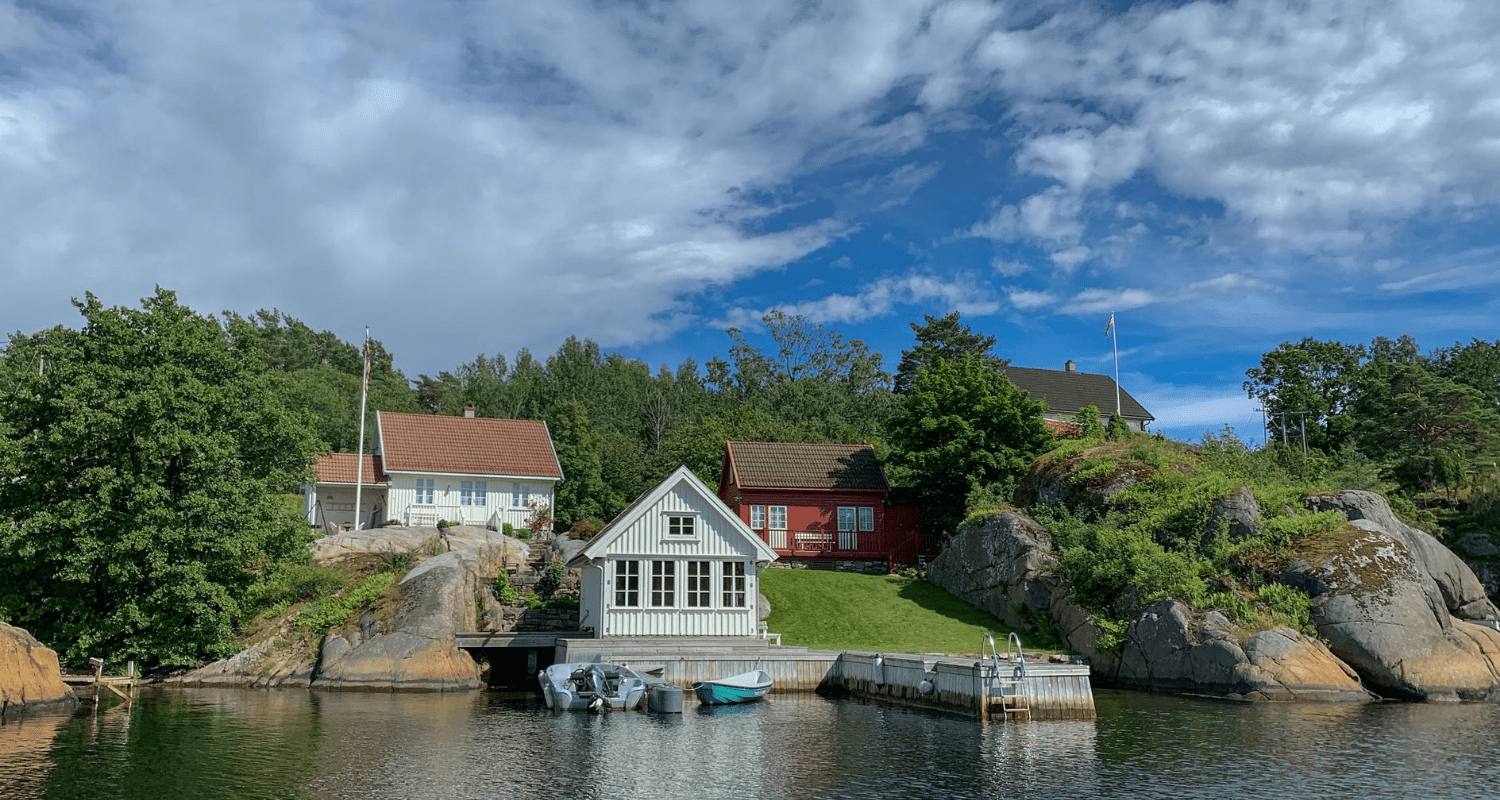

Do You Pay Capital Gains On Sale Of Second Home Yes you can avoid capital gains tax on a second home by converting it into your primary residence You must live in the home as your primary residence for at least two of the

