Do You Have To Claim Gambling Winnings On Local Taxes The Internal Revenue Service IRS considers all gambling winnings as taxable income regardless of whether you re a professional gambler or just a casual bettor The

Gambling winnings are fully taxable and you must report the income on your tax return even if you don t get a Form W 2G Gambling income includes but is not limited to The general rule is that some States will require you to claim the gambling winnings in the state where they were won Most states tax all income earned in their state regardless

Do You Have To Claim Gambling Winnings On Local Taxes

Do You Have To Claim Gambling Winnings On Local Taxes

https://ayarlaw.com/new-site/wp-content/uploads/2021/09/shutterstock_605058941-1024x682.jpg

How Much Gambling Winnings Are Taxable

https://claudemoraes.net/wp-content/uploads/2021/05/How-Much-Gambling-Winnings-Are-Taxable.png

Do You Have To Pay Tax On Gambling Winnings Nz

https://mobislot9.weebly.com/uploads/1/3/5/7/135744610/799854862.jpg

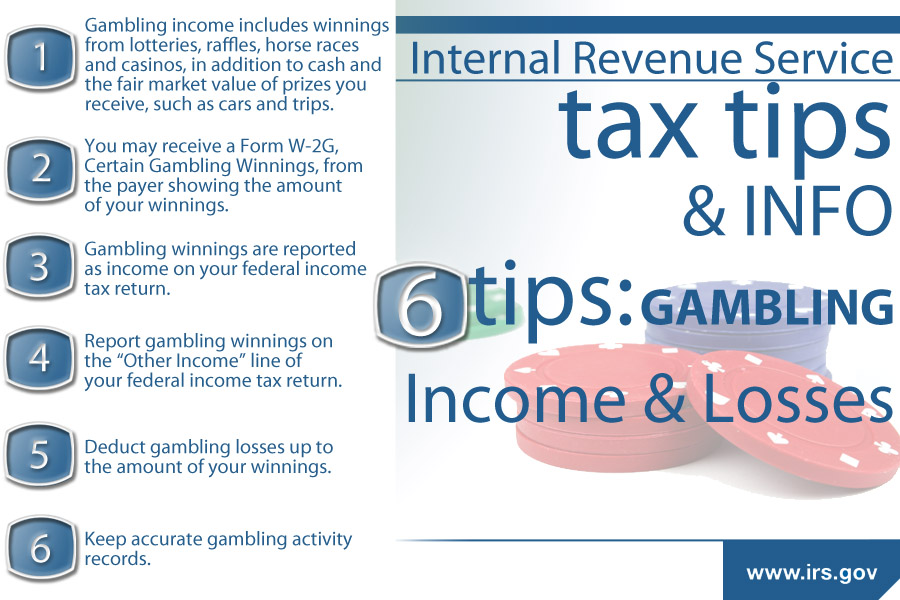

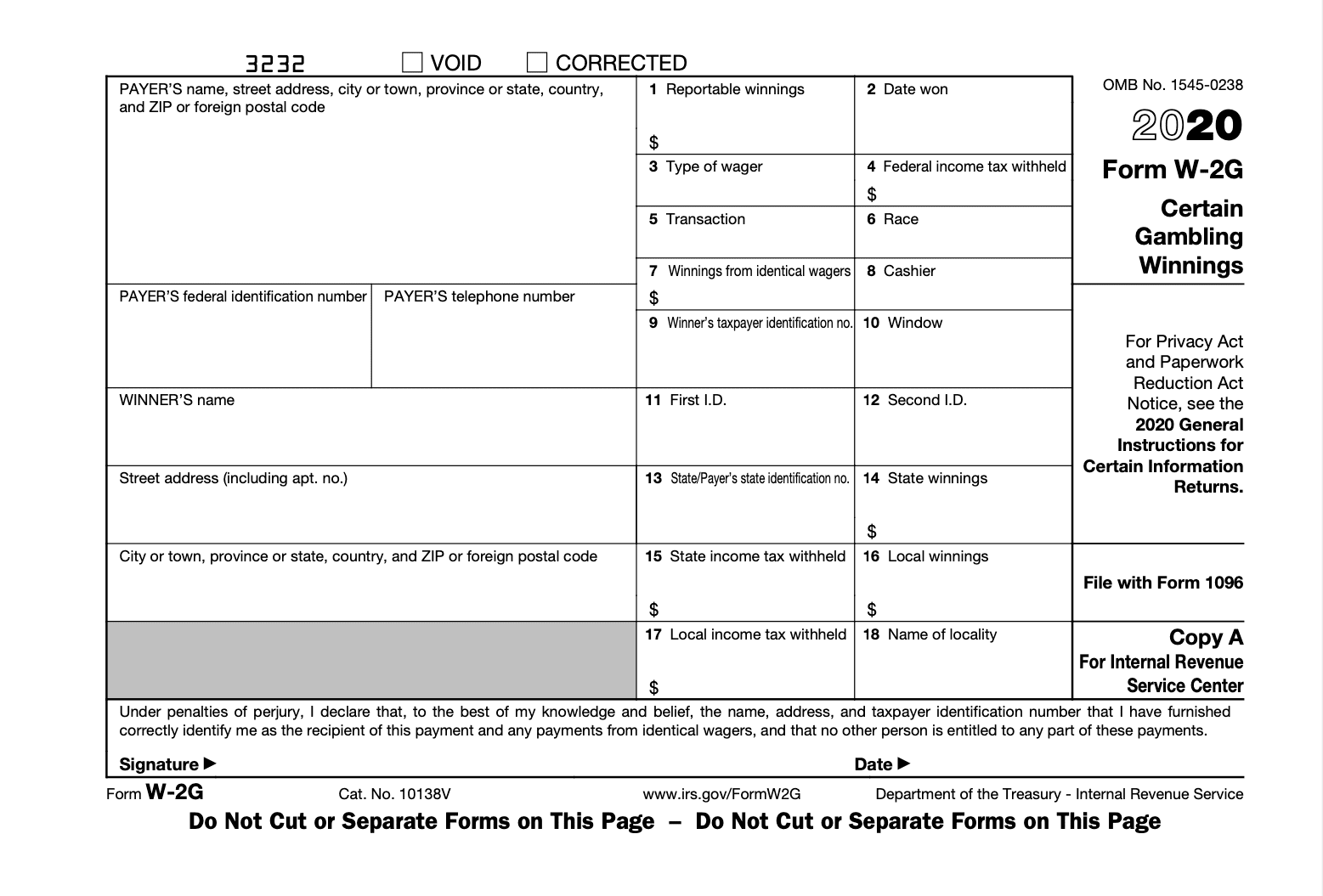

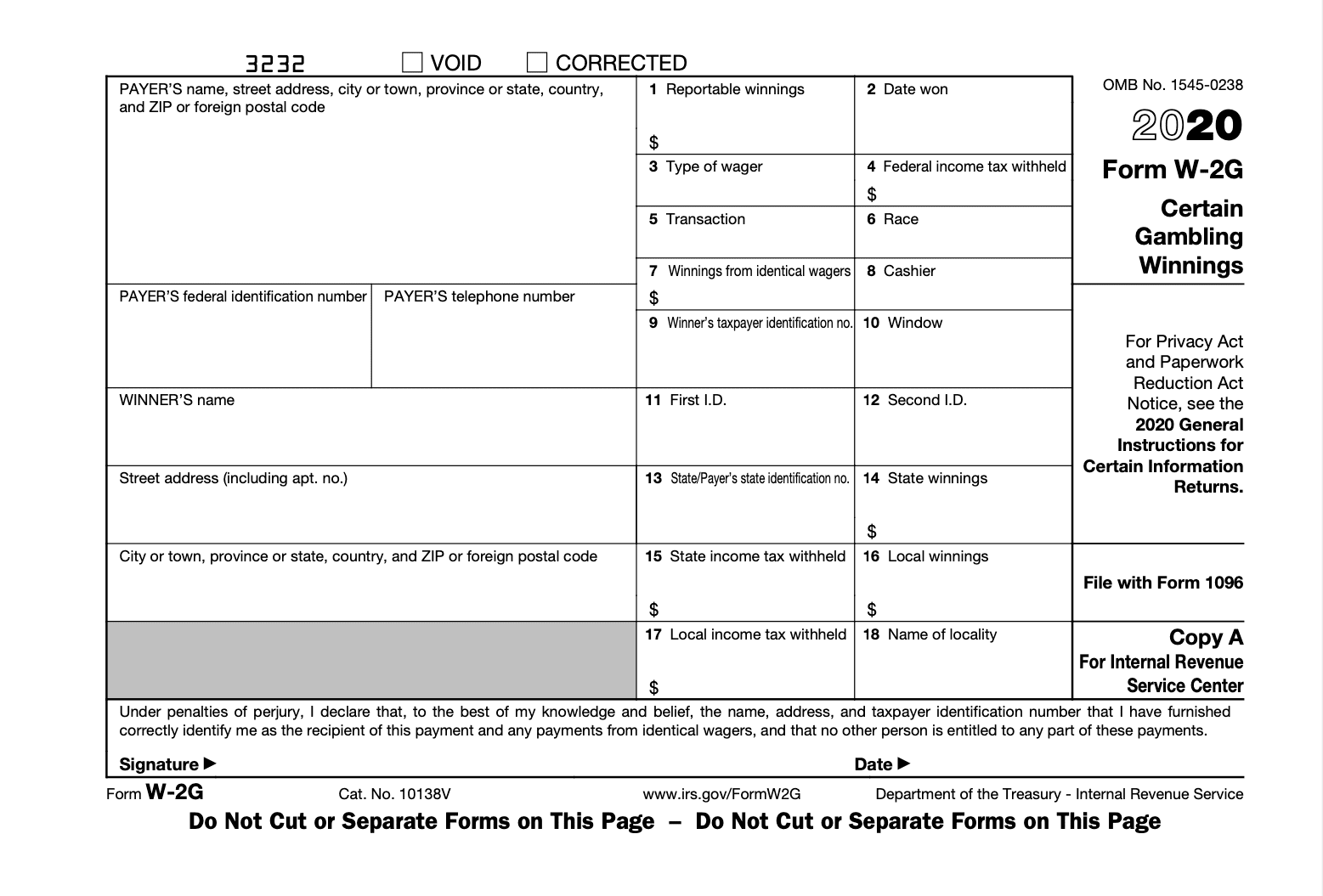

Although you must list all your winnings on your tax return you don t necessarily have to pay tax on the full amount You are allowed to list your annual gambling losses as a Gambling businesses are required to report payouts they made that meet certain thresholds according to the IRS You ll likely receive one or more W 2G forms if you Won 1 200 or more

