Do You Pay Federal And Provincial Income Tax In Canada You have to calculate and pay provincial or territorial income tax in addition to your federal income tax You may also be entitled to provincial or territorial credits in addition to your federal credits

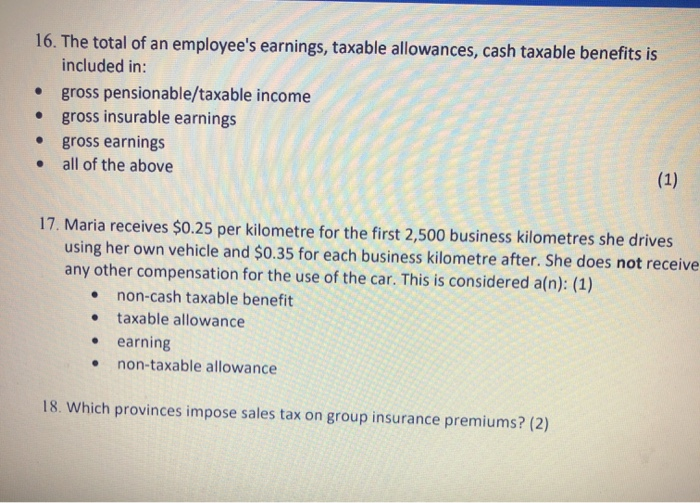

Required payroll deductions by law include income tax contributions to Employment Insurance EI and contributions to the Canada Pension Plan CPP Your income will be taxed depending on your level of As an employer or a payer you are required to deduct federal and provincial or territorial income tax from remuneration and other income that you pay You need to determine

Do You Pay Federal And Provincial Income Tax In Canada

Do You Pay Federal And Provincial Income Tax In Canada

https://www.mondaq.com/images/article_images/452684.jpg

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

https://www.crowe.com/ca/crowesoberman/-/media/Crowe/Firms/Americas/ca/Crowe-Soberman/Images/Insights/Map-of-Canada---Tax-Rates.png?h=2460&la=en-US&w=4276&modified=20200827193401&hash=EAC1D464A20FD6F48830EB22D7C826BC0DD935B2

