Do You Have To File Taxes For Health Care You must file a tax return if enrolled in Health Insurance Marketplace plan Get details on tax forms you need to file

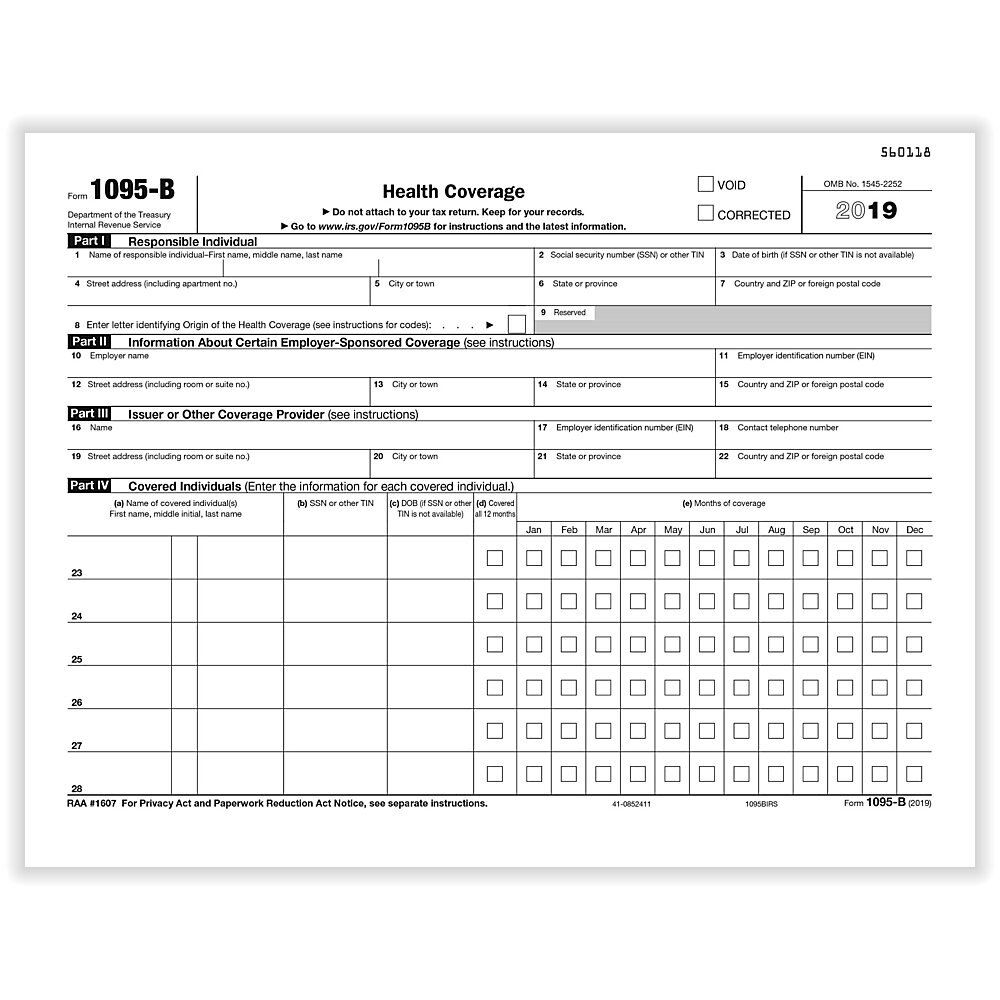

If you do not have a tax filing requirement you do not have to file a tax return solely because you received the Form 1095 B reflecting your Medicaid coverage If you enrolled in coverage If you live in a state that requires you to have health coverage and you don t have coverage or an exemption you ll be charged a fee when you file your 2023 state taxes Check with your state

Do You Have To File Taxes For Health Care

Do You Have To File Taxes For Health Care

https://dyernews.com/wp-content/uploads/taxmap-1.png

How Much Do You Have To Make To File Taxes In The U S TheStreet

https://www.thestreet.com/.image/t_share/MTg3MzA1MzE4MjY5NTkzNDg2/taxes-promo-image.png