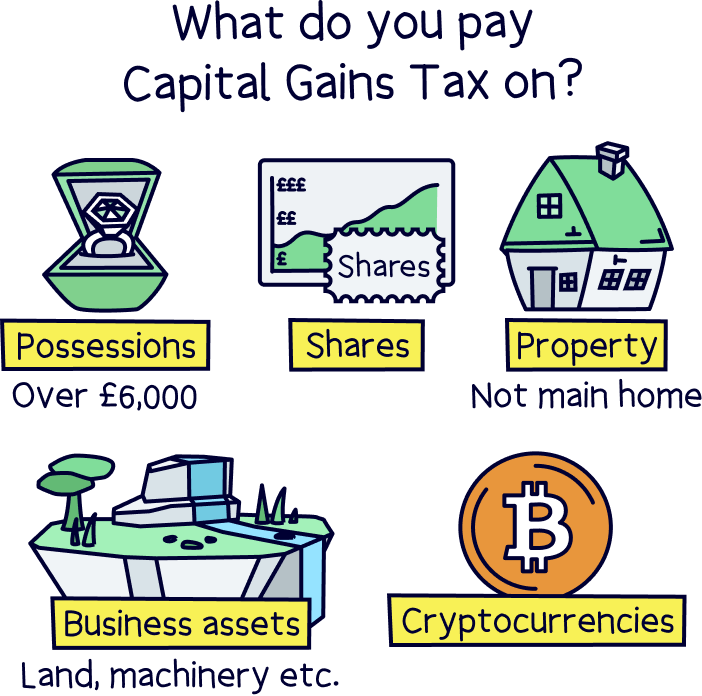

Capital gains taxes are levied anytime you sell an asset you ve held over a year You pay them on the profit you made in the sale not the actual You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of property that s not your home for example buy to let properties business

Do You Pay Capital Gains On Sale Of Second Home

Do You Pay Capital Gains On Sale Of Second Home

https://www.quickmovenow.com/wp-content/uploads/capital-gains-tax-on-property-1200x1200-c-default.jpg

Do You Pay Capital Gains When Flipping A House

https://www.nestorysusamigos.com/img/f7c9f3af005c94b3c6bb94a25457f42d.jpg?09

What Is Capital Gains Tax Nuts About Money

https://global-uploads.webflow.com/5efd08d11ce84361c2679ce1/631ee556fddd92403157462b_what-do-you-pay-capital-gains-tax-on.png

If you buy a home and a dramatic rise in value causes you to sell it a year later you would be required to pay full capital gains tax short term or long term on the house In a nutshell any net capital gain you make upon the sale of a second home is taxable at the appropriate rate long term or short term Capital gains tax on an investment property

You must report all 1099 B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital You may not owe capital gains tax on a second home sale if you meet certain requirements Learn what they are

Download Do You Pay Capital Gains On Sale Of Second Home

More picture related to Do You Pay Capital Gains On Sale Of Second Home

Things You Need To Know About Capital Gains Tax Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property.webp

Do You Pay Capital Gains Tax When You Sell Your Home Wiztax

https://www.wiztax.com/wp-content/uploads/2023/11/[email protected]

Reducing Capital Gains Tax On Second Home Sales

https://www.ukpropertyaccountants.co.uk/wp-content/uploads/2023/09/capital-gains-tax-on-sale-of-second-home.jpg

If you have a capital gain from the sale of your main home you may qualify to exclude up to 250 000 of that gain from your income or up to 500 000 of that gain if you file a joint Answer Your second residence such as a vacation home is considered a capital asset Use Schedule D Form 1040 Capital Gains and Losses and Form 8949 Sales and

Can You Avoid Capital Gains Tax On Real Estate It s possible to legally defer or avoid paying capital gains tax when you sell a home You can avoid capital gains tax This means that if you sell your home for a gain of less than 250 000 or 500 000 if married filing jointly you will not be obligated to pay capital gains tax on that amount