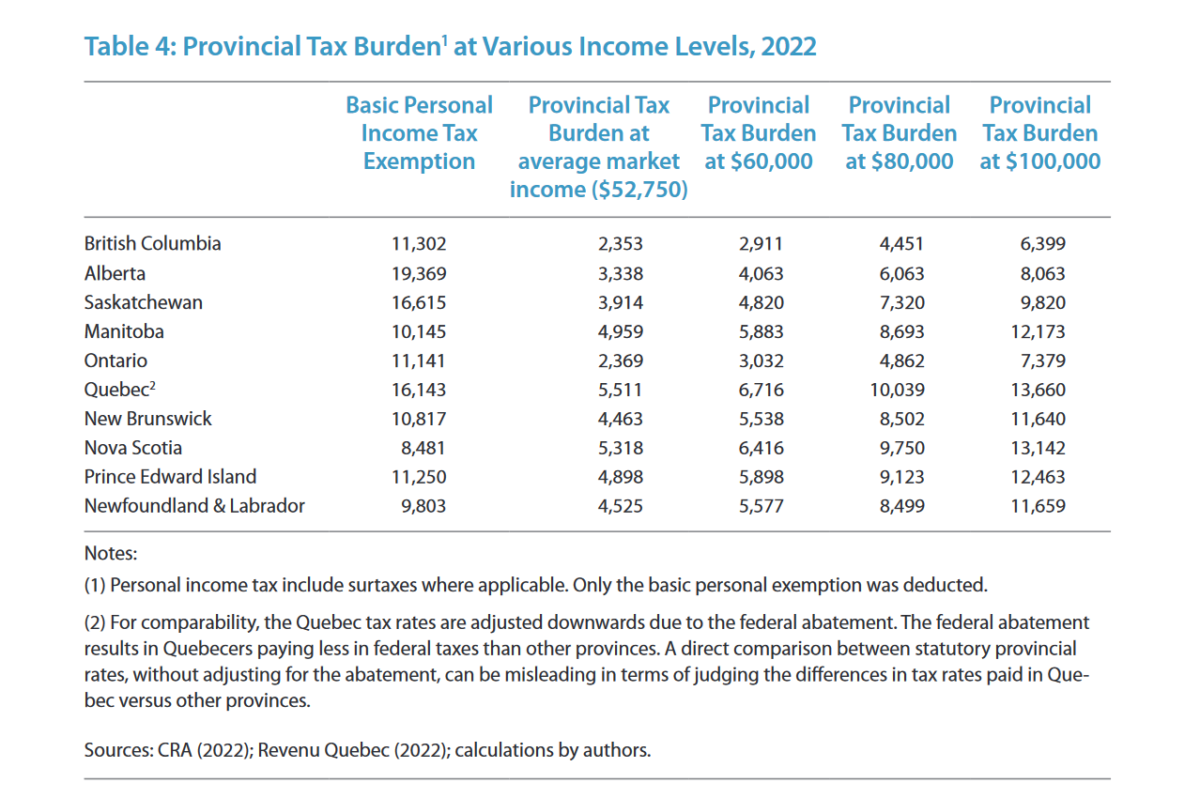

Tax Comparison These Provinces Have The Least Income Tax In Canada

https://www.todocanada.ca/wp-content/uploads/Screenshot-2022-09-28-at-14-25-35-Comparing-Provincial-Marginal-Tax-Rates-for-Middle-Income-Earners-Across-Canada-comparing-provincial-marginal-tax-rates-for-middle-income-earners2.pdf.png