Do I Have To File Taxes The Answer Depends On Income Age Filing

https://www.bankrate.com/2018/12/04134544/Do-you-have-to-file-taxes.jpg

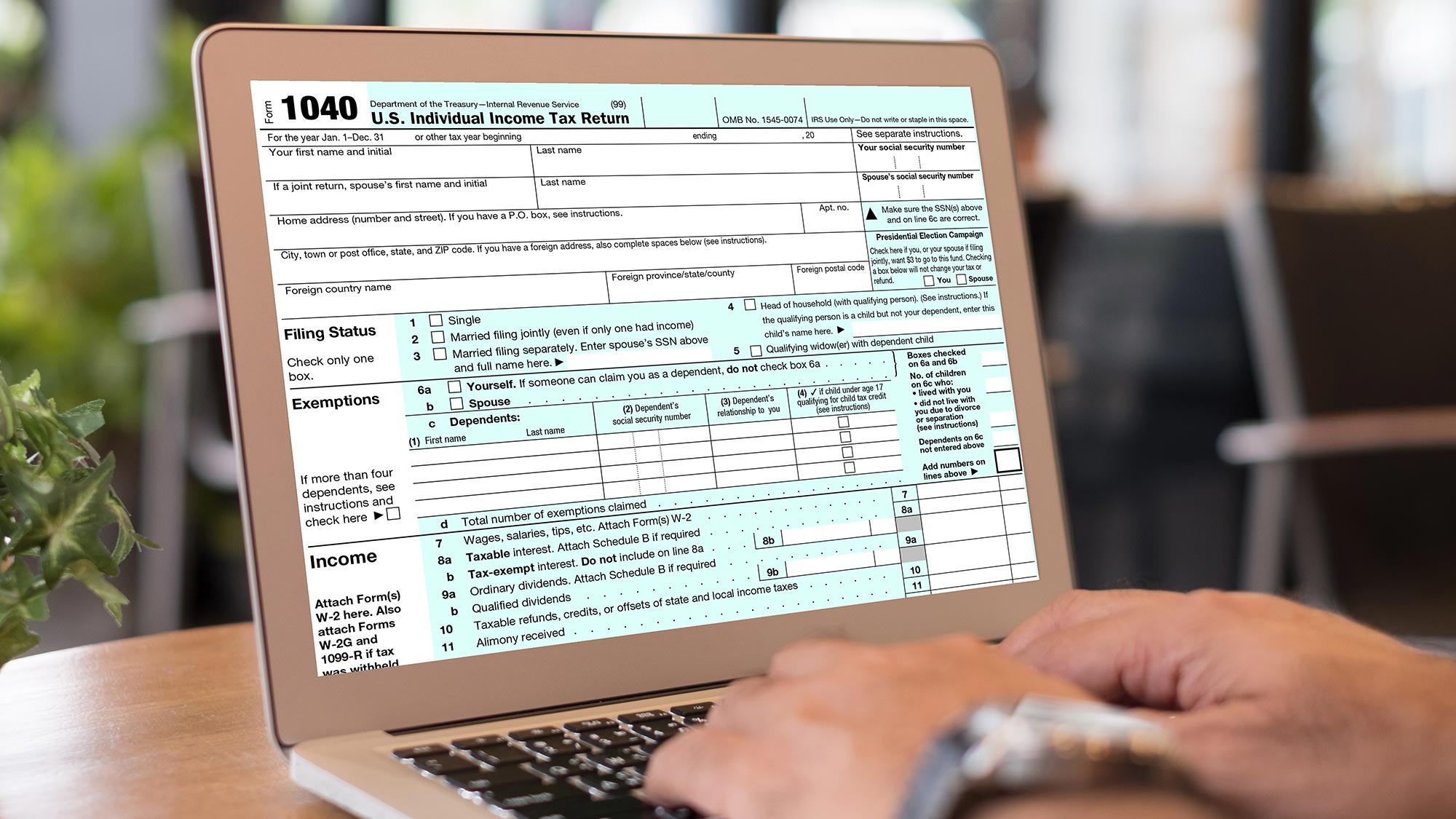

Key Takeaways The Affordable Care Act mandates that everyone has to have health insurance coverage Beginning after 2018 there s no longer a federal tax penalty for If you purchased health care insurance through the Marketplace you should receive a Form 1095 A Health Insurance Marketplace Statement at the beginning of the tax

Key Points About 12 9 million people enrolled in health insurance through the public exchange are eligible for subsidies that reduce their monthly premiums At tax time No you no longer need to prove you have health insurance on your federal tax returns This change happened in 2019 when Congress ended the tax penalty for not having

