Do You Pay Tax On A Redundancy Payout In Australia Tax free amounts Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax

You don t normally have to pay tax on a payment that meets the ATO s definition of a genuine redundancy up to a tax free limit The tax free limit which changes every Last updated 9 November 2023 Print or Download Payments to employees Informing your employees Payments that are ETPs Accrued leave Redundancy and early

Do You Pay Tax On A Redundancy Payout In Australia

Do You Pay Tax On A Redundancy Payout In Australia

http://www.nxtgennexus.com/wp-content/uploads/2017/08/Taxes_stock-1080x675.jpg

Redundancy Pay With Earlier Casual Service Workdynamic Australia

https://workdynamic.com.au/wp-content/uploads/redundancy-pay.jpg

Do You Pay Tax On A Life Insurance Payout In The UK Money To The Masses

https://moneytothemasses.com/wp-content/uploads/2022/04/Do-you-pay-tax-on-a-life-insurance-payout-UK.png

A redundancy payment also known as Employment Termination Payment ETP is a lump sum amount paid to an employee after redundancy There are a few different Genuine redundancy payments are taxed at special rates and part of the redundancy payment can be paid tax free The tax free limit consists of two elements a base

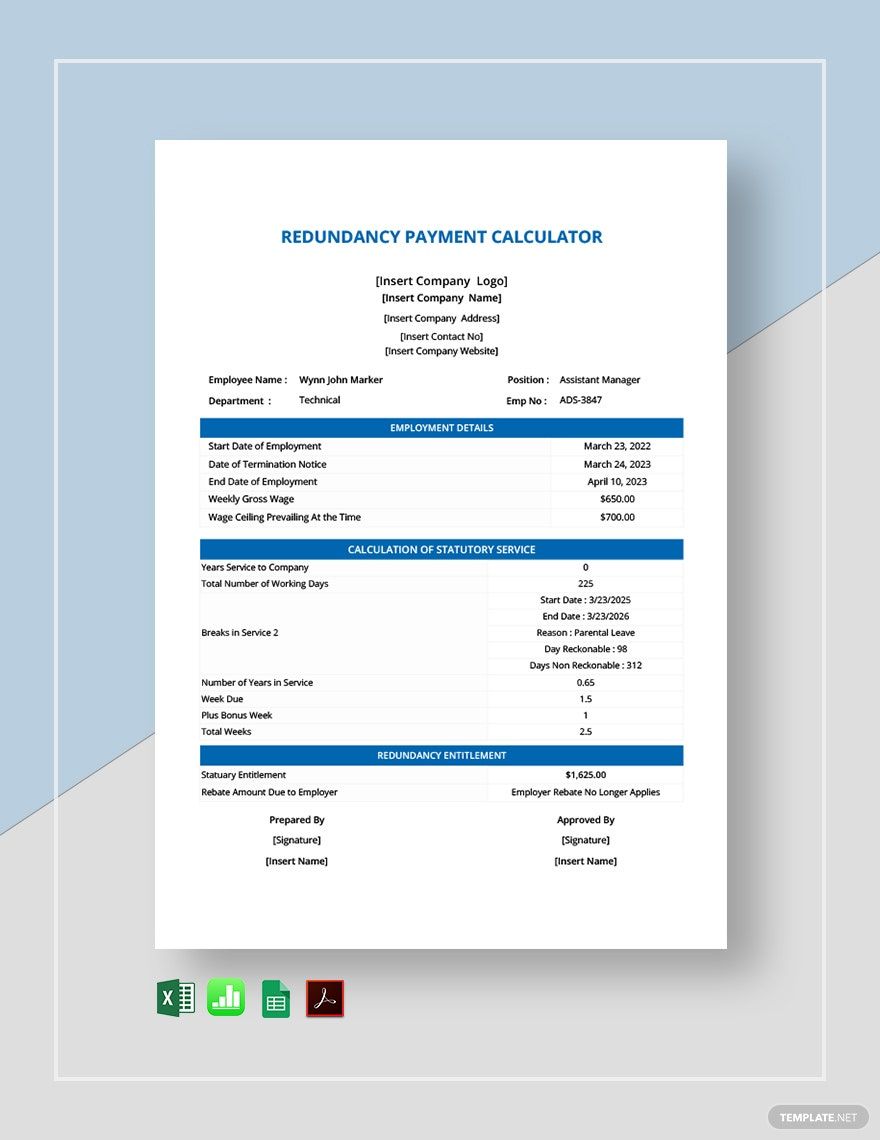

This Calculator is developed for Australians to estimate their possible redundancy payment entitlements tax on redundancy payout and net after tax redundancy pay How much tax does an employee pay on redundancy The tax your employee pays on redundancy depends on several factors Their redundancy pay which must be considered a genuine

