Do You Have To Pay Property Taxes If You Are Over 65 Often if you re 65 or older you ll be able to reduce your property tax bill not only on a house but mobile and manufactured homes houseboats townhomes condominiums and so on You will have to apply You

A senior property tax exemption reduces the amount seniors 65 years of age or older have to pay in taxes on properties they own Property taxes are quite possibly the most widely When you withdraw money from the account later in life you pay no additional taxes The most common forms of back end retirement accounts are Roth IRAs Most 401 k withdrawals are subject to ordinary income taxes except in the case of net unrealized appreciation NUA

Do You Have To Pay Property Taxes If You Are Over 65

Do You Have To Pay Property Taxes If You Are Over 65

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time-1536x1086.jpeg

Pay Property Taxes Bristol TN Official Website

https://www.bristoltn.org/ImageRepository/Document?documentID=7990

Let The IRS Take Your Money If You Don t Work To Keep It The IRS Gets It

http://radcliffcpa.com/wp-content/uploads/2018/10/tax-money-to-Uncle-Sam.jpg

The answer might surprise you In most U S states homeowners over a certain age are eligible for a property tax exemption If you re a homeowner over the age of 65 you pay less in taxes on your home than others in the community For seniors this can mean significant savings each year Only one spouse must typically be 65 or over if you re married and you own your property jointly Note New York will allow you to continue claiming your exemption if your spouse was over 65 but is now deceased

If I am age 65 or older disabled or a surviving spouse who is age 55 or older does a tax ceiling apply to county city or junior college district property taxes Yes if the county commissioners court city council or board of the junior college district authorizes a tax limitation on the homesteads of persons age 65 or older or disabled Capital Gains Tax for People Over 65 For individuals over 65 capital gains tax applies at 0 for long term gains on assets held over a year and 15 for short term gains under a year Despite age the IRS determines tax based on asset sale profits with no special breaks for those 65 and older It s essential to understand these rates and any

Download Do You Have To Pay Property Taxes If You Are Over 65

More picture related to Do You Have To Pay Property Taxes If You Are Over 65

How To Legally Never Pay Taxes Again YouTube

https://i.ytimg.com/vi/q63F1pBrUHA/maxresdefault.jpg

How To File Back Taxes SDG Accountants

https://sdgaccountant.com/wp-content/uploads/2021/06/File-Back-Taxes.jpg

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=3200&height=1680&fit=crop

The property tax reduction program could reduce your property taxes by 250 to 1 500 To get this break you must be 65 and own and live in your home Additionally your total 2022 income after You pay property taxes for as long as you own your home Most states reserve homestead exemption eligibility for Veterans people living with disabilities older adults over age 65 and first

Basically if you re 65 or older you have to file a for tax year 2023 which is due in 2024 if your gross income is 15 700 or higher If you re married filing jointly and both 65 or older that amount is 30 700 If you re married filing jointly and only one of you is 65 or older that amount is 29 200 That said there is one Twenty four states and the District of Columbia offer property tax deferral programs for senior homeowners who qualify The age for qualifying varies from 62 in California Georgia and Oregon to age 70 in Arizona South Dakota and Florida Taxes are deferred as long as the homeowner owns the property and are then paid from the proceeds if the

Fully Legal But Shrouded In Fear Paying Taxes If You re Undocumented Pt 1

https://cdn.website-editor.net/b6dc991097d3471985d43c4debddb563/dms3rep/multi/0429-taxes-646509_1280.jpg

Everything You Need To Know About The 2023 Tax Season

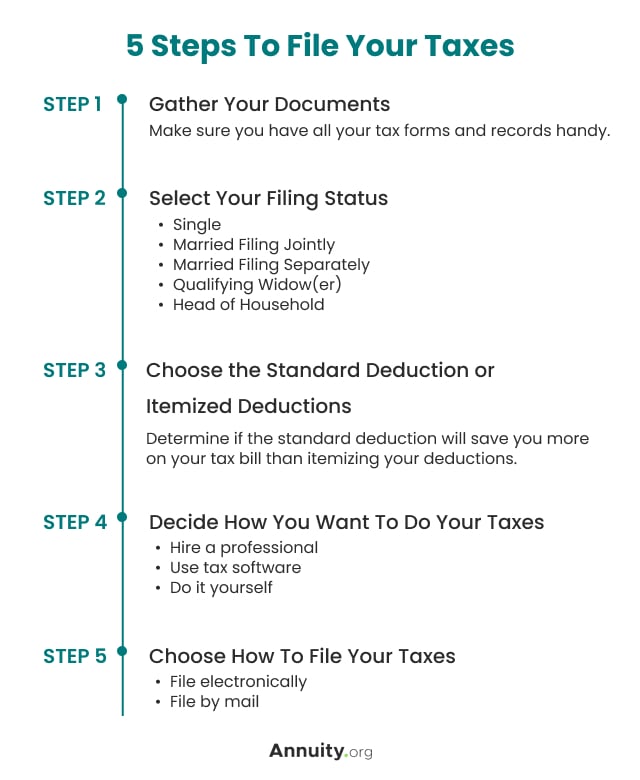

https://www.annuity.org/wp-content/uploads/5-steps-to-file-your-taxes.jpg

https://smartasset.com/retirement/at-what-age-do...

Often if you re 65 or older you ll be able to reduce your property tax bill not only on a house but mobile and manufactured homes houseboats townhomes condominiums and so on You will have to apply You

https://themortgagereports.com/63473

A senior property tax exemption reduces the amount seniors 65 years of age or older have to pay in taxes on properties they own Property taxes are quite possibly the most widely

The Shocking Story Of How I Forgot To Pay Tax On My YouTube Income

Fully Legal But Shrouded In Fear Paying Taxes If You re Undocumented Pt 1

Do I Have To Pay Taxes On My Weekly Workers Compensation Benefits Or

At What Point Do I Have To Pay Taxes On My Online Sales YouTube

Why Do I Have To Pay Taxes

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Waar Gaat Je Belastinggeld Heen Adam Faliq

Get Ready To Grab Your Ankles Jay Beattey s No More Wall Street

A Beginner s Guide To Taxes Do I Have To File A Tax Return

Do You Have To Pay Property Taxes If You Are Over 65 - For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes The biggest question though is how will schools be able to recoup the expected loss in revenue