Do You Get A Tax Deduction For Working From Home If you have a remote working agreement with your employer you are entitled to a home office deduction The deductible amount hinges on whether remote work accounts for more than half of the year s working days An employee working from home for less than half of the year can claim 450 euros

If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time your employer has an

Do You Get A Tax Deduction For Working From Home

Do You Get A Tax Deduction For Working From Home

https://i.pinimg.com/736x/80/f5/2d/80f52dac2182daa554539d9580ab22d3.jpg

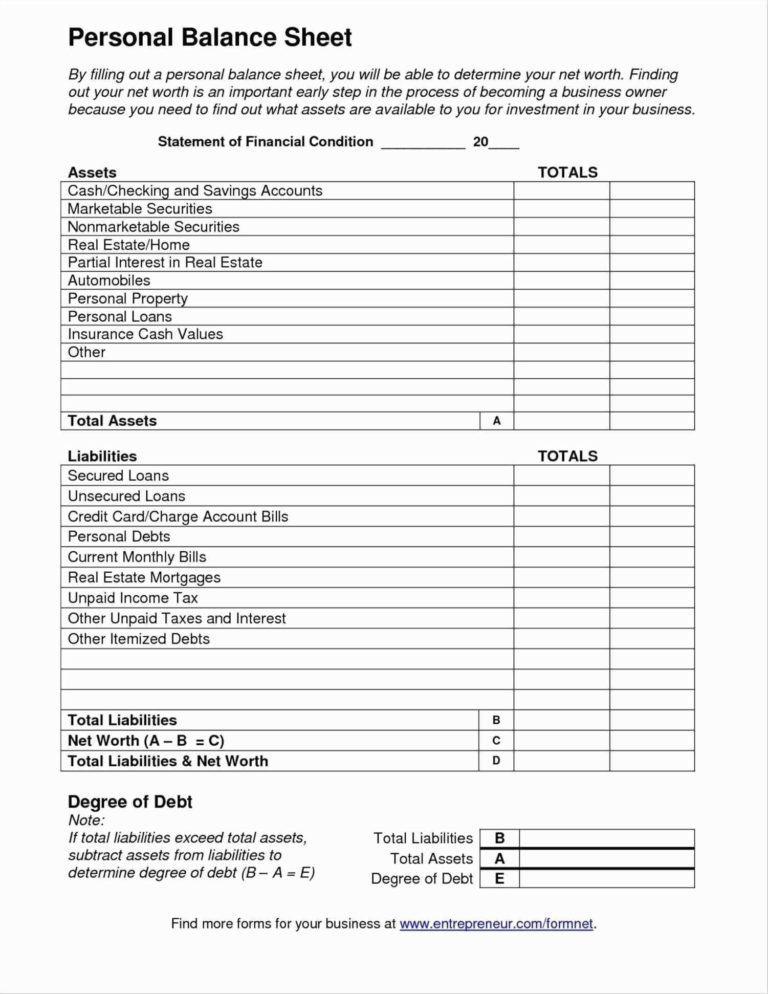

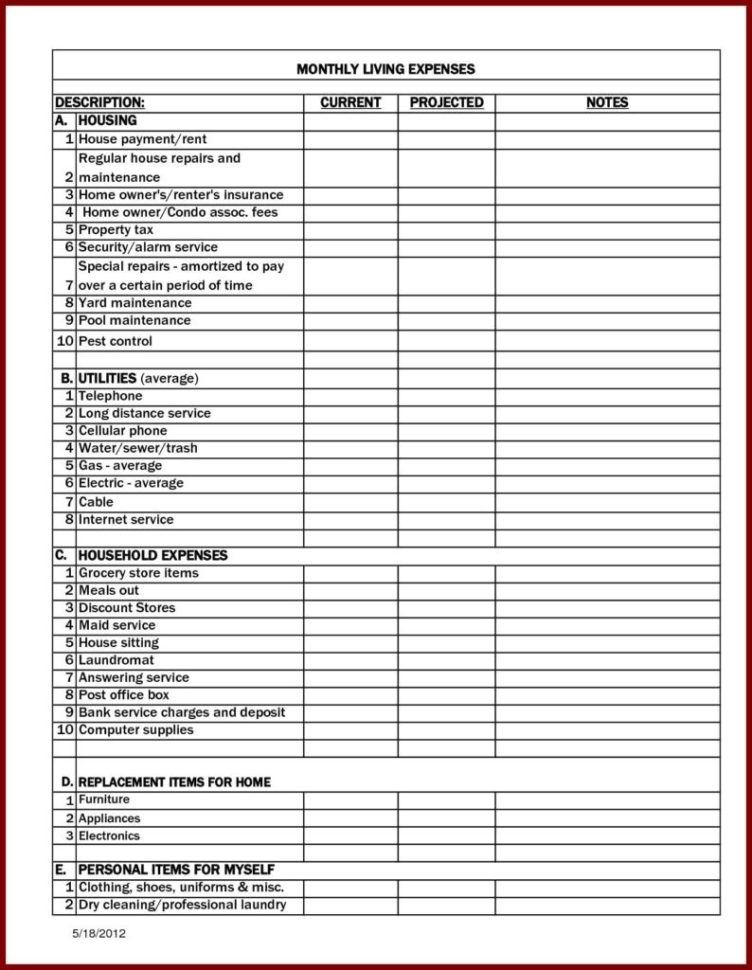

Printable Itemized Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

Can You Get A Tax Deduction For Working From Home YouTube

https://i.ytimg.com/vi/7mwHL9ktMIw/maxresdefault.jpg

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction To take this deduction you ll need to figure out the percentage of your home used for business 2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

