Do You Pay Fica Taxes On Retirement Income Web You may not pay FICA taxes if your retirement income isn t from wages or a business If you receive Social Security benefits you may owe income taxes depending on the amount you receive and your overall tax circumstances However Social Security payments aren t subject to FICA Other retirement income may also be excluded

Web 7 Juni 2023 nbsp 0183 32 Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security Roth IRA retirement Web 23 Feb 2020 nbsp 0183 32 Assuming you have income in retirement you will be subject to at least some income taxes in your golden years

Do You Pay Fica Taxes On Retirement Income

Do You Pay Fica Taxes On Retirement Income

https://i.pinimg.com/originals/4b/a1/2b/4ba12b616e7502e134656249e7a44c8d.jpg

State by State Guide To Taxes On Retirees Best Places To Retire Tax

https://i.pinimg.com/originals/05/86/50/05865057c5e38f18c29cea4530dd875f.png

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

Web 31 Juli 2022 nbsp 0183 32 Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status Distributions from 401 k and traditional IRA accounts are generally taxable Web 27 Nov 2023 nbsp 0183 32 Yes There is no exemption for paying the Federal Insurance Contribution Act FICA payroll taxes that fund the Social Security and Medicare systems As long as you work in a job that is covered by Social Security FICA taxes will

Web 16 Mai 2023 nbsp 0183 32 Retirement Money Home What Is the FICA Tax Learn the rates to see how the FICA tax applies to your income By Rachel Hartman Reviewed by Katy Marquardt May 16 2023 at 11 08 a m Web 15 Nov 2023 nbsp 0183 32 In 2023 only the first 160 200 of your earnings are subject to the Social Security tax In 2024 the first 168 600 is subject to the tax For both years there is an additional 0 9 surtax

Download Do You Pay Fica Taxes On Retirement Income

More picture related to Do You Pay Fica Taxes On Retirement Income

Are Social Security FICA Taxes Really Retirement Plan Contributions

https://www.finivi.com/wp-content/uploads/2017/12/iStock-494146669.jpg

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Difference Between Medicare And Fica

https://www.thebalancemoney.com/thmb/zAT5_tpE6atAzgdg8wvYYHMBKZc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png

Do You Pay FICA On Retirement Income

https://www.realized1031.com/hs-fs/hubfs/retirement-1349717855.jpg?width=1500&height=784&name=retirement-1349717855.jpg

Web 19 Sept 2023 nbsp 0183 32 Social Security tax For this part of the FICA tax employers must withhold 6 2 of your taxable gross income up to 160 200 what you make over that isn t taxed Then your employer has to match your contribution up to that same limit Medicare tax The second portion of the FICA tax is the Medicare tax Web 14 Dez 2023 nbsp 0183 32 Like federal income tax FICA taxes are mandatory and in most cases you can t get around them But since they pay for Medicare and Social Security you will in a sense get the money back at least indirectly once you retire For this reason some people would say that FICA taxes aren t taxes

Web You have to pay income tax on your pension and on withdrawals from any tax deferred investments such as traditional IRAs 401 k s 403 b s and similar retirement plans and tax deferred annuities in the year you take the money The taxes that are due reduce the amount you have left to spend Web 14 Sept 2021 nbsp 0183 32 FICA taxes are broken down as follows 6 2 of wages for Social Security capped at 160 200 of wages for 2023 and 1 45 of wages for Medicare no limit for a total FICA tax rate of 7 65

If You Live In This State You Will Not Pay Retirement Taxes

https://www.tododisca.com/en/wp-content/uploads/2023/08/You-can-save-money-in-your-retirement-income-if-you-live-in-one-of-these-States.jpg

