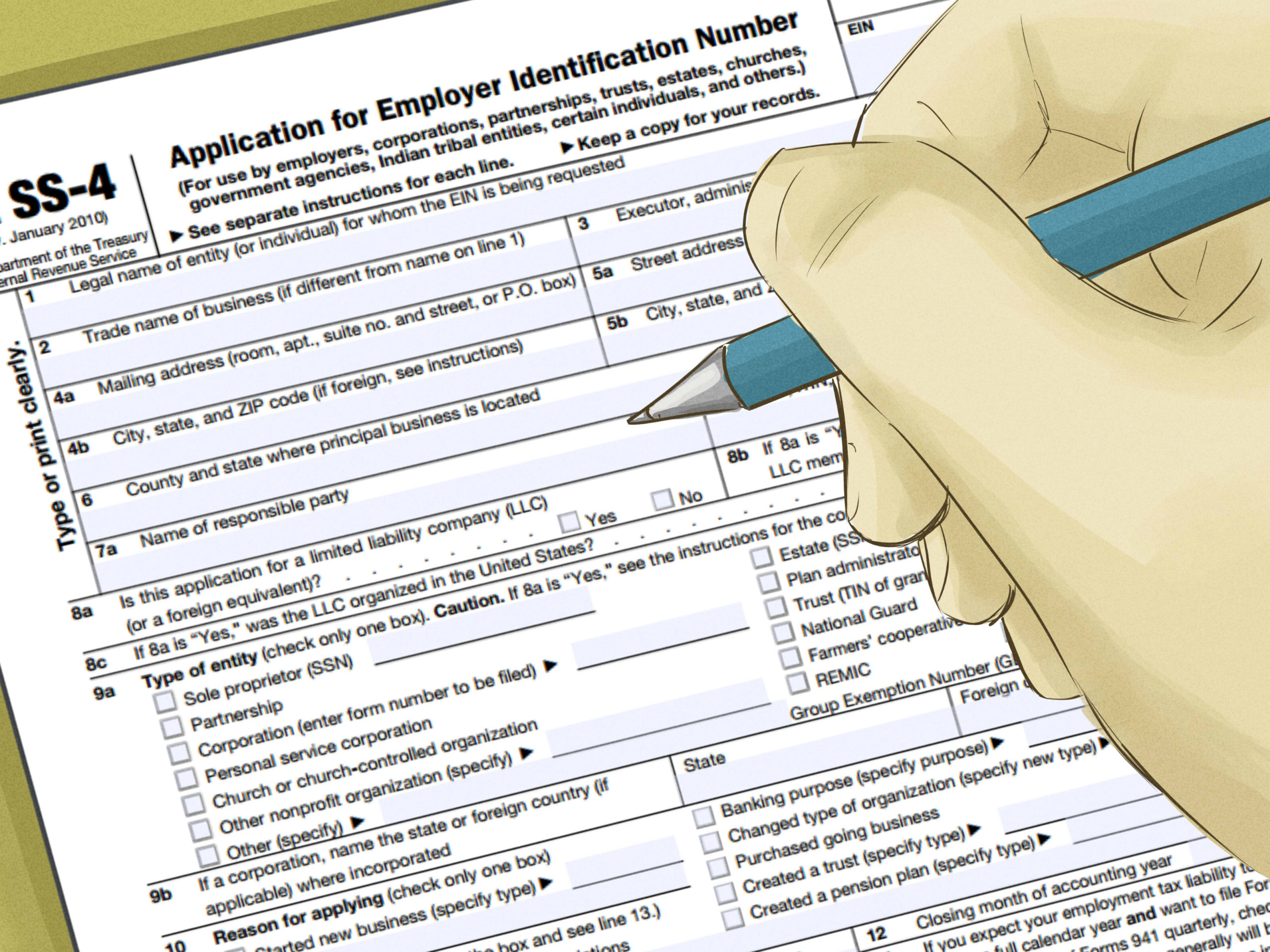

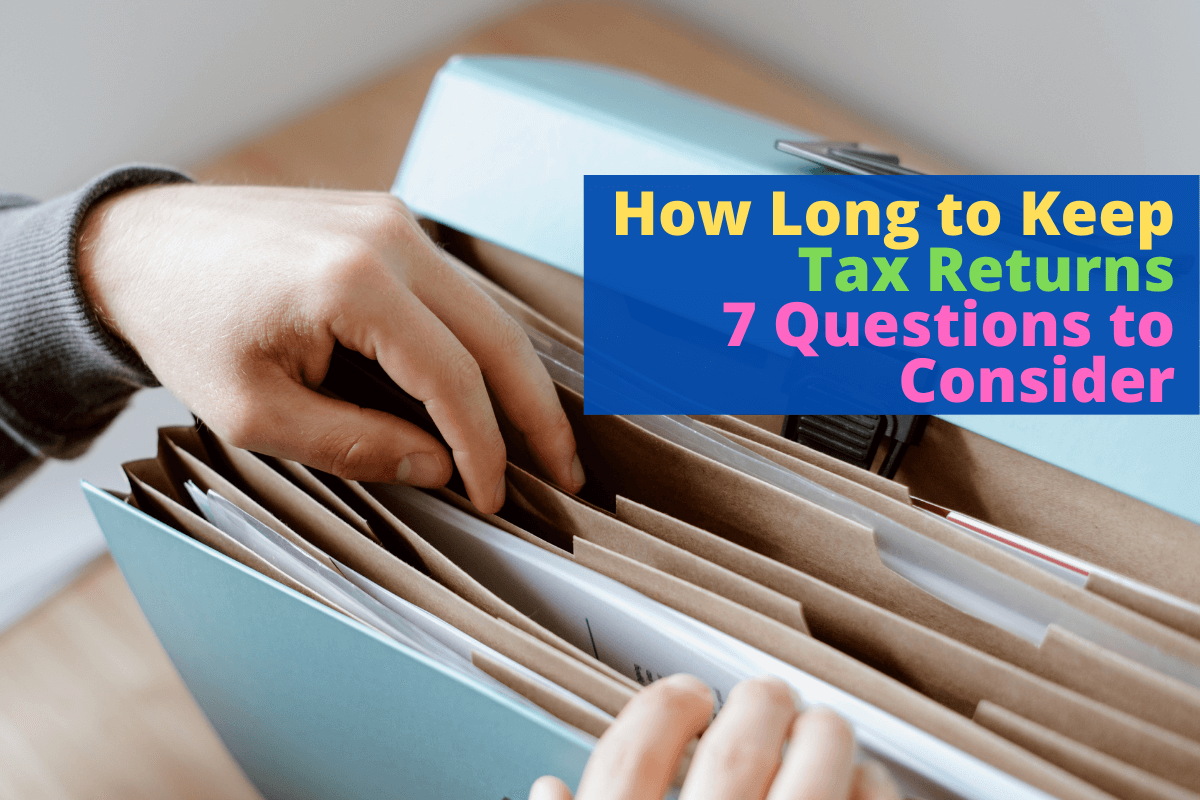

How To Find Tax ID Number TIN Number

https://tinidentificationnumber.com/wp-content/uploads/2021/08/4-ways-to-find-a-federal-tax-id-number-wikihow-1-scaled.jpg

Ride A Bike Get A Tax Break Congress Introduces 2 Bicycle Commuter

https://s3.amazonaws.com/images.gearjunkie.com/uploads/2020/10/Person-Riding-a-Bike.jpeg

https://ttlc.intuit.com/community/tax-credits...

There s not much to claim for purchasing a personal vehicle You can only deduct the sales tax you paid when you purchased the vehicle by adding it to the Sales Tax Table amount for your state and the vehicle registration fees that you paid if your state bases the fee on the value of your truck

https://www.axisbank.com/progress-with-us/money...

Get a tax break for buying a car 3 Mins Sep 09 2020 Tweet If you are self employed and plan on buying a car September is the perfect month to do so Is it an auspicious period Are the stars aligned in your favour which makes it a lucky time for you No the reasons are more practical and have to do with tax benefits Let us see how

Buying A Car 101 Useful Tips To Consider Before You Do Colliers News

How To Find Tax ID Number TIN Number

Do You Get A Tax Break For Starting A Business A Comprehensive Guide

How Long To Keep Tax Returns 7 Questions To Consider Parent Portfolio

Federal Solar Tax Credit What It Is How To Claim It For 2024

When Can You File Taxes In 2023 Kiplinger

When Can You File Taxes In 2023 Kiplinger

What Is A Corporate Tax Return with Picture

Best Non Owner Car Insurance What You Need To Know

Can I Get A Tax Break If My Crypto Platform Files For Bankruptcy

Do You Get A Tax Break For Buying A New Car - IR 2023 160 Sept 1 2023 WASHINGTON The Internal Revenue Service reminded consumers considering an automobile purchase to be sure to understand several recent changes to the new Clean Vehicle Credit for qualified plug in electric drive vehicles including qualified manufacturers and tax rules