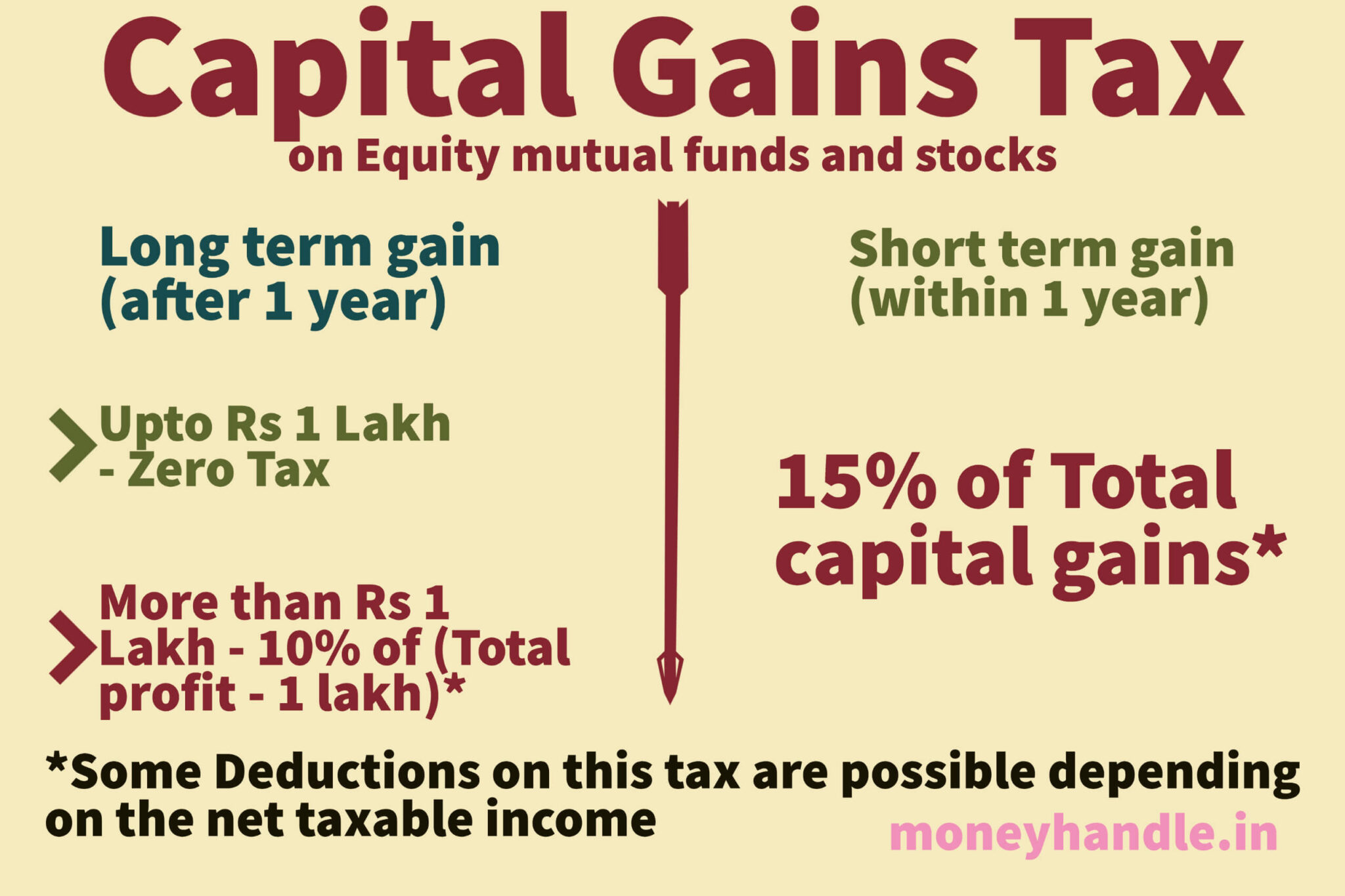

Long Term Capital Gain Tax On Shares Tax Rates Exemption

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/11/long-term-capital-gain-on-shares-image.jpg

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

https://www.investopedia.com/thmb/UI6A79KPsxlzUrWWWOL_qH92Gts=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png

https://www.financestrategists.com/tax/tax...

Yes you can avoid capital gains tax on a second home by converting it into your primary residence You must live in the home as your primary residence for at least two of the

https://www.fool.com/real-estate/2022/02/09/...

Capital gains taxes are levied anytime you sell an asset you ve held over a year You pay them on the profit you made in the sale not the actual

Capital Gains Tax On Inherited Property A Complete Guide

Long Term Capital Gain Tax On Shares Tax Rates Exemption

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

Capital Gains Definition Rules Taxes And Asset Types 2023

Will I Pay Capital Gains On The Sale Of My Second Home

Capital Gains Tax India Simplified Read This If You Invest In Stocks

Why You Won t Regret Buying Treasury Bonds Yielding 5

Why You Won t Regret Buying Treasury Bonds Yielding 5

Qualified Dividends And Capital Gains Worksheet Line 16

How To Disclose Capital Gains In Your Income Tax Return

Capital Gains Tax When You Sell Your Property Property Tax Specialists

Do You Pay Capital Gains On Sale Of Second Home - If you buy a home and a dramatic rise in value causes you to sell it a year later you would be required to pay full capital gains tax short term or long term on the house