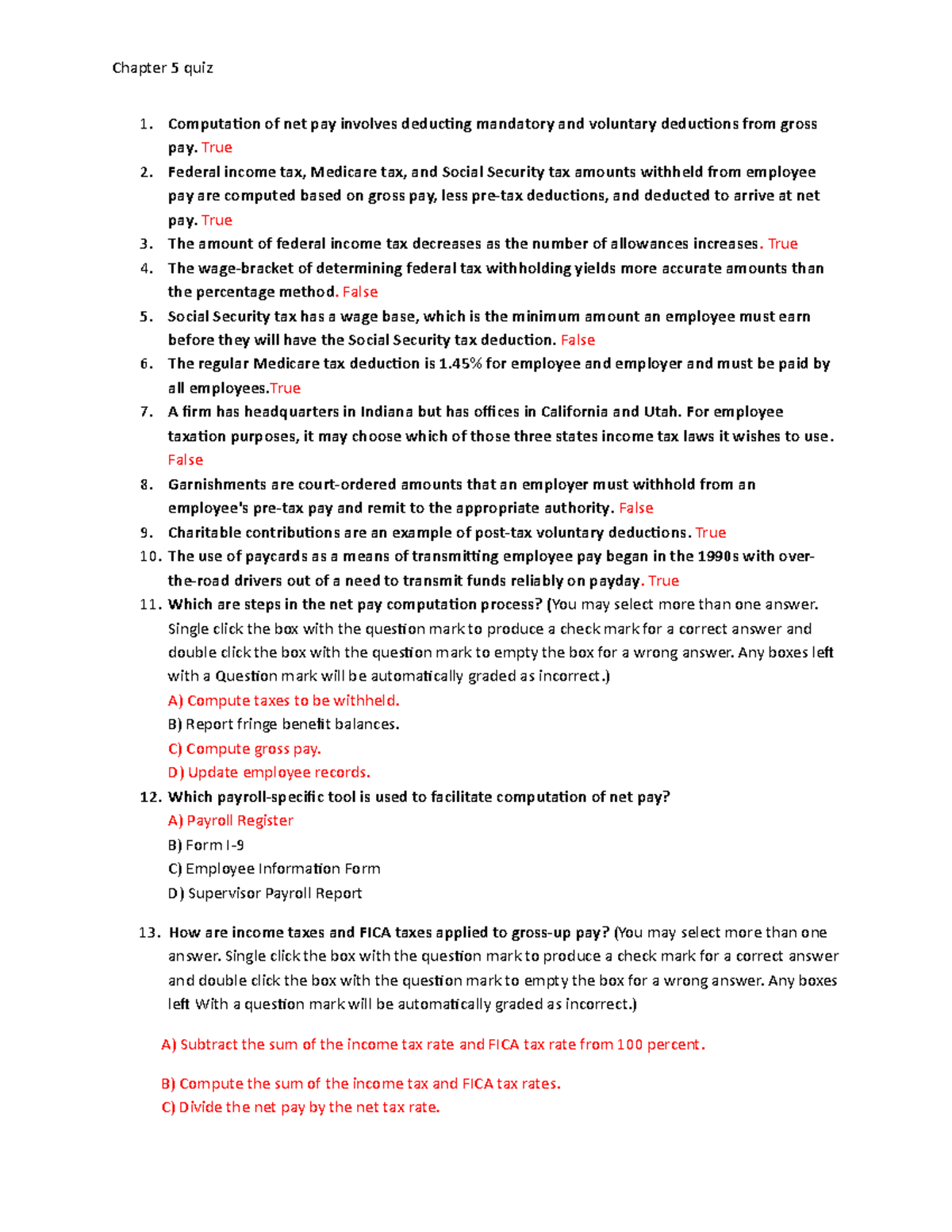

Chapter 5 Quiz Employee Net Pay And Pay Methods Compute Social

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bb3e23cca94d72cdd99dbb7f2742a06b/thumb_1200_1553.png

https://www.realized1031.com/blog/do-you-pay-fica-on-retirement-income

Web You may not pay FICA taxes if your retirement income isn t from wages or a business If you receive Social Security benefits you may owe income taxes depending on the amount you receive and your overall tax circumstances However Social Security payments aren t subject to FICA Other retirement income may also be excluded

https://www.nerdwallet.com/.../is-retirement-income-taxable

Web 7 Juni 2023 nbsp 0183 32 Retirement income from tax deferred accounts such as 401 k s 403 b s or Traditional IRAs is taxable as is income from pensions annuities and Social Security Roth IRA retirement

