Do You Get A Tax Deduction For Buying A Hybrid Car The IRS will give a federal tax credit of 2 500 to 7 500 for the purchase of new electric vehicles on or after January 1 2019 This credit will last until each participating

If you buy a new hybrid car between Jan 1 2006 and Dec 31 2010 you might be able to get a decent tax credit Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of either

Do You Get A Tax Deduction For Buying A Hybrid Car

Do You Get A Tax Deduction For Buying A Hybrid Car

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

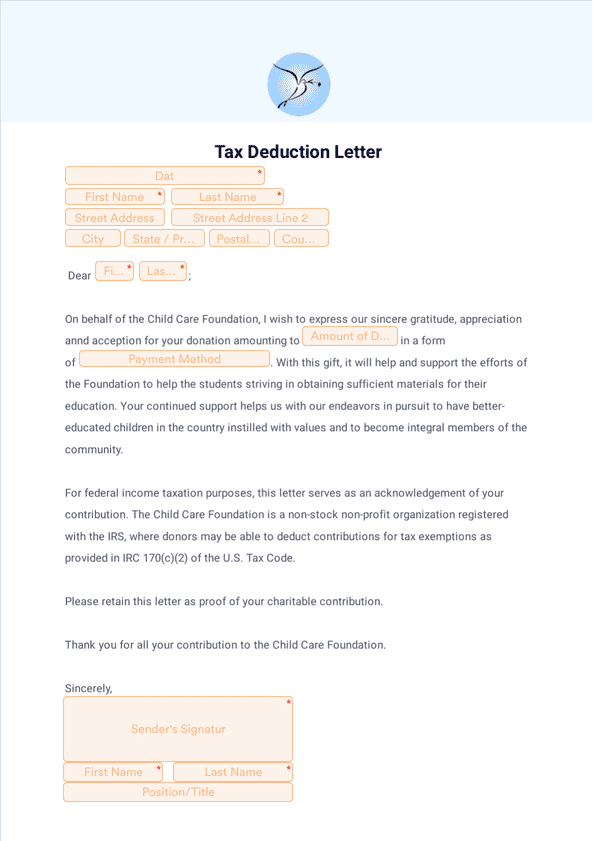

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act Plug in hybrid all electric and fuel cell electric vehicles purchased new in or after 2023 may be eligible for a federal income tax credit of up to 7 500

Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit The credit equals 30 of the sale price up to a You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a

Download Do You Get A Tax Deduction For Buying A Hybrid Car

More picture related to Do You Get A Tax Deduction For Buying A Hybrid Car

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

How To Get A Business Mileage Tax Deduction Small Business Sarah

https://i.pinimg.com/originals/a3/62/55/a362559fd8fc4165527746652c8c35c5.jpg

Is there a tax credit for buying a hybrid car or electric vehicle Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return You may be able to get a maximum of 7 500 towards your taxes on your tax return The government offers tax breaks on hybrid vehicles as an incentive for consumers to go green If you have considered making the switch to a hybrid vehicle then getting informed about the potential tax breaks is your next step

Many more EVs and plug in hybrids are eligible for the federal tax subsidy of up to 7 500 including vehicles built outside North America as long as drivers lease them or buy used rather A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to 7 500 provided it was manufactured in North America But the rules are

How Do Tax Deductions For Donating A Car Actually Work

https://automarketwatch.com/wp-content/uploads/2021/02/How-Do-Tax-Deductions-for-Donating-A-Car-Actually-Work.png

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

https://www.caranddriver.com/.../hybrid-car-tax-credit

The IRS will give a federal tax credit of 2 500 to 7 500 for the purchase of new electric vehicles on or after January 1 2019 This credit will last until each participating

https://auto.howstuffworks.com/fuel-efficiency/...

If you buy a new hybrid car between Jan 1 2006 and Dec 31 2010 you might be able to get a decent tax credit

Tax Deductions You Can Deduct What Napkin Finance

How Do Tax Deductions For Donating A Car Actually Work

How To Get A Business Mileage Tax Deduction Business Mileage

5 Helpful Hybrid Car Maintenance Tips Christian s Automotive

Tax Deductions Template For Freelancers Google Sheets

What Is A Tax Deduction

What Is A Tax Deduction

Tax Deductions Write Offs To Save You Money Financial Gym

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Can You Claim A Tax Deduction For Your Car Purchase

Do You Get A Tax Deduction For Buying A Hybrid Car - Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit The credit equals 30 of the sale price up to a