Do You Have To Use Hsa For Medical Expenses You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family

HSAs are accounts you can use to set aside tax free money for medical expenses The money you contribute often earns interest or investment returns These earnings are also tax free Money saved in your HSA can be used to pay qualified medical expenses and those aren t just standard medical bills from the doctor s office HSAs generally cover a wide range of medical expenses Here are some qualified expenses you could pay for with HSA dollars that you might not know about

Do You Have To Use Hsa For Medical Expenses

Do You Have To Use Hsa For Medical Expenses

https://www.insuranceneighbor.com/wp-content/uploads/sites/2939/2020/11/HSA-Money-Medical-Health.jpg

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Using A Health Savings Account HSA To Pay For Childbirth Intrepid

https://static.twentyoverten.com/5d5413591d304774fba39eb3/9CD5sTbawrq/HSA_Childbirth_infographic.jpg

Health care expenses could have been incurred during any year you had your HSA Cover Long Term Care If you buy long term care insurance you can use HSA funds to pay for the annual premiums The IRS has posted answers to frequently asked questions focused on whether certain costs related to nutrition wellness and general health are medical expenses that may be paid or

You have options for using your HSA to pay for qualified medical expenses You can also use the funds to reimburse yourself for any qualified medical expenses that your insurance didn t cover and you had to pay out of pocket Examples of generally eligible expenses are

Download Do You Have To Use Hsa For Medical Expenses

More picture related to Do You Have To Use Hsa For Medical Expenses

Health Savings Accounts And Medicare UnitedHealthcare

https://www.uhc.com/news-articles/medicare-articles/hsas-and-medicare/_jcr_content/root/regioncontainer_1629060422/responsivegrid_440336480/image.coreimg.82.1280.jpeg/1657725416172/blog-hsas-and-medicare.jpeg

What Is A Health Savings Account HSA Jefferson Bank

https://www.jefferson-bank.com/uploadedfiles/images/articles/anatomy-of-hsa-infographic-jb.jpg?v=1D57A10EA85CB80

HSA FSA Use It Or Lose It Why Not Use For Dental Plan DentalStores

https://www.dentalstores.com/site/wp-content/uploads/2018/11/fsa-hsa.jpg

If you use the health savings account HSA to pay your medical expenses then you do not get to itemize medical deductions for the same expenses However if you have enough medical expenses not paid with the HSA you may be able to claim them as an itemized deduction Goodbye seasonal sneezing and menstrual products are considered qualified medical expenses and you can use your HSA bucks to pay for them 3 Telemedicine is covered for 2020 Right now you can see your doctor from the safety and comfort of your home and use your tax free HSA dollars to pay for the appointment

If you use your HSA to buy a qualified medical expense you will not have to pay income taxes on those funds If you use your HSA for something other than a qualified medical expense that distribution is taxable income And you can be subject to a 20 percent penalty for early withdrawal You can use HSA funds to pay for deductibles copayments coinsurance and other qualified medical expenses Withdrawals to pay eligible medical expenses are tax free Unspent HSA funds roll over from year to year allowing you to build tax free savings to pay for medical care later HSAs may earn interest which is not subject to taxes

What s The Difference Between An HSA FSA And HRA Medical Health

https://i.pinimg.com/originals/aa/77/4b/aa774bbfaa51f1cf3e4e1c3926cd8443.jpg

What Is An HSA Guidelines And Advantages Of An HSA Mibuenempleo

https://www.patriotsoftware.com/wp-content/uploads/2022/12/HSA-eligible-expenses-1.png

https://www.investopedia.com/articles/personal...

