Do You Have To Pay Council Tax If Your On Disability Benefits You won t pay any council tax on the annexe if a dependant family member lives there Your family member might be dependent if they re aged 65 or over or they have a physical or mental disability If your annexe is empty you don t need to pay council tax on it If you or someone you live with is disabled

Council tax discounts If you get either the daily living or mobility component of PIP you may get money off your council tax bill It s hard to say exactly how much you ll get off because it depends on things like the component and rate of PIP you re getting However your council will be able to tell you How to apply Wherever you live the amount of Council Tax Support you get depends on many factors including your age your income including any benefits you receive your savings who you live with how much Council Tax you pay You may get more Council Tax Support if you receive a disability or carer s benefit

Do You Have To Pay Council Tax If Your On Disability Benefits

Do You Have To Pay Council Tax If Your On Disability Benefits

https://www.webuyanyhome.com/wp-content/uploads/2017/12/Property-Valuation-scaled.jpeg

Final Year Facts On Council Tax

https://theorbital.co.uk/wp-content/uploads/2017/06/P1060409.jpg

Do International Students Have To Pay Council Tax

https://greatbritishmag.co.uk/wp-content/uploads/2020/11/UK-Council-Tax-Bill.jpg

You won t have to pay council tax if all of the following apply to your second home it will be available as a holiday let for at least 140 days in the current tax year it was advertised commercially as a holiday let for at least 140 days in the last tax year If you or someone you live with is disabled you might qualify for a Council Tax reduction for disabled people or exemption In other words if your home would not need to be as large if you or another occupant were not disabled You then would be eligible for a Disabled Band Reduction Scheme

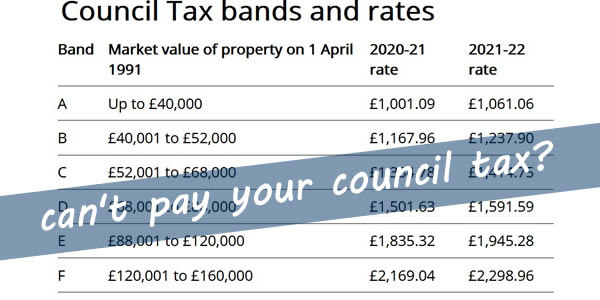

Donate Council tax property bands The amount of council tax that you must pay varies from authority to authority but it is based on the property band that applies to your home These bands are A to H in England and Scotland A to I in Wales Council Tax is collected by your council each year to pay for essential local services such as social care rubbish collection road repairs and community services How much you pay depends on the value of your home and the people living in it You may be eligible for help to reduce your bill

Download Do You Have To Pay Council Tax If Your On Disability Benefits

More picture related to Do You Have To Pay Council Tax If Your On Disability Benefits

What To Do If You Are Struggling To Pay Your Council Tax The Money Pages

https://d3hjf51r9j54j7.cloudfront.net/wp-content/uploads/sites/3/2021/03/council-tax-620x330.jpg

Help For Those Struggling To Pay Council Tax The Knowledge

http://www.knowlewest.co.uk/blog/wp-content/uploads/2020/04/Council-Tax-800x445.jpg

Talk To Us If You Are Struggling To Pay Your Council Tax MBC News Website

https://news.maidstone.gov.uk/__data/assets/image/0011/323678/varieties/1024px.jpg

Getting help to reduce your Council Tax bill If you would like to talk to one of our advisers about Council Tax reductions or other benefits available to people with serious sight problems call our Helpline on 0303 123 9999 You can also email helpline rnib uk Please note that we can only give advice about benefits for people with sight Where your property is already in band A the lowest council tax band and you qualify for this discount your council tax bill will be reduced by 17 instead The types of adaptations could include An extra bathroom or kitchen for a disabled person to use

Council Tax Reduction now falls under the umbrella of Council Tax Support If you are disabled or have a disabled person living with you there may be entitlement to a reduction in Council Tax Council Tax helps pay for local services like policing and refuse collection see also Benefit Rates Your Council Tax bill tells you how much you have to pay for the year how that amount has been worked out the dates you have to pay The cost is usually split into 10 monthly payments Contact

