Do You Get Tax Credit For Solar Panels Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into

Do You Get Tax Credit For Solar Panels

Do You Get Tax Credit For Solar Panels

http://www.skippingstonesdesign.com/wp-content/uploads/2022/03/load-image-2022-03-29T235018.174.jpg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

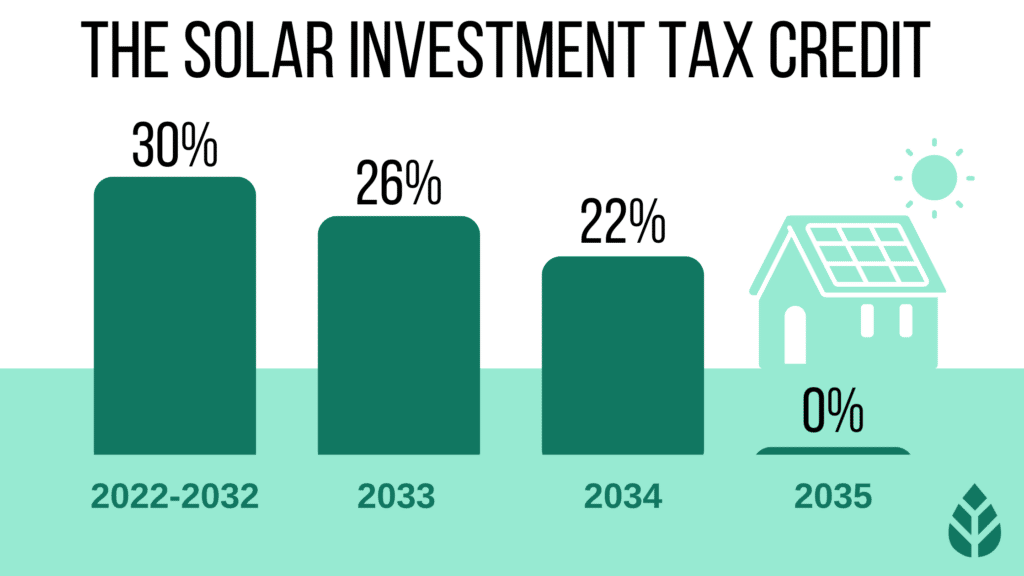

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service

Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy

Download Do You Get Tax Credit For Solar Panels

More picture related to Do You Get Tax Credit For Solar Panels

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

Federal Tax Credit For Solar Panels In 2023

https://static.wixstatic.com/media/f52547_b11ebc1fe3de463497ba3e65f14f30bc~mv2.png/v1/fill/w_980,h_548,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/f52547_b11ebc1fe3de463497ba3e65f14f30bc~mv2.png

The Residential Clean Energy Credit formerly known as the ITC is a tax credit worth 30 of the gross cost of your solar project parts labor the whole For example if you paid 10 000 to install solar on your principal residence in 2024 then the 30 RCEC would mean you are eligible for a tax credit of 3 000 In

In 2024 the federal solar tax credit is equal to 30 of solar installation costs Here s an example of how the solar tax credit works If you installed a home solar power system If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2021/10/What-is-a-Solar-Tax-Credit-R01-1089x1536.jpg

https://www. energy.gov /sites/default/files/2021/02...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into

https://www. nerdwallet.com /.../taxes/s…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each

How Does The Federal Solar Tax Credit Work Nicki Karen

Federal Solar Tax Credits For Businesses Department Of Energy

The Federal Solar Tax Credit What You Need To Know 2022

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Tax Season 2023 Can You Get Tax Credit If You Don t Have A Social

Is There A Tax Credit For Solar Panels 2023 Rules Reward

Is There A Tax Credit For Solar Panels 2023 Rules Reward

Congress Gets Renewable Tax Credit Extension Right Institute For

California Solar Incentives Rebates Tax Credits 2023 Guide

Understanding The Federal Tax Credit For Solar Panels

Do You Get Tax Credit For Solar Panels - The federal solar tax credit is available to any U S homeowner condo owner or cooperative housing corporation member as long as you own a solar panel system