To claim for tax relief for working from home employees can apply directly via GOV UK for free Once their application has been approved the online portal will adjust their tax code for the Can you claim work from home tax deductions If you re an employee you can claim certain job related expenses as a tax deduction but only for tax years prior to 2018 For tax year 2018 and on unreimbursed expenses and home office tax deductions are typically no longer available to employees

Download Do You Get A Tax Deduction For Working From Home

More picture related to Do You Get A Tax Deduction For Working From Home

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture351.png?fit=693%2C345&ssl=1

The Master List Of All Types Of Tax Deductions infographic Free

https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg

What Is Taxable Income Explanation Importance Calculation

https://lh3.googleusercontent.com/3kJD2TxpzVap-1OtKRdXoC1aY3I_VhgBlVZ5fYWNDr2Z0V1-0XSXvvTI-O_hVbm8JQnKlBGItKea6JIYzjp0Sly-7w6XjGFBQeNzQ2dcuOl52cvpKDHiNhHkAoJJ5cbwn5VGvQfZ

Currently W 2 employees can t deduct home office expenses but independent contractors or anyone who is self employed can deduct the costs of having a dedicated workspace at Although you can t take federal tax deductions for work from home expenses if you are an employee some states have enacted their own laws requiring employers to reimburse employees for necessary business expenses or allowing them to deduct unreimbursed employee expenses on their state tax returns

Overview As an employer providing homeworking expenses for your employees you have certain tax National Insurance and reporting obligations Homeworking expenses include equipment services From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self assessment SA returns online or on a paper P87 form

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

List Of Itemized Deductions Worksheet

https://i.pinimg.com/originals/55/f9/87/55f987a2df592c60959f58557847afd6.jpg

https://yle.fi

If you have a remote working agreement with your employer you are entitled to a home office deduction The deductible amount hinges on whether remote work accounts for more than half of the year s working days An employee working from home for less than half of the year can claim 450 euros

https://www.vero.fi › ... › home-office-deduction

If you work from your own home or have rented a separate workspace you can deduct the expenses A workspace deduction is included in the expenses for the production of income If you have wage income you will automatically receive a 750 deduction

Tax Credit Vs Tax Deduction Difference And Comparison Diffen

Tax Deduction Letter Sign Templates Jotform

Itemized Deductions Spreadsheet In Business Itemized Deductions

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

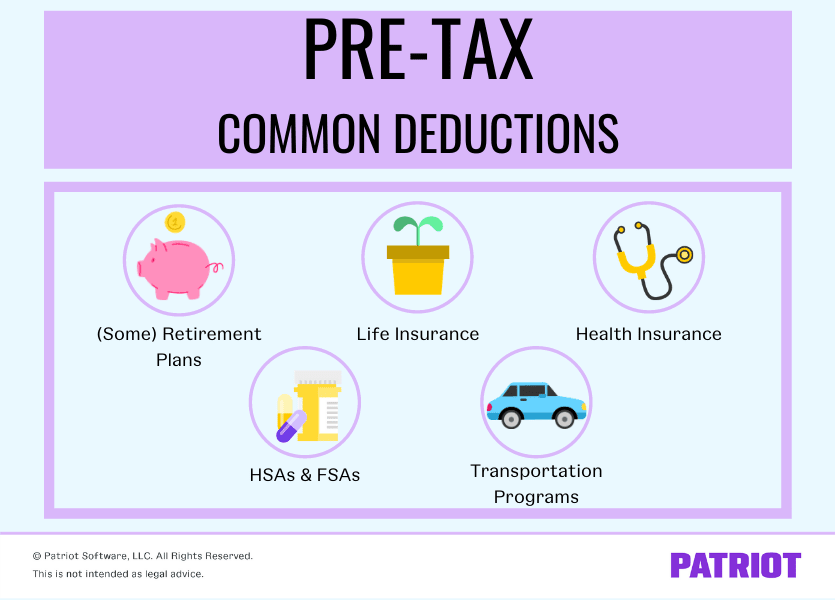

Pre tax Deductions And Contributions Definition List Example

April 15th Can I Get A Tax Deduction For My Countertops

April 15th Can I Get A Tax Deduction For My Countertops

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Printable Itemized Deductions Worksheet

Tax Deduction Spreadsheet Excel Db excel

Do You Get A Tax Deduction For Working From Home - 2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home