Do You Have To Report Foreign Interest Income U S citizens living abroad must report interest income from foreign bank accounts on their U S tax return Steps to report foreign interest income include

If you earn foreign interest income in a country in which you pay U S Tax you are entitled to a Foreign Tax Credit Otherwise the income is combined with your other worldwide Reporting foreign income If you need to pay tax you usually report your foreign income in a Self Assessment tax return But there s some foreign income that s taxed differently If

Do You Have To Report Foreign Interest Income

Do You Have To Report Foreign Interest Income

https://img-cdn.inc.com/image/upload/w_1920,h_1080,c_fill/images/panoramic/getty_1202975142_n68ae3.jpg

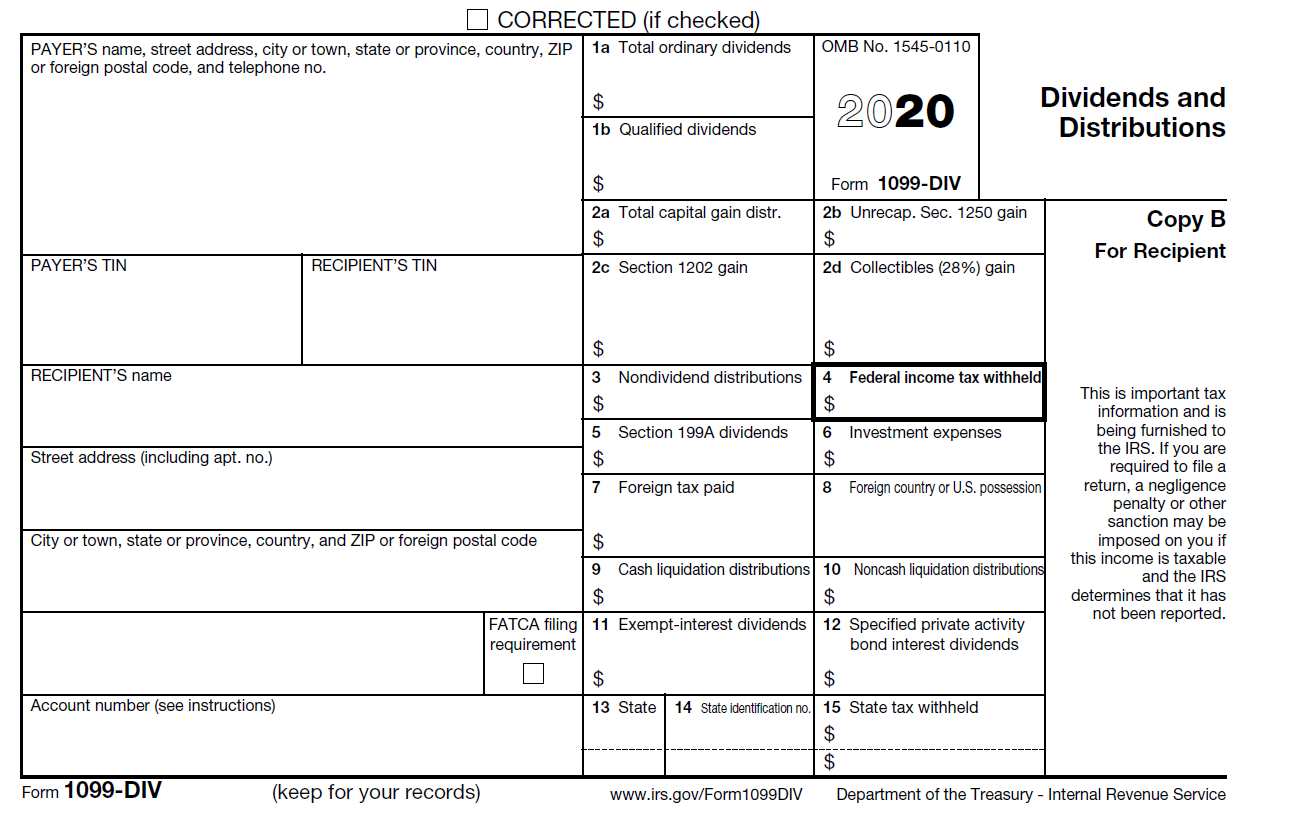

Form 1040 Line 3 Dividends A Practical Guide Article 6 The Law

https://images.squarespace-cdn.com/content/v1/5b2c618596d455860e15ec8f/1605042870808-54YLOLMK4MG6NK5HL92U/1099-DIV+Dividends.PNG

How To Report Foreign Income

https://optimataxrelief.com/wp-content/uploads/2023/04/2023-how-to-report-foreign-income.jpg