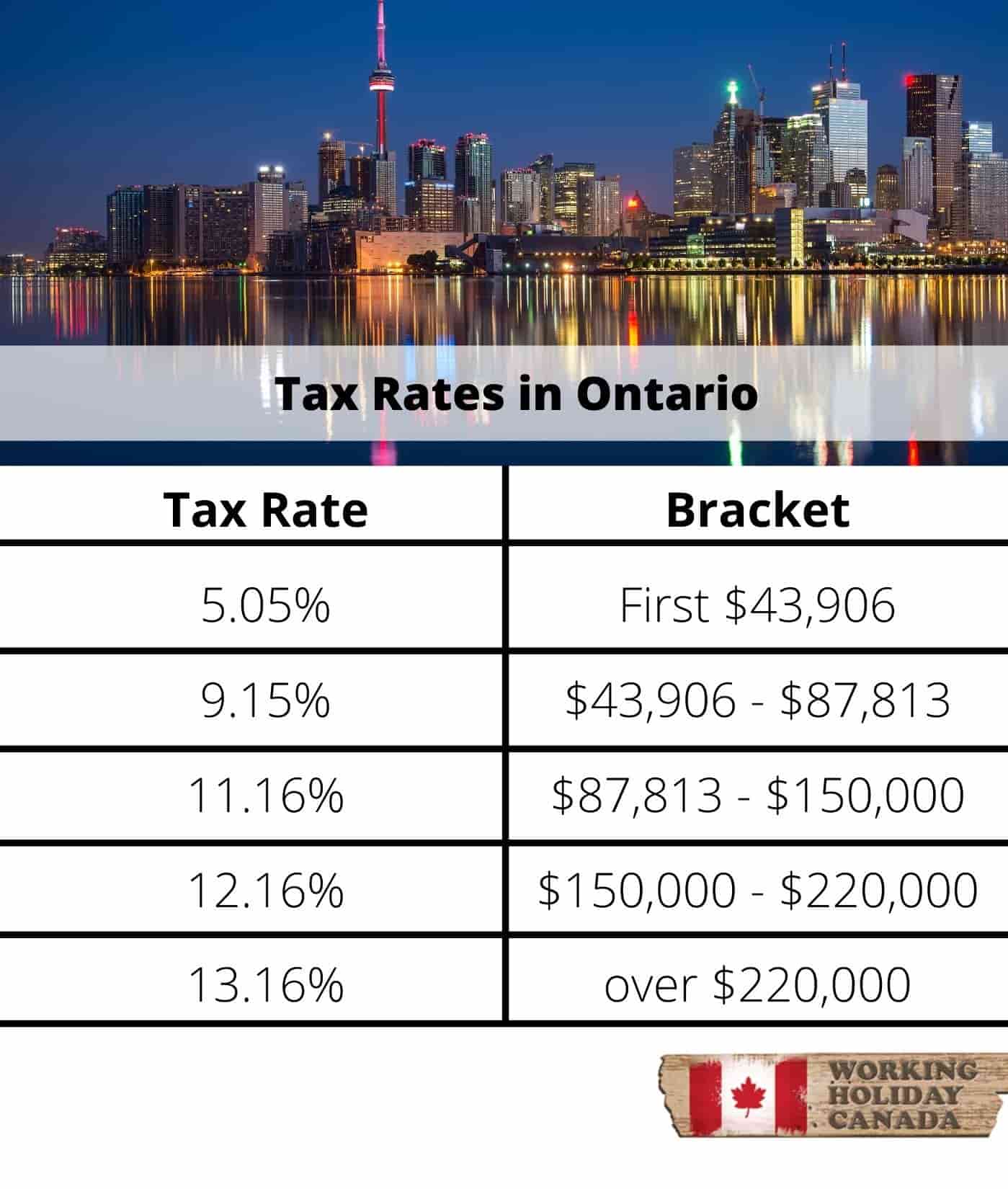

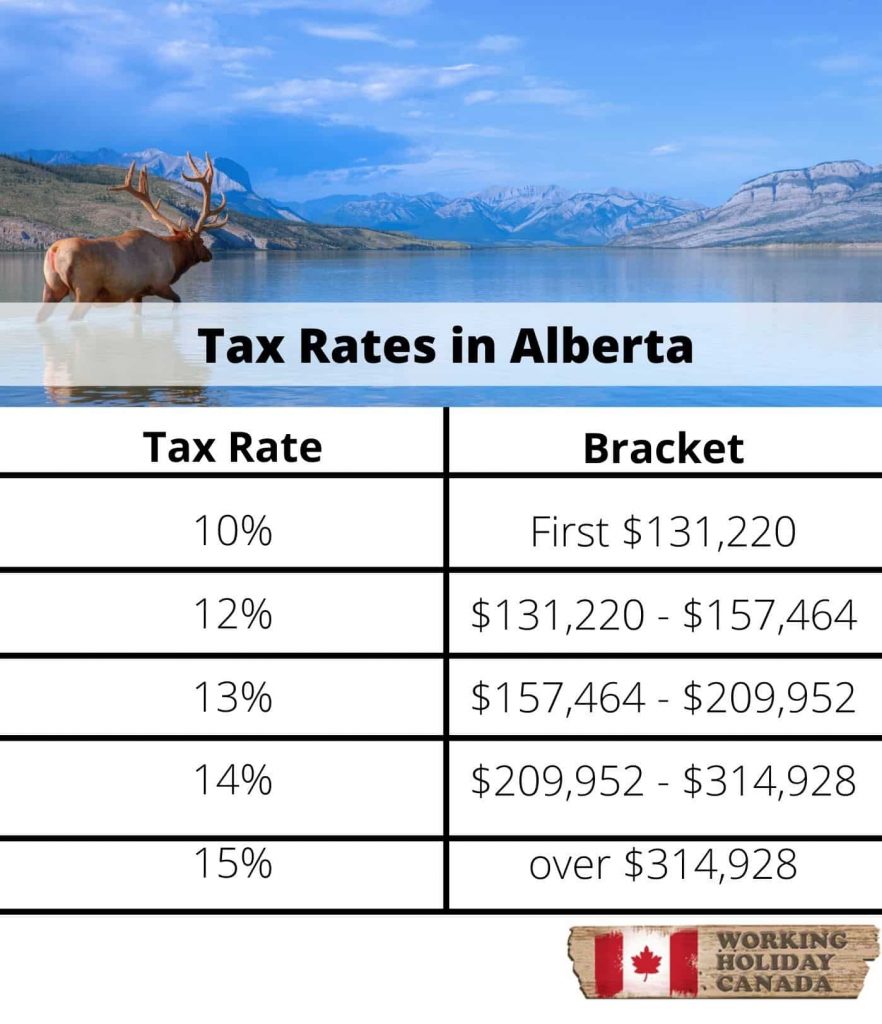

Free simple online income tax calculator 2024 for any province and territory in Canada Use it to estimate how much provincial and federal taxes you need to pay 63 rowsOnce you know what your taxable income is you ll then apply the relevant federal and provincial territorial rates to it Your tax rate will vary by how much income you declare at the end of the year on your T1

You pay income taxes to both federal and provincial governments when you have earned more than the minimum tax free personal amounts Canada utilizes a graduated income tax system meaning that the more Free income tax calculator to estimate quickly your 2024 and 2025 income taxes for all Canadian provinces Find out your tax brackets and how much Federal and Provincial

Download Do You Pay Federal And Provincial Income Tax In Canada

More picture related to Do You Pay Federal And Provincial Income Tax In Canada

Solved 16 The Total Of An Employee s Earnings Taxable Chegg

https://media.cheggcdn.com/study/bd2/bd2e695c-dadd-4045-b35d-528f2f924689/image.png

Tax Rate In Canada 2020 Hot Sex Picture

https://kalfalaw.com/wp-content/uploads/2020/04/Marginal-Tax-Rates-2020_British-Columbia-1536x1187.png

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

Provincial and territorial taxes are not deductible when computing federal provincial or territorial taxable income All provinces and territories compute income tax using tax on income TurboTax s free Canada income tax calculator Estimate your 2024 25 tax refund or taxes owed and check federal and provincial tax rates

