Do You Get Tax Relief If Married If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax

If you re married you may be entitled to a tax break called the marriage tax allowance Find out what it is and how to check if you re missing out Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned For

Do You Get Tax Relief If Married

Do You Get Tax Relief If Married

https://www.irs.com/wp-content/uploads/2018/11/federal_irs_tax_payment_options.jpg

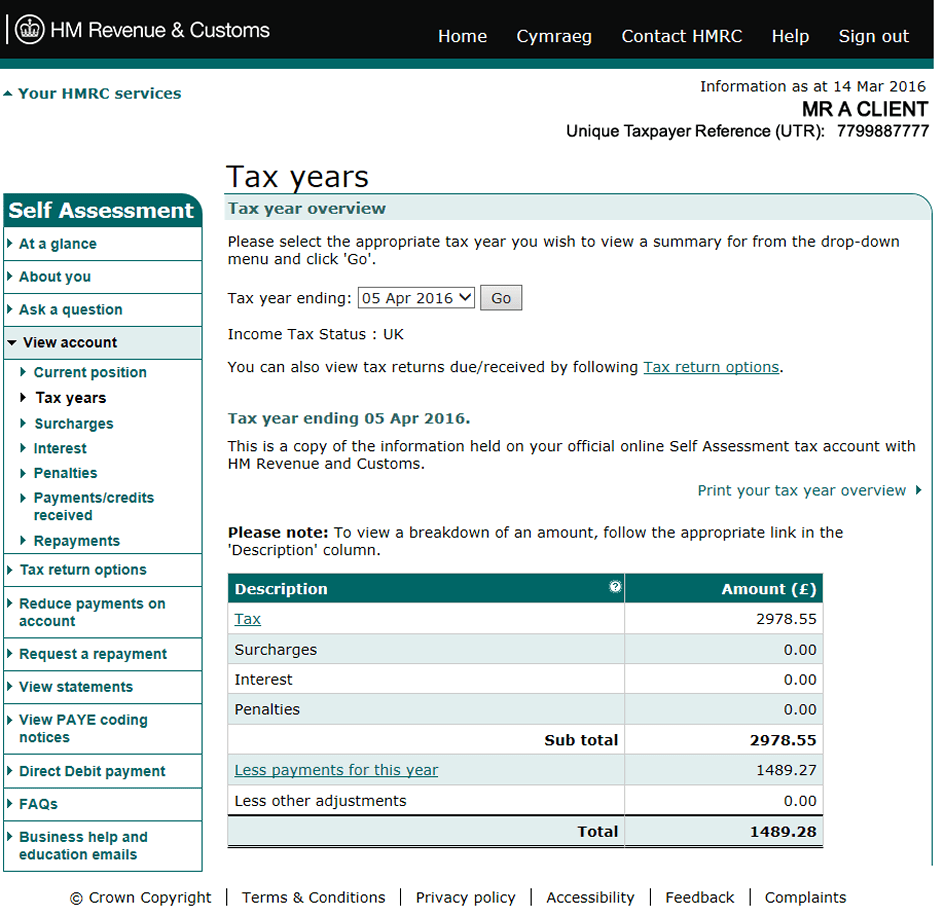

How To Print Your Tax Calculations Better co uk formerly Trussle

https://images.ctfassets.net/bed00l8ra6lf/1c8O9gTiS0yPCj2IORQRha/83df0441e65fdafc9ed02bc52c484409/7._FC_tyoprintyourtaxyo.png

How To Pay Less Tax In Singapore Learning Investment With Jason Cai

https://learninginvestmentwithjasoncai.files.wordpress.com/2021/12/corporate-tax-relief.jpg?w=900

Marriage allowance isn t something that s paid to you instead it s a tax relief for a partner who pays the basic tax rate They ll be taxed on a smaller proportion of their salary so the extra money will Newly married couples must give their employers a new Form W 4 Employee s Withholding Allowance within 10 days If both spouses work they may

You may be entitled to a marriage tax allowance if you re married or in a civil partnership Learn more about how claiming the marriage tax back works If you get married both you and your spouse continue to be treated as single people for tax purposes in that year If however the tax you pay as two single people is greater than

Download Do You Get Tax Relief If Married

More picture related to Do You Get Tax Relief If Married

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Do You Get Money When You Refinance A Loan CreditNinja

https://www.creditninja.com/wp-content/uploads/2022/10/do-you-get-money-when-you-refinance-a-loan-.jpg

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)

Tax Relief Definition

https://www.investopedia.com/thmb/t6w54BaVpZ4h0BR5XBsPhpNx84E=/1500x994/filters:fill(auto,1)/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg

For 2020 you can deduct up to 300 per tax return of qualified cash contributions even if you take the standard deduction For 2021 you can deduct up to If you or your spouse or civil partner are over 65 years of age you can get the Age Tax Credit If your income is below a certain limit you are exempt from income tax and from

