Do You Have Tax Rebate For Shopping In California 2024 What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The nonrefundable

Do You Have Tax Rebate For Shopping In California 2024

Do You Have Tax Rebate For Shopping In California 2024

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Tax Rebate Service No Rebate No Fee MBL Accounting

https://mblaccounting.co.uk/wp-content/uploads/2021/04/Tax-Rebate.jpg

The IRS is sweetening the deal for EV buyers by making it even easier to claim up to 7 500 in tax credits Electic vehicle tax credits can now be collected before you drive the car off the lot Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Used EVs and PHEVs Purchased or Financed in 2024 The credit is 30 percent of the sale price up to a maximum of 4000 That means the minimum sale price needed to claim the full credit is 13 333 Shopping and Deals Money saving What is the EV tax credit 2024 point of sale rebate Another new EV tax credit benefit in 2024 If you re buying a clean vehicle you may have the option as

Download Do You Have Tax Rebate For Shopping In California 2024

More picture related to Do You Have Tax Rebate For Shopping In California 2024

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Newsom Wants Tax Rebate Touts California Way Of Governing

https://kubrick.htvapps.com/vidthumb/6e519345-426d-409d-a2e2-fb53b2bd1872/6e519345-426d-409d-a2e2-fb53b2bd1872_image.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

How To Find The Right Commercial Property Insurance Bluevine Bluevine

https://bluevinecorp.wpengine.com/wp-content/uploads/2023/03/do-you-have-the-right-business-property-insurance-blog.jpg

On January 1 2023 the Inflation Reduction Act of 2022 qualified certain electric vehicles EVs for a tax credit of up to 7 500 for eligible buyers Qualifications include Customers must buy it for their own use not for resale Use the vehicle primarily in the U S Adjusted Gross Income AGI limitations MSRP price caps Researchers have found that consumers overwhelmingly prefer an immediate rebate at point of sale Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024

These credits which can provide cash back or lower any tax you might owe are available to Californians with incomes up to 30 950 for CalEITC and up to 30 931 for YCTC and FYTC CalEITC can be worth up to 3 529 while YCTC and FYTC can be up to 1 117 Individuals earning less than 63 398 may also qualify for the federal EITC Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

California s Middleclass Tax Rebate Explained

https://media.marketrealist.com/brand-img/u0kecbPYz/1024x536/jeshoots-com-ltnvqhdkkmw-unsplash-1656407256155.jpg

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

https://www.msn.com/en-us/autos/news/here-s-the-evs-that-qualify-for-the-7-500-federal-tax-rebate-in-2024/ar-BB1h0Hpr

Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of

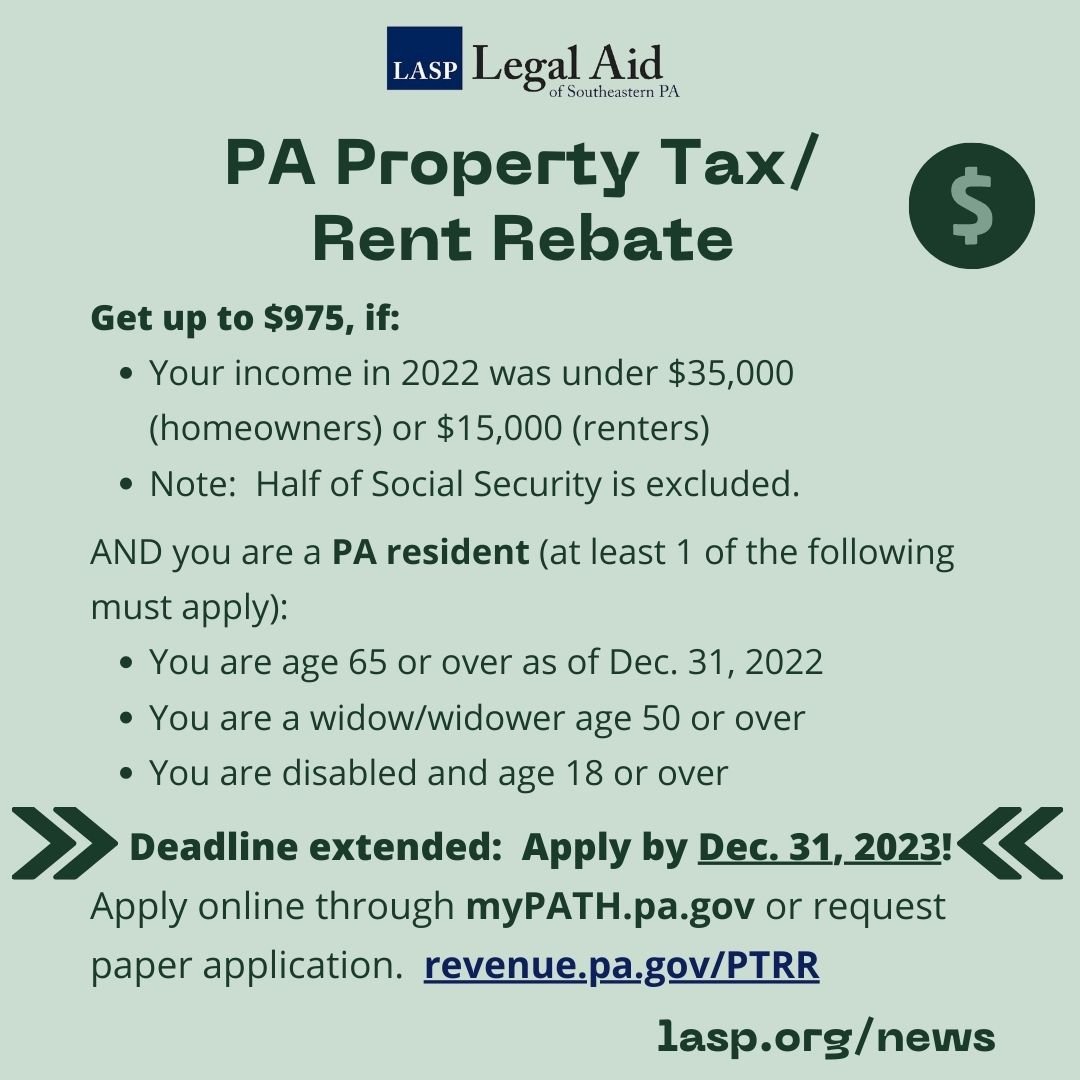

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

California s Middleclass Tax Rebate Explained

Official Houston Astros 2017 Season Thread Page 1240 TexAgs

Income Tax Rebate Under Section 87A

500 Virginia Tax Rebate Checks You Still Have 10 Days To Claim It TrendRadars

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Do Tax Rebates Get Paid Automatically Tax Banana

P55 Tax Rebate Form Application PrintableRebateForm

Do You Have Tax Rebate For Shopping In California 2024 - Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act