Canadian federal income tax is calculated separately from provincial territorial income tax However both are calculated on the same tax return except for Quebec When using tax Several important differences distinguish federal and provincial taxes in Canada Tax rates vary between the federal and provincial levels with provinces adjusting rates to suit

Top 1 Pay Nearly Half Of Federal Income Taxes

https://image.cnbcfm.com/api/v1/image/102558054-538528619.jpg?v=1532564324

2019 Provincial Tax Rates Frontier Centre For Public Policy

https://i0.wp.com/fcpp.org/wp-content/uploads/2019-Provincial-Tax-Rates.png?resize=781%2C582&ssl=1

https://www.canada.ca › en › revenue-agency › services...

You have to calculate and pay provincial or territorial income tax in addition to your federal income tax You may also be entitled to provincial or territorial credits in addition to your federal credits

https://www.getsmarteraboutmoney.ca › lea…

Required payroll deductions by law include income tax contributions to Employment Insurance EI and contributions to the Canada Pension Plan CPP Your income will be taxed depending on your level of

Tax Comparison These Provinces Have The Least Income Tax In Canada

Top 1 Pay Nearly Half Of Federal Income Taxes

-1625833913635.png)

Canadian Tax Rates

The Basics Of Tax In Canada WorkingHolidayinCanada

The Basics Of Tax In Canada Workingholidayincanada

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Irs Tax Brackets 2023 Chart Printable Forms Free Online