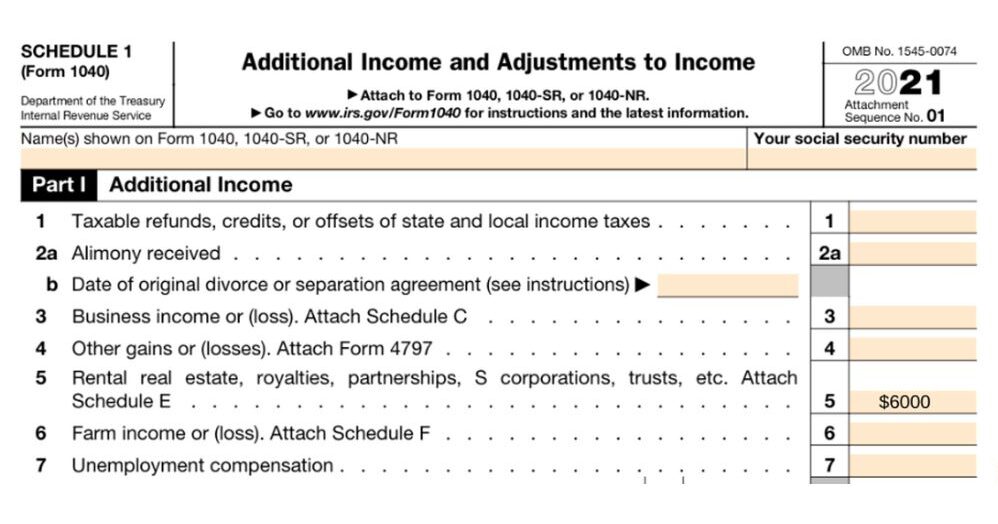

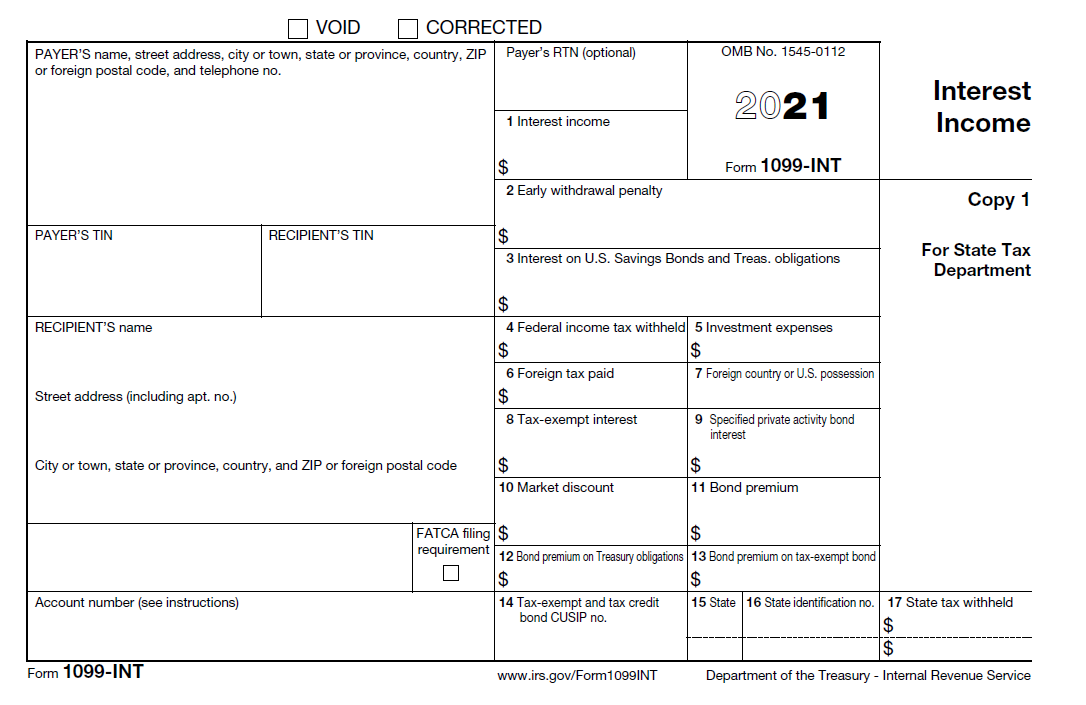

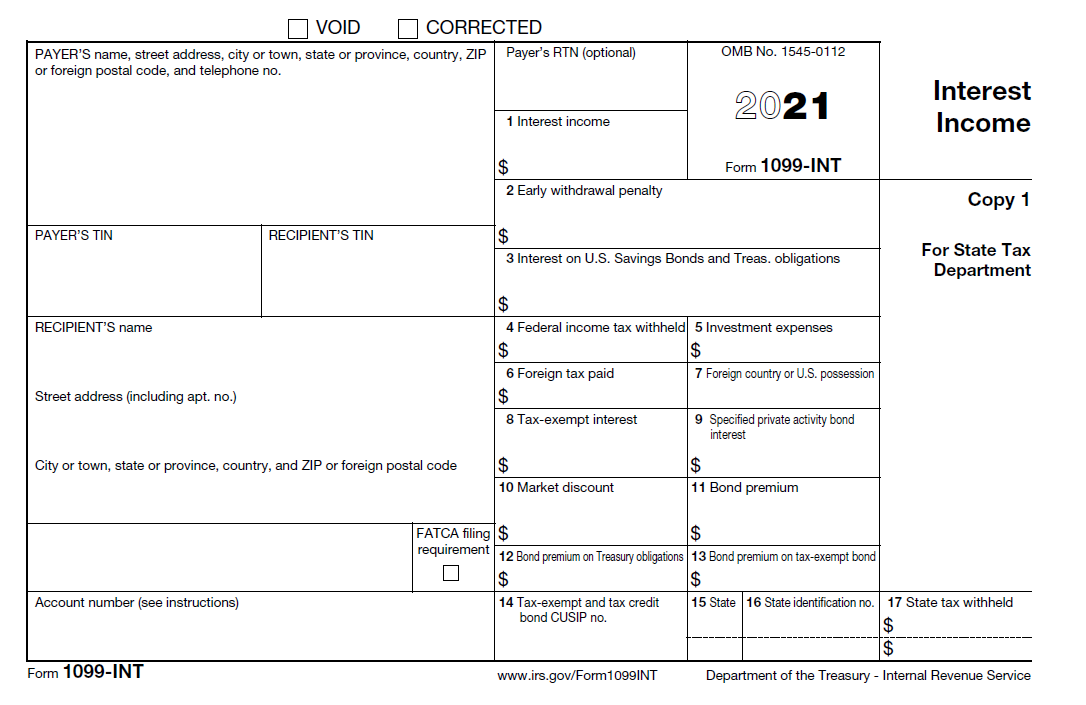

Key Takeaways Interest on bonds mutual funds CDs and demand deposits of 10 or more is taxable Taxable interest is taxed just like ordinary income Payors must file Form 1099 INT and Generally U S citizens and resident aliens must report all worldwide income including income from foreign trusts and foreign bank and securities accounts such as interest income To do this

If you are a U S citizen with investment income from sources outside the United States foreign income you must report that income on your tax return unless it is exempt by If you paid foreign taxes on your interest or dividend income you may be able to claim a foreign tax credit when you calculate your federal see line 40500 and

Download Do You Have To Report Foreign Interest Income

More picture related to Do You Have To Report Foreign Interest Income

Is Bank Interest Taxable Taxation Portal

https://taxationportal.com/wp-content/uploads/2022/02/bank-interest.jpg

IRS Form 2555 H R Block

https://www.hrblock.com/expat-tax-preparation/resource-center/wp-content/uploads/2022/10/form-2555-tablet.jpeg

Labour Pains Do You Have To Sign A Release To Get A Severance Package

https://3.bp.blogspot.com/-2EsO57u_wCM/WOwlQrzepuI/AAAAAAAAA0Q/_iyiGeyawdc5-VbdHFV2jnNz8ldu3mb5QCLcB/s1600/iStock-493191012.jpg

Use the foreign section of the tax return to record your overseas income or gains Include income that s already been taxed abroad to get Foreign Tax Credit Relief if you re eligible If you have a financial interest in or signature authority over a foreign financial account including a bank account brokerage account mutual fund trust or other type