Download Do You Have To File Taxes For Health Care

More picture related to Do You Have To File Taxes For Health Care

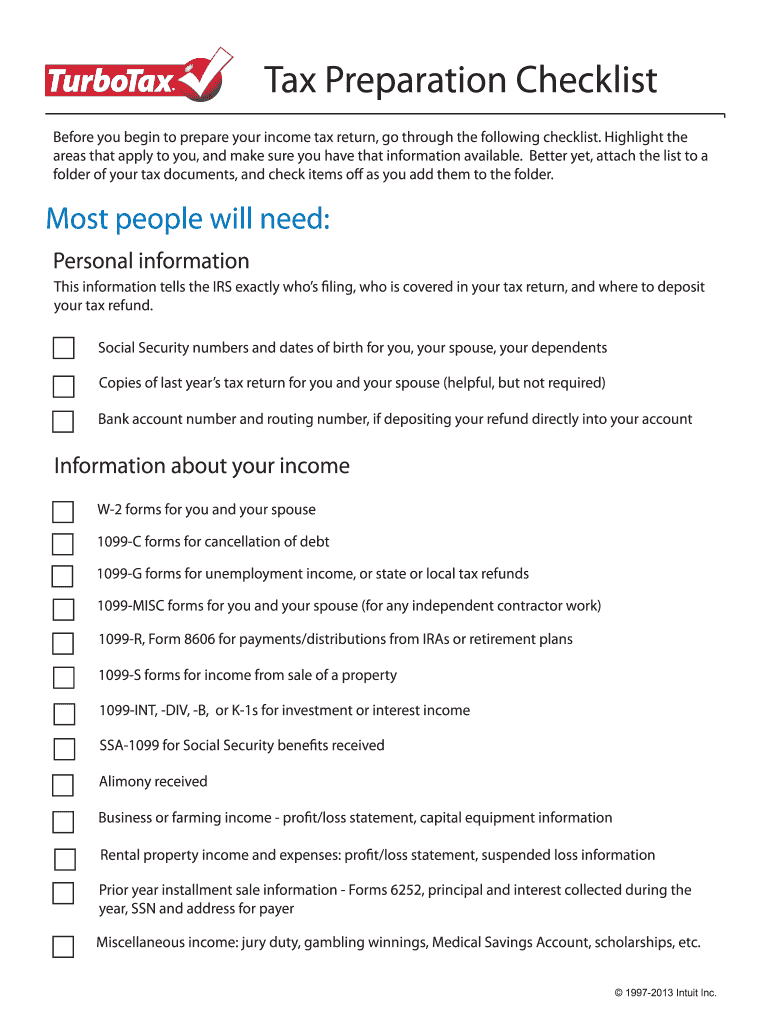

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Tax Preparation Tips For Seniors ElderLife Financial

https://cdn.elderlifefinancial.com/wp-content/uploads/2022/12/seniors-prep-for-taxes.jpg?strip=all&lossy=1&w=1280&ssl=1

Fast Tax Bookkeeping Estate And Tax Planning CA NV Beyond

https://i2.wp.com/fasttax.us/wp-content/uploads/2016/01/faq_small.png?fit=3100%2C1737&ssl=1

Before you file your taxes it s important to organize all your tax forms to make sure you aren t missing anything If you paid for health insurance or want to claim medical See how to complete 2022 tax return Overview of tax form 1095 A health coverage tool penalties for not having coverage more

The individual shared responsibility provision requires you and each member of your family to have qualifying health care coverage qualify for a coverage exemption or make an individual When an in home caregiver is considered an employee a variety of federal and state laws require the family to 1 collect and remit the caregiver s withholding tax obligation 2 collect and

