Do You Pay Tax On Interest Earned Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned

Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA You won t pay tax on those types of accounts until you start taking withdrawals How the tax rate affects your savings account interest Your tax rate will depend on two things your income for the year and how much interest you earned on your accounts Your income determines which tax bracket you fall into For 2021 here are the income tax brackets based on your filing status

Do You Pay Tax On Interest Earned

Do You Pay Tax On Interest Earned

https://www.expatustax.com/wp-content/uploads/2023/03/How-much-tax-do-you-pay-UK.jpg

Quarterly Tax Calculator Calculate Estimated Taxes

https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/63499df76fe7a914e18ab62c_quarterly-tax-calculator.png

Tax On Interest Earned In The UK TaxDash

https://taxdash.co.uk/wp-content/uploads/2022/03/Interest-Blog.jpeg

Interest earned outside tax wrappers like ISAs or pensions can be liable for tax In this article we explain whether you should be paying tax on your savings interest how to go about it and whether you can lower your tax bill Personal savings allowance explained Interest on your savings is paid to you gross Most of the time you ll report interest income on your federal tax return and that money will be taxed as ordinary income That means your interest income will be added on top of your other sources of ordinary income to help determine what income tax bracket you re in and then it will be taxed according to your income tax rate

Interest earned on CDs is taxed as ordinary income at your individual federal income tax rate This rate can range from 10 to 37 depending on your taxable income and filing status Not Interest income becomes taxable when it s actually paid to you assuming you use the cash method of accounting and the vast majority of taxpayers do It might accrue in 2022 but if it s not credited to you until 2023 for some reason you would report it on your 2023 return when you file in 2024

Download Do You Pay Tax On Interest Earned

More picture related to Do You Pay Tax On Interest Earned

How To File Taxes On Childs Ak Pfd StayLittleHarbor

https://cdn.staylittleharbor.com/do_i_have_to_pay_taxes_on_my_childs_pfd.jpg

Do You Pay TAX On Your Property Investment In Dubai FAQ S ABOUT DUBAI

https://i.ytimg.com/vi/KhkpjHosJGw/maxresdefault.jpg

Do You Pay Income Tax When You Sell Inherited Property Legacy Design

https://www.ldstrategies.com/wp-content/uploads/Income-tax-083121.jpg

Before tax day arrives brokerages banks and financial institutions will send you a 1099 INT for interest or 1099 DIV for dividends which displays how much interest you ve earned in the How it works Each tax year you get these tax free allowances Your Personal Allowance for all income Up to 5 000 from your starting rate for savings so you can earn interest without paying tax If you earn more than your Personal Allowance in non savings income this is reduced by 1 for every 1 earned

The personal savings allowance allows you to earn up to 1 000 of interest tax free on top of the starting rate for savers The allowance varies depending on your income tax bracket The IRS treats interest earned on a savings account as earned income meaning it can be taxed So if you received 125 in interest on a high yield savings account in 2023 you re

Tax On Interest Earned How Much Do You Pay RateCity

https://production-content-assets.ratecity.com.au/20190809122359/savings.jpg

How Much Will It Cost To Hire A CPA To Prepare Your Taxes

https://lili.co/wp-content/uploads/2022/02/cpa_blog_2.jpg

https://www.investopedia.com/ask/answers/052515/...

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned

https://smartasset.com/taxes/how-much-interest-from-interest-is-taxable

Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA You won t pay tax on those types of accounts until you start taking withdrawals

