Do You Get Tax Relief On Your Employers Pension Contributions Tax relief The government will usually add money to your workplace pension in the form of tax relief if both of the following apply you pay Income Tax you pay into a personal

An employer can only receive tax relief on a pension contribution if it s made on behalf of an employee or in some circumstances an ex employee A The deduction for the employers contributions to registered pension schemes is for the period of account in which it is paid by the employer and for no other period In practice

Do You Get Tax Relief On Your Employers Pension Contributions

Do You Get Tax Relief On Your Employers Pension Contributions

https://contentservices.appthebusiness.com/wp-content/uploads/2022/09/Pension_Contributions-980x653.jpg

How Pension Contributions Work

https://equable.org/wp-content/uploads/2019/08/GettyImages-1025271340-1024x1024.jpg

A Consultation On Pensions Tax Relief Provisio Wealth

https://www.provisio.co.uk/wp-content/uploads/2015/07/pensionsimage.jpg

Subject to your employer s approval you can save tax and National Insurance by exchanging part of your salary for an employer pension contribution separate to any There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer

Simply put any pension contribution you make as an employer to a registered pension scheme in respect of any director or employee will receive corporation tax Your pension contributions are deducted from your salary by your employer before income tax is calculated on it so you get relief on the amount immediately at your highest rate of

Download Do You Get Tax Relief On Your Employers Pension Contributions

More picture related to Do You Get Tax Relief On Your Employers Pension Contributions

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

How To Get Tax Relief On Bad Debt CHW Accounting

https://chw-accounting.co.uk/wp-content/uploads/2019/08/Tax-Relief-1024x680.jpg

Pension Contributors Retirees Agitate As Unresolved Complaints Pile Up

https://cdn.vanguardngr.com/wp-content/uploads/2021/05/pension1.jpg

You usually pay tax if savings in your pension pots go above 100 of your earnings in a year this is the limit on tax relief you get 60 000 a year check your annual The basic rate of tax relief is 20 This means for every 1 of a worker s contribution we ll claim 20p from the government If the worker s contribution is 5 and they re eligible for

Tax relief on your employer s contributions Usually you would have to pay Income Tax on money you receive from your employer But if the money is going into your pension If you re paying into a workplace pension scheme organised by your employer and are earning under 50 270 for the 2023 24 tax year you won t need to declare your

Why Should I Invest In A Pension

https://sterlingandlaw-hampshire.co.uk/wp-content/uploads/2022/04/Pensions-tax-relief-government-contributions-1024x682.jpg

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

https://www.gov.uk/workplace-pensions/what-you...

Tax relief The government will usually add money to your workplace pension in the form of tax relief if both of the following apply you pay Income Tax you pay into a personal

https://adviser.royallondon.com/technical-central/...

An employer can only receive tax relief on a pension contribution if it s made on behalf of an employee or in some circumstances an ex employee A

What Is Pension Tax Relief Moneybox Save And Invest

Why Should I Invest In A Pension

Pension Tax Relief In The United Kingdom UK Pension Help

Changes In NHS Pension Contributions Are You A Winner Or Loser

How To Claim Higher Rate Tax Relief On Pension Contributions

Tax Relief On Personal Pension Contributions Shaw Austin Accountants

Tax Relief On Personal Pension Contributions Shaw Austin Accountants

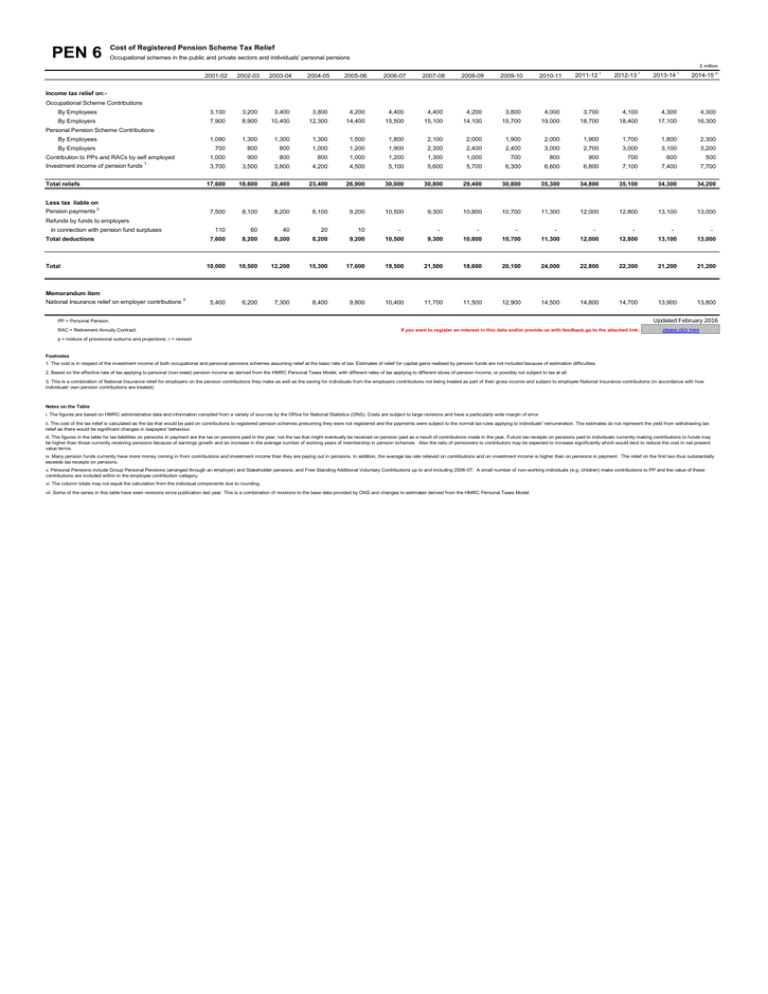

Cost Of Registered Pension Scheme Tax Relief

Tax Relief On Pension Contributions 20 40 Profit Right Away All

.jpg)

Huisdieren Pension Vogels

Do You Get Tax Relief On Your Employers Pension Contributions - Your pension contributions are deducted from your salary by your employer before income tax is calculated on it so you get relief on the amount immediately at your highest rate of