Do You Get Taxed On Your Rental Income If we ask you to send a tax return you must give details of your rental income and expenses for the tax year even if you have no tax to pay If you have had property income you ve

Your rental profits are taxed at the same rates as income you receive from your business or employment 0 20 40 or 45 depending on which tax band the income falls into Your rental income gets added to any other income you earn which could tip you into a higher tax bracket The first 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property rental is between

Do You Get Taxed On Your Rental Income

Do You Get Taxed On Your Rental Income

https://i.ytimg.com/vi/GxsA3gpKoag/maxresdefault.jpg

Do I Get Taxed On Rental Income Compass Accounting

https://www.compass-cpa.com/wp-content/uploads/2018/09/Rental-income-1024x529.jpeg

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

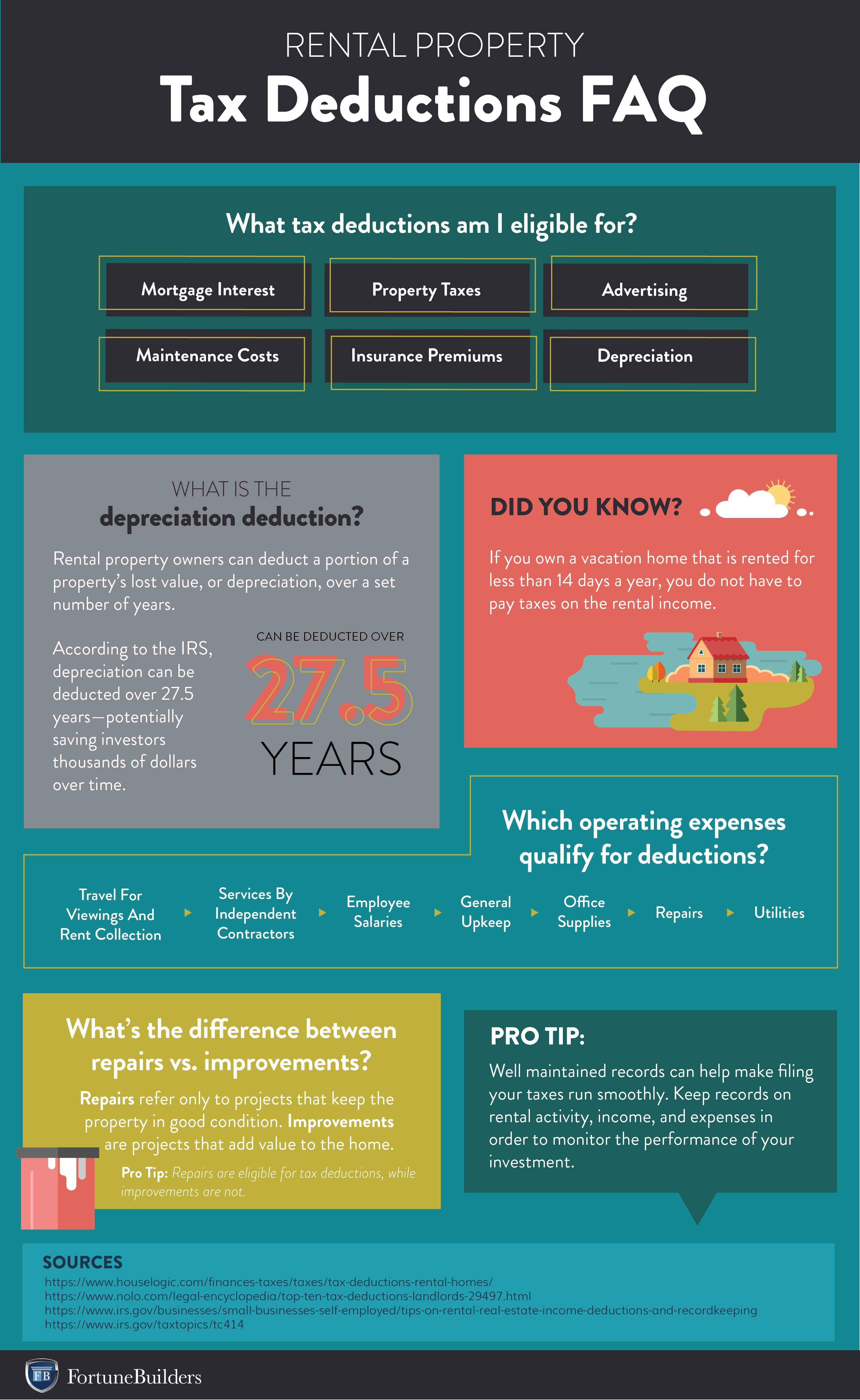

What You Can Deduct From Taxes on Rental Income It might sound like being a landlord and collecting rent is a big tax headache But remember that you can also deduct expenses to shrink your tax liability You can deduct costs like the on your rental property operating expenses repairs and depreciation The IRS treats rental income as regular income for tax purposes This means you ll need to add your rental income to any other income sources you may have when you file your taxes Keep in mind that you may be able to deduct certain qualified expenses to decrease what you owe at the end of the year

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it was earned Rental income is taxed as ordinary income but you may be able to lower your tax burden by claiming certain deductions on your tax return You can deduct expenses related to owning

Download Do You Get Taxed On Your Rental Income

More picture related to Do You Get Taxed On Your Rental Income

Yo Dawg We Herd U Like Taxes So We Put Taxes On Your Taxed Income So

https://i.kym-cdn.com/photos/images/facebook/001/729/853/65b

Do You Get Taxed On Cd Interest Tax Walls

https://thumbor.forbes.com/thumbor/960x0/https://specials-images.forbesimg.com/dam/imageserve/1146286907/960x0.jpg%3Ffit%3Dscale

Do You Get Taxed When You Sell Your Home Tax Walls

https://m.foolcdn.com/media/millionacres/images/calculating_taxes_9aFt1Mn.width-1200.jpg