All gambling winnings are taxable but only some gambling winnings are recorded with a Form W 2G Winnings from gambling lotteries and contests must be reported as You re required to report all gambling winnings including the fair market value of noncash prizes you win as other income on your tax return You can t subtract the cost of a

Download Do You Have To Claim Gambling Winnings On Local Taxes

More picture related to Do You Have To Claim Gambling Winnings On Local Taxes

Do You Have To Report Casino Winnings On Taxes ZOMG Candy

https://zomgcandy.com/wp-content/uploads/2021/12/kaysha-V3qzwMY2ak0-unsplash-5-810x540.jpg

Tax On Online Gambling Winnings Guide With Calculator

https://www.offshoresportsbooks.com/wp-content/uploads/Tax-on-Online-Gambling-Winnings-Guide-1.png

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

https://www.casino.org/blog/wp-content/uploads/form-w2g-casino-winnings-taxes.png

In other words you can t have a net gambling loss on your tax return Bad news if you don t itemize your deductions you will have to pay taxes on the entire winnings even if You re required to report all of your gambling winnings as income on your tax return even if you end up losing money overall You may receive a Form W 2G Certain

Yes you are required to pay your state or local taxes on your gambling winnings In case you travel to another state and snag some huge winning combo there that other state Do senior citizens have to pay taxes on gambling winnings Yes even senior citizens have to pay taxes on gambling winnings since it s considered taxable income All