Prepare For Taxes On Your Retirement Accounts Epstein White

If You Live In This State You Will Not Pay Retirement Taxes

Retiring These States Won t Tax Your Distributions

The Most Common Sources Of Retirement Income SmartZone Finance

7 Steps To Tax Efficient Retirement Income Tax Planning To Grow Your

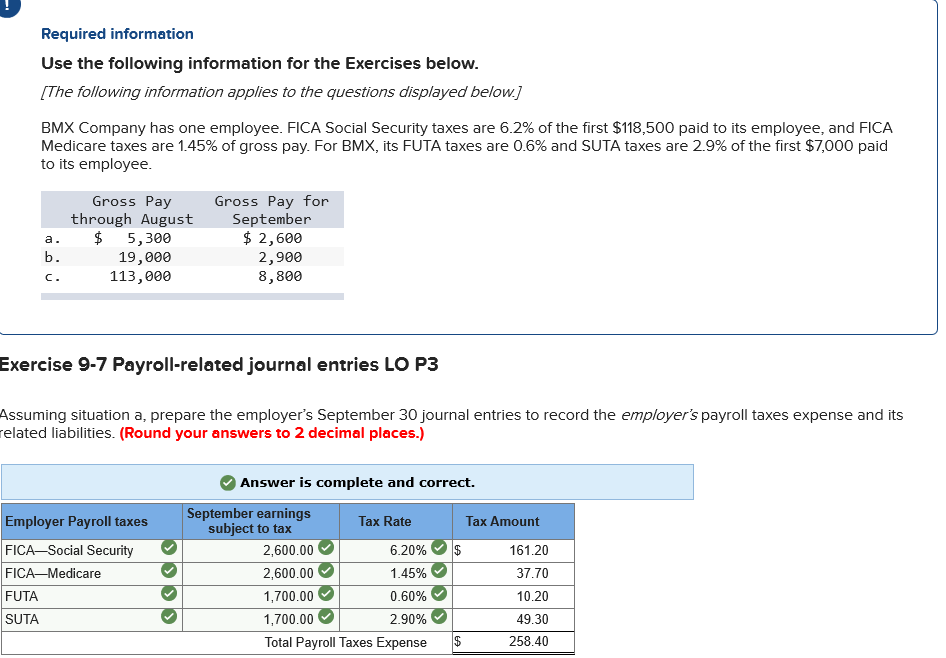

