Do You Get A Tax Rebate For Buying A Hybrid Car Starting on Jan 1 2023 people who purchase eligible electric vehicles can receive 2 500 to 7 500 in tax credits The value of the credit can be directly subtracted from the purchase

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act According to the U S Department of Energy you can receive a tax credit of up to 7 500 for each electric vehicle you purchase on or after January 1 2010 The IRS will give a federal

Do You Get A Tax Rebate For Buying A Hybrid Car

Do You Get A Tax Rebate For Buying A Hybrid Car

https://static.cargurus.com/images/article/2017/05/26/10/20/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-4169818146229685017-1600x1200.jpeg

How To Qualify For A Tax Rebate For Insulating Your Home

https://cdn-www.terminix.com/-/media/Feature/Terminix/Articles/Insulation-Attic-Installment-Technician.jpg?rev=1a8cb3da7c0a447989639e28fe8462d4

What s The Difference Between Accounting Profit And Taxable Profit

https://flamingo-accounting.co.uk/wp-content/uploads/2020/01/piggy-2889044_1920.jpg

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses Automotive A full list of electric vehicles and hybrids that qualify for federal tax credits Which EVs qualify for tax credits Here s a list of car models new and used that qualify

For the balance of 2023 the incentive remains an income tax credit applied to the buyer s tax liability for the year of purchase Eligible vehicles must have MSRPs below 55 000 for passenger The tax credit rules get a lot stricter in 2024 Here are the EVs and plug in hybrids that still qualify

Download Do You Get A Tax Rebate For Buying A Hybrid Car

More picture related to Do You Get A Tax Rebate For Buying A Hybrid Car

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/19/10/07/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-5583828754740272087-1600x1200.jpeg