Download Do You Pay Tax On A Redundancy Payout In Australia

More picture related to Do You Pay Tax On A Redundancy Payout In Australia

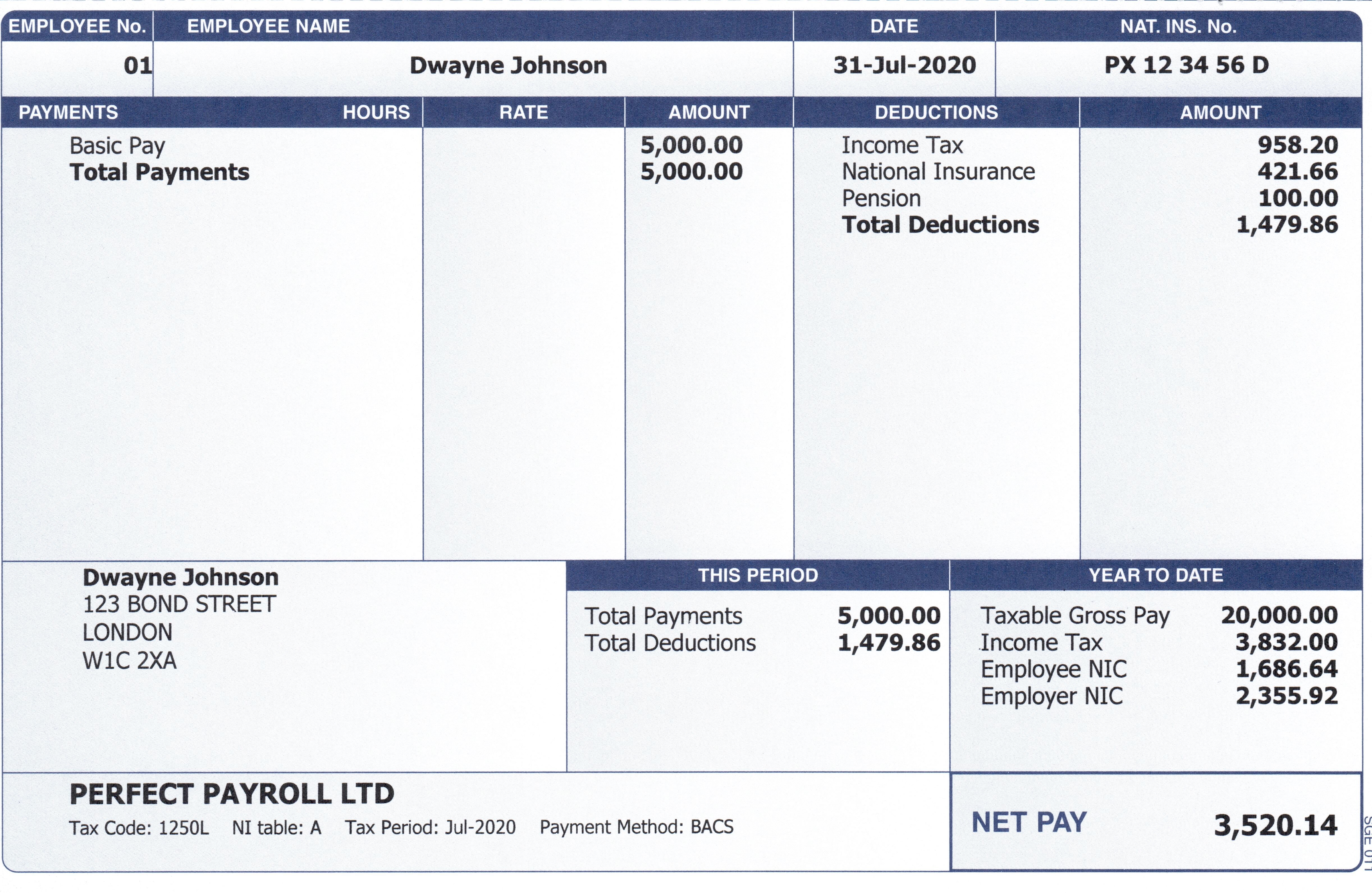

Payslip Explained Australia Login Pages Info

https://www.payslipsonline.co.uk/resource/products/88763/0dea81ab.jpg

How To Calculate Redundancy Pay In Australia 2022 Update

https://australialawyers.com.au/wp-content/uploads/2022/08/redundancy-pay.jpeg

Redundancy Payment What To Do With It

https://s.yimg.com/uu/api/res/1.2/rZicfk33qd2AbvQtuxo4wA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2020-08/ca6904c0-d77f-11ea-bfb3-3160aa51c6da

