Do You Get Tax Credit For Paying Student Loans You can claim these education tax credits and deductions as a student if you re not claimed as a dependent on anyone else s tax

The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022 Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

Do You Get Tax Credit For Paying Student Loans

Do You Get Tax Credit For Paying Student Loans

https://www.twentyfree.co/wp-content/uploads/2020/09/10-Steps-To-Paying-Off-Your-Student-Loans-Fast-1024x576.png

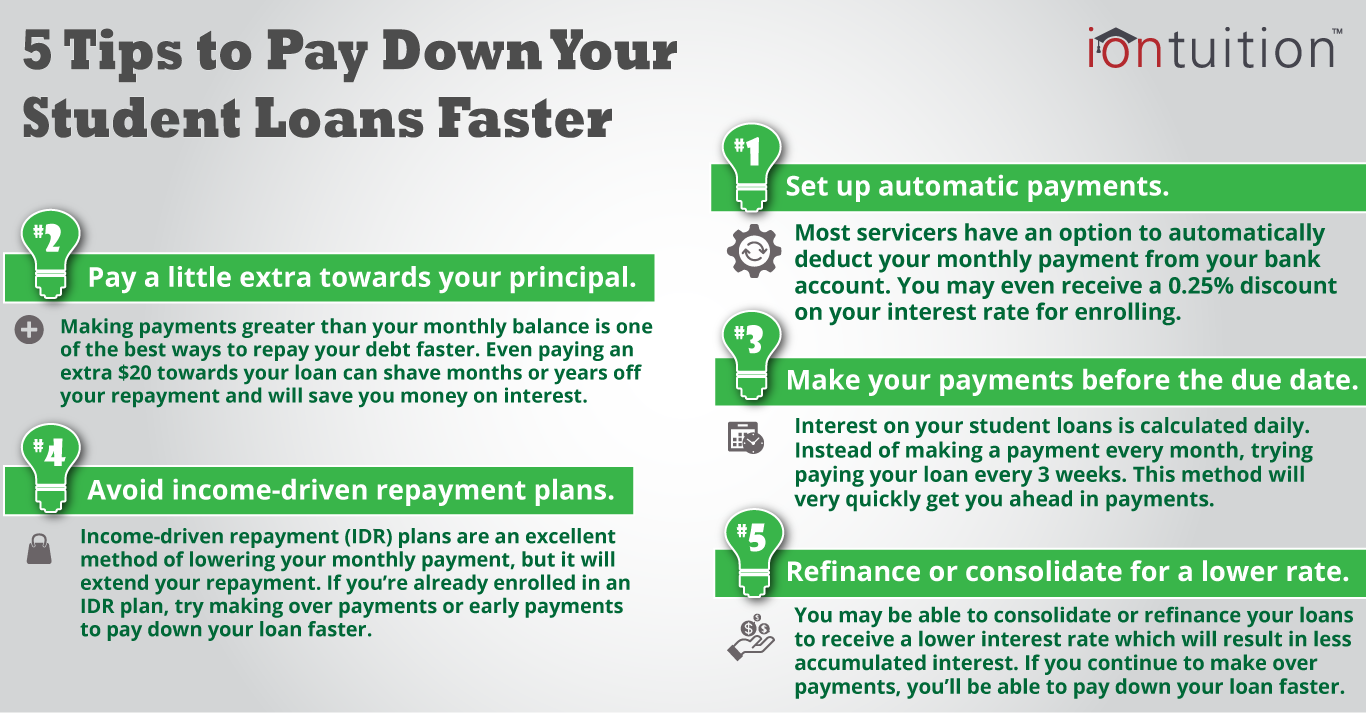

5 Tips To Repay Your Student Loans Faster IonTuition

https://s28637.pcdn.co/wp-content/uploads/2017/12/5-tips-to-pay-down-your-student-loans-faster_content.png

5 Tips For Paying Back Student Loans Unigo

https://www.unigo.com/wp-content/uploads/2015/11/5-tips-for-paying-back-student-loans.jpg

A1 No but the Protecting Americans Against Tax Hikes PATH Act of 2015 made AOTC permanent The AOTC helps defray the cost of higher education expenses for tuition You can take a tax deduction for the interest paid on student loans that you took out for yourself your spouse or your dependent This benefit applies to all loans not just

In many cases the interest portion of your student loan payments paid during the tax year is tax deductible Your tax deduction is limited to interest up to 2 500 or the amount of interest you actually Credits can reduce the amount of tax you owe dollar for dollar A deduction reduces your taxable income unlike a credit which reduces the amount of tax you pay Yes If you paid student loan

Download Do You Get Tax Credit For Paying Student Loans

More picture related to Do You Get Tax Credit For Paying Student Loans

Online Businesses Should Register And Comply With Their Tax Obligations

https://philcpa.org/wp-content/uploads/2020/07/Tax.jpg

How Do Student Loans Appear On Your Credit Report CreditRepair

https://www.creditrepair.com/blog/wp-content/uploads/2016/06/shutterstock_406924213-2000x1333.jpg