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

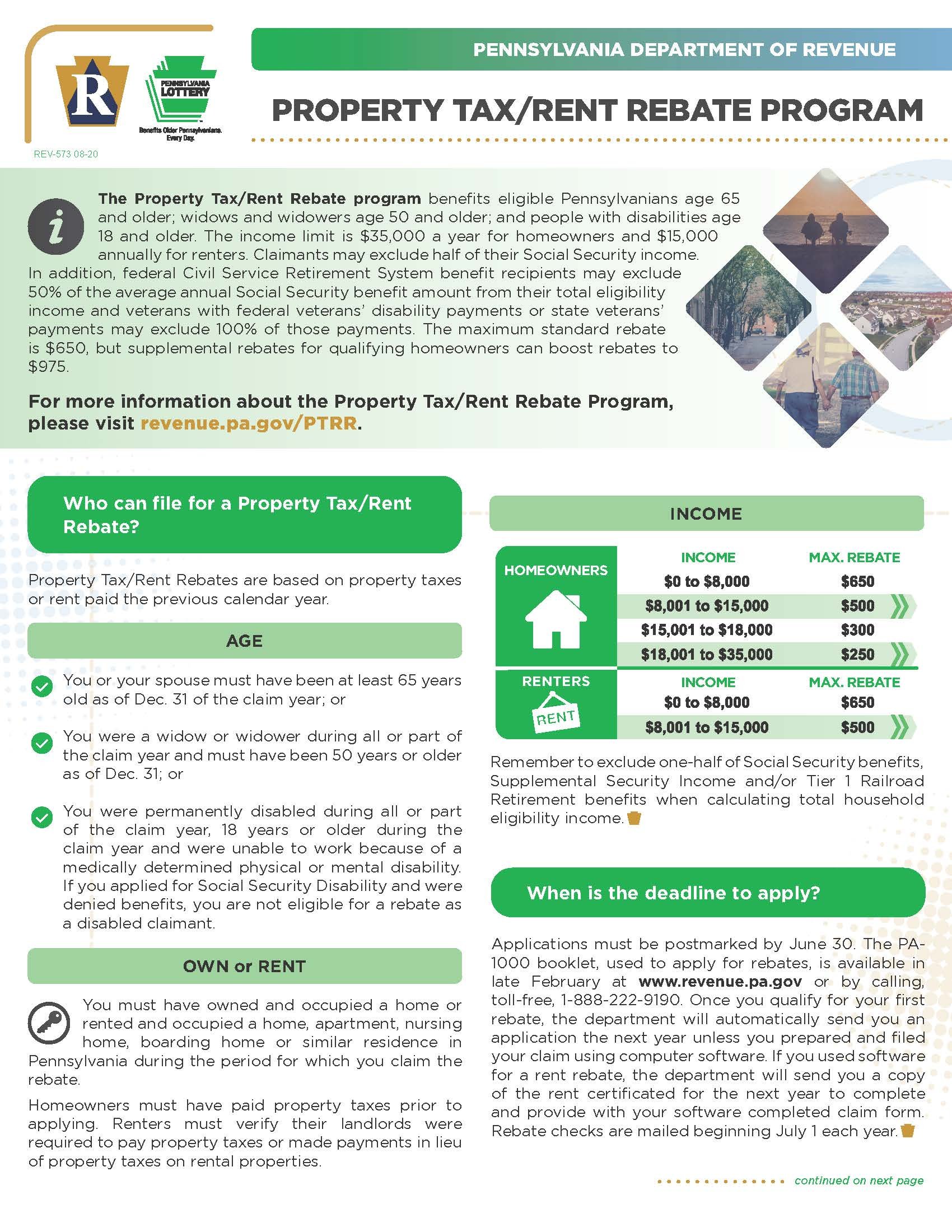

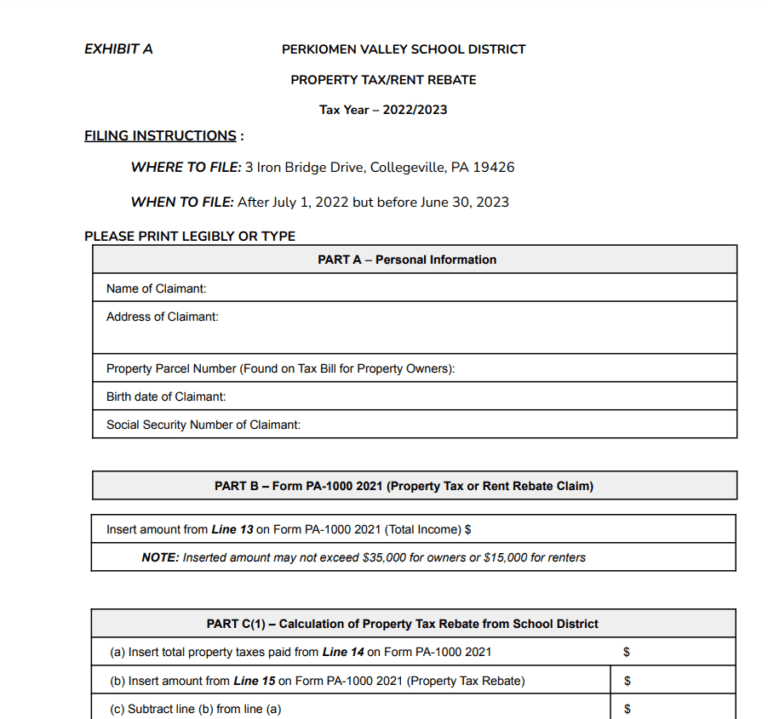

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

It turns out a credit is slightly more helpful than a deduction A tax credit reduces the amount of money you owe the IRS right away For example if you earn 40 000 per year and are taxed at 10 percent you ll owe the IRS 4 000 A tax credit of 500 will reduce the amount you owe to 3 500 The IRS reports that Toyota has already reached the 60 000 vehicle limit effective October 1st 2006 the tax credit will be reduced If you purchased a hybrid car in 2005 you would be eligible for a deduction not a credit on your 2005 tax return If you decide to purchase a gas saving car be sure to check with your auto dealer to

46 Terms To Know Before Buying A Hybrid Or Electric Vehicle Trust Auto

https://img.321ignition.io/321ignition-v4-prod-images/public/613bb2ed5ce9c8010acca31f/cms/tesla-model-x-2048x1024.jpg

Things You Need To Know Before Buying A Hybrid Car Best Trend Car

https://www.besttrendcar.com/wp-content/uploads/2021/11/Things-You-Need-to-Know-Before-Buying-a-Hybrid-Car1-1024x621.jpg

https://marketrealist.com/automotive/are-hybrids...

Starting on Jan 1 2023 people who purchase eligible electric vehicles can receive 2 500 to 7 500 in tax credits The value of the credit can be directly subtracted from the purchase

https://www.consumerreports.org/cars/hybrids-evs/...

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Older Disabled Residents Can File For Property Tax Rent Rebate Program

46 Terms To Know Before Buying A Hybrid Or Electric Vehicle Trust Auto

Hybrid Cars With Rebates 2023 Carrebate

PA Property Tax Rebate Forms Printable Rebate Form

Its Time To Prepare Your Taxes Read My Blog Post Here Http www

What Is 87 A Rebate Free Tax Filer Blog

What Is 87 A Rebate Free Tax Filer Blog

Hybrid Vs Electric Vehicles Which One Should You Choose

Tax Rebate For Individuals Swaper Investing Blog

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

Do You Get A Tax Rebate For Buying A Hybrid Car - Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return You may be able to get a maximum of 7 500 towards your taxes on your tax return The hybrid tax credit will not increase your refund because it