The tax benefits of marriage are generally more favorable for those married filing jointly For instance you can lower your tax liability and claim more tax credits Getting married can reduce your capital gains tax inheritance tax and income tax while also ensuring your pension continues after you die One of the key ways this works is

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

R D TaxAdvisor UK

https://taxadvisoruk.com/wp-content/uploads/2022/03/RandD-Tax-Credit.jpg

https://www.moneysavingexpert.com/family/m…

If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax

https://www.thetimes.com/.../marriage-tax-allowance

If you re married you may be entitled to a tax break called the marriage tax allowance Find out what it is and how to check if you re missing out

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

What Is The Difference Between Tax Evasion Tax Avoidance Tax Planning

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs

IRS Highlights Tax Exempt Deadline Tiell Tax Service

Child Tax Credit

Child Tax Credit

Tax relief RateMuse

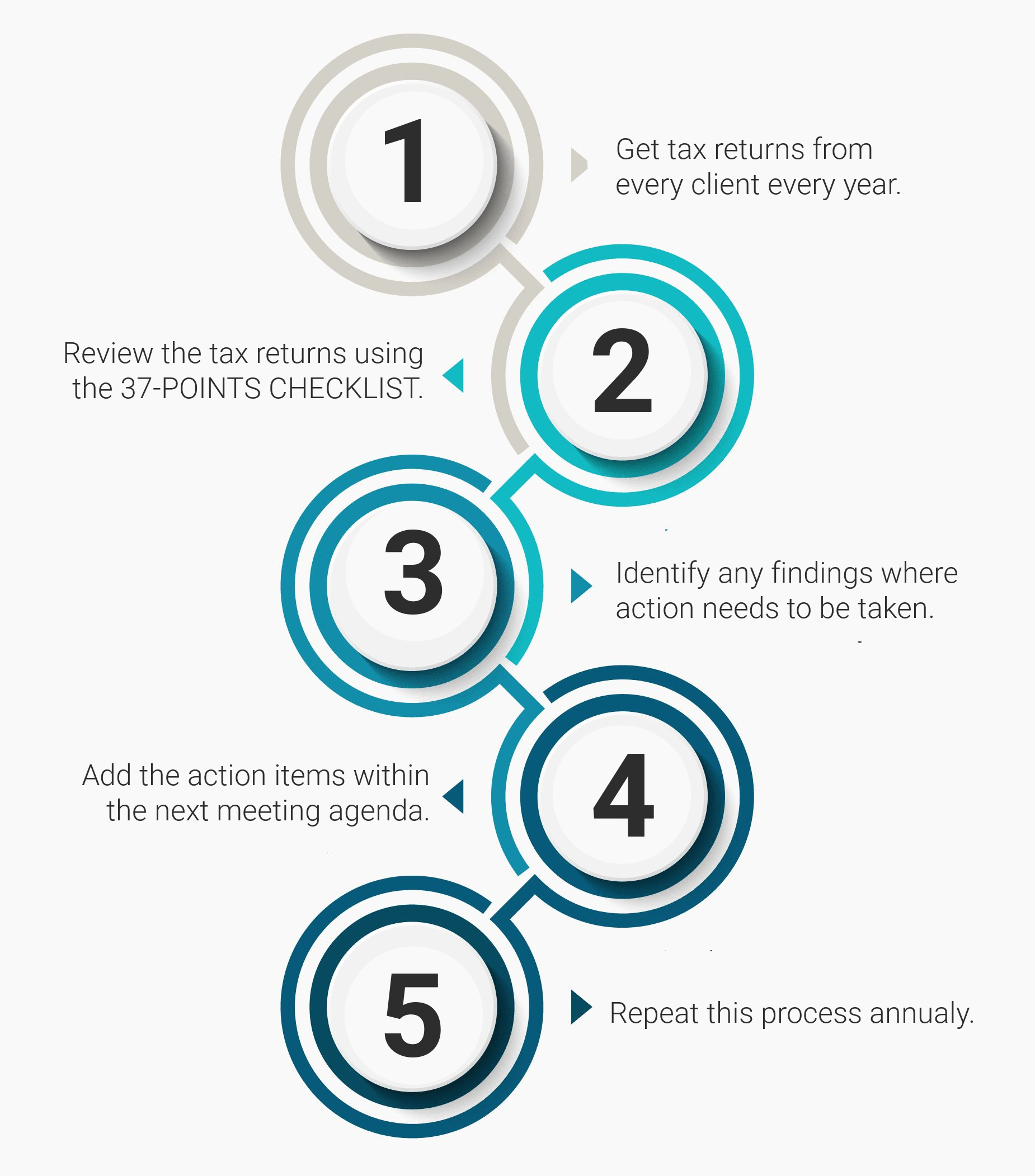

Review Tax Returns Using Our 37 Points Checklist

Get Tax Relief Help If You Qualify

Do You Get Tax Relief If Married - Marriage allowance isn t something that s paid to you instead it s a tax relief for a partner who pays the basic tax rate They ll be taxed on a smaller proportion of their salary so the extra money will