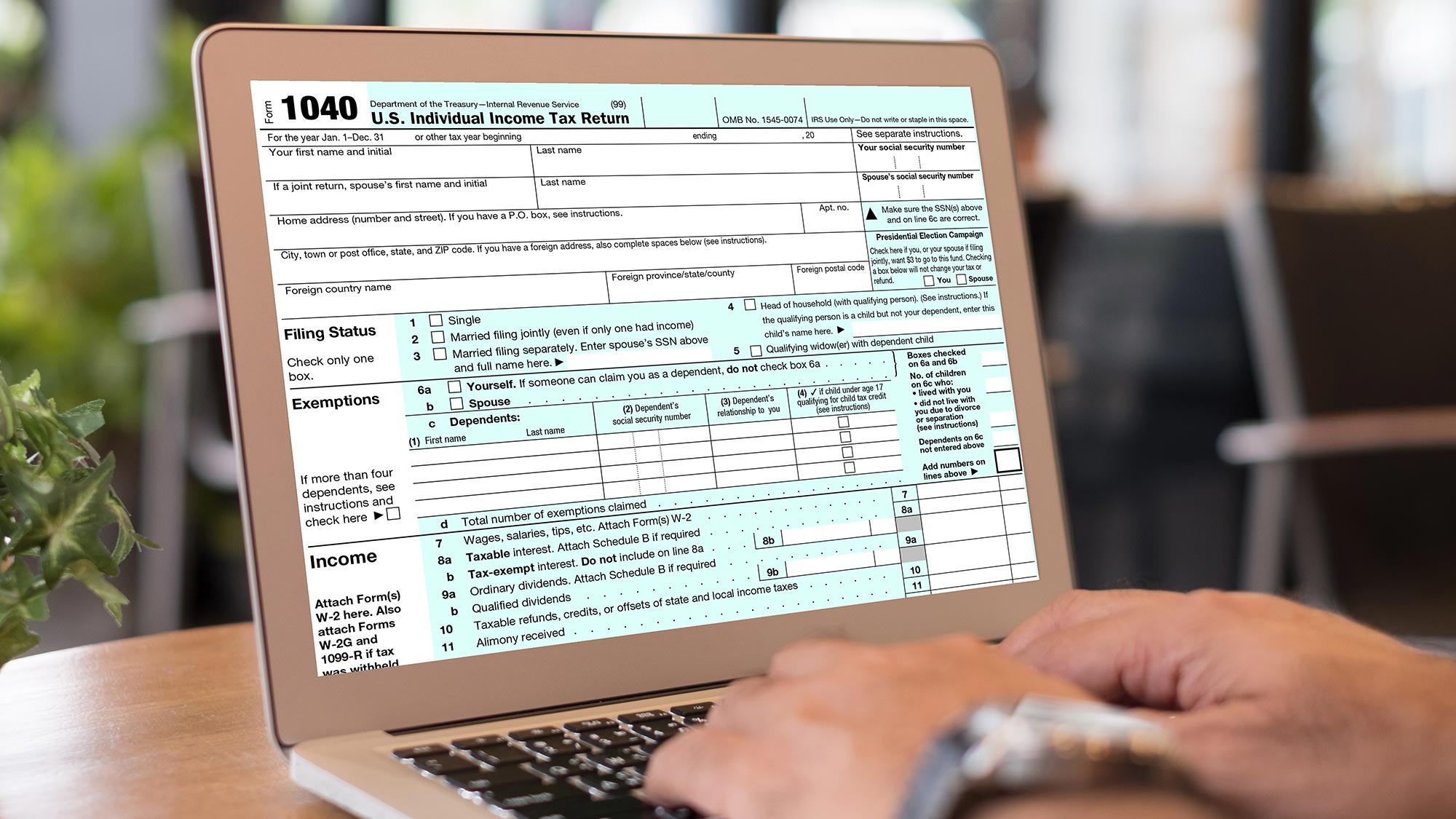

How To File Your Taxes Online Tom s Guide

https://cdn.mos.cms.futurecdn.net/FYmrX62zWPRUkorKLQnKx5.jpg

Tax Preparation Checklist PDF Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/100/93/100093528/large.png

https://www.healthcare.gov/taxes

You must file a tax return if enrolled in Health Insurance Marketplace plan Get details on tax forms you need to file

https://www.irs.gov/affordable-care-act/questions...

If you do not have a tax filing requirement you do not have to file a tax return solely because you received the Form 1095 B reflecting your Medicaid coverage If you enrolled in coverage

When Can You File Taxes In 2023 Kiplinger

How To File Your Taxes Online Tom s Guide

How To File Your Taxes As Uber Eats And Other Delivery Drivers

Tax Season For American Expats 2023 Changes

4 Ways To File Your Taxes This Year Get It Back Tax Credits For

Getsafe Home Insurance Simple Fair Zero Paperwork All In One App

Getsafe Home Insurance Simple Fair Zero Paperwork All In One App

What Tax Forms Do I Need For Employee Health Insurance 2023

How To File LLC Taxes LegalZoom

Does Everyone Have To File Their Income Tax Returns

Do You Have To File Taxes For Health Care - Key Points About 12 9 million people enrolled in health insurance through the public exchange are eligible for subsidies that reduce their monthly premiums At tax time