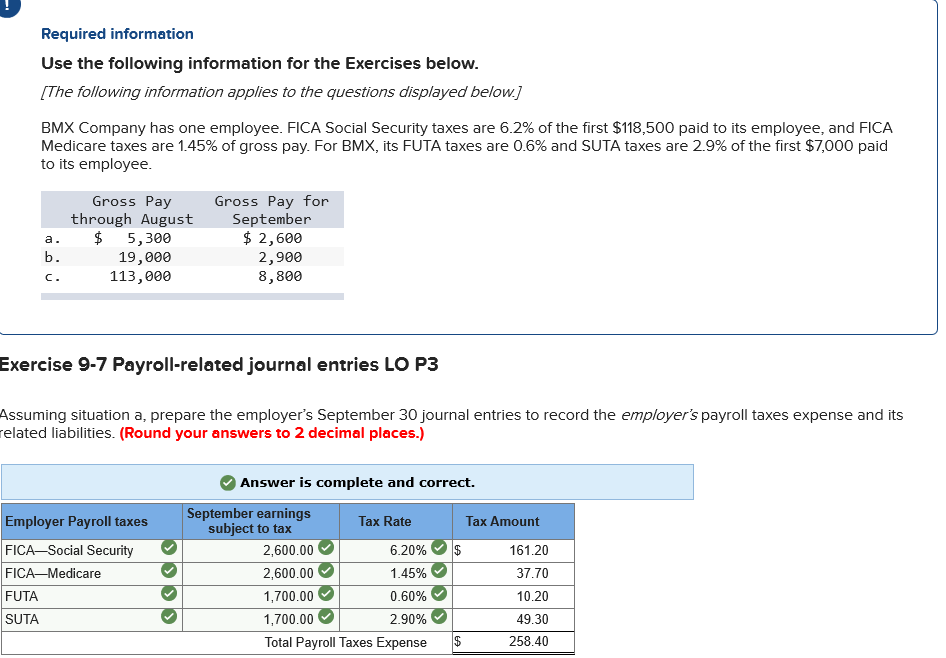

Solved Required Information Use The Following Information Chegg

Solved Required Information Use The Following Information Chegg

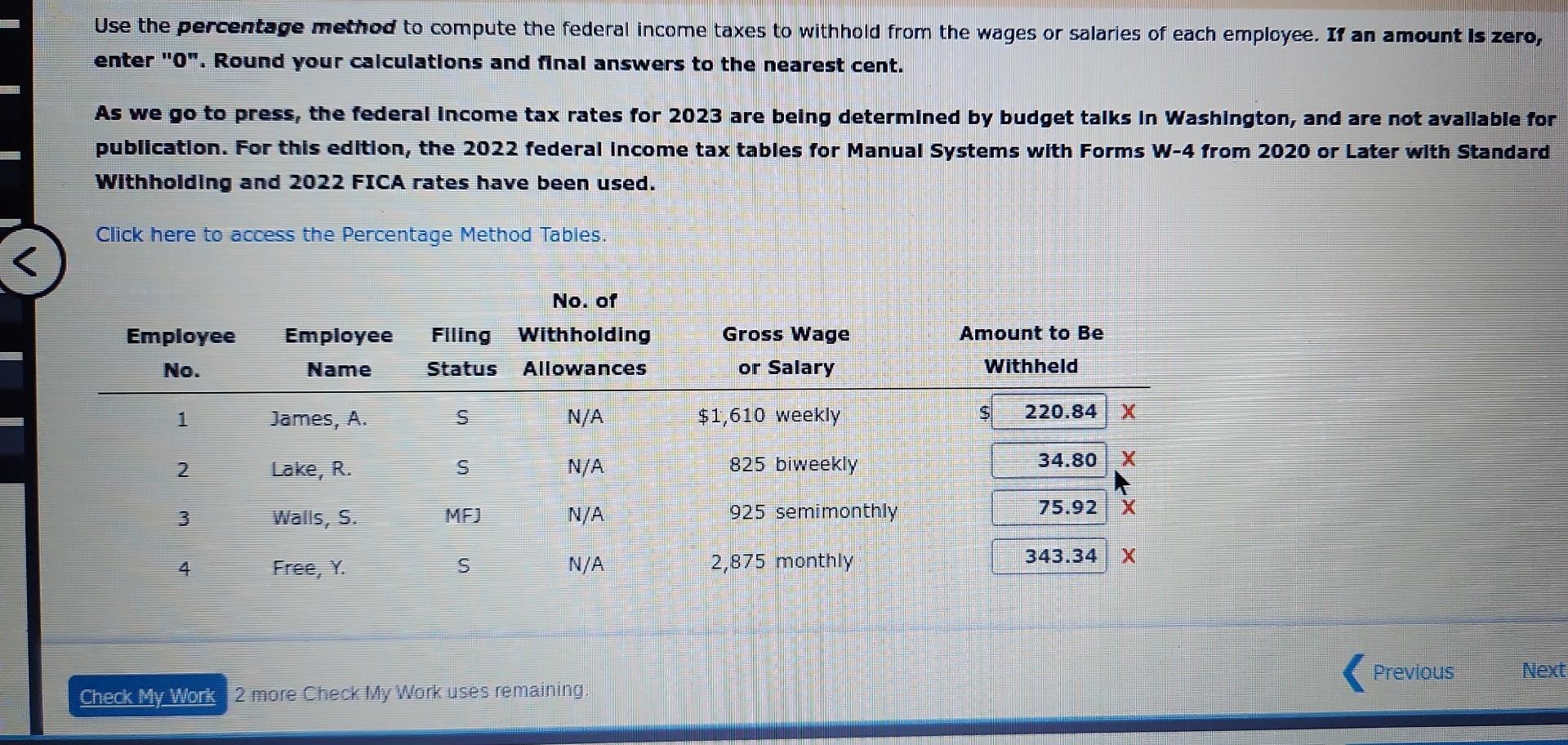

Use The Percentage Method To Compute The Federal Chegg

These Sates Won t Tax Your Retirement Income Kiplinger