Calculating the rental income tax Step 1 Subtract total deductible expenses of 9 840 from your total annual rental income of 18 000 8 160 net income before depreciation Step 2 Calculate depreciation 101 500 property basis 27 5 years 3 691 annual depreciation expense Rental income is taxed as ordinary income using progressive tax brackets which range from 10 to 37 depending on your filing status and taxable income Taxing rental income also requires special tax forms which we ll outline next

How much tax you pay on your rental income depends on whether it is active or passive income and which tax bracket you fall into In most cases rental income is considered passive meaning it s taxed at the marginal tax rate This starts at 10 and goes up to 35 as listed in detail above Income from a rental property is taxed as ordinary income with a real estate investor paying tax based on their marginal tax bracket Federal income tax brackets in 2023 range from 10 up to 37 So if you are married filing a joint return and your total reported income is 300 000 24 of your rental income will go toward taxes

How Rental Income Is Taxed A Property Owner s Guide

https://wp-assets.stessa.com/wp-content/uploads/2021/05/28071901/iStock-1127350098.jpg

How Is Rental Income Taxed What You Need To Know FortuneBuilders

https://www.fortunebuilders.com/wp-content/uploads/2019/06/rental-income-taxes.png

https://www.gov.uk/guidance/income-tax-when-you...

If we ask you to send a tax return you must give details of your rental income and expenses for the tax year even if you have no tax to pay If you have had property income you ve

https://www.which.co.uk/money/tax/income-tax/tax-on...

Your rental profits are taxed at the same rates as income you receive from your business or employment 0 20 40 or 45 depending on which tax band the income falls into Your rental income gets added to any other income you earn which could tip you into a higher tax bracket

Investment Accounts When Do I Get Taxed Personal Finance Club

How Rental Income Is Taxed A Property Owner s Guide

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Really My Bonus Is Taxed The Same As My Paycheck Human Investing

Federal And State Income Taxes Due July 15th

Complete Guide To How Rental Income Is Taxed For Landlords

Complete Guide To How Rental Income Is Taxed For Landlords

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Do You Get Taxed On Your Rental Income - What You Can Deduct From Taxes on Rental Income It might sound like being a landlord and collecting rent is a big tax headache But remember that you can also deduct expenses to shrink your tax liability You can deduct costs like the on your rental property operating expenses repairs and depreciation