Personal Income Tax Rate 2018 Joanne Walsh

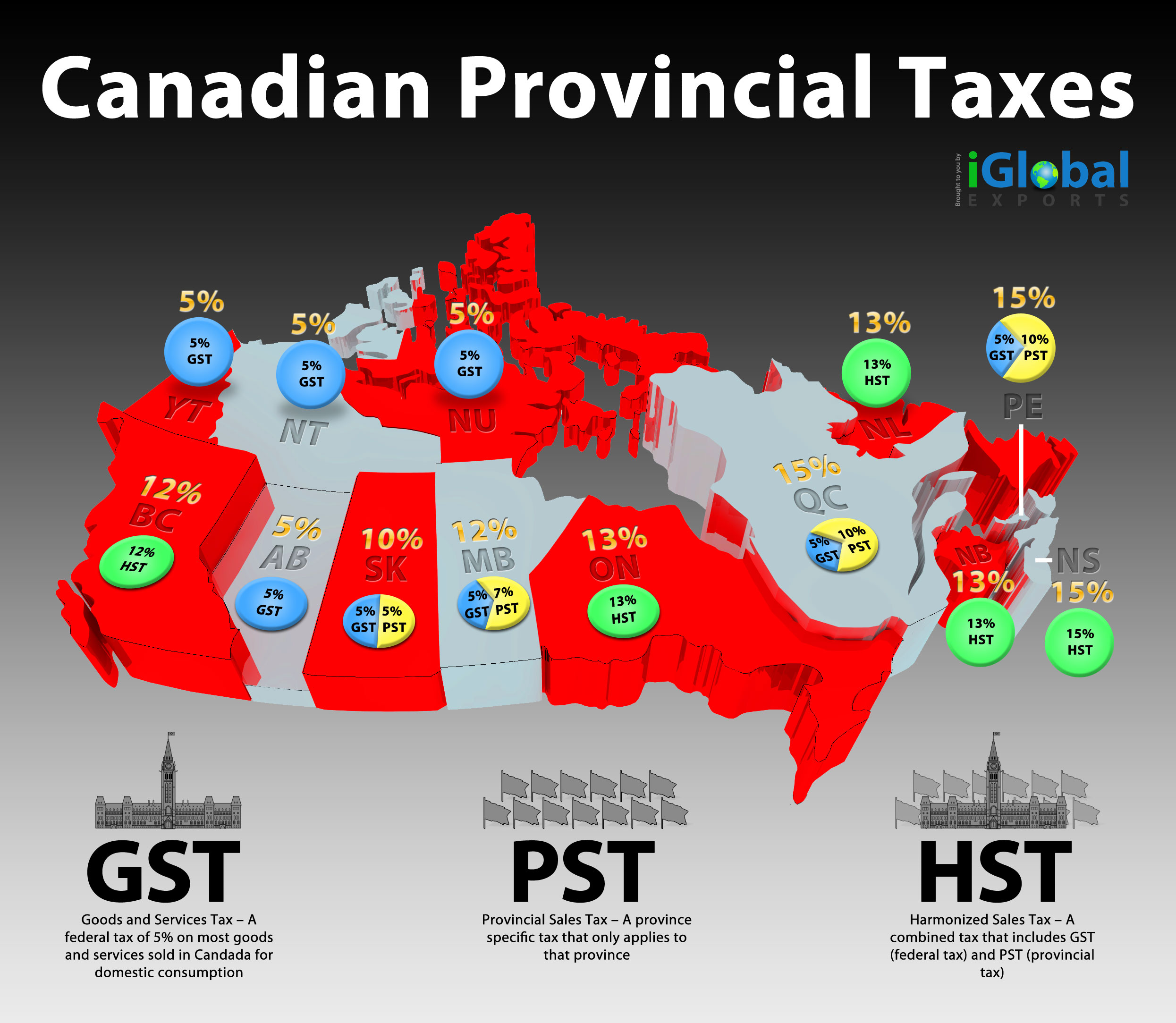

Canadian Provincial Taxes Visual ly

Mn Tax Tables 2017 M1 Elcho Table

Do You Pay Federal And Provincial Income Tax In Canada - Free simple online income tax calculator 2024 for any province and territory in Canada Use it to estimate how much provincial and federal taxes you need to pay