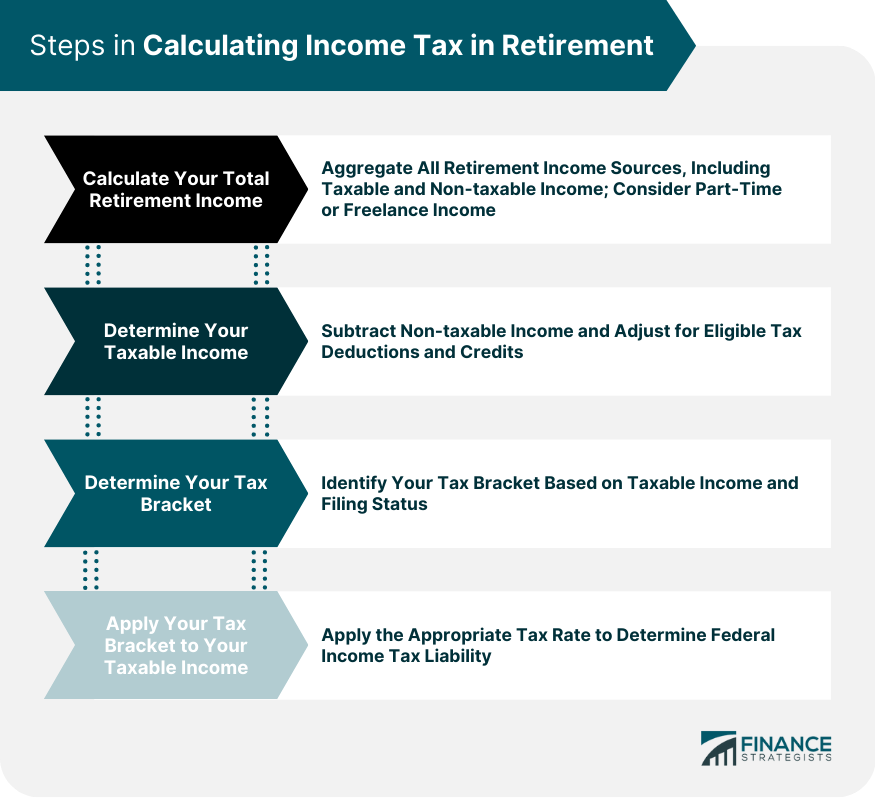

How To Calculate Income Tax In Retirement Finance Strategists

Do You Pay Fica Taxes On Retirement Income - Web 15 Nov 2023 nbsp 0183 32 In 2023 only the first 160 200 of your earnings are subject to the Social Security tax In 2024 the first 168 600 is subject to the tax For both years there is an additional 0 9 surtax