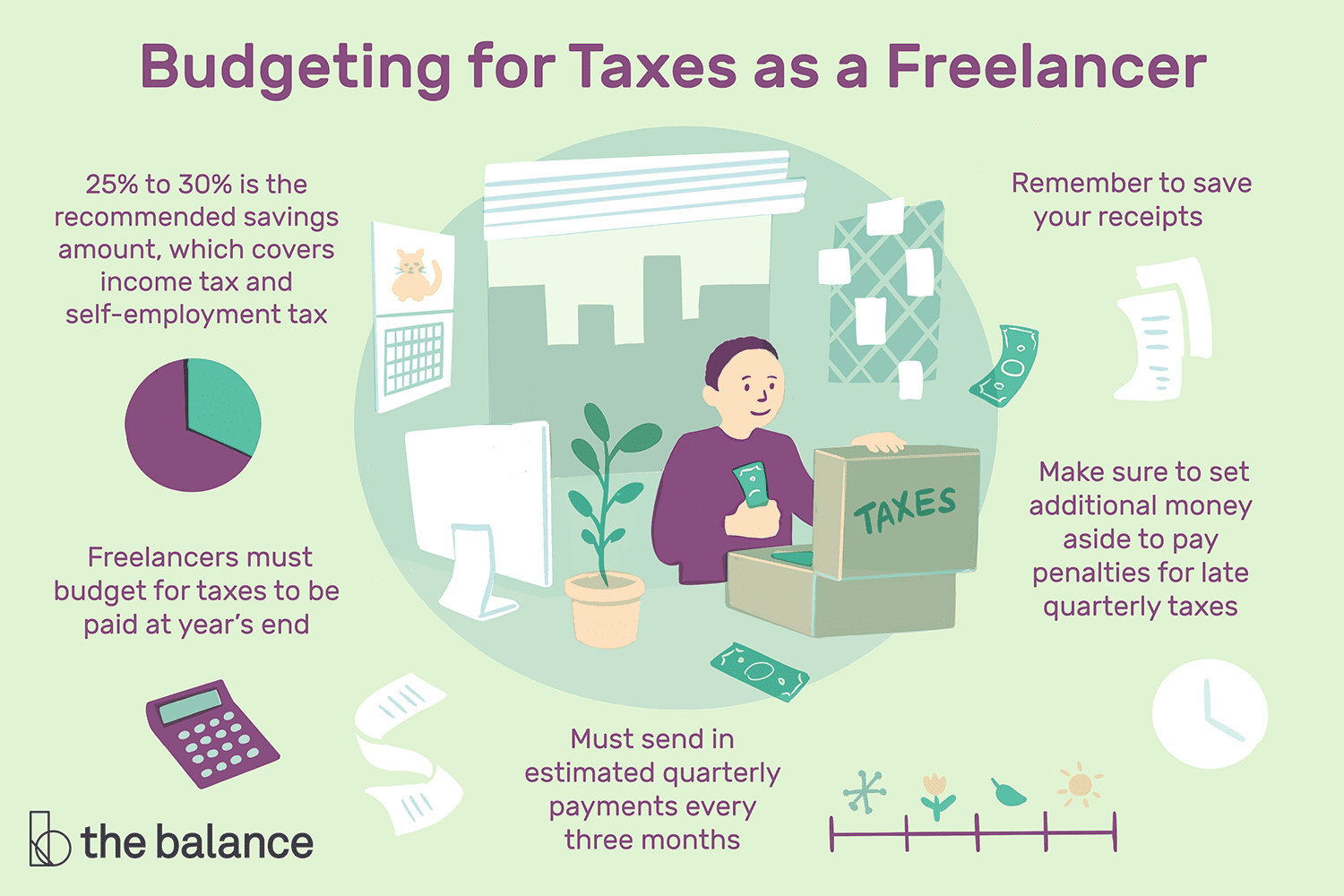

Let s Talk About Taxes SoundGirls

Tax On Interest Earned How Much Do You Pay RateCity

Do You Pay Tax On A Life Insurance Payout In The UK Money To The Masses

How To Legally Never Pay Taxes Again YouTube

How Do You Pay Tax On A Side Hustle In Australia Business Tax In

Do You Pay Tax On Gold In Canada Electro

Do You Pay Tax On Gold In Canada Electro

Taxes On Social Security Benefits Inflation Protection

IRS Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Do You Pay Tax If Your Business Makes A Loss Tax Walls

Do You Pay Tax On Interest Earned - Interest earned on CDs is taxed as ordinary income at your individual federal income tax rate This rate can range from 10 to 37 depending on your taxable income and filing status Not