How To Pay Off Student Loan Faster Even If You Are Broke My Worthy

https://i.pinimg.com/originals/65/4b/80/654b80b96533af1d88f03885a7a70e1b.png

The income limit is 80 000 for single filers or 170 000 for joint filers for the student loan interest deduction The educator expense deduction covers expenses up to 300 in 2023 and does not Based on factors such as your filing status and household income you may qualify for certain tax deductions and credits if you paid interest on a qualified student

Most student loan debt forgiven in 2021 through 2025 is tax free for federal income tax purposes This relief enacted in the March 2021 stimulus law is an exception If you are a student and make more than 12 000 in taxable income in a fiscal year you can use one of these student loan tax credits and the tax deduction to

Time To Get Tax Credit For Energy efficient Update Tax Credits How

https://i.pinimg.com/736x/88/58/9e/88589e7a81333374b5fea381f068e141--to-get.jpg

Student Loan Payments MoneyMatters101

https://www.moneymatters101.com/wp-content/uploads/2018/04/stloans4.jpg

https://www.nerdwallet.com/article/loans/stu…

You can claim these education tax credits and deductions as a student if you re not claimed as a dependent on anyone else s tax

https://www.nerdwallet.com/article/loans/student...

The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

Pay Off Student Loans Faster With These 5 Strategic Options Student

Time To Get Tax Credit For Energy efficient Update Tax Credits How

How To Pay Off Student Loans Fast With These 15 Proven Strategies

The Electric Car Tax Credit What You Need To Know OsVehicle

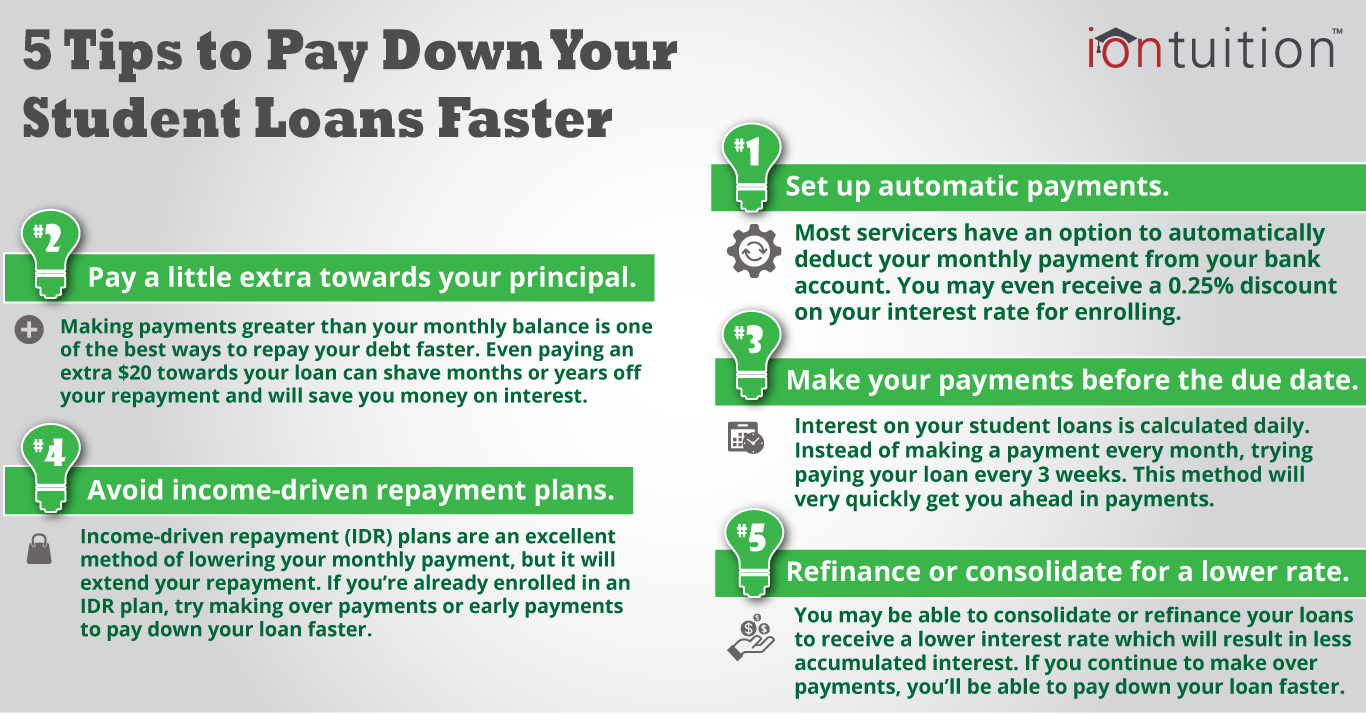

Student Loan Tips To Use When Applying Repaying Prep Expert

What To Do After Paying Your Student Loans CreditCarder

What To Do After Paying Your Student Loans CreditCarder

Loan Payments To Resume Harrisburg University

The Lifetime Learning Credit Is A Federal Tax Credit For Paying College

Tax Season 2023 Can You Get Tax Credit If You Don t Have A Social

Do You Get Tax Credit For Paying Student Loans - The student loan interest deduction value varies based on your income and tax bracket Estimate your deduction s worth by multiplying your deductible interest by