Under the NES redundancy pay doesn t need to be paid in some circumstances For example if the employer is a small business employer or the employee is a casual First 235 000 taxed at 17 All ages Above 235 000 taxed at 47 Other redundancy payments Annual leave 100 of lump sum is taxed at 32 maximum Long service

These are both valid redundancy payments as explained here As such the tax free limit applies The limit in Janice s case is 10 399 5 200 x 1 15 599 This Redeployment If your job is made redundant your employer must offer you another suitable role if they can This is known as redeployment A suitable role is one that takes

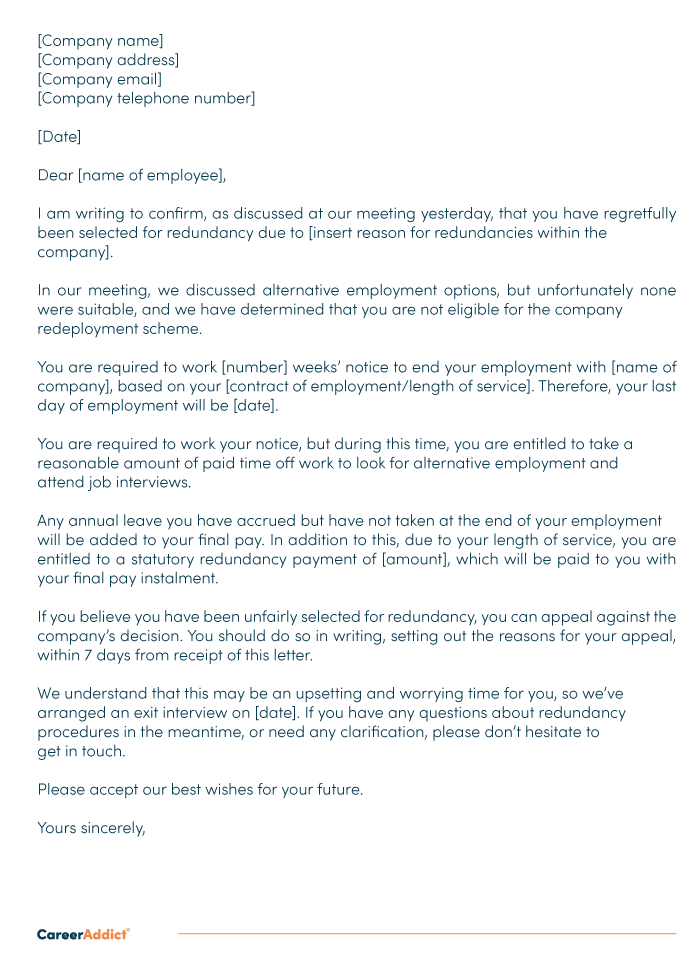

Pin On Letter Template

https://i.pinimg.com/originals/36/66/86/36668665fd706d3ecea8de0b2be6ec6b.png

Redundancy Payment Calculator Template In Google Docs Excel Google

https://images.template.net/44503/Redundancy-Payment-Calculator-1.jpg

https://www.ato.gov.au/Business/Engaging-a-worker/...

Tax free amounts Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax

https://www.commbank.com.au/articles/tax/tax-on...

You don t normally have to pay tax on a payment that meets the ATO s definition of a genuine redundancy up to a tax free limit The tax free limit which changes every

Top 1 Pay Nearly Half Of Federal Income Taxes

Pin On Letter Template

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

How To Write A Redundancy Letter with Example Honovel

Do You Pay Tax On A Property Investment Ep154

How To Legally Never Pay Taxes Again YouTube

How To Legally Never Pay Taxes Again YouTube

How To Write A Redundancy Appeal Letter

Do You Need To Pay Taxes On Your TSP Withdrawal This Tax Season

Do You Pay Tax On A Transfer Of Equity SAM Conveyancing

Do You Pay Tax On A Redundancy Payout In Australia - Depending on the amount of your genuine redundancy payment it may be made up of either or often both a tax free amount and a taxable amount The taxable