How To Document Gambling Losses For Irs Cleverph

http://cleverph.weebly.com/uploads/1/2/5/2/125262053/419924241.jpg

Do You Have To Pay Tax Selling On Etsy UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2022/03/Do-I-have-to-pay-tax-selling-on-Etsy-scaled.jpeg

https://financebuzz.com › taxes-on-gambling-wins-losses

The Internal Revenue Service IRS considers all gambling winnings as taxable income regardless of whether you re a professional gambler or just a casual bettor The

https://www.jacksonhewitt.com › tax-help › tax-tips...

Gambling winnings are fully taxable and you must report the income on your tax return even if you don t get a Form W 2G Gambling income includes but is not limited to

Form 1040 Gambling Winnings And Losses YouTube

How To Document Gambling Losses For Irs Cleverph

What You Should Know About Taxes On Gambling Winnings Tax Resolution

6 Tips On Gambling And Income Taxes Don t Play The IRS For A Sucker

Are Gambling Winnings Taxable In America KIM S BLOG

French Withholding Tax Form 5000 WithholdingForm

French Withholding Tax Form 5000 WithholdingForm

Do You Pay Taxes On Casino Winnings 22 Countries Explained

Are Gambling Winnings Taxed In Canada

Can You Claim Gambling Losses On Your Taxes

Do You Have To Claim Gambling Winnings On Local Taxes - Generally if you receive 600 or more in gambling winnings the payer is required to issue you a Form W 2G If you have won more than 5 000 the payer may be required to withhold 28 of