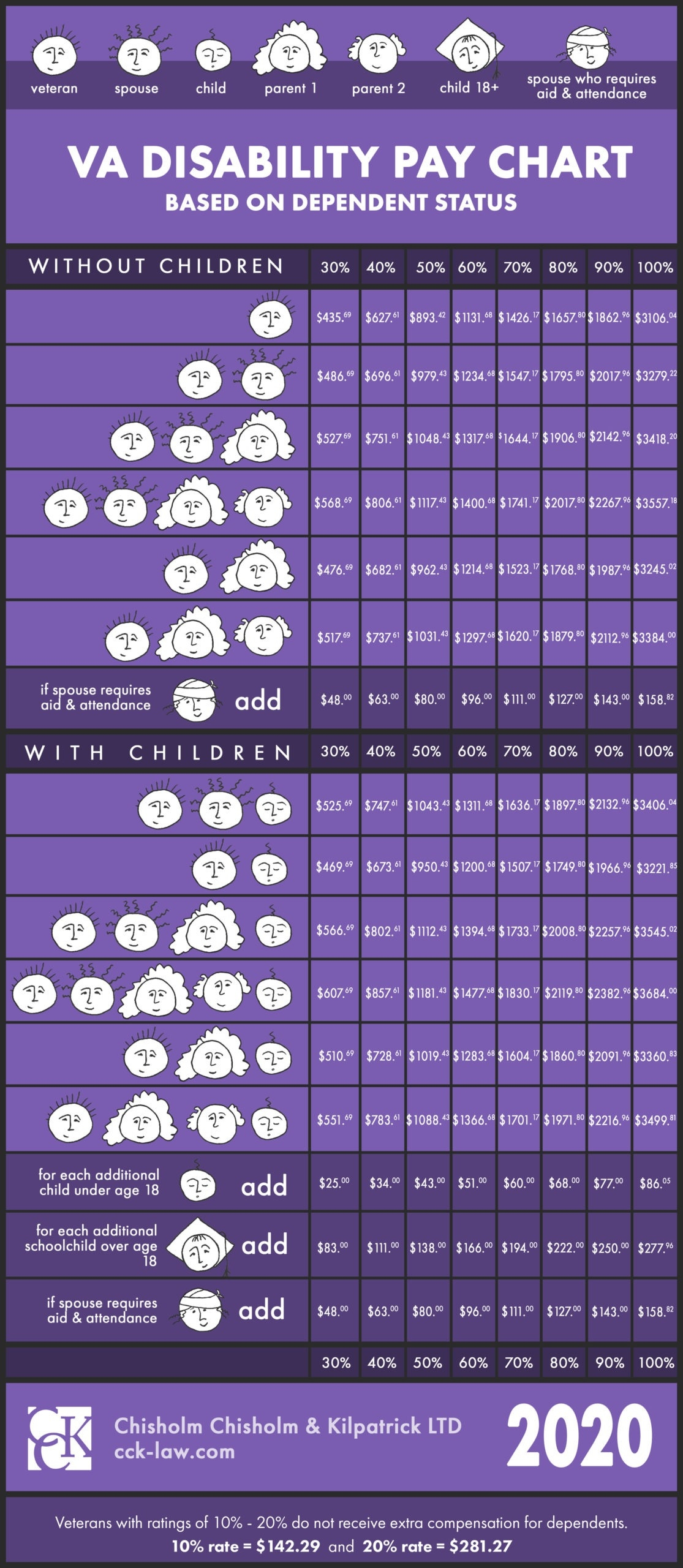

VA Disability Payment Increase VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/2020-va-disability-pay-chart-va-claims-insider-1.jpg

How To Find Out Much Council Tax Is Swimmingkey13

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/02/03/16438847418952.jpg

https://www.citizensadvice.org.uk/housing/council...

You won t pay any council tax on the annexe if a dependant family member lives there Your family member might be dependent if they re aged 65 or over or they have a physical or mental disability If your annexe is empty you don t need to pay council tax on it If you or someone you live with is disabled

https://www.citizensadvice.org.uk/benefits/sick-or...

Council tax discounts If you get either the daily living or mobility component of PIP you may get money off your council tax bill It s hard to say exactly how much you ll get off because it depends on things like the component and rate of PIP you re getting However your council will be able to tell you How to apply

Council Tax Debt Could I Write Some Off Debt Guardians

VA Disability Payment Increase VA Disability Rates 2021

Ways To Pay Your Council Tax Complete Guide YouTube

Council Tax Exemption For Unoccupied Properties Following A Death

Do You Have To Pay Federal Taxes On Your Disability Benefits

The Government Entitlement Program That s About To Dry Up The Fiscal

The Government Entitlement Program That s About To Dry Up The Fiscal

VA Disability Rates 2000 VA Disability Rates 2021

What To Do If You Have Problems Paying Your Council Tax

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Do You Have To Pay Council Tax If Your On Disability Benefits - If you or someone you live with is disabled you might qualify for a Council Tax reduction for disabled people or exemption In other words if your home would not need to be as large if you or another occupant were not disabled You then would be eligible for a Disabled Band Reduction Scheme