For accountants understanding how to navigate foreign asset reporting is essential as the IRS requires taxpayers to report certain foreign assets to ensure Check if you need to declare foreign income and pay tax the tax you pay depends on your residency for tax purposes Australian resident foreign and worldwide income As

Interest Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/06/21155832/Interest-Income-Example-Calculation.jpg

How Much Foreign Income Is Tax Free In USA Leia Aqui How Much

https://brighttax.com/wp-content/uploads/2023/01/bright-tax-web-taxation-resources-how-to-complete-form-1040-rental-income-edited.jpg

https://www.visaverge.com/knowledge/reporting...

U S citizens living abroad must report interest income from foreign bank accounts on their U S tax return Steps to report foreign interest income include

https://www.goldinglawyers.com/foreign-interest...

If you earn foreign interest income in a country in which you pay U S Tax you are entitled to a Foreign Tax Credit Otherwise the income is combined with your other worldwide

How To Report Foreign Pension Income Counting My Pennies

Interest Income Formula And Calculation

What Is Out Of Order In Case Of CC And OD Accounts Theinfosagar

US VISA What To Do If You Lose Your Job GoUSA live

Foreign Bank Account Report FBAR Direct Tax Relief

Form 1040 Line 2 Interest A Practical Guide Article 5 The Law

Form 1040 Line 2 Interest A Practical Guide Article 5 The Law

US Expat Tax Return Evaluation Your Opinion Matters Most US Expat

Interest Expense In A Monthly Financial Model Cash Interest Vs

Form 8858 For U S Expats With Foreign Rental Income Guide

Do You Have To Report Foreign Interest Income - Key Takeaways Interest on bonds mutual funds CDs and demand deposits of 10 or more is taxable Taxable interest is taxed just like ordinary income Payors must file Form 1099 INT and