You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family

https://www.healthline.com/health/stress/health-savings-account-hsa

HSAs are accounts you can use to set aside tax free money for medical expenses The money you contribute often earns interest or investment returns These earnings are also tax free

Smart Shopping Use Your HSA And FSA Funds To Buy Eyewear EZOnTheEyes

What s The Difference Between An HSA FSA And HRA Medical Health

Health Savings Account HSA Eligible Expense Guide 2023

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

How To Quickly And Tax Efficiently Draw Down HSA Assets

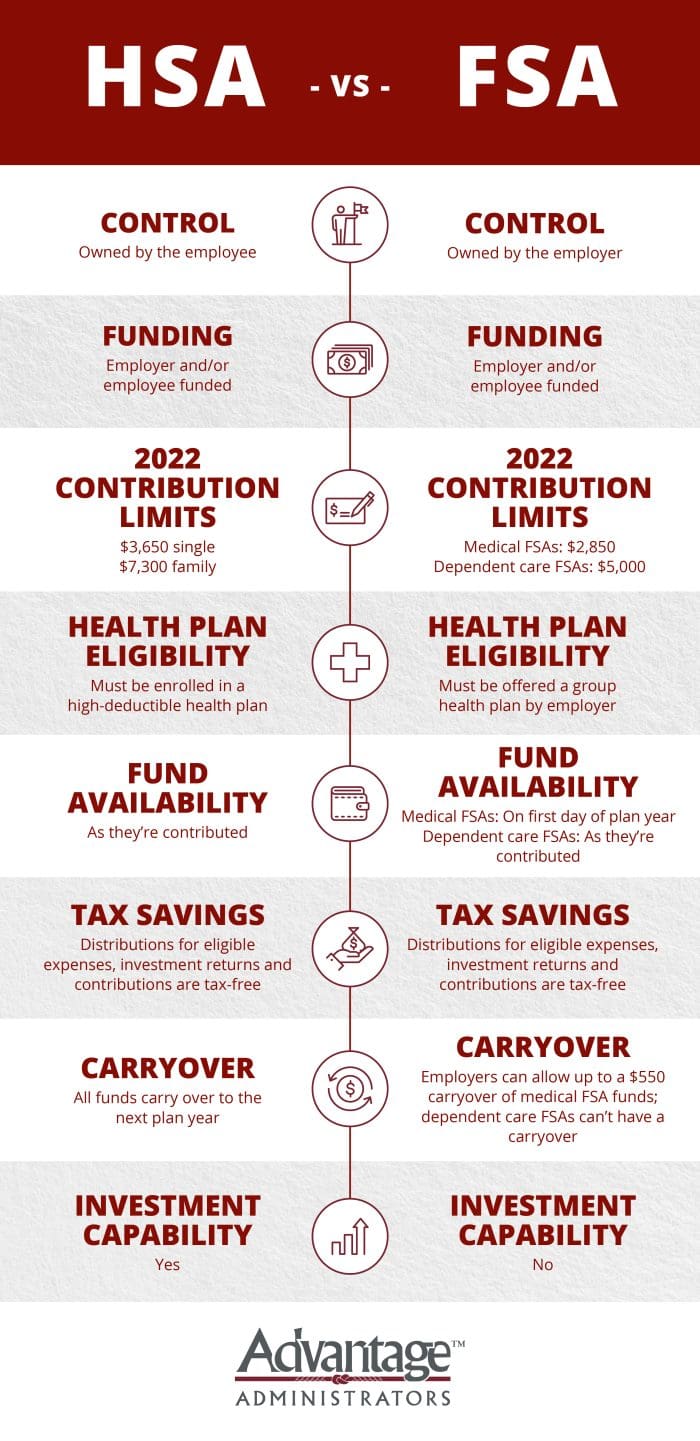

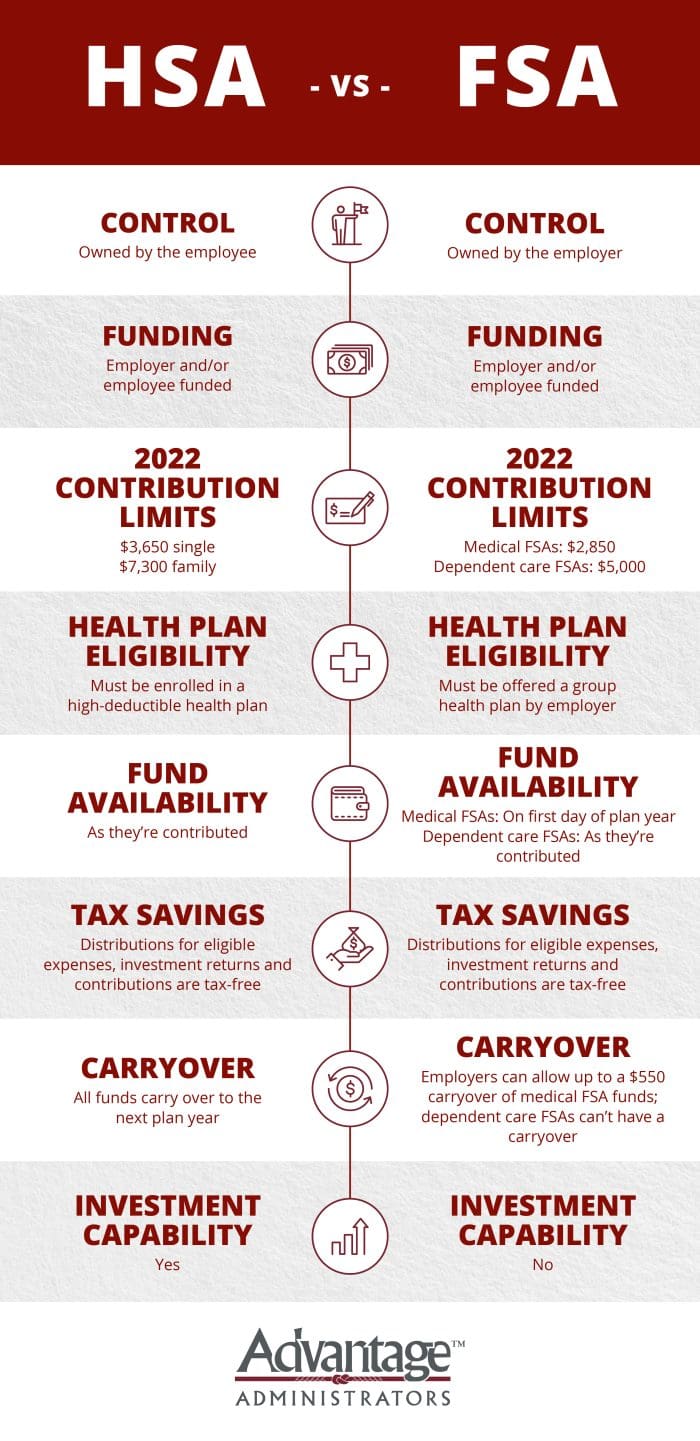

HSA Vs FSA See How You ll Save With Each Advantage Administrators

HSA Vs FSA See How You ll Save With Each Advantage Administrators

Comparison Of HSA health Savings FSA Flexible Spending HRA

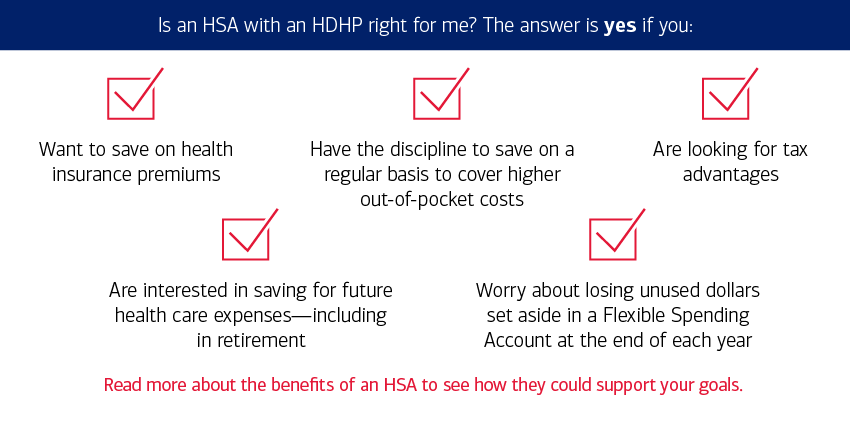

Is An HSA Right For Me

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

What Is Fsa hra Eligible Health Care Expenses Judson Lister

Do You Have To Use Hsa For Medical Expenses - Eligible HSA expenses HSAs have serious tax benefits but to fully take advantage of them you must use the funds for qualified medical expenses